As in the traditional theory, short-run costs are distinguished into average variable costs (AVC) and average fixed costs (AFC).

The average fixed cost:

This is the cost of indirect factors, that is, the cost of the physical and personal organisation of the firm.

The fixed costs include the costs for:

ADVERTISEMENTS:

(a) The salaries and other expenses of administrative staff

(b) The salaries of staff involved directly in the production, but paid on a fixed-term basis

(c) The wear and tear of machinery (standard depreciation allowances)

(d) The expenses for maintenance of buildings

ADVERTISEMENTS:

(e) The expenses for the maintenance of land on which the plant is installed and operates.

The ‘planning’ of the plant (or the firm) consists in deciding the ‘size’ of these fixed, indirect factors, which determine the size of the plant, because they set limits to its production. (Direct factors such as labour and raw materials are assumed not to set limits on size; the firm can acquire them easily from the market without any time lag.)

The businessman will start his planning with a figure for the level of output which he anticipates selling, and he will choose the size of plant which will allow him to produce this level of output more efficiently and with the maximum flexibility. The plant will have a capacity larger than the ‘expected average’ level of sales, because the businessman wants to have some reserve capacity for various reasons.

The businessman will want to be able to meet seasonal and cyclical fluctuations in his demand. Such fluctuations cannot always be met efficiently by a stock-inventory policy. Reserve capacity will allow the entrepreneur to work with more shifts and with lower costs than a stock-piling policy. Reserve capacity will give the businessman greater flexibility for repairs of broken- down machinery without disrupting the smooth flow of the production process.

ADVERTISEMENTS:

The entrepreneur will want to have more freedom to increase his output if demand increases. All businessmen hope for growth. In view of anticipated increases in demand the entrepreneur builds some reserve capacity, because he would not like to let all new demand go to his rivals, as this may endanger his future hold on the market. It also gives him some flexibility for minor alterations of his product, in view of changing tastes of customers.

Technology usually makes it necessary to build into the plant some reserve capacity. Some basic types of machinery (e.g. a turbine) may not be technically fully employed when combined with other small types of machines in certain numbers, more of which may not be required, given the specific size of the chosen plant. Also such basic machinery may be difficult to install due to time-lags in the acquisition.

The entrepreneurs will thus buy from the beginning such a ‘basic’ machine which allows the highest flexibility, in view of future growth in demand, even though this is a more expensive alternative now. Furthermore some machinery may be so specialized as to be available only to order, which takes time. In this case such machinery will be bought in excess of the minimum required at present numbers, as a reserve.

Some reserve capacity will always be allowed in the land and buildings, since expansion of operations may be seriously limited if new land or new buildings have to be acquired. Finally, there will be some reserve capacity on the ‘organisational and administrative’ level. The administrative staff will be hired at such numbers as to allow some increase in the operations of the firm. In summary, the businessman will not necessarily choose the plant which will give him today the lowest cost, but rather that equipment which will allow him the greatest possible flexibility, for minor alterations of his product or his technique.

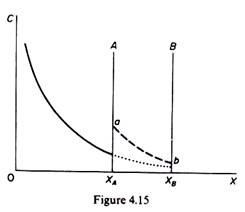

Under these conditions the AFC curve will be as in figure 4.15. The firm has some ‘largest-capacity’ units of machinery which set an absolute limit to the short-run expansion of output (boundary B in figure 4.15). The firm has also small-unit machinery, which sets a limit to expansion (boundary A in figure 4.15).

This, however, is not an absolute boundary, because the firm can increase its output in the short run (until the absolute limit B is encountered), either by paying overtime to direct labour for working longer hours (in this case the AFC is shown by the dotted line in figure 4.15), or by buying some additional small-unit types of machinery (in this case the AFC curve shifts upwards, and starts falling again, as shown by the line ab in figure 4.15).

The average variable cost:

As in the traditional theory, the average variable cost of modern microeconomics includes the cost of:

ADVERTISEMENTS:

(a) Direct labour which varies with output

(b) Raw materials

(c) Running expenses of machinery.

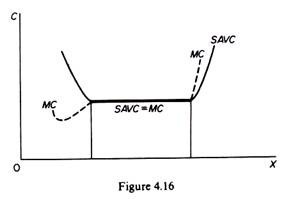

The SAVC in modern theory has a saucer-type shape, that is, it is broadly U-shaped but has a flat stretch over a range of output (figure 4.16). The flat stretch corresponds to the built-in-the-plant reserve capacity. Over this stretch the SAVC is equal to the MC, both being constant per unit of output. To the left of the flat stretch, MC lies below the SAVC, while to the right of the flat stretch the MC rises above the SAVC.

ADVERTISEMENTS:

The falling part of the SAVC shows the reduction in costs due to the better utilization of the fixed factor and the consequent increase in skills and productivity of the variable factor (labour). With better skills the wastes in raw materials are also being reduced and a better utilization of the whole plant is reached.

The increasing part of the SAVC reflects reduction in labour productivity due to the longer hours of work, the increase in cost of labour due to overtime payment (which is higher than the current wage), the wastes in materials and the more frequent breakdown of machinery as the firm operates with overtime or with more shifts.

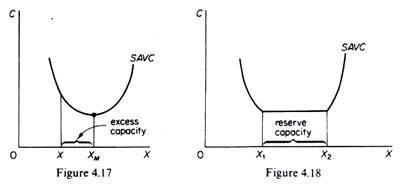

The innovation of modern microeconomics in this field is the theoretical establishment of a short-run SAVC curve with a flat stretch over a certain range of output. The reserve capacity makes it possible to have constant SAVC within a certain range of output (figure 4.18). It should be clear that this reserve capacity is planned in order to give the maximum flexibility in the operation of the firm. It is completely different from the excess capacity which arises with the U-shaped costs of the traditional theory of the firm.

ADVERTISEMENTS:

The traditional theory assumes that each plant is designed without any flexibility; it is designed to produce optimally only a single level of output (XM in figure 4.17). If the firm produces an output X smaller than XM there is excess (unplanned) capacity, equal to the difference XM – X. This excess capacity is obviously undesirable because it leads to higher unit costs.

In the modern theory of costs the range of output X1X2 in figure 4.18 reflects the planned reserve capacity which does not lead to increases in costs. The firm anticipates using its plant sometimes closer to X1 and at others closer to X2. On the average the entrepreneur expects to operate his plant within the X1X2 range.

Usually firms consider that the ‘normal’ level of utilization of their plant is somewhere between two-thirds and three-quarters of their capacity, that is, at a point closer to X2 than to X1. The level of utilization of the plant which firms consider as ‘normal’ is called ‘the load factor’ of the plant.

The average total cost:

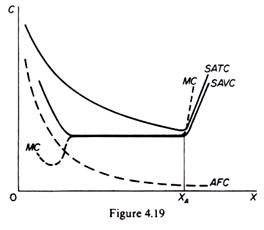

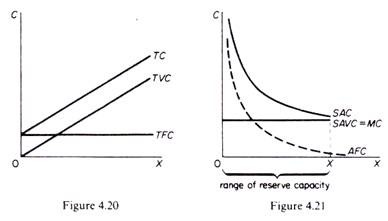

The average total cost is obtained by adding the average fixed (inclusive of the normal profit) and the average variable costs at each level of output. The ATC is shown in figure 4.19. The A TC curve falls continuously up to the level of output (X2) at which the reserve capacity is exhausted. Beyond that level ATC will start rising. The MC will intersect the average total-cost curve at its minimum point (which occurs to the right of the level of output XA, at which the flat stretch of the AVC ends).

ADVERTISEMENTS:

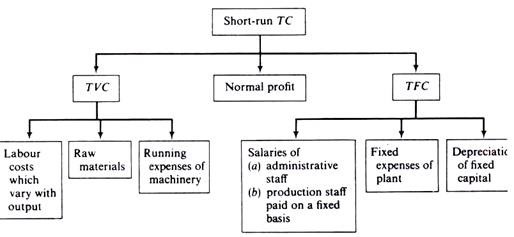

The composition of the short-run total costs may be schematically presented as follows:

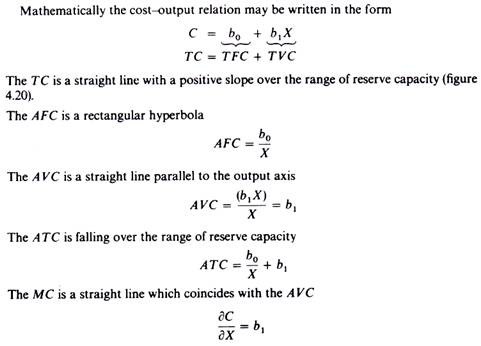

Thus over the range of reserve capacity we have MC = AVC = b1, while the ATC falls continuously over this range (figure 4.21). Note that the above total-cost function does not extend to the increasing part of costs, that is, it does not apply to ranges of output beyond the reserve capacity of the firm.