In the whole of microeconomics we develop and use models that involve marginal analysis, a technique used to analyse problems by examining the results of small changes. The concept of the margin is central to economic analysis.

In economics the word ‘margin’ refers to anything extra. ‘At the margin’ means at the point where the last unit is produced or consumed. Marginal refers to the extra, additional, or next unit of output, consumption, or any other measurable quantity that can be increased or decreased by incremental amounts. There are various marginal concepts such as marginal utility, marginal cost, marginal revenue, marginal product and marginal profit.

These concepts are widely used in microeconomics. So long as the marginal cost of producing a commodity is less than its price, a firm will produce extra units. A profit-maximising firm reaches equilibrium by equating marginal revenue with marginal cost. And one important technique of pricing is the marginal cost pricing. Moreover, so long as the marginal utility of a commodity is greater than its price a consumer will buy extra units of the commodity.

A few important economic laws have been developed on the basis of the marginal concept, such as the law of diminishing marginal utility and the law of diminishing marginal returns.

ADVERTISEMENTS:

In any discussion of factor pricing and income distribution we speak of marginal revenue product and the value of marginal product. We also use the term marginal cost of a resource, called marginal factor cost. Other terms used are marginal rate of substitution, marginal rate of transformations marginal rate of technical substitution, marginal utility of money and so on.

The important point to note here is that, most economic decisions are made at the margin. For example, we consume the extra slice of bread work the extra hour, produce the extra unit, take on the extra client in our accounting firm. There are the daily decision made by households and firms that determine prices, output, and other important economic quantities.

Marginal analysis refers to a technique used to analyse problems in which the results of small changes are studied and analysed. It refers to the examination of the effects of adding one extra unit to, or taking away one unit from, some economic variable. The decision to consume one extra unit depends on marginal utility. Similarly, the decision to produce one extra unit depends on marginal cost. And the decision to employ one extra worker depends on its marginal product.

We use the marginal concept in macroeconomics, too. We use the terms marginal efficiency of capital, marginal efficiency of investment, marginal cost of capital frequency. In investment decisions and project appraisal we use a marginal per capita re-investment quotient criterion.

ADVERTISEMENTS:

We also speak of margin requirement when we discuss monetary (credit) policy of the Central Bank. Other marginal concepts used in macroeconomics are the marginal propensity to consume, the marginal propensity to save, the marginal propensity to invest, the marginal propensity to import, the marginal tax rate.

Economics is largely concerned with economising, which means making the most of what we have. In practice, economising is not so much a complete rejection of one good in favour of another, but rather deciding whether to have a little bit more of one and not quite so much of another. It is principally an adjustment at the margin.

The Marginal Principle:

One of the most important principles is the marginal principle which simply states that one should look at the marginal costs and benefits of decisions and ignore past and sunk costs.

ADVERTISEMENTS:

This principle simply suggests that “people will maximise their incomes or profits or satisfactions by counting only the marginal costs or benefits of a decision.”

The marginal principle can be applied in various situations. First of all a profit-maximising firm reaches equilibrium by equating MR with MC. Similarly, an individual takes decision on investment in a financial asset like an equity share or on house only on the basis of marginal returns and costs.

Welfare Maximisation in Competitive Equilibrium:

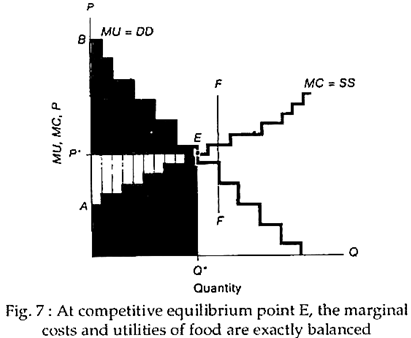

In a competitive situation a consumer maximises his utility by equating its MU with P. Similarly, a firm maximises profit by equating MC with P. So in equilibrium P is equal to both MR and MC. The demand curve for food is downward sloping due to diminishing MU and the supply curve is upward sloping due to increasing MC (or diminishing returns). As Fig. 7 shows at competitive equilibrium point E, the marginal costs and utilities of food are equal. So, social welfare is maximised.

Marginal Cost Pricing:

Moreover, marginal cost pricing plays a central role in market economy. As Samuelson and Nordhaus have rightly put it: “Only when prices are equal to marginal costs is the economy obtaining the maximum output and economic surplus from its scarce resources of land, labour and capital.”