The below mentioned article provides an essay on foreign trade policy in Indian economy with regards to free trade versus protection.

Introduction:

The foreign trade policy is concerned with whether a country should adopt the policy of free trade or of protection.

If the policy of protection of domestic industries is adopted, the question which is faced whether protection should be achieved through imposing tariffs on imports or through the fixation of quota or through licensing of imports.

The foreign trade policy has been the subject of heated discussion since the time of Adam Smith who advocated for free trade and recommended that tariffs should be removed to avail of the advantages of free trade. Even today, economists are divided over this question of foreign trade policy.

ADVERTISEMENTS:

Various arguments have been given for and against free trade. If the policy of protection of domestic industries is adopted, the question is whether for this purpose tariffs should be imposed on imports or quantitative restrictions through quota and licensing be applied.

In India certain political parties and group have been demanding a policy of ‘Swadeshi’ which in essence means that domestic industries should be protected against low-priced imports of goods from abroad, that is, free foreign trade should not be allowed.

Besides Adam Smith, the other famous classical economist David Ricardo in his famous work “On the Principles of Political Economy and Taxation” also defended free trade to promote efficiency and productivity in the economy.

Adam Smith and the other earlier economists thought that it pays a country to specialise in the production of those goods it can produce more cheaply than any other country and import those goods it can obtain at less cost or price than it would cost to produce them at home. This means they should specialise according to absolute cost advantage.

ADVERTISEMENTS:

However, Ricardo put forward the ‘Theory of Comparative Cost’ where he demonstrated that to obtain benefits from trade it is not necessary that countries should produce these goods for which their absolute cost of production is the lowest.

He proved that it could pay a country to import a good even though it could produce that good at a lower cost, if its cost is relatively lower in the production of some other good. Ricardo’s theory of trade rests on the idea of relative efficiency or comparative cost.

Despite the classical arguments for free trade to promote efficiency and well-being of the people, various countries have been following the protectionist policies which militate against free trade.

By imposing heavy tariff duties on imports of goods or fixing quotas of imports they have prevented free trade to take place between countries. Several arguments have been given in favour of protection. In what follows we spell out this free trade vs. protection controversy.

Trade Policy: Tariffs and Quotas:

Despite many benefits of free trade, the various countries have put up barriers to trade to protect their domestic industries. A number of instruments are used to protect the domestic industries to free trade but most important are tariffs and quotas. Both tariffs and quotas can be imposed either on imports or exports but they are mostly imposed on imports. Barriers to exports are quite uncommon.

ADVERTISEMENTS:

We briefly explain below these tariff barriers:

1. Tariffs:

Tariffs are excise duties imposed on imported goods. The objective of imposing tariffs may be either raising revenue for the Government or providing protection to the domestic industries.

Therefore, two types of tariffs are distinguished:

(1) Revenue tariffs, and

(2) Protective tariffs.

Revenue tariffs are usually imposed on the imports of those products which are not produced domestically. Rates of revenue tariffs are generally small but yields a good revenue for the Government. For example in USA, tariffs are imposed on tin, coffee and bananas which are not produced in that country. Their obvious purpose is to provide revenue to the Government.

Protective tariff, on the other hand are imposed to provide protection to the domestic producers from foreign competition. The rates of these tariffs are not so high as to completely prohibit their imports into a country. Rise in prices of their products as a result of imposition of tariffs, foreign producers lose their superior competitive power.

ADVERTISEMENTS:

2. Import Quotas:

Import quotas are another instrument used to check free trade. Import quotas refer to the maximum quantities of goods which may be permitted to be imported during any period of time. They are also referred to as quantitative restrictions on imports. Quotas are more effective method of reducing trade than tariffs.

A given commodity may be imported in a relatively large quantity despite high tariffs but low quotas totally stop the imports of a commodity beyond the fixed quota of the commodity. Since international negotiations to reduce trade barriers have tended to focus on tariffs, the various countries have resorted to non-tariff barriers to free trade. We discuss below the effects of tariffs and quotas.

Effects of a Tariff:

Let us now examine the economic effects of tariffs used as a trade barrier to protect domestic industries. We use partial equilibrium approach represented by supply and demand analysis to examine the effects of tariffs. Let us take a product, say computer, in which India has a comparative disadvantage.

ADVERTISEMENTS:

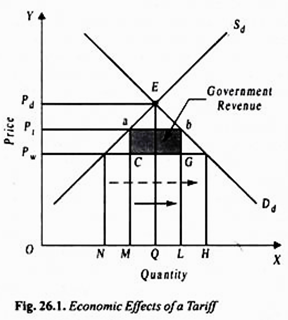

In Fig. 26.1 we have drawn domestic demand and supply curve Dd and Sd respectively of computers in India. In the absence of foreign trade, domestic price OPd is determined at which OQ quantity of computers is demanded and sold. Assume now that the Indian economy is now opened to trade with USA which has a comparative advantage in the production of computers.

Suppose OPw represents the world price at which USA sells computers. We assume that when the Indian economy is opened to trade, it can import computers from the USA at this world price OPw. In other words, free trade price is OPw.

It will be seen from Fig. 26.1 that at free trade OPw, the domestic demand (or consumption) for computers is OH and the domestic producers are supplying ON quantity. Thus, with free trade out of OH quantity of consumption of computers, domestic production is ON. The quantity NH of computers is being imported.

Consumption Effect:

ADVERTISEMENTS:

Now suppose that in order to protect domestic computer industry India imposes a tariff of Pw Pt per computer. As a result price of computer in India will rise to OPt. The imposition of tariff and consequently rise in the price of computers in India will have a variety of effects.

First, as shall be seen from Fig. 26.1 that at a higher price OPt, the consumption of computers in India will decline to OL computers as the higher price causes buyers of computers to move up the demand curve Dd. This is a consumption effect of the tariff. It follows that the Indian consumers of computers have been badly hurt by the imposition of tariff on computers.

As a result of tariff, they pay PwPt more per computer which they now buy at the higher price. Besides, tariff induces them to buy fewer computers with the result that they reallocate a part of their expenditure to less desired substitute products.

Production Effect:

Second, tariff benefits Indian producers of computers as they will now be able to sell their computers at a higher price OPt instead of free trade price OPw. Further, at a higher price OPt, they will produce and supply more computers by moving up the domestic supply curve Sd.

It will be seen from Fig. 26.1 that at price OPt, domestic producers of computers raises domestic production and quantity supplied from ON to OM. This is the production effect of tariff. It should be further noted that the increase in domestic production of computers by NM implies that some scarce resources will be bid away from other presumably more efficient industries.

ADVERTISEMENTS:

Trade Effect:

Third, as a result of imposition of tariff by India, American producers will be hurt. It may be noted that American producers would not get the higher price OPt as the higher price is due to tariff which will be obtained by the Indian Government. For American producers price of computers will remain at OPw. Since due to rise in price to OPt, domestic production increases to OM and domestic consumption falls to OL, the imports of computers fall from NH to ML. This is trade effect of tariff.

Revenue Effect:

Now, the important effect which is to be examined is whether economic well- being of the nation will increase as a result of imposition of tariff. The answer is in the negative. Of course, the Indian Government will gain from tariff equal to the revenue it collects from tariff.

With rise in price by Pw Pt per computer and the import of computers reduced to ML, (or ab) the total revenue of the Government from tariff will be equal to the shaded area abGC. This is the revenue effect of tariff. This revenue from tariff obtained by the Government is “essentially a transfer of income from the consumers to government and does not represent any net change in the nation’s well being. The result is that government gains a portion of what consumers lose.”

But the effects of tariffs go beyond the basis of partial equilibrium analysis of demand and supply. The imposition of tariff on computers will reduce export earnings of American computer industry-the industry in which it has a comparative advantage. Because of lower exports of computers, the production of computers will be reduced in the USA.

ADVERTISEMENTS:

This will cause the resources to be shifted from relatively more efficient computer industry to relatively inefficient industries of the USA in which it has a comparative disadvantage. Thus tariffs cause misallocation of resources. To conclude in the words of Professors McConnel and Brue, “specialisation and unfettered world trade based on comparative advantage would lead to the efficient use of world resources and an expansion of the world’s real output. The purpose and effect of protective tariffs are to reduce world trade. Therefore, aside from their specific effects upon consumers, foreign and domestic producers, tariffs diminish the world’s real output.”

Effects of Quotas:

Quotas are quantitative restrictions on the quantity or value of a commodity to be imported in a country during a period. Since quota limits the imports of a commodity, it reduces supply of a commodity in a country as compared to the case with a free trade.

Like tariffs, quotas raise the prices of imported goods and encourage domestic production of those goods. But in case of quotas, the government does not collect any revenue. Quotas may be imposed against imports from all countries or used against the imports of only a few countries.

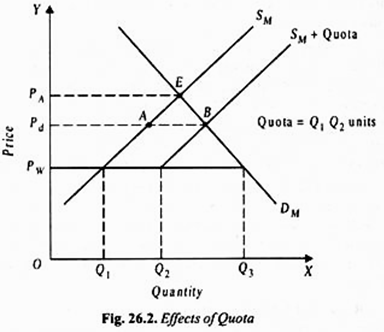

Economic effects of quota are graphically shown in Fig. 26.2 where DM and SM are domestic demand and supply curves of a commodity respectively. In the absence of trade, price of the commodity in the country is PA. Suppose the world price of the product is PW.

Under free trade, at price Pw of the commodity the domestic producers of country will produce OQ1 quantity but as domestic demand of the product at price Pw is OQ3 the quantity Q1 Q3 represents the imports at the world price Pw. Now assume that the Government imposes a quota and fixes the quantity of the product equal to Q1Q2 to be imported.

With this the total supply of the product in the domestic market will be away from the domestic supply SM equal to the distance Q1Q2. Incorporating the quota equal to Q1Q2 we draw a new supply curve SM+ Quota, which lies to the left of the free-trade supply curve SM.

ADVERTISEMENTS:

It will be seen from Fig. 26.2 that interaction of the supply curve (SM + Quota) with the domestic demand curve DM determines price Pd which is higher than the world price Pw. It will be seen from Fig. 26.2 that difference AB between demand and domestic supply at price Pd is exactly equal to the fixed quota of Q1Q2 quantity of imports.

It is thus dear that, like tariffs, fixation of quota has served to limit trade and raise price. It will therefore have same effects as we have explained in case of tariff. It may however be noted that, unlike tariff, in case of quota Government would not collect any revenue.

Case for Free Trade:

The following arguments have been given in defence of free trade:

1. Gains in Output and Well-being from Specialisation:

The case for free trade is fundamentally based on the gain in output and well-being a country obtains from specialising in the production of those goods in which it is relatively more efficient and therefore export a part of them and in exchange gets those goods from other countries in production of which they are comparatively more efficient.

Specialisation and trading in this way would achieve a more efficient allocation of resources and a higher level of output and well-being. To quote Prof. Haberler, “International division of labour and international trade which enable every country to specialise and to export those things which it can produce cheaper in exchange for what others can provide at a lower cost, have been and still are one of the basic factors promoting well-being and increasing national income of every participating country.”

2. Gains from Economies of Scale:

ADVERTISEMENTS:

An important gain from trade is that it enables the trading countries to benefit from the economies of scale. If a country does not trade with others, its firms will produce goods to meet the domestic demand for a product. If domestic demand for a product is small, each of them will produce at a higher cost since they would not be able to enjoy the benefits of the economies of large scale production.

Accordingly, the production of goods will be inefficient. Trade allows a country to export goods with the result that level of output of goods in a country will exceed domestic demand within a country. Thus trade expands the market for goods and enables the producers to take advantage of the economies of scale. Adam Smith was the first economist who pointed out that specialisation was limited by the size of the market.

Trade makes it possible for the producers to move beyond domestic market into international market and therefore makes it worthwhile to specialise and produce on a large scale and thereby to lower cost per unit.

For example, in a small country such as Ceylon domestic demand would not be sufficient to produce efficiently large luxury cars on a large scale at a lower cost. Their production on a large scale at lower cost requires wider international market for sale of luxury cars.

3. Long-Run Dynamic Gains:

Free trade also leads to dynamic gains being obtained from trade. Dynamic gains from trade refer to its stimulation of economic growth. Dennis Robertson described foreign trade as ‘an engine of growth’. The stimulation of growth through foreign trade are apparent from the rapid growth of such economies such as Japan, Taiwan, South Korea, Singapore, Hong Kong and China.

Free trade promotes economic growth through:

(1) Raising the rate of saving and investment;

(2) Import of capital goods, and

(3) Transfer of technology.

(i) Raising rate of saving and investment:

Increase in national product or real national income of a country obtained through trade above the level that prevails in autarky leads to a higher level of saving. The higher level of saving ensures a higher rate of investment and capital formation which stimulates growth.

Hence if trade raises the rate of saving, it also promotes economic growth. The higher rate of saving makes it easier for the developing countries to break ‘the vicious circle of poverty’ and to “take off into self-sustained growth.”

(ii) Import of capital goods:

Besides trade permits a country to import capital goods in exchange for exports of consumer goods or surplus raw materials, and thereby accelerates industrial growth. Imports of capital goods adds to the capital stock in a country and raises its productive capacity more than it would have been possible without trade. Free trade also often enables a country to borrow from other countries to finance import of capital goods.

(iii) Transfer of technology:

If different countries worked in isolation the new technology developed in one country would remain confined locally. Through trade technological progress tends to feed on each other. A technology discovered by one is improved by another and so technology goes on being improved successively.

Imagine if every country had to invent a wheel, a steam engine, electricity operating in an isolated manner, how slow would have been the progress in technology. The trade increases international diffusion of technology and in this way transfer of technology from the developed countries to the developing countries have been possible.

In the modern times technology developed in one country by a firm is licensed to firms in other countries. Through this process, technology is transferred from country to country. In the absence of trade between countries such transfer of technology would not take place and as a result economic growth would be slower.

4. Promotes Competition and Prevents Monopoly:

The case for free trade also rests on the fact that it promotes competition and prevents the emergence of monopolies in the domestic economy. In the absence of trade and therefore without facing any competition from foreign firms, domestic firms tend to become inefficient which causes rise in cost per unit of output and therefore higher prices of goods.

When trade is free, increased competition by foreign firms forces domestic firms to adopt measures to increase their efficiency and make efforts to reduce cost by employing lowest-cost production techniques. Free trade also compels them to be innovative and to improve the quality of their products.

Further, free trade provides consumers a wide range of products from which to choose. The increase in efficiency and the adoption of improved technology not only lowers prices of products but also contributes to economic growth.

5. Political Gains from Free Trade:

Free trade increases well-being or standard of living of the trading countries and this mutual welfare gains from trade make different nations economically dependent on each other. The economic interdependence raises the likelihood of reduced hostility between countries.

Economic interdependence provides powerful incentives for peaceful solution of disputes. Trade between economically interdependent countries increases the potential losses from war and thus reduces the likelihood of armed conflict.

Despite the above gains from free trade, countries have put up various barriers to free trade flows.

The important barriers to free trade are:

(1) The imposition of tariffs (i.e., duties on imports of goods),

(2) The fixation of import quotas,

(3) The licensing of imports.

The reasons for these trade barriers are that different nations want to protect their domestic industries, to increase employment opportunities, to improve their balance of payments and to achieve other goals. We therefore discuss below the case for protection and then in a later section will examine the impact of trade barriers, especially tariffs on welfare and growth.

Case for Protection:

Despite gains from free trade, many arguments have been given against free trade and in favour of protection. By protection we mean in order to safeguard the domestic industries from low-priced imports some barriers against import of foreign goods are imposed. Some arguments given in defence of protection are irrational and invalid, whereas some are valid. We critically examine below various arguments given in favour of protection (i.e., against free foreign trade).

Nationalism:

First argument for protection has been that nationalistic feeling or patriotism requires that people of a country should buy products of their domestic industries rather than foreign products. In the USA there has been a campaign ‘Be American, buy American’ appealing people to buy American goods instead of imported foreign products.

Similarly, in India recent campaign of ‘Swadeshi’ appeals to the patriotic feeling of the Indian people that we should protect our indigenous industries and impose barriers on imports of foreign goods or provide subsidies to our industries. However, this argument is misplaced and invalid.

Those policy makers who yield to such arguments deny the people of a country the gains from trade such as rise in productive efficiency and greater well-being, stimulus to growth through higher capital formation and spread of superior technology. Thus restrictions imposed on trade in the name of nationalism or swadeshi are actually contrary to our national interests because they promote inefficiency and prevents rapid economic growth.

Employment Argument:

An important argument for protection is that it will lead to increase in domestic employment or at least preserves present domestic employment. It is often believed that imports of goods from abroad reduce domestic employment.

Therefore, if instead of imports we produce those goods at home, employment in the country will increase. Besides, as prices of imported goods are lower, the domestic producers would not be able to compete with them and may be competed out of the market. This will destroy even present jobs in the domestic industries. It is therefore concluded that protection of domestic industries will lead to their expansion and therefore employment in them will increase.

In our view employment argument for protection is not logical and valid. This argument ignores the adverse effects of protection on our industries. An important economic principle is that exports must pay for imports. If imports are restricted by imposing barriers, the exports cannot remain unaffected.

For example, many raw materials and capital goods are imported to be used in industries which export goods. If imports are restricted, exports will therefore fall. This will lead to the decline in employment in export industries which will offset the increase in employment in the import-substituting industries.

Further, when you restrict imports to protect domestic industries so that they should expand, other countries are likely to retaliate and will impose restrictions on our exports which are imported by them. This too will reduce exports and cause reduction in employment in export industries. Thus net effect on employment of restricting imports for providing protection to domestic industries may not be positive.

Infant Industry Argument:

A powerful argument given in support of protection, especially in the context of developing countries is infant industries should be provided protection from the competition of low-priced imports of the mature and well-established industries of the developed industrialized countries.

Shortly after American Revolution, Alexander Hamilton argued that British industrial supremacy was due to its early start over American infant industries. He pointed out that these infant American industries required temporary protection for some time so that they should grow and achieve production efficiency and economies of scale before they could successfully compete with low-cost British goods. He thus argued that temporary protection of infant American industries was necessary for industrial development of America.

Similarly, the infant industry argument has been advanced for protecting infant industries of the developing countries from competition of the low-cost firms of the industrialized developed countries. Given some time, these infant industries will grow and will be able to benefit from the economies of scale and learn the techniques necessary to lower their cost of production.

As a result, over a period of time their cost per unit will go down and will therefore be in a position to compete with the foreign imports. Therefore, for some time they should be protected otherwise they would be destroyed by foreign competition.

However, there are some lacuna in infant industry argument. First, it is assumed that protected infant industries will make efforts to lower cost when provided protection. However, actual experience shows that it is more likely that protected industries lose incentives to become efficient and lower cost. It is said “once an infant, always an infant.”

Secondly, even if an industry makes efforts to improve productivity and lower cost per unit when it is provided protection, it has been assumed in the argument that the Government is the best judge as to which industries will prove to be capable of competing low-priced foreign goods.

It has been asserted in defence of free trade that selection of industries which will acquire competitive strength can be done better by private market mechanism. It is pointed out that when opening up the economy to foreign competition the domestic industries would try to increase their efficiency.

As a result, only those industries will survive which are efficient and produce at a lower cost. Therefore, it is argued that it is better if the domestic industries are left to foreign competition and in this way they will have incentives to improve productivity to escape from losses. Only those domestic industries will survive and operate which are efficient and produce at a low cost per unit.

Indian Automobile industry is a shining example of an industry not making any efforts to become efficient even after given protection for more than three decades. Before the setting-up of Maruti Udyog with Japanese collaboration, Indian car industry was fully protected by heavy duties on imports of cars.

The two domestic firms producing Ambassador and Fiat cars did not make any efforts to improve their efficiency, nor did they bring out any better models of their cars. It is only after 1991 that following the policy of liberalisation that new foreign firms such as Daewoo of South Korea, General Motors have come in India and producing new models and at relatively low prices. Even Maruti is now trying to improve its efficiency further and brought out new models of Maruti such as Zen, Esteem.

However, it may be noted that in developing countries the Government is in a better position to protect certain industries such as steel, cement which lead to an expansion of the infrastructure of the developing economies. This is because these industries create external economies and the private firms will not be compensated for creating these external benefits.

Anti-dumping Argument:

The other important argument for protection is that foreign producers compete unfairly by dumping the goods in another country. Dumping is a form of price discrimination when producers of a country sell goods in another country at lower prices than those charged at home.

Of course, consumers in a country in which foreign goods are dumped are beneficiaries, the industries of that country suffer as they are unable to compete with the ‘dumped goods’. Besides, there is more harmful ‘predatory dumping’ which implies that foreign firms try to sell goods in other countries even below cost to establish a worldwide monopoly by driving competitors out of the market. Once the local industries are competed out, they raise prices to obtain monopoly profits.

There is a lot of evidence that firms of USA and Japan often indulge in dumping of their goods in other countries to eliminate competition. But, in our view, instead of providing protection to domestic industries through tariffs or non-tariffs barriers, it will be a better policy to enact laws against dumping. Dumping should be prohibited by law declaring it illegal. In India such a law has been enacted but is not being properly implemented.

Correcting Balance of Payments Deficit:

Correcting deficit in balance of payments is also mentioned as justification for imposing tariffs to restrict imports or fixing of quotas of imports. This appears to be a valid argument for providing protection.

However, in our view the solution for fundamental disequilibrium in the balance of payments lies in the adoption of suitable adjustment in exchange rate, appropriate fiscal and monetary policies to lower domestic prices so as to encourage exports. The deficit in balance of payments can be reduced by ensuring rapid growth in exports of a country.

Redistribution Income:

Case for protection has also been built up on the ground that it can be used for making desirable redistribution of income from one section of society to another. Protection makes some people better off, while others worse off. By providing protection to domestic producers their profits can be raised at the expense of consumers who suffer a loss in consumer surplus as protection denies them consumption of low-priced imported goods. That is, protection redistributes income in favour of domestic producers.

Sometimes protection causes transfer of income from some factors to the others. For example, Heckscher-Ohlin Model of international trade shows that trade benefits the abundant factor and harms the scarce factor. It is therefore scarce factor that demands protection by the Government against imports so that its income may not decrease. This implies that the workers, the owners of labour, and capitalists tend to take opposite views with regard to protection. This is however not confirmed by empirical evidence.

In some countries one of the objectives of economic policy is to redistribute income from the rich to the poor. This can be done by imposing high tariffs on imports of goods considered to be luxury items and levying tariffs on exports of those goods which are considered as necessities.

Higher import tariffs on luxuries will reduce the incomes of the rich as they would pay taxes to the Government. Similarly, higher taxes on exports of necessities ensure greater supplies of them in the domestic market which would lower their domestic prices and benefit the poor.

It may however be noted that direct taxes such as income tax are considered better methods of redistributing income among various sections of a society than the commercial policy. This is because as we shall see below import tariffs levied for protecting industries cause down-weight loss of welfare which are avoided under the direct tax system.

Conclusion:

We have critically examined the various arguments in favour of protection. Some of them are valid, other appears to be misplaced. Some people consider trade as a ‘zero sum game’, that is, in trading if one gains, the other loses. This has given rise to the doctrine of exploitation.

For example, it is believed by some that the developing countries like India are exploited by the developed countries such as the USA, Japan, Britain. That is, the developing countries are net losers in trading with the developed countries. However, in our view, this is wrong thinking. No trade can occur without expectations of gain.

India would not have entered into trade relations with USA if it did not expect to gain from it. Trade occurs between two countries if it benefits both the trading partners, the developed and the developing countries. Therefore, in our view world trade should be promoted by lifting barriers put up by various countries based on wrong notions about effects of free trade.

Some countries such as USA and Japan have resorted to protectionist measures as a retaliation against foreign countries who restrict imports into their countries. The retaliatory actions of imposing trade barriers have done great harm to the expansion of world trade. New international organisation WTO (World Trade Organisation) which has replaced earlier GATT has been set up.

WTO has framed rules which every country should observe so that barriers to trade be removed and world trade be promoted without doing any injustice to the member countries. It may be noted that retaliatory activities of restricting imports from foreign countries generally lead to the depression in the economies of the world as it happened during the worldwide depression of 1930s. The retaliatory activities may cause another global depression.