Security Analysis requires as a first step the sources of information, on the basis of which analysis is made. The Securities market is a perfect auction market where demand/supply pressures determine the price. These demand/supply pressures depend upon the available money and the flow of information. It is in this context that sources of information become relevant. Besides the market analysis and estimate of the intrinsic value around which the market price revolves, would also need an analysis of the flow of information.

Types of Investment Information:

The types of Investment information, which are relevant for our purposes are of the following categories:

(i) World Affairs:

International factors, which influence domestic income, output and employment and for investment in the domestic market by F.F.I.s, O.C.B.s, etc. Also foreign political affairs, wars, and the state of foreign markets affect our markets.

ADVERTISEMENTS:

(ii) Domestic Economic and Political Factors:

Gross domestic products, agricultural output, monsoon, money supply, inflation, Govt. policies, taxation, etc., affect our markets.

(iii) Industry Information:

Market demand, installed capacity, competing units, capacity utilisation, market share of the major units, market leaders, prospects of the industry, international demand for exports, inputs and capital goods abroad, import competing products, labour problems and Govt. policy towards the industry are all relevant factors to be considered in investment decision-making.

ADVERTISEMENTS:

(iv) Company Information:

Corporate data, annual reports, Stock Exchange publications, Dept. of company affairs and their circulars, press releases on corporate affairs by Govt., industry chambers or associations of industries etc. are also relevant for security price analysis.

(v) Security Market Information:

The Credit rating of companies, data on market trends, security market analysis and market reports, equity research reports, trade and settlement data, listing of companies and delisting, record dates and book closures etc., BETA factors, etc. are the needed information for investment management.

ADVERTISEMENTS:

(vi) Security Price Quotations:

Price indices, price and volume data, breadth, daily volatility, range and rate of changes of these variables are also needed for technical analysis.

(vii) Data on Related Markets:

Such as Govt., securities, money market, forex market etc. are useful for deciding on alternative avenues of investment.

(viii) Data on Mutual Funds:

Their schemes and their performance, N A V and repurchase prices etc. are needed as they are also investment avenues.

(ix) Data on Primary Markets/New Issues, etc.

Need for Investment Information:

Investors and Market Analysts depend on the timely and correct information for making investment decisions. In the absence of such information, their decisions will depend on hearsay and hunches. In order to enable the correct investment decisions to be made, investors need to know the sources of information. In the fast expansion of the markets, and increasing complexity of economies, the amount of information is also fast growing.

The collection of information and its analysis is time consuming and expensive. Besides analysis of the information also requires expertise which all investors may not have. The available books on the subject deal with the theoretical aspects and not much practical analysis and down to earth operational aspects. As such the investors are left to make decisions by hunches and intuition and not on scientific analysis of the data. Those who have better information use it to make extra mileage on such information.

ADVERTISEMENTS:

It is also possible that insiders who have the information before it becomes public take advantage of it called Insider trading. At present the SEBI has acquired powers to control insider trading, malpractices and rigging up of prices in the secondary markets in India, and penalise the offenders.

1. World Affairs:

The day-to-day developments abroad are published in Financial Journals like Economic Times, Financial Express, Business Line, etc. Some foreign Journals, like London Economist, Far East Economic Review and Indian Journals like, Business India, Fortune India etc., also contain developments of economic and financial nature in India and abroad. IMF News Survey, World Bank and IMF Quarterly Journal (namely, Finance and Development), News Letters of Foreign Banks like those of Grindlays, Standard, etc., contain all the needed information on world developments.

2. National Economic Affairs:

ADVERTISEMENTS:

The daily news papers particularly financial papers referred to above contain all the national information; Besides Journals like Economic and Political Weekly, Business India, Dataline Business, Business Today and Fortune India contain the material on economic developments. RBI’s Annual Reports, Reports on currency and finance and monthly reports and CMIE reports all contain a wealth of information on the economy and the country. The Economic Survey of the govt. of India and reports of C.S.O., D.G.T.D. and Dept. of companies, etc. do provide the information on, economy, industry, trade sectors of the country. The reports of the Planning Commission and annual reports of various ministries also contain a lot of information.

3. Industry Information:

There are various Associations — Chambers of Commerce, Merchants’ Chamber and other agencies who publish Industry data. The reports of Planning Commission, govt. of India, publications from Industry and Commerce Ministries also contain a lot of information. The CMIE publishes various volumes and update them from time to time containing data on various sectors of the economy and industries, and the subscribers get these volumes and reports.

Directory of Information published by the B.S.E. also contains information on industries and companies and this is updated from time to time. Many Daily financial papers bring out regularly studies on various Industries and their prospects. Industry data at micro level is available in Govt., publications, industry wise, but in view of a large time lag involved in their reports, the monthly reports of various Associations of Industries give more up-to-date and timely information.

ADVERTISEMENTS:

4. Company Information:

The information on various Companies listed on Stock Exchanges is readily available in daily financial papers. Besides the Fort- nightly Journals of Capital Market, Dalai Street, Business India contain a lot of information on the industries and companies, listed on stock exchanges. Results of equity and Market Research are also published in these Journals.

The B.S.E. (Mumbai Stock Exchange) publishes Directory of Information on Industries and Companies, which are listed on Stock Exchanges, and the Journals of Capital Market and Dalai Street also publish these data. Computer software on these data are available with a number of software companies. The B.S.E. also publishes weekly Reviews, monthly Reviews giving data on various aspects of listed companies.

The Annual Reports of companies and their half-yearly unaudited results are another source of information on the companies. The financial journalists give write ups on various companies after interviewing their executives and these are published in Economic Times and other financial Dailies, like Business Line and Financial Express.

5. Security Market Information:

A number of big Broker Firms who have equity research are sending newsletters on Market Information with Fundamental and Technical analysis, combined in those reports. The Capital Market, Dalai Street, Business India and few other Stock Market Journals like Fortune India, Investment Week, etc., contain the information on security markets. The ICFAI also publishes a monthly called Chartered Financial Analyst, which contains economic data, company information, and market information, Security analysis, Beta factors and a host of other items, useful for security analysis.

ADVERTISEMENTS:

The data on Trade cycles and settlements, record dates, book closures etc., are contained in financial papers like Economic Times, Business Line, Financial Express etc., after they are released by stock exchanges and companies. While the newsletter of Merchant Bankers, brokers’ firms, Investment Analysts, are available to subscribers or their own clients, others are available for all at stipulated prices. The collection of information is thus costly and time consuming.

6. Security Price Quotations:

The daily quotations on various Stock Exchanges OTCEI, NSE are published in the daily papers. Each Stock Exchange is publishing its own daily quotations list, giving out opening, high, low and closing quotations of all traded securities. They also publish volume of trade for individual securities and also the total for all securities traded on a daily basis, in terms of shares and value of trades.

The Price indices, for all securities, industry wise, region wise etc., are published by the RBI, B.S.E. and major Stock Exchanges, in the country. Besides each financial Daily has its own Index published in its paper. All these indices, daily volumes, highs, lows, advances, declines etc., of well traded Companies, Gainers and Losers and such similar information, useful for both technical and fundamental analysis is available from all Stock Exchanges and published in financial Dailies and Journals. The Capital Market and Dalai Street journals also give Company information regarding their fundamentals, P/E, EPS, GPM, etc., along with the price data. Daily highs and lows, can be seen as against yearly highs/lows for each of the securities in financial Dailies.

The patterns of shareholding, distribution schedule, floating stock, past price data are available in all software and B.S.E. Directory. B.S.E. publishes all the data useful for technical analysis and these data are compiled by the computer specialists and floppies are available on official Daily quotations and Technical charts of each of the major companies listed on Stock Exchanges. The computer software data are also sold by software companies for those who have computer facility. For others, these data can be collected from daily papers, weekly and fortnightly Journals on Stock Markets, like Dalai Street and Capital Market.

7. Data on Related Markets:

ADVERTISEMENTS:

Data on Money Market, Govt. Securities Market are available in the publications of RBI and D.F.H.I., Indian Banks Association, Securities Trading Corporation and banks and NSE. These data are published on a daily basis on the financial Dailies and journals. The publications who deal with these markets are however fewer in number compared to those on stock and capital markets.

The information on Forex Market is available in RBI publications, Foreign Exchange Dealers Association (FEDAI) and foreign banks. These data are published in the form of exchange rates and cross Currency rates in Financial Dailies regularly. The developments in these markets are reviewed in the Dailies or weekly and fortnightly Journals.

The data on Bullion market and rates for gold and silver are available on a Daily basis in the financial press. These data are published in RBI Bulletins and are also available in CMIE reports. Many of these data on Forex Markets in countries abroad can be obtained from London Economist, Far Eastern Economic Review, and Wall Street Journal.

8. Data on Mutual Funds, UTI etc.:

These are published in the Daily financial papers — at least once in a week in the Investment Weekly or Investors’ Guide. They give the Current Schemes, NAV of each scheme if quoted as against the Market price, if traded, repurchase price, redemption rate, etc. in respect of close ended funds and daily purchase and sale prices for open ended funds. Besides, however all the journals, magazines and reports on Stock Markets also contain the relevant information on Mutual funds, as many of their schemes are quoted and traded on the Stock Exchanges. Thus, the Capital Market, Dalai Street and Business India also contain information on Mutual Funds.

9. Data on Primary Market:

ADVERTISEMENTS:

New Issues in the Pipeline are first known to the SEBI as they get the Draft Prospectus for vetting and even before that, they would come to know of them from Merchant bankers’ reports. But consolidation and publications of this information is done by a Magazine called “PRIME” publication. Prime publishes all information of new issues in the pipe line — industry wise and size wise analysis and public over subscription and under subscription etc. The performance of companies, Merchant bankers, underwriters and brokers etc., in the New Issue Market are also analysed by them. Geographical and centre-wise collection of new issues and other relevant company information is given by them.

Following them a number of Magazines, merchant bankers, Registrars and Brokers like Karvys are publishing them. Financial journalists are giving a write up on the forthcoming new issues as also some cable operators. The RBI and Dept. of Company Affairs in addition to SEBI collect and publish these data from time to time in their reports once in a quarter, half-yearly and yearly.

Uses of these Data for Investment Information:

The Broker firms, Investment consultancy firms, Portfolio Managers require all the investment information on Companies, industry and Economy.

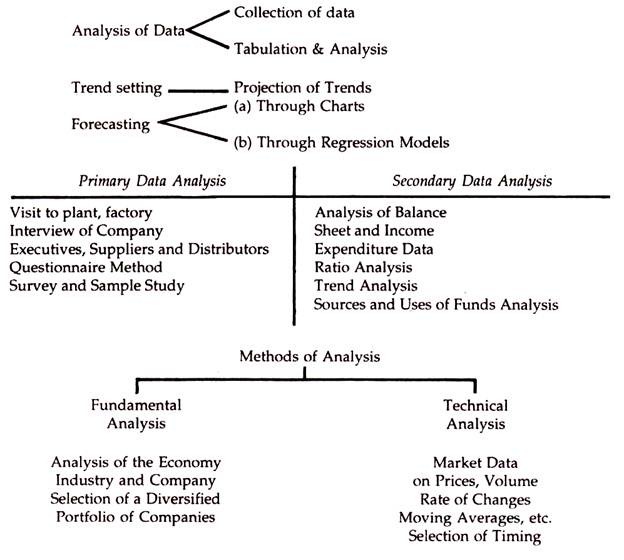

Their tasks in this connection can be set out as follows:

ADVERTISEMENTS:

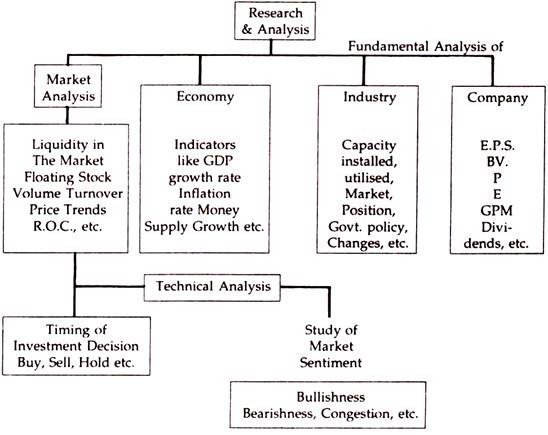

ROC is rate of change of prices and volumes. Research Methods are very varied starting from Deskwork to plant visits.

Steps to be followed:

(a) Pattern of ownership of shares

(b) Proportion of public holding

(c) Floating stock for trading

(d) High/Low prices for the year

(e) Daily volatility of prices – Opening, High, Low and Closing

(f) Breadth of the Market

(g) No. of shares traded and their volumes vis-a-vis the total volume for all companies

(h) Declines/Advances among scrips

(i) Chart of Daily price trends, moving average trends — to get signals of buy/sell etc.

(j) Trace out the intrinsic value of the share by Fundamental Analysis — Adjust for the expectations and sentiment in the Market to take a decision whether the price in the market is fair price or not.

Study of the company through financial variables (BV, EPS, P/e, etc.), visit the plant and interview the chief executives of the company for knowing the expectations, as also of the merchant bankers and financial institutions, are the further steps.

Scrips chosen on all these counts are properly timed through Technical Analysis for a proper investment decision-making. An analysis of risk in terms of variability of returns (standard deviation) of each company vis-a-vis the Market, use of Beta factor for risk which is systematic and diversification of investments into various industries and companies to reduce the unsystematic risks are the further steps in portfolio management.

Conclusion:

It will thus be seen that the sources of information for investment purposes is only the first step. Collection and collation and analysis of the data are the more important next steps. The data and information, are necessary for not only proper investment decision, but for Portfolio Management, revision and evaluation.