The optimum level of capital can be obtained when Marginal Cost of Capital (MCK) is equal to the Marginal Revenue Productivity of Capital (MRPK).

MCK refers to the rate of interest in the market.In financial market, MCK is constant and known.

However, with the increases in the level of demand, interest rate of market also increases. MRPK refers to the product of Marginal Physical Productivity of Capital (MPPK) and product’s price (P).

It can be expressed as follows:

ADVERTISEMENTS:

MRPK = MPPK * P

Law of diminishing returns applies on investment, which implies that with increase in MCK, MPPK decreases. It means that productivity of capital decreases with increase in the cost of capital. Let us understand the determination of optimum level of capital with the help of an example.

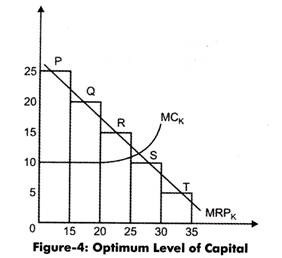

Suppose, an organization has five projects P, Q, R, S, and T having different and varied marginal revenue of capital (MRK). When MRPK of projects are plotted in descending order on a graph, then the demand curve is obtained in the step form For MCK curve, it is assumed that Rs. 20 million can be raised at 10% of interest rate that is constant.

When the amount of capital increases, it leads to an increase in MCK. The point at which MCK intersects MRPK is known as equilibrium o capital and the amount of capital at equilibrium level is termed as the optimum amount of capital.

ADVERTISEMENTS:

Figure-4 shows the optimum level of capital:

However, this is only the theoretical determination of optimum level of capital. In practical application, this determination would not be able to explain capital budgeting and investment decisions. Investment decisions require planning, speculation and evaluation of capital and products both. For meeting all these requirements, organizations generally conduct pre-investment research and analyze the requirement for capital in their different production units. After that, projects are evaluated for their profitability and feasibility.