Lending of money is for a return in the form of interest. The rates of interest vary with the purpose and maturity and a host of other factors. Thus, advances made by banks and financial institutions are at varying rates of interest and Reserve Bank has allowed freedom to banks to fix their prime lending rates, which are the rates charged for high creditworthy borrowers and the minimum basic rate for lending.

If the individuals and institutions make an investment in any asset they base their decision to invest on the basis of some financial arithmetic which takes into account the following factors, among others:

(a) Creditworthiness of the party.

(b) Time period of lending or investment.

ADVERTISEMENTS:

(c) Risk of the activity of investments.

(d) Expected returns over the time period chosen.

(e) Safety and marketability of investments.

1. Yields on Bonds/Fixed Interest Securities:

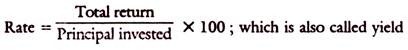

Normally, if we purchase an asset like a bond or debt instrument or debenture or lent money for any purpose the return is calculated by the formula-

If we invest an amount of Rs. 900 on a 12% bond with a face value of 100 by purchasing 10 bonds at Rs. 90 each, then the coupon rate of bond is 12% and face value is Rs. 100, but the market price is Rs. 90. Hence, an investment of Rs. 900 got for the investor 10 bonds.

What is his yield per annum? In an investment of Rs. 90 per bond of face value of Rs. 100, he gets an annual interest of Rs. 12 being the coupon rate which is the interest rate promised for each bond of Rs. 100. Thus, if Rs. 90 can secure Rs. 12 the rate of return for the investor is 12/90 x 100 = 13.3%.

The above is called current yield. The yield is the return on an investment as a percentage per annum.

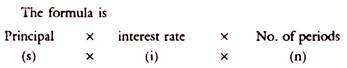

Simple Yield or Interest Calculation:

where principle is 100 and interest rate is 12%, and number of years is 3, then simple interest on Rs. 100 is Rs. 36 (12 x 3).

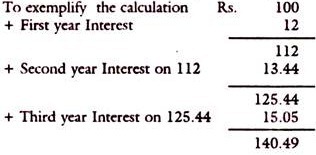

The formula for compound interest is p = s x (1 + i)n. With data in the above example, 100 (1 + 0.12)3 = 140.49.

Present value factors and future value factors are available in the published tables readily and can be referred to them.

The same is derived through the formula given above.

This is called compounding and the reverse is discounting. If 140.49 is to be received in 3 years, what is its present value?

The formula is-

After discounting the future flows to the present (NPV) then comparison of two investments can be made and a decision about investment can be finalised.

Yields on Equity:

ADVERTISEMENTS:

If the investment is in equity shares of a company, the return is in the form of dividend per annum plus capital appreciation or minus depreciation of the original investment due to fluctuations in market prices of shares. Thus, for example, an investor purchased TELCO at Rs. 260 per share and the company declared a dividend of 30%. But the market price of the share increased over the year to Rs. 290 involving a capital gain of Rs. 30 per annum. Thus, an investment of Rs. 260 yielded a return of Rs. 30 as dividend and another Rs. 30 as capital appreciation. The total return is Rs. 60 on an investment of Rs. 260.

The rate of return is 60/260 x 100 = 23% P.A.

The yield on equity is generally lower if only dividends are considered. But an investor in equity shares desires not the yield only, but possible capital appreciation.

Yields are more relevant on all fixed interest yielding investments or instruments like, debentures, bonds, loans, deposits etc., with banks, companies and Government.