The below mentioned article provides notes on effectiveness of monetary policy and fiscal policy.

Effectiveness of Monetary Policy:

It is important to explain to what extent monetary policy is effective in influencing level of national output.

Transmission of changes in money supply, say through open market operations, runs as follows, In the first step increase in money supply following the expansionary monetary policy leads to the fall in rate of interest.

In the second step of transmission mechanism, fall in rate of interest causes increase in total spending or aggregate demand (especially, investment expenditure). Finally, the aggregate output adjusts to the changes in aggregate demand. However, some linkages in transmission process of the effect of changes in money supply may not work.

ADVERTISEMENTS:

First, the change in money supply may not lead to a change in rate of interest. J.M. Keynes pointed out that the liquidity trap may occur at a very low interest rate and prevents the fall in rate of interest following the expansion in money supply. The liquidity trap is a situation in which the public is prepared at a given rate of interest to hold whatever money is supplied.

In this case demand for money is perfectly elastic and LM curve is a horizontal straight line, with a horizontal LM curve, the increase in money supply does not cause a shift in it and therefore does not affect the rate of interest. With rate of interest remaining unaffected, the expansion in money supply, say through open market operations, will not affect the aggregate spending (both consumption and investment demand).

With no change in aggregate demand on spending, the level of national output will remain unchanged. Thus in the situation of liquidity trap “monetary policy carried out through open market operations is powerless to affect the interest rate.”

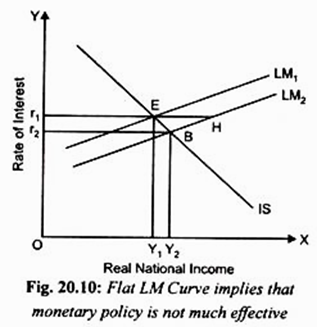

The effect of increase in money supply on aggregate output in case of horizontal LM curve is a bit complicated to show diagrammatically through IS-LM curve model. However, the ineffectiveness of monetary policy in case of the liquidity trap situation can be easily understood if we take the case of relatively flat LM curve (which can be considered as proxy for completely horizontal LM curve) caused by liquidity trap. This is depicted in Fig. 20.10. where a relatively flat LM1 curve intersects the given IS curve at front E determines rate of interest r1 and level of real income Y1.

ADVERTISEMENTS:

Now suppose the Central Bank of the country expands money supply equal to the horizontal distance EH shifting the LM curve to LM2. With the given IS curve the new equilibrium is at point B. It will be seen from the new equilibrium at point B that the interest rate falls only slightly and as a result real national income hardly increases to have any impact on the recessionary conditions.

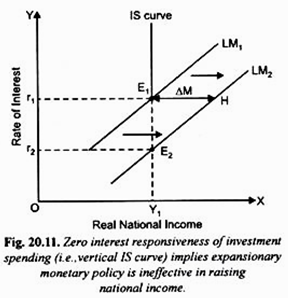

The second factor causing ineffectiveness of monetary policy occurs in the third step of transmission mechanism, namely, changes in aggregate spending or demand in response to changes in interest rate. This happens when changes in rate of interest have insignificant effect on autonomous planned spending, especially investment expenditure.

This situation occurs when business firms are so pessimistic about the future prospects of earning profits that they are reluctant to undertake any further investment in response to lower interest rate. As a result, increase in money supply causing lower interest rates does not lead to the increase in real national income.

ADVERTISEMENTS:

Under these circumstances of unresponsiveness of investment to changes in interest rate the IS curve is a vertical straight line as shown in Figure 20.11 where with the increase in money supply (∆M) equal to E1H does not raise real national income which is ‘stuck’ at Y1 level.

Banks’ Reluctance to Lend:

The third case when monetary policy has only limited effect on investment spending and therefore on real national income occurs when banks are reluctant to increase lending for investment in response to lower interest rate. This happened in the US in 1991 and then in 2008-09 and 2009-10, when global financial crisis occurred.

This situation also seems to have occurred in India in 2008-09 following the global financial crisis. In this case when the Central Bank of the US expanded money supply leading to lower interest rate, banks were reluctant to increase lending for the fear that lending might create bad loans with little possibility of being paid back.

In the US banks had made bad loans relating to real estate i.e., housing. Instead of lending for private spending and investment, banks purchased government securities such as treasury bills which are quite safe investment for banks. If due to risk aversion banks do not lend for private investment, the link in transmission mechanism that involves more private investment in response to lower interest rate breaks down to give boost to real national income.

In India too, when in 2008-09 the Reserve Bank of India lowered its repo rate and cash reserve ratio (CRR) for the banks, they were not much enthusiastic for lending to private firms for fear of default by them in repaying the loans. Therefore, to earn some return on their excess cash reserves due to easy monetary policy, some banks opted for investing in government securities beyond what was required under statutory liquidity ratio (SLR).

However, both in the US in 1991 and 2008-09 and in India in 2008-09 larger cuts in interest rate and expansion in money supply did bring about boost in lending for private investment and consumption for buying durable consumer goods leading to the recovery in the economies.

In this context, it is worth mentioning the policy of ‘quantitative easing’ (QE) which the Federal Reserve of the US is pursuing to revive the American economy under the leadership of its governor Ben Bernanke. Under the policy of quantitative easing the Federal Reserve has been continuously buying government securities since 2010 and pumping into the American economy more money, that is, the US dollars, on a large scale keeping zero rate of interest.

This unconventional monetary policy of quantitative casing ultimately seems to have worked in raising the levels of output and employment in the US and thus achieving recovery of the US economy in 2013 with rate of unemployment falling to 7.6 per cent compared to 10 per cent in the year 2009.

Effectiveness of Fiscal Policy:

Recall that the IS curve describes equilibrium in the goods market. The IS curve slopes downward because as the rate of interest falls investment spending increases causing rise in aggregate demand that leads to the increase in real national income (i.e., GDP).

ADVERTISEMENTS:

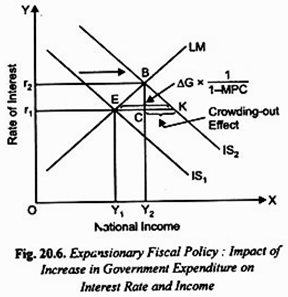

Expansionary fiscal policy may be either in the form of increase in government expenditure or cut in taxes. In both these forms of fiscal stimulus, the IS curve shifts to the right. In our previous Fig. 20.6 of IS-LM curve model we have explained that given the normal upward sloping LM curve increase in government expenditure leads to increase in output or real national income less than that under Keynesian government expenditure multiplier (i.e., less than ∆G x 1/1 – MPC) because of the rise in interest rate.

Now suppose under the expansionary fiscal policy the government increases its expenditure so that there is a shift in the IS1 curve to the right to IS2. This new IS2 curve intersects the given steep LM curve at point E2 and, as will be seen from Figure 20.12, rate of interest rises to r2 and the real national income increases from Y1 to Y2.

ADVERTISEMENTS:

A larger income equal to Y2Y3 or KH has been wiped out due to crowding-out effect of rise in interest rate on investment. To conclude, in case of lower interest-responsiveness of demand for money expansionary fiscal policy is not very effective in bringing about a sufficient increase in real national income.

Horizontal LM Curve:

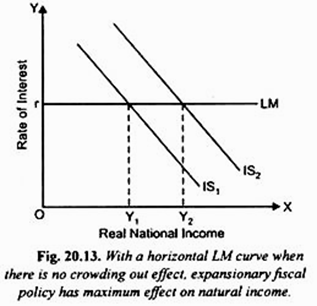

Note that contrary to Figure 20.12 where due to steep upward-sloping LM curve, increase in government expenditure on national income has less than full Keynesian multiplier effect on the equilibrium level of national income due to large crowding-out effect of rise in rate of interest, there is no crowding-out effect when there is infinite interest responsiveness of demand for money and the LM curve is horizontal which occurs when the economy is in the liquidity trap.

ADVERTISEMENTS:

In this case of horizontal LM curve shown in Fig. 20.13 increase in the government expenditure causing a shift in the IS curve to the right to IS2 position. As will be seen from Figure 20.13, rate of interest of remains fixed and as a result there is no crowding out effect and the national income increases by the full multiplier effect of increase in government expenditure that is by ∆G x 1/1 – MPC.

It may however be noted that the horizontal LM curve depicting liquidity trap in the demand for money in which case there is no crowding out effect of fiscal stimulus is an extreme case that may occur when there is severe depression in the economy.

The Classical Case of Zero Interest-Responsiveness of Demand for Money and Crowding-Out Effect:

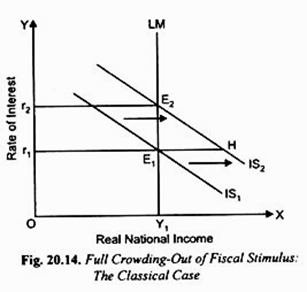

Expansionary fiscal policy, that is, increase in government expenditure or cut in taxes has no effect on the level of real income when the LM curve is vertical, that is, interest- responsiveness of demand for money is zero. This is a classical case where fiscal stimulus provided by increase in government spending increases only the interest rate which crowds out private investment equal to the increase in government expenditure times the multiplier, that is, ∆G x 1/1 – MPC.

As a result, level of national income remains unaffected. Thus, with a vertical LM curve (i.e., zero interest -responsiveness of demand for money), there is full or complete crowding out. This is shown in Fig. 20.14 where a vertical LM curve is drawn at the level of national income Y1. Initially, the IS1 curve intersects the vertical LM curve so that in equilibrium rate of interest is r1 and real national income is Y1.

Now suppose the government adopts expansionary fiscal policy and increases its expenditure shifting the IS curve to IS2. However, the new equilibrium between IS2 curve and the given vertical LM curve is at point E2. In this new equilibrium situation rate of interest has risen from r1 to r2, the level of real national income remains unchanged at Y1.

ADVERTISEMENTS:

This means rise in interest rate has completely wiped out the expansionary effect on the level of real national income by crowding out private investment. In this case crowding-out of private investment equals the increase in government expenditure times its multiplier (i.e. ∆G x 1/1 – MPC) and therefore leaves real national income unaffected.

Numerous historical episodes show that the crowding-out effect is neither complete nor full, nor is it non-existent, it is only partial as shown in the Figure 20.6 depending upon the degree of steepness of LM curve. Whether crowding out is zero, complete or partial depends on the interest- responsiveness of demand for money, that is, slope of the LM curve.

The Importance of Crowding-Out Effect Expansionary Fiscal Policy:

We have seen above that the increase in real national income (i.e., multiplier effect) as a result of expansionary fiscal policy (e.g., increase in government expenditure) depends on interest elasticity of demand for money (that is, slope of LM curve). Three points are worth considering about the effect of fiscal stimulus on real national income.

First, in our analysis of IS-LM curves model, we have assumed that prices remain constant and the existing level of aggregate output (i.e., real national income) is below the full-employment level. In this situation there is a scope for increase in output or real national income and therefore when the government expands its expenditure causing increase in aggregate demand, the firms increase their output and employment. In this case the magnitude of fiscal multiplier is quite large.

However, in a fully employed economy crowding out of fiscal stimulus occurs through a different route. When there is full employment in the economy, increase in aggregate demand leads to the rise in price level as the economy moves up along an upward-sloping short-run aggregate supply curve.

ADVERTISEMENTS:

Now, the rise in price level, nominal money supply remaining constant, reduces the real money supply, that is, M/P decreases. The reduction in money supply shifts the LM curve to the left raising the interest rate to rise until the initial increase in aggregate demand as a result of expansion in government expenditure is fully wiped out.

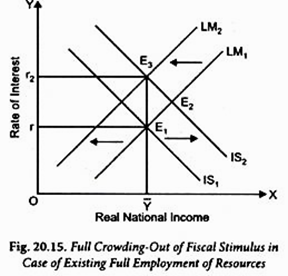

This case is depicted in Fig. 20.15 where initially IS1 and LM1 curves intersect at point E1 and determine level of national income Y which is a full-employment level. Now, the increase in government expenditure causes IS curve to shift to the right IS2, the economy moves to point E2.

Since with a shift in IS curve to IS2 aggregate demand increases along an upward sloping short-run aggregate supply curve, this will lead to the rise in price level resulting in decline in real money supply. This decline in real money supply will bring about a leftward shift in the LM curve to the left to LM2 position and raise the interest rate to r2 so that the initial increase in national income is fully crowded out. As a result, expansionary fiscal policy fails to raise level of real national income and has therefore zero multiplier effect.

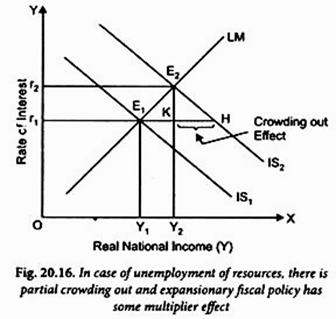

The second case occurs when there is unemployment of resources in the economy and the LM curve slopes upward to the right. In this case fiscal stimulus through increase in government expenditure will raise interest rate but level of real national income will also increase. Due to unemployment resources, there will not be much increase in price level when aggregate demand increases.

As a result, crowding-effect of fiscal stimulus is only partial, and there is net increase in national income. Therefore, in this case there is some multiplier effect of expansionary fiscal policy though it is less than the Keynesian multiplier effect (i.e., ∆G.1/1 – MPC). This case is depicted in Fig. 20.16 where initially IS1 and LM curves intersect at point E1.

ADVERTISEMENTS:

Expansionary fiscal policy with its multiplier effect shifts IS curve to IS2 equal to the horizontal distance E1 H. With the given LM curve and the new IS2 curve the new equilibrium is reached at point E2 and, as will be seen from the Figure 20.16, the national income increases from Y1 to Y2, the income equal to KH has been wiped out due to crowding-out effect of rise in interest rate from r1 to r2.

However, there is further effect of expansionary fiscal policy. With the net increase in national income from Y1 to Y2 resulting from the shift in IS curve from IS1 to IS2 the level of saving will increase. This increase in saving enables the economy to finance a large budget deficit with smaller amount of government borrowing which would ensure interest rate will not rise much and as a result crowding-out effect of expansionary fiscal policy on private investment will be smaller.

Monetary Accommodation:

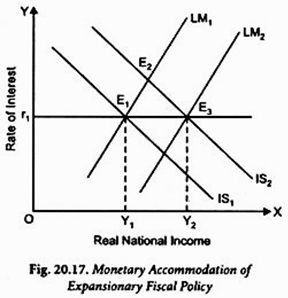

The third case occurs when there is unemployment in the economy so that there is possibility of increases in output as a result of increase in aggregate demand. In this case interest rate need not rise when there is increase in government spending shifting IS curve to the right but at the same time the Central Bank of the country raises the money supply to prevent the rise in interest as a result of increase is government spending. This is called monetary accommodation by the Central Bank.

Thus, “Monetary policy is accommodating when in the course of fiscal expansion, the money supply is increased to prevent interest rates from rising”. In this case of sufficient monetary accommodation, rate of interest does not rise, and therefore there is no crowding-out effect on private investments, the expansionary fiscal policy brings about increase in national income equal to increase in government expenditure times the Keynesian multiplier (i. e., ∆G x 1/1 – MPC).

ADVERTISEMENTS:

This case of monetary accommodation of fiscal expansion is depicted in Fig. 20.17 in which it will be seen that initially equilibrium is at point E1 where IS1 and LM1 curves intersect determine Y1 level of income and r1 rate of interest. Now, fiscal stimulus by the government shifts the IS curve to IS2 and given the LM1 curve, equilibrium will be at point E2 where rate of interest rises to r2 which would crowd out private investment.

To prevent this crowding out, the Central Bank adopts the monetary accommodation policy and for this it increases money supply sufficiently so that LM curve shifts to the right to LM2 which intersects IS2 curve at point E3 so that interest remains at the initial level r1 and income increases to Y2.

Thus the increase in income equal to E1 E3 or Y1 Y2 that occurs equals the increase in government expenditure times the Keynesian multiplier (i.e., ∆G. 1/1-MPC); crowding out having been eliminated by expansion in money supply by the Central Bank.

It may be noted that in 2008-09 and 2009-10 when due to global financial crisis, India faced the problem of large slowdown of the economy, the Indian government adopted fiscal stimulus measures such as raising its expenditure through borrowing on a large scale from the market and cut rates of many indirect taxes to prevent sharp slowdown of the Indian economy, the Reserve Bank of India adopted accommodative monetary policy so that rate of interest does not rise.

To this end, the RBI greatly reduced its repo rate (the ratio at which it lends to the commercial banks) and also lowered the cash reserve ratio (CRR) of the banks so that more finds are available with them to lend to the business firms for investment and consumption purposes, such as housing loans, car loans at lower rate of interest. This policy succeeded and India achieved 6.7 per cent growth in the crisis year 2008- 09 and 8.6 per cent in 2009-10.