The following points highlight the five main applications of marginal analysis. The applications are: 1. Make-or-Buy Decisions 2. Capital Expenditure Decisions 3. Output Expansion and Contraction Decisions 4. Product-Line Decisions 5. Optimal Advertising Decisions.

Marginal Analysis: Application # 1.

Make-or-Buy Decisions:

Decision making under resource constraint is no doubt a complex exercise. If a firm suffers from capacity constraints it has to expand, or purchase certain items from an external source.

However, it is necessary to consider the amount of capital expenditure and the likely cost savings. Purchasing may be worthwhile where suppliers have specialized equipment and can supply at reduced prices but it is necessary to consider the effect of fixed costs on internally made products.

ADVERTISEMENTS:

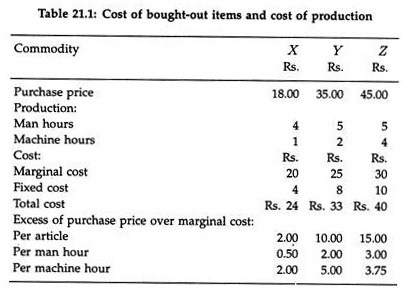

The cost comparison has to be made between the supplier’s price and the marginal cost of producing the goods on the premises. This is because it is assumed that the fixed costs have already been incurred and that the other costs are the variable costs. If there is any resource limitation factor, products which earn the highest rate of contribution per unit of limiting factor should be retained. Consider the following example.

With commodity X the purchase price is less than the marginal cost; so it is profitable to buy outside. Commodity X also shows the lowest rate of contribution per man hour, and if manpower is the limiting factor, again this article will be purchased outside.

If manpower is so short that further outside purchases must be made, then commodity Y should be purchased outside. When machine power is the limiting factor, X again appears to be the first choice for external purchase, since it yields the lowest rate of contribution per machine, and Z is the second choice at a contribution of Rs. 75.

Marginal Analysis: Application # 2.

Capital Expenditure Decisions:

ADVERTISEMENTS:

A business firm’s investment or capital expenditure decisions depend on the marginal efficiency of capital (or the yield) and the rate of interest. So long as the marginal efficiency of capital is greater than the rate of interest, a firm will add to its stock of capital.

However, as more and more capital is applied in the production process, the MEC will fall and the firm will not make any further addition to its stock of capital, when the MEC is exactly equal to the rate of interest (which is the marginal cost of capital in a perfectly competitive capital market).

Marginal Analysis: Application # 3.

Output Expansion and Contraction Decisions:

A profit-maximising firm reaches equilibrium by equating marginal revenue with marginal cost. So long as MR is greater than MC, the firm will expand its volume of output (sales). When MR is equal to MC, the firm does not gain by expanding or contracting its sales volume.

Marginal Analysis: Application # 4.

Product-Line Decisions:

Most modern firms are multi-product firms. In a dynamic world characterized by technological progress and changes in tastes and preferences of buyers a firm is constrained to adopt a policy of developing new products and dropping old products at the same time.

A firm will go on adding new products to its product line so long as the marginal revenue generated by a product exceeds its marginal cost. If the marginal revenue generated by a product is less than its marginal cost, the product should be dropped.

Similarly, the choice of an optimum-product mix depends on the average contribution margin of each product. Different products compete for a limited amount of common resources such as machine hours, labour hours, factory space, etc.

Maximum resources are to be allocated to the production of those commodities which make the maximum contribution towards overhead as also towards fixed cost. (This optimum product-mix problem can also be solved by using the linear programming method).

Marginal Analysis: Application # 5.

Optimal Advertising Decisions:

Advertising plays a very important role in the real world of imperfect competition. It is a technique of demand manipulation. However, it has the effect of raising both cost and price. The question is: how will a firm determine how much to spend for advertising?

The answer to this question can easily be found out by applying the standard marginal principle. A firm will continue to spend money on advertising so long as the marginal revenue (after advertising) exceeds marginal cost (after advertising), or, marginal cost is less than marginal revenue.