Money exerts considerable influence on the level of activity in the economy via the effect of rising and falling price.

It is, therefore, necessary for the Government to act through the banking system, from time to time, in order to vary the amount and price of money and credit in the economy.

Monetary policy refers to the use of official instruments under the control of the central bank to regulate the availability, cost and use of money and credit with the aim of achieving optimum levels of output, employment, price stability and balance of payments equilibrium.

Monetary policy is now regarded as one of the most important tools of economic management.

ADVERTISEMENTS:

An appropriate monetary policy by adjusting money supply to the needs of growth, directing the flow of funds in keeping with the overall economic priorities, and providing institutional facilities for credit in specific areas of economic activity all combined creates a favourable environment for economic growth.

1. Objectives of Monetary Policy:

In the present day, it is generally accepted that the main objective of monetary policy is the promotion of economic growth with reasonable price stability. In other words, monetary policy has to be directed towards attaining a high rate of growth, while maintaining reasonable stability of the internal purchasing power of money.

The central bank attempts to ensure an adequate level of liquidity to support the rate of economic growth envisaged and to assist in the fullest possible utilisation of resources without generating inflationary pressures.

Monetary policy of the Reserve Bank of India is termed as one of ‘controlled monetary expansion’. True, it is essential to expand currency and credit to meet the increased demand for investment funds. So the Reserve Bank expands credit and money supply to meet the genuine requirements of the productive sectors of the economy. However, it is also felt that an undue expansion of money and credit would create destablising forces in the economy. This would hamper the process of development.

ADVERTISEMENTS:

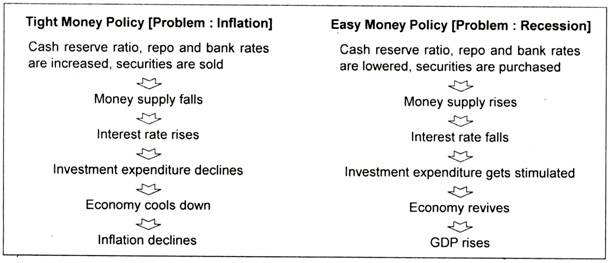

The central bank follows the right money policy when the economy suffers from inflationary tendency. Such requires the availability of credit in a lower degree. The central bank then employs credit instruments to reduce the overall money supply. These are sale of securities, increase in bank rate/repo rate, increase in reserve ratios, etc.

An easy money supply is pursued when the economy is caught in the grip of recession and slowdown. An easy money policy aims at raising the money supply to stimulate the sluggish economy. Purchase of securities, fall in bank rate or in cash reserve ratios or repo rates are the instruments of cheap money policy. The boxed table given below, in a nutshell, gives the essence of monetary policy.

A central bank has to function within the ambit of the current economic milieu of the country. If the dominant emphasis is on planned development as in a country like India monetary policy has, in addition, to take care of promotional aspects such as monetary integration of the country.

In recent years, the objective of monetary policy in India has been two-fold. It has to facilitate the flow of an adequate volume of bank credit to industry, agriculture and trade to meet their genuine needs and provide selective encouragement to sectors which stand in need of special assistance such as the weaker sections of the community and the neglected sectors and areas in the country.

ADVERTISEMENTS:

At the same time, to keep inflationary pressures under check, it has to restrain undue credit expansion and also ensure that credit is not directed to undesirable purposes. As the central monetary authority, the RBI’s chief function is to ensure the availability of credit to the extent that is appropriate to sustain the tempo of development and promote the maintenance of internal price stability.

The focus of monetary policy needs to be adjusted from time to time, so as to soften the impact of created money on the economy and at the same time, to achieve the objectives of planned development. The first decade (1951- 60) of the plan era saw the revival of the traditional weapons of monetary control; during the second half (1956-60) of that decade regulatory functions were deployed.

In the sixties, the problem was of the accompanying increases in money supply. By the 1970s and through the 1980s, the twin objectives of provision of credit for attaining faster economic growth and price stabilisation assumed importance. This policy thus, came to be known as ‘controlled monetary expansion’.

2. Assessment:

Now let us see as to what extent the RBI is successful in achieving the monetary policy objectives the objective of price stability and stability in output growth.

So far as the first objective is concerned, the RBI’s performance is creditable. And for this purpose, it has set up a number of institutions so as to meet the genuine needs of agriculture, industries, commerce and other productive activities. It has strengthened the money market. It has also widened the security market.

Actually, both money market and capital market have been widened in recent years by the introduction of several new instruments, such as the setting up of the Discount and Finance House of India Ltd. in 1988 as an institution which could promote a secondary market in various market instruments. Industrial credit has been a major function of the RBI. It regularly assists cooperative credit societies.

Under the auspices of the RBI, Agricultural Refinance and Development Corporation (1963) and the National Bank for Agriculture and Rural Development ((NABARD) 1982) were set up. Several specialised financial institutions catering to the needs of large and medium industries like IFCI, SFCs, IDBI, etc., were set up under the RBI’s sponsorship. Thus, the performance of the RBI in this direction is, undoubtedly, creditable.

In spite of these developments and the setting up of a huge financial infrastructure by the RBI, we must say that the stability in output growth cannot be attributed entirely to the RBIs monetary policy. There are other key parameters that influence growth as well as prevent fluctuations in output growth much beyond the RBI’s control.

ADVERTISEMENTS:

Now, let us see how far the RBI’s monetary policy is effective in holding the price line. We know that there is a nexus between money supply, prices, and output. An increase in money supply in excess of what is required to support the growth of output will cause price level to rise.

To hold the price line, the RBI employs several credit control instruments like bank rate, statutory liquidity ratio, cash reserve ratio, repo and reverse repo rate, selective credit controls, etc. However, while diagnosing the disease of price rise in India, one cannot establish a positive link between money supply and price level.

There are periods when the extremely high rates of inflation were caused by reasons for price rise besides increase in money supply. One cannot really blame the RBI for its failure to maintain relative price stability. In this connection, Dr. I. G. Patel’s remark is worth noting: “… the role of the monetary policy in combating inflation in any country is strictly limited and that monetary policy can be effective” not when it is used in conjunction with only fiscal and income policy.

Something must be said regarding the developments of monetary policy in the 1990s. It must be referred here that the macroeconomic stabilisation and structural reforms consequent upon the fiscal crisis as well as BOP crisis brought in fundamental changes in the country’s conduct of monetary policy. Monetary policy requires to be adapted to the challenges coming out from the various reforms especially in the financial sector and the ongoing process of global integration of the Indian economy.

ADVERTISEMENTS:

It is because of the global integration that monetary policy has now come to be increasingly influenced by exogenous influences growing out of the external environment. Taking all these factors into account, the RBI, in the late 1990s, shifted its stance from direct to indirect instruments of monetary policy in consonance with the increasing market orientation of the economy (Rakesh Mohan). That is why the market-based open market operations and CRR as an indirect instrument has been receiving more attention.

Since July 1991, the RBI decided to keep monetary growth at moderate levels. Accordingly, reserve money (i.e., net RBI credit to Government, net foreign exchange assets of the RBI) grew between 11-13 p.c. in the first two years of the stabilisation programme.

As a result, inflation rate declined from 16 p.c. to 7 p.c. in the second half of 1993. However, such monetary stringency did not continue long. That is why the sources of money supply and monetary policy stance were changed in the late 1994. But, during 1994-95, M, and M2 grew at the rates of 27 p.c. and 22.2 p.c. resulting in a rise in inflation rate of 12 p.c. in January 1995. This rate declined during 1995- 96.

When there has been a slowdown in monetary growth, e.g. through prudent monetary policies, the RBI has been able to contain monetary growth to 15.0-15.5 p.c. in 1996-97. As a result, inflation rate in this year remained as low as 6.4 p.c.. For 1997-98 it was 4.8 p.c. Inflation since then has been moderating. Between 2001-02 and 2005-06, average annual growth rate of inflation stood at 4.1 p.c. However, inflation rate rose from 3.3.p.c. in August 2005 to 6.1 p.c. in January 2007 and to nearly 13 p.c. in September 2008—a record indeed after 1991-92.

ADVERTISEMENTS:

External factors like an all-time record in the rise in oil price (almost touching $ 150 per barrel during July-August 2008) and global food crisis causing soaring food prices were the major causes for inflation at that time. The RBI since then has been intervening to keep price level under control by employing variety of credit control instruments. Inflation rate by mid-January 2C06 has fallen to 9 below 6 p.c.

Now the Indian economy is caught in severe economic slowdown consequent upon global economic recession since October- November 2008. However, the RBI has changed its stance towards correcting the economic collapse. The outcome of these monitory measures can only be known after a few months.

The RBI hopes that if everything goes as of now, Indian economy will get greater relief by the end-March 2009. Such optimism may die down if the current global recession drifts further to a new low. The trend, however, does not anger well in early February 2009.

Still then, one must not forget the limitations of monetary policy. First, inflation in India is caused by both exogenous and endogenous forces. For instance, non-stop population growth, demand for higher wages, etc. pull up the price level. Further, we import inflation from abroad. For instance, rise in prices of petroleum by the OPEC aggravates the problem of inflation. In such a situation, monetary policy has little to achieve its objective of price stability.

Secondly, monetary policy instruments of the RBI lose their edge because of the existence of unorganised and unregulated indigenous money market. RBI’s monetary policy is effective only in the organised component of the money market.

Thirdly, the growth of black money is really thwarting the RBI’s monetary policy objective. The proliferation of black money in carrying out various transactions has upset the objective of price stability. And the RBI is merely a spectator in this line.

ADVERTISEMENTS:

However, over the passage of time, the money market has become a healthier one. Some of the unorganised sectors of the money market are being regulated by the RBI. Organised banking sector has witnessed a rapid growth after late 1960s. In view of these developments, the RBI’s monetary policy has assumed a great significance in furthering the country’s economic growth and in maintaining relative price stability.

3. Evaluation of Monetary Policy of the RBI:

One of the important objectives of monetary policy of the RBI is ‘growth with stability’. The RBI assists the Government by providing necessary finance. But at the same time it controls and regulates total money supply to ensure price stability. The RBI’s policy has been named ‘controlled monetary expansion’.

However, the RBI has not always come out gloriously in holding the price line. The main reason for price rise during the entire Plan Period has been an enormous expansion of M, and M3. This has resulted in an expansion of credit—thereby causing ‘hangover of excess liquidity’. This always has fanned inflationary price rise.

After bank nationalisation in 1969 we experienced a state of excess liquidity in the different monetary spheres. Non-banking financial intermediaries like mutual funds and capital market have witnessed a massive increase in deposits.

Thus, it is clear that no longer commercial banks alone determine the overall liquidity position of the economy. Because of the proliferation of non-banking financial companies in recent years, supply of credit money increased enormously. But unlike commercial banks, these institutions are not controlled and regulated by the RBI.

Therefore, RBI’s monetary policy in such a set-up cannot be successful in holding the price line. Further, for this, the RBI is not to be blamed alone. Inflation, in India, is caused by the Government’s deficit financing, chronic shortages of consumer goods and, above all, black money. In these circumstances, the RBI’s policy of controlling credit is likely to be ineffective.

ADVERTISEMENTS:

In spite of this, the performance of the RBI is not altogether unsatisfactory. It is largely due to the RBI’s effort that the volume of unorganised segment of money market has been dwarfed.

The monetary policy of the RBI is not the magic wand for the fundamental problem of the Indian economy the problem of low economic growth. Yet, it can control inflationary tendencies. And, its role in this direction is no less in significant. The year 2008-09 sees threats to growth and stability mainly from the global developments.

This has raised the domestic inflation rate to a high of nearly 13 p.c. in September-October, 2008. It is because of monetary policy measures taken by the RBI, inflation rate has come down to 5.6 p.c. by end January, 2009.

The overall stance of monetary policy of the RBI stated in its Annual Monetary Policy, 2008-09, aims at ensuring a monetary and interest rate environment that accords high priority in stability, well-anchored inflation expectations and orderly conditions in financial markets while being conducive to continuation of the growth momentum.

The RBI says: “The conduct of monetary policy in the context of bringing down inflationary pressures and anchoring inflation expectation is, however, complicated by global developments and domestic demand pressures.” Recent recessionary tendencies developed all over the globe including India have put a brake on the rising inflation rates. Fall in oil prices to even less than $ 35 per barrel from a high of $ 147 per barrel six months back and other factors have brought down the inflation rate to less than 6 p.c. in January 2009.

The current problem is the credit crunch and lack of confidence of investors to invest in businesses. The RBI has been putting great and sincere efforts to arrest the recessionary tendencies. However, measures so far adopted by the RBI and the Government are believed to be inadequate to minimise the impact of global recession in the country.