The classical economists had explained growth process in terms of rate of technological progress and population growth.

In their opinion, technological progress remains in lead for some time but finally it disappears when the falling rate of profit prevents further accumulation of capital.

It is at this stage that the economy slumps down into stagnation.

In broad way, the classical theory of economic development may be stated as: suppose an expected increase in profits brings about an increase in investment which adds to the existing stock of capital and to the steady flow of improved techniques. This increase in capital accumulation raises the wage fund. Higher wages induce an accelerated population growth which causes the demand for food to rise. Food production is raised by employing additional labour and capital. But diminishing returns to land bring about rise in labour cost and as a result, the price of corn goes up.

ADVERTISEMENTS:

In turn, rents increase, wages rise, thereby reducing profits. Reduction in profit implies reduction in investment, retarded technological progress, diminution of wage fund and slowing down of population growth and capital accumulation. “In the classical model, the end result of capitalist development is stagnation… This stagnation resulted from the natural tendency of profits to fall and consequent chopping off capital accumulation”. When this happens, capital accumulation ceases, population becomes constant and stationary state sets in.

Mathematical Explanation:

The basic proportions of classical theory of growth can be explained in terms of mathematical equation as this makes the model brief simple and easy.

Proposition 1.

The production Function:

The total output of an economy depends upon the size of labour, the stock of capital, the amount of available natural resources and available technology. Thus, it expresses a function relationship between dependent and independent valuables i.e.

ADVERTISEMENTS:

Q = f (L, K, N, T)

Q = Total output

L = Size of labour

K = Stock of capital

ADVERTISEMENTS:

N = Amount of available natural resources.

T = Technology.

N is constant because it cannot be increased quantitatively, but its quality can be improved by advanced technology. So the total output ultimately depends upon labour force, stock of capital and technology.

Proposition 2:

Technological progress depends on investment.

The relation between technological progress and investment is T =f (I)

i.e. the technology depends upon the size of investment i.e. why classical economists stressed on capital accumulation and saving rather than technological progress.

Proposition 3:

Investment depends on profits.

It is true that investment depends upon profits. The capitalist will make investment only if it is profitable. Here investment means net addition to the existing stock of capital i.e.

I = ∆K = f(R)

ADVERTISEMENTS:

K = Net addition to capital stock.

R = Return on capital investment or profit.

Proposition 4:

Profits depend, upon labour supply and level of technology.

According to classical economists, profit is the function of labour supply and technological progress. The application of improved technology in agriculture can raise productivity and hence profits. Thus, profits are not only influenced by the level of technology, but by labour force as well.

ADVERTISEMENTS:

R = F (T, L)

The level of technology depends upon the level of investment and it depends on profits. Profits, in turn, depend on the level of technology. This argument explains the interdependence of these factors.

T = f (I)

= f [I(R)]

ADVERTISEMENTS:

= f{R (T,L)}

The crux of this circular argument is that technical progress is vital for economic development.

Proposition 5:

The size of labour force depends on size of the wage fund.

This proposition explains the iron law of wages. If the wage fund is raised, the size of the labour force will be large and vice- versa. The people in past did not visualize that population growth could adversely affect their standard of living. Under these circumstances, the classical theory of population establishes a relation between size of labour and the wage fund.

L = f (W)

W = Wage fund.

ADVERTISEMENTS:

L = Size of labour force.

Proposition 6:

Size of labour force depends upon level of investment.

The classical economists believed that wage fund depends upon the savings of the capitalist and these savings find their way in investment automatically. So wage fund is the function of investment or investment determines the size of wage fund, i.e.

W = f (I)

Where I = Level of Investment

W = Wage fund.

Proposition 7:

ADVERTISEMENTS:

Closing equation:

There are six equations above having 7 variables. So their value cannot be determined. The system determinates when the number of unknowns is equal to the number of the equations and operational function is of the form.

Q = R + W

Q = Total output

R = Profits

W = Wages.

ADVERTISEMENTS:

i.e. the output is the sum of profits and wages together.

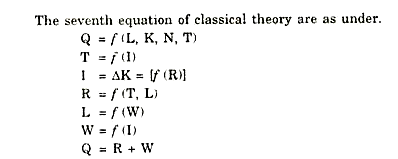

The seventh equation of classical theory are as under.

The circulatory system can be stated as:

The economic development implies in the level of output. This increase is possible due to the application of improved technology, which in turn, depends upon the level of investment. The investment is determined by the level of profit. The level of profits will be determined by the size of wage fund which, in turn, will influence the labour force or population growth. Population growth will necessitate the discovery of new scientific inventions for raising the total output.

The circulatory system may be stated as:

In the classical model, the end result of development activity is the stationary state. The stationary state in the opinion of the classicalists was essentially a concept of mature economy and, thus, it should not be interpreted as something characterised by under development.