The following points highlight the top two Strategies of Alternative Monetary Policy. The Strategies are: 1. Targeting Monetary Aggregates 2. Targeting the Interest Rate.

Alternative Monetary Strategy # 1. Targeting Monetary Aggregates:

The ultimate objective of a central bank is to reach target values of variables as the unemployment rate, the inflation rate, and growth in real GDP.

The implicit assumption with a monetary aggregate as an intermediate target is that, ceteris paribus, higher rates of growth in the money supply increase inflation while lowering unemployment (raising the level of economic activity) in the short run.

By contrast lower monetary growth rates are, ceteris paribus, associated with lower inflation rates and higher short-run rates of unemployment.

ADVERTISEMENTS:

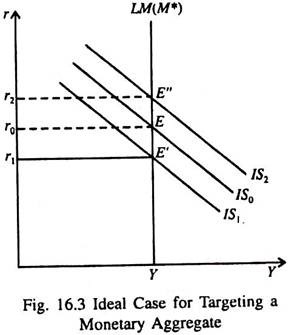

The ideal case for targeting a monetary aggregate is one where the LM curve is vertical as shown in Fig. 16.3. If, in a situation where the demand for money is totally interest-inelastic and perfectly stable, the central bank fixes money supply target M*, the LM curve becomes vertical at LM (M*). Income will be at the target level Y* regardless of the IS curve and the rate of interest.

The point is that although hitting the money supply target guarantees that we will hit the income target, unanticipated shocks that shift the IS curve will cause interest rate fluctuations. If the IS curve shifts from IS0 to IS1, or IS2, the interest will either fall to r1 or r2. If the central bank also had a desired level for the interest rate, for example r0, it would miss this interest- rate target.

The interest rate must be free to adjust depending on the position of the IS curve. Thus out first prediction is that: the central bank cannot generally hit both interest-rate and money-supply targets. If money supply target is fixed, the interest rate will vary.

Monetarist’s View on Money Supply Targeting:

ADVERTISEMENTS:

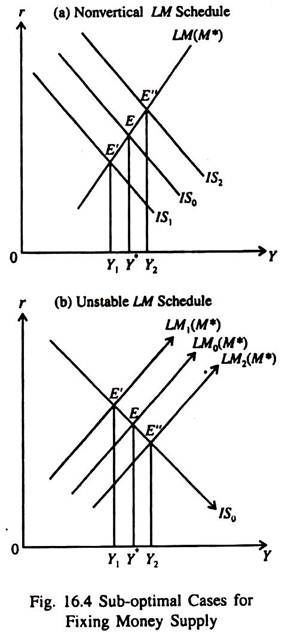

Monetarists believe that the LM curve is steep and that, at least in most situations, demand for money is stable. Monetarists, therefore, suggest targeting monetary aggregates. Such a situation is shown in Fig. 16.4.

In part (a) money demand is not totally interest- inelastic and the LM curve is upward-sloping. In such a situation hitting the money supply target will cause income rise to the target level Y* only if the IS schedule is at the predicted position IS0. If, due to some unanticipated shocks, the IS curve shifts to IS1, or IS2, income will either fall to Y1 or rise to Y2 — even if money supply remains constant at M*.

In part (b) we assume that the central bank hits the money supply target M*, which, on the basis of its forecast of money demand, should set the LM curve at LM0 (M*) and hit the income target Y*.

ADVERTISEMENTS:

If, due to some unanticipated shock to the money demand function, the LM curve shifts to either LM, (M*) or LM2 (M*), income will be either fall to or rise to Y2, and the income target will be missed even if the money supply is at the target level M*.

Alternative Monetary Strategy # 2. Targeting the Interest Rate:

A monetary policy strategy of targeting the rate of interest creates uncertainty about the IS curve. This point is illustrated in Fig. 16.5. If the central bank targets (or pegs) the interest rate, then the LM curve becomes horizontal. To keep the equilibrium rate of interest unchanged the central bank supplies the required amount of money to keep the money market in equilibrium at the target interest rate.

If the IS curve is at IS1 instead of at the predicted position IS0, equilibrium income will be at Yr,1 i.e., below the target level. If the money supply is the intermediate target, the LM curve is vertical and the income target will be reached.

Thus whether the LM curve is vertical or upward sloping, a money-supply target is superior to an interest-rate target when there is uncertainty about the IS curve. The reason is that, when the IS curve shifts away from its predicted position, the movement in the interest rate dampens the effect of the shift on income. This monetary damper can be shut off by targeting the interest rate.

Fig. 16.5 shows that if the money supply is the target, then — with a rise in autonomous investment — income (due to shift of the IS curve from IS0 to IS2) rises, the demand for money increases and the rate of interest rises to r2. This chokes off investment demand to some extent. So overall investment rises by less than it otherwise would. This can be avoided by targeting the interest rate at r*.

With an increase in income, the central bank has to make open market purchases to expand money supply to meet the demand for money fully so that the rate of interest does not go above the target level of r*. Since in this case the IS curve is IS1, national income falls below the target level (Y*) to Yr,1.

If the money supply is the intermediate target, with upward-sloping LM curve LM (M*), income will fall from Y* to only Y1, (not to Yr,1).

If there is uncertainty about money demand, targeting interest rate will cause income to fall. If the interest rate is the target, the LM curve is horizontal and stable as in Fig. 16.6 (the solid LM line). It does not shift when there is a shift in the money demand function.

ADVERTISEMENTS:

For example, when the demand for money increases at a given level of income, the central bank increases money supply accordingly. As a result income does not fall with an interest rate target. It remains unchanged at Y*.

Even if the target level of money supply is achieved, however, with a money supply target, M*, a positive shock to money demand (a desirable new type of bank deposit) will

shift the LM curve from its expected position will fall below the target level (Y*) to Y1, and the interest rate will rise to Y1.

Thus, if there is uncertainty regarding stability in money demand, an interest rate target is preferable to a money supply target. If the interest rate is the target, the output market is not affected by shocks to money demand. The money supply adjusts to maintain the target level of the interest rate.

ADVERTISEMENTS:

If money supply is targeted, the shock to money demand affects the interest rate and thus aggregate demand and real income. In this case the real sector (the output market) cannot be insulated from shocks to money demand.