Compare and Contrast the Keynesian and Monetarist Views on Monetary Policy!

Monetary Policy:

Monetarists base their arguments in the context of the quantity theory of money.

One version of this theory is expressed in the following equation:

MV= PQ

ADVERTISEMENTS:

where M is the supply of money, Q is the quantity of national output sold in a given year, P is the average level of prices and V is the income-velocity of circulation of money. PQ is thus the money value of national output sold. MV is the total spending on national output, and therefore must equal PQ. The quantity equation of exchange is true by definition. What a change in M does to P, however, is a matter of debate. The controversy centres on whether and how V and Q are affected by changes in the money supply (M).

The monetarists argue that in the long run V is determined totally independently of the money supply (M). Thus a change in M leaves V unaffected but brings a corresponding change in expenditure (MV) in the economy. Monetarists therefore claim that monetary policy over the longer term is an extremely powerful weapon for controlling aggregate demand (PQ).

Keynesians argue that V tends to vary inversely with M, but rather unpredictably. An increase in money supply will not necessarily have much effect on spending. Instead people may simply increase their holding of idle balances with a corresponding decline in the speed with which money circulates (V).

How much extra idle balances people will hold will depend on their expectations of changes in interest rates, prices and exchange rates. Since expectations are difficult to predict, the amount by which V will fall is also difficult to predict. Keynesians therefore claim that monetary policy is an extremely unreliable weapon for controlling aggregate demand.

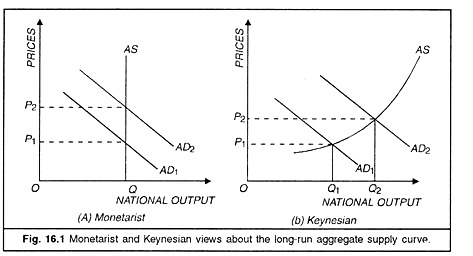

The second difference of opinion between monetarists and Keynesians is on the quantity of national output. Monetarists argue that aggregate supply is inelastic in the long run, and therefore output is determined independently of aggregate demand. Any rise in MV will be totally reflected in a rise in prices. The stock of money therefore determines the price level. The rate of increase in money supply determines the rate of inflation. In the long run, control of money supply does not affect output and employment.

Keynesians argue that aggregate supply is relatively elastic except when full employment is approached. Thus Q is a variable. A tight monetary policy therefore, is likely to reduce output as well as the price level to the extent that it does affect aggregate demand, especially when there is resistance from monopolistic firms and unions to price and wage cuts. If monetary policy is successful in reducing aggregate demand, it can lead to a prolonged recession.

The Traditional Keynesian Transmission Mechanism:

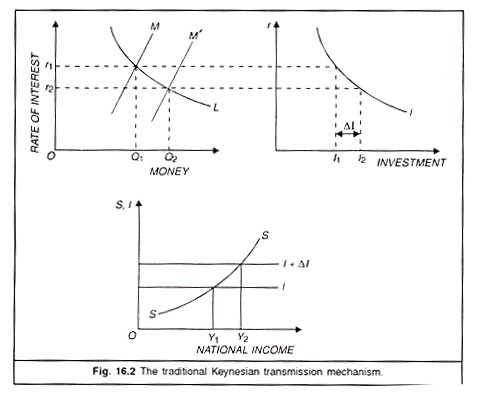

In order to weigh the arguments over the variability of V, it is necessary to see just how a change in money supply is transmitted through to a change in aggregate demand. Keynesians maintain that transmission mechanisms are indirect. That is, changes in money supply affect aggregate demand via changes in interest rates or exchange rates. We look first at the interest rate mechanism with the help of the following figures, 16.2.

Changes in money supply affect aggregate demand in three stages:

ADVERTISEMENTS:

1. A rise in money supply from M to M’ leads to a fall in the rate of interest from r1 to r2.

2. The fall in the rate of interest leads to more investment and any other interest-sensitive expenditures from I1to I2

3. A rise in investment leads to a multiplied rise in national income from Y1 to Y2.

However, according to Keynesians, stages I and II are unpredictable and perhaps rather weak. In their view, the demand for money is interest-elastic. The speculative demand for money is highly responsive to changes in interest rates. If people expect the rate of interest to rise and thus the prices of bonds and other securities to fall, few people would want to buy them. Instead, there will be a very high demand for liquid assets like money and near money.

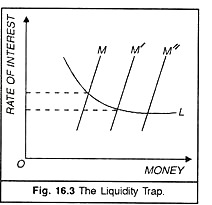

The demand for money for idle balances will therefore be highly interest elastic. The demand for money curve (the liquidity preference curve) will be shallow and may even be infinitely elastic at some minimum interest rate. This is the situation where everyone believes that interest rates will rise, and therefore no one wants to buy bonds. Everybody wants to hold liquid assets.

We show the very shallow L curve in Figure 16.3. We find that a rise in money supply from M to M’ leads to only a small fall in the rate of interest from r1 to r2. Once people believe that the rate of interest will not fall, any further increase in money supply will have no effect on r. The additional money issued will be absorbed by the public in what Keynes called the liquidity trap. People simply hold the additional money as idle balances.

A more serious problem with the use of monetary policy is that the liquidity preference curve L is unstable. People hold speculative balances when they anticipate that interest rates will rise {i.e. security prices will fall). But it is not just the current interest rate that affects people’s expectations of the future direction of interest rates.

Many factors could affect such expectations:

ADVERTISEMENTS:

1. Changes in foreign interest rates

2. Changes in exchange rates

3. Statements of government intentions on economic policy.

4. Good or bad industrial news

ADVERTISEMENTS:

5. Newly published figures on inflation or money supply. If inflation or the growth rate in money supply is higher than anticipated, people will expect a rise in interest rates in anticipation of a tighter monetary policy.

Thus the L curve can be highly volatile. Given an unstable demand for money, it is difficult to predict the effect on interest rates of a change in money supply.

Keynesians argue that it is best to focus on controlling interest rates. This policy is likely to cause a more stable demand for money. With fewer shifts in the speculative demand which in turn helps control the interest rates.

ADVERTISEMENTS:

Further, Keynesians believe that investment demand is interest-inelastic, especially when there is a recession. Even significant changes in interest rates do not change investment much. For example, fixed investment in plant and machinery is not very interest-sensitive. But other components of investment demand (i.e. investment in stocks and consumer demand financed by banks) may well be interest- elastic. However, Keynesians assert that the investment demand curve is shifting erratically with the expectations of investors.

We can conclude by saying that monetary policy is likely to be effective only if people have confidence in its effectiveness. The psychological effect can be quite powerful. It demands considerable political skill to manipulate it, however.

The Monetarist Position on Monetary Policy:

Monetarists differ from Keynesians in that they believe in the direct transmission mechanism. When money supply is increased, people hold more money in their hands than they want to hold. So they spend the surplus money on securities, goods and services, thereby increasing aggregate effective demand.

The theoretical underpinning for this is given by the theory of portfolio balance. This theory states that people hold their wealth in a variety of assets—bills, bonds, shares or physical assets such as cars and houses. If money supply with the public expands, their portfolio balance is disturbed.

The result is a change in the yields of bonds and securities as well as physical goods. The extra money will be used to purchase near money and liquid assets as a result of which their prices in the market go up. The reshuffling of the people’s portfolios would go on as long as the balance in their portfolios is not restored. The mechanism has been criticised by Keynesians. They doubt whether the mechanism operates so nicely in the short period and in this direct manner.

There are two possible means of injecting money into people’s portfolios:

ADVERTISEMENTS:

(1) An expansionary fiscal policy financed by an increased money supply, and

(2) The use of monetary techniques.

In the first case, it is the working of fiscal policy and in the second case there is an inevitable time lag in the effects of monetary policy. So the process must depend upon the indirect mechanism.

Monetarists also see monetary policy operating through the indirect mechanism. They hold that this mechanism is more powerful than the traditional Keynesians believe it to be. This is because they have different assumptions: (1) that the liquidity preference curve is relatively inelastic due to the much smaller role played by the speculative balances in the demand for money, and (2) that investment demand curve is relatively elastic. As a result, the effect of monetary policy on aggregate demand is much greater than the Keynesians perceived.

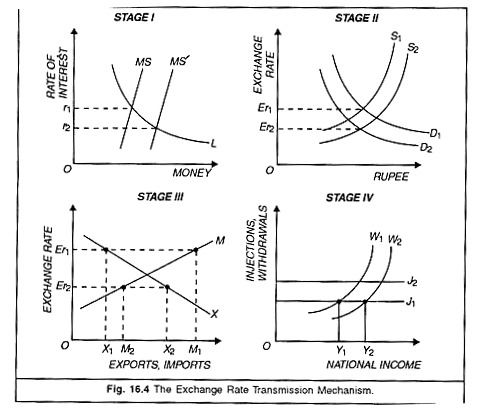

Monetarists argue that, in an open economy with free, floating exchange rates, the effect of an increase in money supply is stronger still. Any fall in interest rates will have such a strong effect on international capital flows and the exchange rate that the rise in money supply will be transmitted relatively quickly to aggregate demand. This should be clear from the Figure 16.4 given above. The indirect mechanism operates from stage I to stage IV where the fall in the rate of interest from r1 to r2 ends up in increase of national income by Y1 Y2.

ADVERTISEMENTS:

Monetarists admit that the interest rates and yields on securities do fall in the short run as a result of the fall in the velocity of money (V). People may well hold larger money balances when the yields on non-money assets fall. Furthermore, the direct mechanism may take time to operate and V may fall in the meantime.

Monetarists also recognise that the demand for money can shift unpredictably in the short run with changing expectations. For these reasons, monetarists conclude that monetary policy cannot be used for demand management in the short run. Here at least there is a measure of agreement between Keynesians and monetarists.

Monetarists do believe, however, in the long-run stability of V, firstly because the direct mechanism gets sufficient time to work through and secondly because of the effect of monetary expansion on inflation and interest rates. The effect of inflation works as follows.

When money supply is initially raised, both the interest rate and V fall. But if the money supply is increased continuously for some time, the rate of inflation goes up and so do the nominal rates of interest. In choosing between money and non-money assets, people consider the nominal rate of interest as the opportunity cost of holding up. Since this opportunity cost goes up, people choose to hold less money and more of the interest-earning assets.

As a consequence, V rises back again. So the velocity of money is fairly stable in the long run, and monetary policy serves as a potent tool of controlling aggregate demand. For this reason, monetarists favour a longer-term approach to monetary policy including targets for the growth of money supply.

Fiscal Policy:

The Keynesian Position:

Fiscal policy is considered by Keynesians as the prime instrument of controlling aggregate demand. In their view, fiscal policy can be used either to shift aggregate demand so as to mitigate a persistent inflationary and deflationary gap or to ‘fine tune’ the economy by smoothing out cyclical fluctuations. If the economy is in a deep recession, aggregate demand can be boosted through tax cuts and increased government expenditure.

ADVERTISEMENTS:

It is difficult to decide on the size of tax cuts and raising of public expenditure but the economy can get the economy moving. The difficulty with this policy is that it can worsen the balance of payments position through larger imports. But all the same, fiscal policy can help to stabilise the economy.

The main monetarist objection to the use of fiscal policy as a cure for recession is that it cannot operate to increase output in the long period. Whichever the mode of financing the budget, the money supplies gets increased in the long run. In other words, fiscal policy cannot work to cure recessions in the long run without an accommodating monetary policy. Inflation is inevitable in such a situation.

If the country is on a floating exchange rate regime, the inflation can lead to depreciation of the country’s currency. This will directly fuel inflation by raising the prices of imports. On the opposite side, if the economy is under persistent demand-pull inflation associated with near-full employment, Keynesians argue that deflationary fiscal policy should be used.

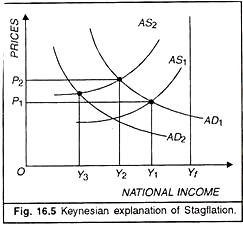

The persistently high inflation of the 1970s was accompanied by rising unemployment. Keynesians explain this stagflation in terms of a left-ward shift in the aggregate supply curve as shown in the figure given below. A reduction in aggregate demand under these circumstances may offset the inflationary effect. But this solution is highly unpopular politically because it entails further decline in output and a corresponding rise in unemployment.

What is more, there may be adverse supply-side effects of tax increase. It may reduce incentives and push up costs. Cuts in government expenditure may have serious effects on such socially-sensitive sectors as health, education and public transport.

ADVERTISEMENTS:

Damage to such infra-structure may damage the prospects of long-term growth. Thus, it is doubtful that deflation can squeeze out the inflation from the economy without causing a severe depression. All this depends on the shape of the supply curve and people’s expectations about the future prices and policies.

The advantages claimed for a stabilisation policy through fiscal measures are:

(1) The avoidance of alternating periods of unemployment and stagnation followed by periods of inflation and balance of payments deficits, and

(2) The creation of a more certain and stable environment for business to plan and invest, thereby encouraging faster long-term growth in output.

The main problems with fine tuning the economy are the time lags in recognition of the situation, taking appropriate action and the lag in results of the policy. Keynesians therefore advise continuous monitoring of the economy, forecasting of output and prices and taking of timely action.

The Monetarist View:

Monetarists make a clear distinction between pure fiscal policy where fiscal policy operates with no change in the money supply and a fiscal policy operating alongside a change in money supply. The latter could be due either to a deliberately chosen mix of fiscal and monetary policies or to a passive adjustment of money supply to accommodate an expansionary/contractionary fiscal policy.

Monetarists hold that a pure fiscal policy is unfit to be used for stabilisation of the economy. There are difficulties in predicting the people’s reactions to the fiscal measures. There is the problem of unexpected supply and demand shocks to the economy. So it cannot be used to control aggregate demand with any precision.

In the long-run, pure fiscal policy is totally ineffective as increases in public expenditure lead to corresponding decreases in private expenditure. This is known as the problem of crowding out of private investment when public investment is increased through fiscal policy. Fiscal policy has its monetary effects in the form of changes in interest rates.

When public expenditure is increased either through public borrowing or through tax financing, money supply falls short of the increased demand for money and the market rate of interest goes up as is shown in the figures given below. This causes crowding out of private investment.

Just how much crowding out will occur when there is an expansionary fiscal policy but money supply is not allowed to be expanded, depends on two factors:

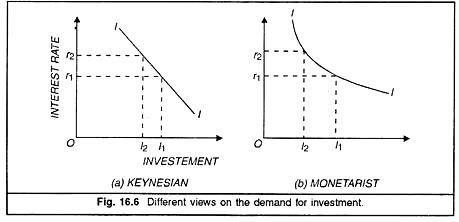

1. The responsiveness (elasticity) of the demand for money to a change in the interest rate. Keynesians assume that the demand for money is relatively elastic and therefore an increase in demand i.e. shifts of the L curve to the right, will lead to a small rise in the rate of interest. As against this, monetarists contend that the demand for money is relatively inelastic in which case a similar shift to the right of the demand curve will lead to a bigger rise in the interest rates.

2. The elasticity of investment with respect to a change in interest rates. Keynesians maintain that investment is relatively unresponsive to changes in interest rates. Businessmen are much more likely to be affected by the state of the market in which they sell their products rather than by interest rate as one of their costs.

As a result, when the interest rate rises, there is a small fall in investment. Monetarists, however, believe that investment is relatively more responsive to changes in interest rate than the Keynesians assume.

The two points of view are illustrated in the following figures.