The following points highlight the three main situations of the Monetary-Fiscal Link. The situations are: 1. Mild Recession 2. Deep Recession 3. No Recession.

Situation of the Monetary-Fiscal Link # 1. Mild Recession:

Recessions are periods of high unemployment, low incomes and increased economic distress and hardship.

While depressions have economy- wide impacts, recessions may be mild or deep. Suppose a tax increase shifts the IS curve to the left.

Income falls due to a fall in consumption caused by a fall in disposable income.

ADVERTISEMENTS:

Since the demand for money falls at a lower level of income, the rate of interest falls, too. The fall in income causes a recession.

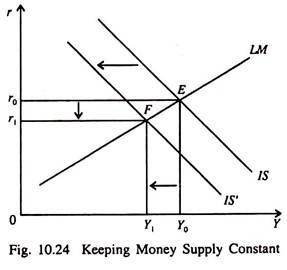

The central bank remains neutral and allows the rate of interest to fall. The fall in Y is less than that in case of a deep recession due to crowding-in effect (as r falls, I increases, and Y increases, thereby partly neutralising the fall in Y.) See Fig. 10.24 where both Y and r fall when money supply remains constant.

Situation of the Monetary-Fiscal Link # 2. Deep Recession:

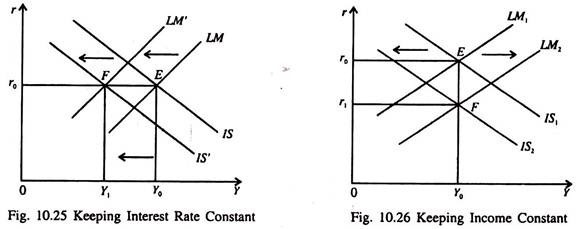

Now in Fig. 10.25 the central bank reduces M to keep r constant at its initial level in the face of a tax increase which shifts the IS curve to the left as in Fig. 10.24. The fall in M shifts the LM curve to the left. Now r does not fall but Y falls by a larger amount than in the situation where the central bank holds M constant.

ADVERTISEMENTS:

Whereas in Fig. 10.24 the lower r stimulated I and partly offset the contractionary effect of tax hike, in Fig. 10.25 the central bank deepens the recession by keeping r high. Here we have the worst mix of policies — fiscal contraction accompanied by monetary contraction to keep r constant.

Situation of the Monetary-Fiscal Link # 3. No Recession:

Now we consider a situation of no recession ensured by the best mix of the two policies — fiscal contraction accompanied by monetary expansion. By shifting the LM curve to the right the central bank offsets the leftward shift of the IS curve.

As a result r falls, but tax increase does not lead to a fall in Y as shown by a movement from E to F. So there is no recession. But r falls sharply. There is a change in the composition of Y. The higher taxes reduce C, but lower r stimulates I. Since the two effects exactly balance, Y remains unchanged.

ADVERTISEMENTS:

The last of the above three effects is the most desirable. It is because Y contraction (or recession) is avoided by making appropriate use of monetary and fiscal measures.