The following points highlight the top seven methods used for the evaluation of investment proposals. The methods are:- 1. Urgency Method 2. Pay-Back Period Method 3. Unadjusted Return on Investment Method 4. Net Present Value Method 5. Internal Rate of Return Method 6. Terminal Value Method 7. Benefit-Cost Ratio Method.

1. Urgency Method:

In many situations in the life of a business concern an ad hoc decision is needed in respect of an investment expenditure. For instance, if a part of machine stops working leading to complete breakdown and disruption in the production process, it will be justified to replace it immediately by new one even without comparing the cost and future profit. Any decision on investment expenditure on the basis of urgency should be taken only if it is fully warranted and justified.

2. Pay-Back Period Method:

This is also known as ‘payoff and pay out’ method. This method is employed to determine the number of years in which the capital expenditure incurred is expected to pay for itself. This method describes in terms of period of time, the relationship between cash inflow and total amount of investment.

The pay-back period is the number of years during which the income is expected. The criterion here is that the average income from a proposed investment be sufficient to cover investment within a period of time. It is calculated by dividing investment by the amount of return per annum after charging taxation but before charging depreciation.

ADVERTISEMENTS:

This period may be calculated by the following formula:

Pay-back Period = Net Investment/Cash Inflow

3. Unadjusted Return on Investment Method:

This method is also called Accounting Rate of Return Method or Financial Statement Method or Return on Investment or Average Rate of Return Method. Here the main feature is that the rate of return is based on the figures for income and investment which are determined according to conventional accounting concepts.

The rate of return is expressed as a percentage of the earnings to the investment in a particular project. There is no general agreement as to what constitutes investment and income. Income may be taken as the average annual earnings, normal earnings or the earnings of the first year of the project. Investments may be taken as the initial investment or the average outlay over the life of the investment.

ADVERTISEMENTS:

The rate of return on investment refers to the rate of interest that will make the present value of future earnings just equal to the cost of investment.

It may be calculated according to any one of the following methods:

(i) Annual Average Net Earning/Original Investment x 100

(ii) Annual Average over Earning/Average Investment x 100

ADVERTISEMENTS:

The term average annual net earnings is the average of the earning over the whole of the economic life of the project.

(iii) Increase in Expected Future Annual Net Earnings/Initial Increase in required Investment x 100

The amount of average investment can be calculated according to any one of the following methods:

(i) Original Investment/2

(ii) Original Investment – Scrap Value of the Asset/2

(iii) Original Investment + Scrap Value of the Asset/2

4. Net Present Value Method:

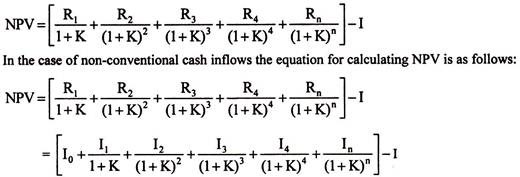

The net present value method is one of the discounted cash flow or time adjusted method. This is generally considered to be the best method for evaluating capital investment proposals. In case of this method, cash inflows and cash outflows associated with each project are first worked out. The net present value is the difference between the total present value of future cash inflows and the total present value of future cash outflows.

The equation for calculating net profit value in case of conventional cash flows can be as follows:

where NPV = Net present value

ADVERTISEMENTS:

R = Cash inflows at different time periods

K = Cost of capital

I = Cash outflows at different time periods.

5. Internal Rate of Return Method:

ADVERTISEMENTS:

This method is also called Time Adjusted Return on Investment or Discounted Rate of Return. This method measures the rate of return which earnings are expected to yield on investments. Internal rate of return is defined as the maximum rate of interest that could be paid for the capital employed over the life of an investment without loss on the projects.

The rate is similar to the effective rate of interest calculated on debentures purchased or sold. This is calculated on the basis of the funds utilised from time to time as opposed to the investment made at the beginning. This method incorporates the time value of money in the investment calculation.

The formula for the discounted rate of return is:

ADVERTISEMENTS:

C = the supply price of the asset.

F = the future cash flows.

S = the salvage value of the asset in years,

r = the discounted rate of return.

6. Terminal Value Method:

This method is based on the assumption that operating saving of each year is invested in another outlet at a certain rate of return from the moment of its receipt till the end of the economic life of the projects. This method incorporates the assumption about how the cash inflows are reinvested once they are received and thus avoids any influence of the cost of capital on cash inflows. However, cash inflows of the last year of the project will not be reinvested.

As such, the compounded values of cash inflows should be determined as the basis of compounding factor which may be obtained from compound interest table or by the following formula:

ADVERTISEMENTS:

A =P (1+i)n where P=1

7. Benefit-Cost Ratio Method:

This method is based on time adjusted techniques and is also called Profitability Index or Desirability Factor. The procedure of deriving the benefit cost ratio criterion is the same as that of NPV. What is done is to divide the present value of benefit by the present value of cost. The ratio between the two would give us the benefit-cost ratio which indicates benefit per rupee of cost.

The calculation of benefit-cost ratio is shown as follows:

Benefit Cost Ratio (BCR) = Present Value of Benefits/Present Value of Cost