In this article we will discuss about theory of Cost:- 1. Subject-Matter on Theory of Cost 2. Information on Cost 3. Purpose of Cost Data 4. Decisions Requiring Cost Information 5. Costs and Expenses 6. Factors Affecting Cost Behaviour.

Subject-Matter on Theory of Cost:

We may now set forth the fundamentals of the theory of cost. Since cost and productivity (of resources) are interrelated, a study of production theory demands a review of the theory of cost. Costs are one of the two major factors with which profit-making firms have to deal wisely.

Successful managers are certainly aware that it is the level of cost relative to revenue that determines the firm’s overall profitability. This theory is important in managerial decision-making because it provides a framework for the theory of supply and governs two important production decisions made by managers: whether or not to shut down and how much to produce.

As early as 1927, the noted economist J. B. Clark made the following statement:

ADVERTISEMENTS:

“A graduate class in economic theory would be a success if students gained from it an understanding of the meaning of cost in all its many respects.”

These words are still valid today. The implication is that the study of cost is really complex because of its accounting, financial engineering and legal implications. Frequently there is controversy over the nature of costs, the definition of costs and what costs are relevant for managerial decision-making.

Most of the controversy disappears as soon it is realized that cost information is required for various purposes and for different kinds of problems. Moreover, the particular information required varies from one problem to another.

Since different people—viz. accountants, economists and engineers—are concerned with the study of costs for different purposes there are various ideas about costs, many of which are adapted to different purposes.

Information on Cost:

In any business activity concerned with making maximum profit from available resources, some information on cost is essential. The usual view taken of cost is a negative one. This is because the term ‘cost’ implies a measurement of the value of the resources, broadly defined, that are sacrificed as a result of any revenue-making activity. But in the real world, one can take a positive view of costs.

ADVERTISEMENTS:

If this approach is taken, cost minimization and profit maximization may not imply the same thing. There may be a situation in which a deliberate increase in costs may appear to be logical and necessary. It may thus be desirable to buy more reliable and more expensive plant and equipment, or spend more money on advertising or sales promotion, or use higher quality but more costly materials.

Purpose of Cost Data:

There are three broad purposes for which cost data are required:

i. Decision-Making:

If the expected effects on profits of any possible action or decision, appears to be important, estimates of the cost effects of the decision do have obvious relevance.

ii. Forecasting Future Cost Levels:

ADVERTISEMENTS:

Here, some event or process change is anticipated (such as rising prices of raw materials or energy) which will affect the company’s cost levels to some extent.

iii. Control Systems:

By setting cost levels for various divisions of the company or perhaps for individual products, the company can develop a standard on the basis of which it can monitor and evaluate subsequent performance. One systematic way of using cost data for this purpose is standard costing.

Decisions Requiring Cost Information:

In practice, a company can take the following four kinds of actions in its production department and each kind of action will call for the provision of cost information:

1. A change in output level.

2. A change in product line, i.e., a new product is added or an existing product dropped.

3. A change in product mix, i.e., the production department changes the proportions of the company’s products within some constant level of output (e.g., the concept of broad banding introduced in the recent past).

4. A change in the process of production, i.e., the production engineers change the equipment, materials, or methods used in production.

The above changes may occur simultaneously. For example, there is unlikely to be a change in product mix without any change in output level. Likewise, substantial changes in output level may justify a change in production process if, for some reason, other processes appear to be more efficient at the new level (e.g., use of robots in assembly line).

These potential changes are within the management’s discretion, i.e., the management can decide for or against such actions in the light of their expected effects on profit. The need for such changes may arise due to changes in tastes and preferences of buyers, in market conditions, or technological progress which may make available new products or improved production processes.

ADVERTISEMENTS:

Other effects on cost may arise due to external factors over which management has little control. Thus, such effects do not depend on the response of management, such as increases in the prices of raw materials, labour, energy and capital (i.e., interest rates).

In such situations, the management’s task is to foresee such changes and to plan an appropriate response. However, assuming that the company’s operations were previously optimal in the face of increase in input prices, increase in the company’s cost level is unavoidable. Management will try to minimize this increase by making one or more of the four types of changes listed above.

In managerial economics, we study the nature and behaviour of costs in order to make efficient resource allocation decisions. However, before we discuss various cost concepts, it is necessary to identify at the outset certain general factors which affect cost behaviour in a modern business firm. It is also necessary to discuss the relationship between production and cost.

The theory of cost is developed from the underlying theory of production, that production theory shows how to find out the least cost combination of inputs for producing a given level of output with a fixed set of input prices.

ADVERTISEMENTS:

Therefore, it follows by transitive logic, that just as cost theory provides the foundation of supply, production theory provides the foundation for the theory of cost. In other words, the production function and input prices determine the cost of producing any specific level of output.

To start with, we shall discuss a few important concepts. Then we set forth the theory of cost in the short-run. In the short-run, since the level of usage of some inputs is fixed, some costs are fixed also. We then analyse cost behaviour in the long-run, when all input usages are variable and hence all costs are variable.

Let us begin with a distinction between cost and expense.

Costs and Expenses:

In general, costs are classified in many ways:

ADVERTISEMENTS:

(1) By what was acquired,

(2) By how the cost object was used or

(3) By the functional form that relates the cost to some other variable.

Thus, the following definition of cost is adopted:

A cost is the value of assets given up, or to be given up, to acquire other assets. Cost is distinguished from expense, which is the value of assets given up to generate revenue.

Expenses are the costs incurred in connection with revenue generation. The term ‘expense’ connotes ‘sacrifices made’, ‘the cost of services or benefits received’, or ‘resources consumed’ during an accounting period. The term ‘cost’ is not synonymous with ‘expense’.

ADVERTISEMENTS:

As just explained, expense means a decrease in owners’ equity that arises from the operation of a business during a specified accounting period, whereas cost means any monetary sacrifice whether or not the sacrifice affects owners’ equity during a given accounting period.

The American Accounting Association Committee gives the following definition:

Expense is the expired cost, directly or indirectly related to a given fiscal period, of the flow of goods or services into the market and of related operations …recognition of cost expiration is based either on a complete or partial decline in the usefulness of assets or on the appearance of a liability without a corresponding increase in assets.

Asset or Expense?

When one part of a transaction results in a decrease in cash or an increase in a liability the accountant must often answer the question: Is the other part of the transaction an increase in an asset, or is it an expense? If it is the former, income is unaffected, if it is the latter, income gets reduced.

One useful way of approaching this problem is to consider whether, at the end of the accounting period, the business will own something that qualified as an asset, as this word is defined in accounting. If not, the item must be ‘written off’ as an expense.

Expenses and Expenditures:

Expenditure takes place when an asset or a service is acquired. The expenditure may be made by cash, by the exchange of another asset, or by incurring a liability.

ADVERTISEMENTS:

Over the entire life of a business, most expenditures made by a business become expenses and there are no expenses that are not represented by an expenditure. In any time segment shorter than the life of a business, however, there is hardly any correspondence between expenses and expenditure.

Example:

In 1988, Rs. 1,000 of fuel oil was purchased for cash. There was an expenditure of Rs. 1,000 and an exchange of one asset for another, i.e., money for fuel oil. If none of this fuel oil was consumed in 1988, there was no expense in 1988. If the fuel oil was consumed in 1989, there was an expense of Rs. 1,000 in 1989.

You acquired a gas cylinder at Rs. 120 last month and it became empty exactly after one month. In this case your cost is Rs. 120 and your daily expense is Rs. 4. Cost may be incurred at a fixed point in time, but expense is a flow (i.e., so much per period).

Costs, Expenses and Losses:

Clearly, most costs eventually become expenses. In fact, some become an expense virtually at the same time as the cost is incurred. When this is true, we often use the terms cost and expenses synonymously. For example, if a firm buys supplies for sales people only as the supplies are needed, and the supplies are used immediately to help generate sales, we usually call the outlay for supplies an expense.

But, in fact, there was both a cost and an expense involved. In service organizations and retail organizations, for example, most labour services are used directly to generate revenues. In these cases, there is no harm in referring to the expenditures for labour as labour expense. In many situations, however, labour services are not used directly to generate revenue; they are used to produce a product.

ADVERTISEMENTS:

In these cases the cost of labour services becomes part of the cost of the product produced. We use cash to acquire labour services and the labour services are used to acquire completed units of a product.

The labour will become an expense only when the associated product is finally used to generate revenue (i.e., when the product is sold). Hence, in a manufacturing organization, the labour to construct a product becomes part of the cost of the product.

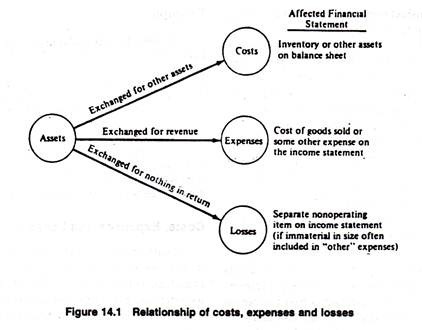

We noted that most costs eventually become expenses. There is an important exception to the rule: when assets are given up for nothing in return, the value of the assets given up becomes a loss. Thus, if some sales supplies are carelessly destroyed, the firm will have incurred a loss from destroyed supplies. Fig. 14.1 shows the relationship among costs, expenses and losses.

Factors Affecting Cost Behaviour:

Cost behaviour is the result of various forces. The determination of the functional relationship of cost to each major force helps to provide the informational foundation for various cost forecasts, and estimates of alternative costs of rival programmes characterizing cost analysis in business economics.

What forces determine the behaviour of costs, e.g., account for differences in cost per tonne of steel produced in different plants, both in the private and public sectors and from month to month? The determinants of cost differ from firm to firm and situation to situation.

ADVERTISEMENTS:

Still, there are a few determinants that have enough importance in modern manufacturing enterprises, viz.:

(1) Rate of output (i.e., utilisation of fixed plant),

(2) Size of plant,

(3) Prices of inputs (materials and labour),

(4) Technology,

(5) Size of lot,

(6) Stability of output, and

(7) Efficiency of management and labour.

1. Rate of Output:

Economists have long speculated that marginal costs rise continuously as output rate increases above some given level. The resulting average cost curve has a U-shaped relation to output. Contrarily, businesses have generally assumed that marginal cost is constant, at least over the output range of normal experience.

2. Size of Plant:

The short-run cost curves represent cost variation with a few alternative sizes of fixed plant and reflect the notion that for each product level, there is a minimum-cost size which makes the best compromise between indivisibilities of big machinery and the high cost of coordinating big plants.

When we draw these short-run curves on the chart, we can trace an envelope curve which shows, for each output rate, the minimum-cost level and the size of plant that produces it. Such an envelope is the long-run cost curve. It does not pass through the minimum points of all the short-run cost curves except one, because there is in general some slightly different sized plants that can produce that output at even lower cost.

However, no plant is built with the expectation of an absolutely fixed output rate. It is important to know not only minimum cost points, but cost behaviour with fluctuating output rates, changes in product-mix, and the like. Furthermore, flexibility for adaptation of plants to new types of products as they develop is an important part of long-run decisions.

3. Prices of Factors (Inputs):

In the language of Joel Dean, “The effect of changes in wage rates and material prices upon costs must usually be anticipated for the future in choosing among alternative programmes … changes in wages and the prices affect not only the cost per unit of inputs but also the minimum-cost mixture of labour, materials and capital.”

In fact, high wages and low material prices allow a large amount of wastage and rejects. Moreover, high wages also promote substitution of capital equipment for labour and stimulate technical research in automatic machinery and the use of mechanical energy.

4. Technology:

The relationship between technology and cost behaviour is close. Often a single change in equipment alters not only the technology but also the scale of the plant and its flexibility for changes in output. Technological change often leads to a fall in average cost but raises the productivity of existing resources.

5. Lot Size:

Production cost per unit goes down with lot size, but storage and risk cost per unit goes up. Usually, in large-scale production, cost of production tends to fall initially with increase in lot size (i.e., the size of a single production job).

6. Other Factors:

The volatility of output rate also affects cost behaviour. Stability and plan ability of output lead to various cost savings. Additional cost savings occur due to learning effect and technological progress. Cost behaviour is also affected by the variability of the product-mix.

Conclusion:

To find the lowest-cost operating pattern for a given output rate often involves a choice among several dimensions of operation.

For example, output could be raised by increasing:

(i) Speed of machines;

(ii) Number of machine hours per day;

(iii) Number of days of operation per month, and/or by

(iv) Number of machines operated.

Some Basic Concepts of Costs:

i. Fixed and Variable Costs:

In the short run, some inputs (especially capital stock or size of the plant) remain fixed. Since these inputs have to be paid regardless of the level of output produced, these payments to the fixed factors of production remain constant irrespective of the level of output, whether anything is produced at all.

This payment goes by the name fixed cost. An example would be monthly payments on a loan from a development bank like the Industrial Finance Corporation of India. These payments have to be made even if the firm does not produce anything during a given period.

The payments to variable factors of production are treated as variable costs. Producing more output requires more inputs. Thus, variable cost increases as the level of output, and correspondingly, the usage of inputs increase. Examples of variable cost would be cost of raw materials, and use of machines on rental basis.

ii. Explicit and Implicit Costs:

In general, costs refer only to explicit costs. In fact, historical costs are costs of the firm for which explicit payment has been made sometime in the past or for which the firm is committed to future payments. While preparing income statement, a financial accountant seeks to record such costs as data.

Examples of such costs are wages and salaries, rent, cost of materials, depreciation, the amount paid for a machine, and interest payments. Whether these- costs are fixed or variable, they are the amounts that firms must pay to owners of the resources in order to bid these resources away from alternative uses.

The obvious advantage of restricting cost figures to those based on historical costs is that objectivity-records of transactions should exist from which the figures can be verified.

However, most economists consider the concept of historical costs to be too narrow when estimating the total costs of the firm, and they also include implicit opportunity costs which the firm has to incur.

Implicit costs are those which do not involve actual payment by a firm to factors of production, but nevertheless represent costs to the firm in the sense that in order to use certain inputs in the production process, opportunities for the firm to use them elsewhere have been foregone.

To illustrate the concept: consider two firms that produce a particular good and are identical in all respects. Both use equal amounts of the same resources to produce the same amount of the goods. The owner of one firm rents the building in which the goods is produced.

The owner of the other firm inherited the building the firm uses and, therefore, has to pay no rent. It may apparently seem that the costs of the second producer is lower. But this is not really so. For decision-making purposes, the costs for both are the same even though the second firm pays no rent for using the factory building.

The reason is that, using the building to produce goods, costs the second firm the amount of income that could have been earned had it been rented at the prevailing market rate. Since these two buildings are the same in all respects, presumably the market rentals would be identical.

Differently put, a part of the cost incurred by the second firm is the (implicit) payment from firm owners to themselves as the owners of a resource (the factory building). Thus, what owners of a firm could make from selling or leasing a resource they own (if they were not using it in their firms) would be treated as part of implicit cost.

Likewise, the value of the firm owner’s time that is used to manage the business is also component of total implicit costs. Presumably, if the owner of a firm (say, an engineer) were not managing the business, he could obtain a job in another firm, possibly as a manager.

The salary that could be earned in this alternative occupation is an implicit cost that should be recorded as part of the total cost of production. These implicit costs are just as real as explicit costs and both are important for decision-making purposes.