In this article we will discuss about the general and conflicting objectives of monetary policy.

General Objectives of Monetary Policy:

(i) Neutrality of Money

(ii) Exchange Stability

(iii) Price Stability

ADVERTISEMENTS:

(iv) Full Employment

(v) Economic growth

(vi) Conflicting Objectives of Monetary Policy

(vii) Conclusion- Choosing a suitable Objectives.

ADVERTISEMENTS:

Various objectives or goals of monetary policy are:

(i) Neutrality of Money

(ii) Exchange Stability

(iii) Price Stability

ADVERTISEMENTS:

(iv) Alternative Price Policies

(v) Full Employment

(vi) Economic growth

These objectives are discussed in detail in the following articles:

(i) Neutrality of Money:

Economists like Wicksteed, Hayek, Robertson, advocated that the main objective of the monetary policy is to maintain complete neutrality of money. The policy of neutrality of money seeks to do away with the disturbing effect of changes in the quantity of money on important economic variables, like income, output, employment and prices.

According to this policy, money supply should be controlled in such a way that money should be neutral its effects. In other words, the changes in money supply should not change the total volume of output and total transactions of goods and services in the economy.

The policy of neutrality of money is based on the assumption that money is purely a passive factor. It functions only as a medium of exchange. In the absence of money, barter (i.e., direct exchange of goods for goods) determines the relative values of goods. The function of money is only to reflect these relative values and not to distort them.

On the basis of the assumption of the passive or neutral role of money, the advocates of the neutrality of money hold the view that money should not be allowed to interfere in the neutral functioning of the economic forces both on the supply and demand sides, such as productive efficiency, cost of production, consumer preferences.

The exponents of the neutral money policy believe that monetary changes are the root cause of all economic ills. They cause disturbances in the smooth working of the economic system. They are responsible for the occurrence of trade cycles. They bring changes in the real variables like income, output, employment and relative prices. They cause imbalance between demand and supply, consumption and production.

ADVERTISEMENTS:

Thus, economic fluctuations (inflation and deflation) are the result of non-neutral money (involving changes in money supply) and stability in the economic system with no inflation and deflation requires the adoption of neutral money policy (involving constant money supply).

Thus, according to the policy of neutral money, if the money is made neutral and the money supply is kept constant, there will be no disturbances in the economic system. In such a situation, relative prices will change according to the changes in the demand and supply of goods and services, economic resources will be allocated according to the wants of the society, and there will be no inflation and deflation.

However, this does not mean that the money supply should be kept constant under all circumstances:

(i) The supply of money will have to be changed from time to time to provide for the changes in the velocity of money; in the periods of a fall in the velocity of money, the supply of money has to be increased and in periods of a rise in the velocity of money, the supply of money has to be reduced.

ADVERTISEMENTS:

It is, in fact, the volume of effective money supply (including both the volume of standard and bank money as well as the velocity of circulation of the money) which should be kept constant.

(ii) The money supply will also be changed to neutralise the basic changes in the economic structure of the country. Such basic changes are changes in population, changes in the techniques of production, innovations, etc.

Criticism of Neutral Money Objective:

The neutral money objective has been criticised on the following grounds:

ADVERTISEMENTS:

(i) The concept of neutral money is an outmoded concept. It is based on the classical quantity theory of money according to which there exists a direct and proportionate relationship between the quantity of money and the level of prices. This theory has many limitations and has been discarded by the economists.

(ii) The neutral money policy will not ensure stability in a growing economy as characterised by continuous technological improvements. If, in such an economy, supply of money is kept constant, it would lead to deflationary conditions with continuously falling prices.

(iii) The concept of neutral money fails to explain the conditions of depression in the economy. During depression, prices fall even though there is no reduction in money supply. Similarly, prices fail to rise during depression even when the supply of money is increased,

(iv) The neutral money policy is self-contradictory in nature. On the one hand it assumes a passive role for money because the concept of neutral money is based on philosophy of laissez-faire (or government non-intervention).

On the other hand, it requires the monetary authority to maintain an effective money supply through time-to-time adjustments in accordance with the fundamental changes in the economy. Clearly the active of role of the monetary authority and the philosophy of laissez-faire cannot go together.

(v) Neutral money policy is impracticable in the sense that the philosophy of laissez-faire on which it is based, is unrealistic in a modern economy. Supply of money has to be increased for reviving the economy from depression. Again, economic development in an underdeveloped country is not possible without the expansion of money.

ADVERTISEMENTS:

(vi) Money is not neutral in the actual world. It plays an active and dynamic role in the process of economic development and in dealing with the situations of inflation and deflation.

(vii) Neutral money policy is difficult to implement. It requires that adjustments in money supply are to be made keeping in view the changes in the velocity of money. But, in practice, it is not possible to have accurate estimates of the changes in the velocity of circulation of money.

In short, the neutral money supply is now an outmoded policy. It cannot control economic fluctuations and is unable to fulfill the requirements of economic development. In a modern economy, monetary expansion is indispensable and money is no more neutral.

(ii) Exchange Stability:

Exchange rate stability has been the traditional objective of monetary policy under gold standard. It was considered the primary objective, while stability of prices was considered secondary because of the great importance of international trade among the leading countries of the world.

Main arguments made in favour of exchange stability and against exchange instability are given below:

(i) Stable exchange rates are essential for the promotion of smooth international trade.

ADVERTISEMENTS:

(ii) Fluctuations in the exchange rates lead to lack of confidence in a particular currency and might result in the flight of capital from the country whose currency is unstable in value.

(iii) Frequent changes in the exchange rates encourage speculation in the exchange markets.

(iv) Fluctuations in exchange rates also lead to fluctuations in the internal price level.

(v) Fluctuations in the exchange rates adversely affect the economic and political relationship among the countries.

(vi) International lending and investment is seriously affected as a result of fluctuating exchange rates.

The objective of exchange stability is achieved through establishing equilibrium in the balance of payments.

ADVERTISEMENTS:

Monetary policy plays an important role in bringing balance of payments equilibrium without disturbing the stable exchange rate. A country with a deficit in balance of payments, for example, adopts a restrictive monetary policy. Contraction of currency and credit as a result of the restrictive monetary policy brings down the price level within the country. This will encourage exports and discourage imports. Increase in exports and decrease in imports will, in turn, correct the disequilibrium in the balance of payments position.

Exchange rate stability as an objective of monetary policy has been criticised on two grounds:

(a) Exchange rate stability is generally achieved at the expense of internal price stability. But, fluctuations in the internal price level cause serious disturbances in the economy and adversely affect its smooth working and progress,

(b) With stable exchange rates, the inflationary and deflationary conditions of some countries are passed on to other countries. This puts the country with stable exchange rates at the mercy of the other countries, thereby seriously affecting the economy of that country.

In the modern times, when International Monetary Fund has been established to deal with the problem of maintaining exchange rate stability among the member countries and most of the countries of the world are members of this institution, the exchange stability as an objective of monetary policy of a country has lost much of its force. The modern welfare governments are more concerned with establishing internal price stability rather than maintaining exchange stability.

(iii) Price Stability:

With the abandonment of gold standard after the World War II, exchange stability was replaced by price stability as an objective of monetary policy. Greater attention was paid to the problem of removing violent fluctuations in the domestic fluctuations in the prices through various monetary controls and regulations. Price stability refers to the absence of any market trend or sharp short-run movements in the general price level.

ADVERTISEMENTS:

Price stability does not mean that each and every price should be kept fixed; it means that the average of prices or the general price level, as measured by the wholesale price index, should not be allowed to fluctuate beyond certain minimum limit. Stable price level does not mean fixed or frozen price level. Economists generally regard 2 to 4 % annual rise in prices as the stable price level.

Arguments in Favour of Price Stability:

The price stabilisation is advocated on the basis of the following arguments:

(i) Price instability leads to great disturbances in the economy and price stability ensures smooth functioning of the economy and creates conditions for stable economic growth.

(ii) Inflation and deflation representing cumulative rise and fall in prices respectively are both economically disturbing and socially undesirable. They create problems of production and distribution.

(iii) Inflation is socially unjust because it redistributes income and wealth in favour of the rich.

(iv) Deflation leads to the reduction of income and output and cause widespread unemployment.

(v) Periods of price and business fluctuations, such as the hyper-inflation of 1923-24 and the Great Depression of 1929-33 have been the periods of great international upheavals, leading to World War II.

(vi) Price stability eliminates cyclical fluctuations and helps to promote business activity. It results in active and stable prosperity.

(vii) Periods of price stability enable money to perform its functions of- (a) store of value and (b) standard of deferred payment smoothly.

(viii) Price stability leads to equitable distribution of income and wealth among various sections of the society.

(ix) Stability of price level promotes economic progress and economic welfare in the country.

Arguments against Price Stability:

The Policy of price stabilisation has been criticised on the following grounds:

(i) The concept of price stability is vague because it is difficult to determine the price level which is to be stabilised.

(ii) The concept of price stability also does not make it clear which prices are to be stabilised-wholesale prices or retail prices, consumer goods prices or producer goods prices.

(iii) Price changes are the symptoms, and not the cause of business fluctuations. Price stability deals only with symptoms and not the disease; it may not bring stability in business activity.

(iv) Variations in prices are necessary for the successful working of the price mechanism in a capitalist economy and price mechanism plays an important role in the optimum allocation of resources in the economy. The policy of price stabilisation renders the price mechanism unnecessary and ineffective.

(v) Price stability reduces production and retards economic progress. Stabilised prices leave no incentive for the businessmen to increase production because there will be no increase in profit margin. They will also not be interested in making new investments.

(vi) In a country marked by widespread unemployment, price stability is not a desirable objective. Some increases in the price level are necessary to encourage the business community to increase production and employment.

(vii) The monetary policy aiming at price stability proves unequitable and redistributes income and wealth against fixed income groups, particularly during the periods of declining costs.

(viii) Price stability is not a feasible objective of monetary policy. The central bank cannot effectively control the volume of credit in the economy because of the existence of a number of non-bank financial intermediaries whose activities are outside the control of the central bank.

Moreover, monetary policy is better suited to control an inflationary rise in prices, but may fail to check the falling prices during a deflationary period.

(iv) Alternative Price Policies:

As alternatives to the policy of price stabilisation, some economists have suggested the policies of rising prices or falling prices.

Arguments in Favour of Slowly Rising Prices:

The policy of slowly rising prices has been advocated on the following grounds:

(i) The policy of slowly rising prices stimulates production. Rising prices mean rising profits and rising profits stimulate investment and production.

(ii) Rising prices not only stimulate production, but also demand and consumption. Producers, wholesalers, retailers, and consumers purchase larger stock of goods in anticipation of continuously rising prices in future.

(iii) Rising prices promote capital formation. They redistribute income in favour of the richer sections of the society who have higher marginal propensity to save. This encourages saving and stimulates capital formation.

(iv) Rising prices prevent deflationary tendencies, increase employment and promote business activity in the country.

(v) Fixed-income groups of the society are also not adversely affected by slowly rising prices. They can easily adapt themselves in the changing situation of gently rising prices.

(vi) Policy of slowly rising prices is a historically tested policy. As Samuelson states: “In mild inflation the wheels of industry are initially well lubricated, and output in near capacity. Private investment is brisk, jobs plentiful. Such has been the historical pattern.”

Arguments against Slowly Rising Prices:

The following are the arguments against the policy of slowly rising prices:

(i) Rising prices reduce the value of money which discourages saving and capital formation in the country.

(ii) During rising prices, producers are tempted to expand their investment and production without caring for the market demand conditions. This may lead to over production which may in turn, result into crisis and collapse.

(iii) In the periods of rising prices, the producers do not bother about cost reduction because their profits are already increasing due to rising prices. Thus, the benefits of cost reduction do not accrue to the consumers.

(iv) Rising prices generally help to create a seller’s market where the goods, even of poor quality, can be easily sold. This leads to the deterioration in the quality of production.

(v) Rising prices stimulate speculative activities in the economy. Instead of increasing production, the producers tend to make quick profits through the activities like hoardings, black marketing etc.

Arguments in Favour of Slowly Falling Price:

The arguments advanced in favour of a policy of slowly falling prices are as follows:

(i) In a period of falling prices, the businessmen try to check the tendency of falling profits by improving business efficiency and reducing cost of production.

(ii) Falling prices discourage speculative activities and instead promote productive activities.

(iii) Falling prices lead to the closure of inefficient and unsound industrial units because such units cannot continue to exist in face of increasing losses due to falling prices.

(iv) Falling prices improve the distribution of income and make it more equitable by increasing the share of the wage-earners.

(v) Consumers are also benefited from the falling prices because they can purchase goods and services at cheaper prices. This increases the economic welfare of the general public.,

(vi) Falling prices encourage export, discourage imports and thus result in the favourable balance of payments.

Arguments against Slowly Falling Prices:

Following are the arguments against the policy of slowly falling prices:

(i) Falling prices, and the resulting falling profits, discourage productive activity, and reduce income, output and employment.

(ii) Continuously falling prices may ultimately lead to depression which may cause considerable harm to the economy.

(iii) Deflationary spiral once initiated cannot be easily controlled by adopting various monetary and fiscal measures.

To conclude, each of the three price policies, i.e., the policy of price stabilisation, the policy of slowly rising prices and the policy of slowly falling prices, has its own merits and demerits, and, therefore, no one price policy can be declared as the ideal policy. The question as to which price policy should be adopted will ultimately depend on the actual conditions prevailing in the country.

Under the conditions of hyper-inflation, a policy of falling prices will be a suitable policy, while during deflationary conditions, a policy of rising prices will be desirable. In fact, no one price policy should be adopted permanently; the price policy should be changed from time to time in accordance with the changing requirements of the country.

(v) Full Employment:

With the publication of Keynes’ General Theory of Employment, Interest and Money (1936), full employment became the ideal goal of monetary policy. Keynes emphasised the role of monetary policy in promoting full employment of human and natural resources in the country.

He advocated cheap money policy, i.e., expansion of currency and credit and reduction in rate of interest, to achieve the goal of full employment. Full employment of labour and full utilisation of other productive resources is important from the point of view of maximising economic welfare in the country.

Meaning of Full Employment:

The concept of full employment is vague and ambiguous. It has been differently interpreted by different economists. However, one thing is clear that full employment does not mean complete absence of unemployment. In other words, full employment does not mean that each and every person in the country who is fit and free is employed productively.

In fact, full employment is compatible with some amount (i.e., 3 to 4%) of seasonal and frictional unemployment. According to Beveridge, full employment means that “unemployment is reduced to short intervals of standby, with the certainty that very soon one will be wanted in one’s old job again or will be wanted in a new job within one’s power.”

Full Employment in Developed and Underdeveloped Countries:

The problem of full employment is different for developed and underdeveloped countries. The developed countries, like England and America, may already have achieved the level of full employment and the problem in these countries is to maintain this level by avoiding all kinds of fluctuations. On the other hand, the underdeveloped countries, like India, are characterised by wide-spread unemployment and underemployment.

So the problem in these countries is to remove unemployment by providing job to all those who are willing to work. Thus, the problem in an underdeveloped country is to achieve full employment, whereas that, in a developed country is to maintain full employment.

Achievement and Maintenance of Full Employment Level:

Monetary policy can help the economy to achieve full employment. According to Keynes, unemployment is mainly due to deficiency of investment and the level of full employment can be achieved by increasing investment and making it equal to the saving at the full employment level.

The main task of monetary policy is to expand money supply and reduce rate of interest to that optimum level which raises the investment demand and equates it with full employment saving.

The monetary policy aiming at increasing investment and ultimately achieving full employment is commonly called cheap money policy. Cheap money policy stimulates investment by expanding money supply and reducing the interest rate

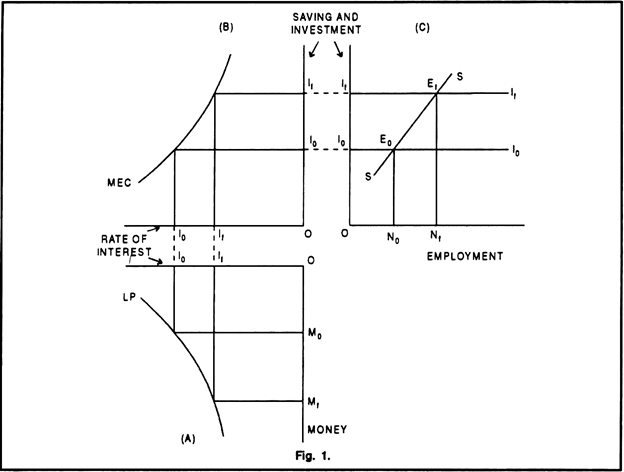

Figure 1 illustrates the process of achieving full employment through monetary policy. Initially in Figure 1 A, the money supply is OM0, and given the liquidity preference curve (LP), the rate of interest is Oi0, In Figure 1B, given the marginal efficiency of capital curve (MEC), the investment demand corresponding to Oi0, rate of interest is OI0.

In Figure 1C, given the saving curve (SS), the economy is in equilibrium at point E0 where I0I0 investment curve (representing OI0 investment) intersects saving curve SS, generating ON0, employment.

ON0 employment level is not full employment level because there exists N0, Nf amount of unemployment. To reach full employment level (ONf), investment must be increased from OI0, to OIf. For this, the monetary authority will have to increase money supply from OM0 to OMf which will reduce the rate of interest from O0 to Oif (Figure 1A).

The reduced rate of interest (i.e., from Oi0, to Oif) will increase investment from Oi0 to Oif (Figure 1B); Increased investment will shift the investment curve from l0l0 to Iflf which now intersects the saving curve (SS) at Ef, representing full employment ONf (Figure 1C). Thus, cheap money policy (i.e., increasing money supply) enables the economy to achieve full employment level.

Once full employment level is reached the problem of monetary policy is to maintain it by keeping saving investment equality at full employment level. If investment is allowed to exceed saving at full employment level, inflationary forces will appear; and if investment falls below saving at full employment level, deflation will appear. Thus, the monetary policy must aim at maintaining saving-investment equality at full employment.

Arguments in Favour of Full Employment Objective:

Full employment as an objective of monetary policy is advocated on the following grounds:

(i) The policy of full employment is a humanitarian policy because it tries to solve human problem of unemployment and underemployment.

(ii) By fully employing all the unemployed people and all other unutilized resources the policy of full employment helps to achieve maximum economic welfare.

(iii) The policy of full employment will eliminate cyclical fluctuations in the economy. By keeping saving-investment equality at full-employment level, it removes the possibility of inflationary and deflationary tendencies.

(iv) The maintenance of full unemployment also implies exchange rate stability and balance of payment equilibrium because fluctuations in the exchange rates and the resultant di-equilibrium will definitely disturb the full-employment level.

In short, full employment as an objective of monetary policy is superior to other objectives because the achievement of full employment automatically leads to the achievement of all other desirable objectives, such as, exchange rate stability, internal price stability, full utilisation of economic resources, etc.

(vi) Economic Growth:

Traditionally, monetary policy has been regarded as a short-run policy primarily aiming at achieving the objectives of price stability and full employment. But, quite recently, the emphasis has been shifted from full employment or price stability to economic growth as the main objective of monetary policy.

The monetary policy is now no longer considered as a short-run policy of securing full-employment level free from cyclical fluctuations. On the other hand the main objective of monetary policy now is to achieve the long-run goal of ever-increasing rate of economic growth.

In the U.S.A. Employment Act of 1946 made it obligatory on the federal government to take all possible measures not only to promote maximum employment, but also maximum production in the country. The objective of economic growth is also important from the point of view of the underdeveloped countries.

The real problem in these countries is not the short-run cyclical fluctuations in production and employment, but is one of long run structural changes aiming at creating conditions necessary for economic development. Thus, the main objective of monetary policy is an underdeveloped country should be to play an active part in the process of economic development.

In fact, economic growth has been aptly made the primary objective of monetary policy.

The following arguments can be advanced in favour of economic growth:

(i) The objective of full employment cannot possibly be achieved without raising the rate of economic growth.

(ii) Increasing the rate of economic growth is necessary if the people are to be provided with ever- rising living standards.

(iii) Rapid economic growth is essential for the survival of the developing countries in the present competitive world.

(iv) The objective of economic growth takes into consideration the broader long-term perspective. It is concerned with economic and technological progress of the country.

(v) According to Woodworth, the objective of economic growth deserves priority because of two reasons:

(a) Despite the enormous improvement in the living standards in the western world, poverty still remains the world’s burning economic problem.

(b) Economic growth is an essential ingredient of the economic and political institutions.

Some economists have opposed the growth objective of monetary policy in underdeveloped countries. According to Howard Ellis, for example, any monetary policy promoting economic growth in an underdeveloped country is doomed to frustration because such countries are highly susceptible to inflationary pressures.

But, the majority of the economists is in favour of the monetary policy having economic growth and is of the view that monetary policy should explicitly adopt economic growth as its primary objective.

Economic growth has been defined as the process whereby the real national income of a country increases over a long period of time. In this process, money can play an important role as a mobilising agent. Most of the countries, particularly the less developed countries, possess the physical and human resources necessary for economic growth, but their resources remain un- utilized largely due to lack of necessary finances.

Under such conditions, an expansionary monetary policy, by providing necessary monetary resources, will be able to mobilise the unutilized resources and thus will activate and accelerate the process of economic growth.

The monetary policy aiming at promoting economic growth must satisfy two conditions:

(i) The monetary policy must be flexible. In other words, it must be able to establish equilibrium between aggregate demand for money and aggregate supply of goods and services. When aggregate demand for money exceeds the aggregate supply of goods a restrictive monetary policy should be adopted.

On the contrary, when aggregate supply of goods and services exceeds aggregate monetary demand, an expansionary monetary policy should be adopted. Thus, a flexible monetary policy ensures price stabilisation which is necessary for economic growth.

(ii) The monetary policy should be able to promote capital formation. In other words, it should create favourable atmosphere for promoting saving and investment in the country. For this, the aim of the monetary policy should be to remove price fluctuations and establish reasonable price stability.

Conflicting Objectives of Monetary Policy:

Various objectives of the monetary policy, though desirable, cannot be pursued together because they are not compatible with each other.

For example, a conflict or trade off exists between:

(a) Exchange stability and price stability,

(b) Foil employment and economic growth,

(c) Price stability and economic growth, and

(d) Full employment and price stability.

These sets of conflicting objectives are discussed below:

(a) Exchange Stability and Price Stability:

Exchange stability and price stability are the two conflicting objectives of monetary policy. Both of these objectives cannot be achieved simultaneously; any one of these objectives can be achieved only by sacrificing the other. For example, under gold standard, the objective of exchange stability was achieved, but the objective of price stability remained unfulfilled.

There are, however, certain cases in which the two objectives of exchange stability and price stability become complementary and can be achieved together:

(i) Under gold standard, both these objectives can be achieved if the rules of the game are followed strictly. For example, if a country has sufficient gold reserves, it need not reduce money supply if there is outflow of gold as a result of unfavorable balance of payments.

Similarly, if there is inflow of gold due to favourable balance of payments, the country can immobilise the influx of gold and does not allow it to have inflationary effect on domestic prices. Thus, in both these situations, the external exchange stability is achieved without disturbing the internal price stability.

(ii) Both the objectives can also be achieved together when the policy of exchange stabilisation coincides with the policy of price stabilisation. For example, under gold standard, if there is an outflow of gold due to unfavorable balance of payments, the country must contract money supply to maintain exchange stability.

But, if the country in question is already operating at the full employment level and the internal prices are rising, the contraction of money supply will lead to the achievement of both exchange stability and price stability.

Similarly, a policy of monetary expansion will be able to achieve both exchange stability and price stability if there is favourable balance of payments and the country is also experiencing deflationary situation, requiring an increase in the money supply to stimulate investment, employment and prices.

(iii) Mundell has suggested a strategy to reconcile the objectives of exchange and price stability by assigning different objectives to monetary and fiscal policy. According to him, expansionary fiscal policy should be used to move the economy ahead with price stability and tight monetary policy should be used to keep interest rates high, thereby attracting the capital inflows necessary for maintaining the balances of payment equilibrium without depressing the exchanges rate.

This view is based on the assumption that the expansionary fiscal policy will be able to more than offset the restrictive effects on the domestic economy of the tight monetary policy.

(iv) In modern times, the objectives of exchange stability and price stability are reconciled through international monetary cooperation. The task of maintaining exchange stability has been entrusted to the International Monetary Fund (IMF) of which most of the countries are members. On the other hand, the objective of internal price stability is achieved by individual countries through their internal monetary policies.

(b) Full Employment and Economic Growth:

The objectives of foil employment and economic growth, though interrelated in some respects, are also incompatible with each other and have basic differences. They are interrelated in the sense the both help and reinforce each other. A policy of foil employment promotes economic growth and a policy of economic growth increases employment.

But in most of the cases, the two objectives of full employments and economic growth come into conflict with each other. Employment may be increased even with uneconomic industrial units. Again, promotion of economic growth through basic and heavy industries may not generate much employment, at least in the short period.

The main differences between the objectives of full employment and economic growth are discussed below:

(i) Full employment means full utilisation of job opportunities within the limits of available resources. Economic growth means creation of additional employment opportunities by developing new economic resources.

(ii) Full employment is a static concept. It refers to the utilisation of existing production capacity of the economy under static conditions i.e. with given economic resources, production methods and technology.

Economic growth, on the other hand, is a dynamic concept. It involves the increase in the productive capacity of the economy by developing additional economic resources, improving technology and exploiting new investment opportunities.

(iii) Full employment is a short-term concept. It means elimination of unemployment in the short-run. Economic growth is a long-term concept. It means increasing the volume of employment in the long period.

The policy of full employment involves giving employment at current wage rates, whereas the policy of economic growth aims at providing employment at ever-increasing wage rate, thus improving the living standards of the people.

(iv) The policy of full employment is a demand-oriented policy. It aims at increasing the effective demand because deficiency of effective demand is the main cause of unemployment. The policy of economic growth is a supply-oriented policy. It concentrates on increasing the productive capacity of the economy by increasing the volume of economic resources.

(v) The policy of full employment is more suitable for the developed economies, while the policy of economic growth is more suitable for less-developed or developing economies.

(c) Price Stability and Economic Growth:

The objectives of price stability and economic growth are also not always compatible. While slowly rising prices are conductive to economic growth, the inflationary rise in prices obstructs the growth process.

An expansionary monetary policy, and the resultant rise in prices before the level of full employment promotes economic growth. But the expansion of money supply after the level of full employment results in inflationary rise in prices, which may hinder economic growth.

Inflation (particularly hyper-inflation after full employment) adversely affects the process of economic growth due to the following reasons:

(i) Inflation results in economic inefficiency and uneconomic use of productive resources.

(ii) Inflation leads to industrial disputes and industrial unrest, thus seriously affecting the production in the industries.

(iii) Inflation encourages the production of consumer goods rather than producer goods because the prices of consumer goods rise much faster. The reduction in the supply of producer goods, in turn, hinders the process of economic growth.

(iv) Deflationary monetary measures undertaken to control inflation also tends to adversely affect long- term planning and economic growth process.

(d) Full Employment and Price Stability:

Economists like A.W. Phillips, Paul Samuelson, etc. have found that there exists a trade-off between unemployment and inflation. This trade-off is weaker or even non-existent in the long run in comparison to that in the short run.

In other words, the objectives of full employment and price stability are incompatible with each other. Economists have observed that some level of unemployment (5 to 6%) is necessary for achieving the objective of price stability.

If anti-inflationary policies are adopted, they will tend to produce greater unemployment. The problem before the policy makers is to choose between inflation and unemployment objectives keeping in view the general welfare of the public and weighing the relative benefits and costs of both inflation and unemployment to different sections of the society.

Conclusion-Choosing a Suitable Objective:

All the objectives of monetary policy, i. e., exchange stability, price stability, full employment, economic growth, etc., are important and have their relative merits and demerits; None of these objectives is completely undesirable and should be abandoned. But the problem is that these objectives are not compatible with each other and, therefore, cannot be achieved simultaneously.

The ideal solution to this problem must keep in view the following considerations:

(a) Different degrees of priority should be assigned to various objectives in accordance with the economic conditions prevailing in the country and objectives should be chosen which have higher priority and are most suitable for the economy,

(b) While formulating the monetary policy, some degree of compromise among the conflicting objectives is considered better than selecting only one objective and leaving all others,

(c) No objective of monetary policy should be considered permanent and the monetary authority should keep on changing various objectives in accordance with the changing requirements of the economy.

Some of the suitable monetary policy objectives relevant to different economic conditions are suggested below:

(i) A country facing depression and unemployment should adopt full employment as the objective of its monetary policy,

(ii) For a country experiencing inflationary pressures, price stabilisation is the most suitable objective for its monetary policy.

(iii) In a small country largely dependent on exports, the monetary policy should aim at maintaining exchange stability.

(iv) Similarly, a country intending to secure foreign capital for its economic development should also try to achieve exchange stability through its monetary policy,

(v) For a developing or underdeveloped economy, the most suitable objective of monetary policy is the promotion of economic growth.

(vi) Short-run objectives of price stability should be reasonably balanced with the long-run objective of economic growth, while formulating a monetary policy.