The balanced growth theory can be explained with the views of:

(a) Rosenstein Rodan and

(b) Ragnar Nurkse and

(c) Lewis

ADVERTISEMENTS:

(A) Views of Rosenstein Rodan:

In 1943 article, Rosenstein Rodan propounded this theory but without using the term balanced growth. He stated that the Social Marginal Product (SMP) of an investment is different from its Private Marginal Product (PMP). If different industries are planned accordingly to their SMP, the growth of the economy would be much more than it the industries had been planned according to their PMP. SMP is greater than PMP because of the complementarity of different industries which leads to the most profitable investment from the social point of view.

He illustrates it with a popular example to shoe factory. If a large shoe factory is started in the region where 20,000 unemployed workers are employed. Now in case, the workers spend their entire wages on shoes, it would create market for shoes. If series of industries are started, in that case the demand of different industries would increase via multiplier process. This would lead to planned industrialization. Ragnar Nurkse has also developed his thesis on these lines.

(B) Views of Ragnar Nurkse:

ADVERTISEMENTS:

Prof. Nurkse has given a proper explanation of the theory of balanced growth. He holds that the major obstacle to the development of the underdeveloped countries is the vicious circle of poverty. This vicious circle of poverty shows that income in underdeveloped countries is low. Low income leads to low savings. Low savings will naturally result in low investment, which will result in less production. Low production will generate low income. Low income will create low demand for goods. In other words, it will result in smaller markets (limited extent of markets). Thus, there will be no inducement to invest.

According to Nurkse “The inducement to invest may be low because of the small buying power of the people, which is due to their small real income, which again is due to low productivity. The low level of productivity however is a result of the small amount of capital used in production which in turn may be caused, at last partly, by inducement to invest.” So, in order to break the vicious circle of poverty in the under-developed countries, it is essential to have a balance between demand and supply.

Ranger Nurkse is of the view that economic development is adversely affected by vicious circle of poverty. The economic development can take place only if vicious circle of poverty is broken. The vicious circle of poverty operates both on the demand and supply side.

(a) Demand Side:

ADVERTISEMENTS:

Vicious circle of poverty affects the demand side of capital formation. The underdeveloped countries are poor because their level of income is low. Due to low level of income, their demand for low income goods is low.

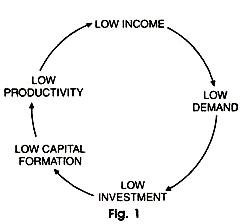

Vicious circle of poverty: On Demand Side:

In UDCs the size of the market is limited. As a result, private investors do not get opportunities for more investment. This reduces investment and capita. Hence productivity of capital would fall.

This reduced per capita income as explained as follows:

Low Income → Low Size of Market → Low Investment → Low Productivity → Low Income.

(b) Supply Side:

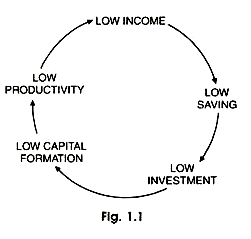

Vicious circle of poverty affects the supply side of capital formation. In the underdeveloped countries, poverty exists because the per capita income of the people is low. Due to low per capita income, the level of saving is low. Since investment depends on savings, so investment would be low due to which capital formation would be low. Low capital formation would lead to low productivity which would result in poverty. This is how vicious circle from supply side completes.

Low-Income → Low Savings → Low Investment → Low Capital → Formation → Low Productivity → Low Income

ADVERTISEMENTS:

Vicious Circle of Poverty: Supply Side:

The underdeveloped countries, can resort to capital formation and accelerate the pace of economic development only by breaking the vicious circle of poverty. Once the vicious circle of poverty is broken, the economy would be on the rails to development. Now the question is how to break the vicious circle of poverty.

How to Break Vicious Circle of Poverty?

(i) Complementary Demand:

ADVERTISEMENTS:

The vicious circle of poverty cannot be broken with industrial investment decisions. This means vicious circle of poverty cannot be broken only by making investment in one industry or one sector. Rather, there should be overall investment in all the sectors. This is the only way to enlarge the size of the market. In order to clear his views, Nurkse has given example of shoe industry as given by Rosenstein Rodan.

It testifies that investment in shoe industry will not lead to sufficient demand. What we need is to have overall investment, so that labourers of one industry can be the consumers or buyers of the products of others. In the words of Nurkse, “The solution seems to be balanced pattern of investment in a number of different industries so that people working with more productivity, with more capital and improved techniques become each other’s customers.”

When investment will be made in several industries simultaneously, it will increase the income of many people who are employed in various industries. They will purchase goods made by each other for consumption. They will become customers mutually. Thus, with the increase in supply demand will also go up. The extent of market will also increase. It will lead to capital formation and thus, the vicious circle of poverty will get broken. Same would be the case of wage-earners of different industries or sectors.

The complementarity of industries is in reality, the crux of the concept of balanced growth. This is termed as complementarities of demand. According to Nurkse, “Most industries entering for mass consumption are complementary in the sense that they provide a market for and thus supports each other, the basic complementarity stems, in the last analysis from the diversity of human wants. The case for balanced growth rests on the need for a balanced diet.” Thus, on the basis of the complementaries of demand, balanced growth will be helpful in attaining economic progress.

ADVERTISEMENTS:

(ii) Government Intervention:

Nurkse is of the view that the government must intervene in productive activities through economic planning. He is of the view that when government participates in productive activities, it will help in breaking the vicious circle of poverty. Nurkse opines that if entrepreneurs are available in underdeveloped countries, then they can be induced to make investment. But in underdeveloped countries, private entrepreneurs cannot come forward with so much heavy investment. This can easily be carried by the government only. Thus, vicious circle of poverty can be broken only by the intervention of the government.

(iii) External Economies:

Balanced growth also leads to external economies. External economies are those which accrue because of the setting up of new industries and expansion of the existing industries. The accruing of external economies lead to the law of increasing returns to scale. It leads to a fall in the cost of production and hence the price level. A fall in the price leads to the increase in demand which is useful for economic development.

(iv) Economic Growth:

ADVERTISEMENTS:

Balanced growth helps in accelerating the pace of economic growth, G.M.Meier is of the view that “Balanced Growth is a means of getting out of rut”. Nurkse is of the view that increase in investment in different branches of production can enlarge the total market. This can break the bonds of the stationery equilibrium of underdevelopment.

How the Market can be enlarged:

The market size can be enlarged by monetary expansion, salesmanship and advertisement, removing trade restrictions and expanding social other heads i.e., infrastructures. It can be widened either by a reduction in prices or by an increase in money while keeping constant prices. As the circumstances are found, market is not large enough to allow production on such a scale to reduce cost in underdeveloped countries. The solution pointed out for this critical position by Prof. Nurkse, is “More or less synchronized application of capital to a wide range of different industries.

Here is an escape from the deadlock, that is it results in an overall enlargement of the market. People working with more and better tools in a number of complementary projects become each other’s consumer. More industries catering for mass consumption are complementary in the sense that they provide a market for and support each other. The case for balanced growth sets on the need for a balanced diet.”

Nurkse further submits his notion of balanced growth from Say’s law which states that “Supply creates its own Demand” and Mill cites that “Every increase of production, if distributed without miscalculation among all kinds of produce in the proportion which private interest would dictate, creates or rather constitutes its own demand.” Thus, Nurkse’s, balanced growth is a sort of frontal attack—”a wave of capital investment in a number of different industries.” Therefore, the best way is to have simultaneous wave of new plants composed in such a way that full advantage is taken of complementaries on the supply side and of the complementaries of the markets on the demand side.” Investment is wide range of industries will give better division of labour, it leads to vertical and horizontal integration of industries, a common source of raw-materials and technical skill, an expansion of the size of the market and better use of social and economic overhead capital.

Therefore, investment in productive equipment and in human capital should be simultaneous while investment will be fruitless unless people are educated. But Prof. Nurkse pleads that private enterprise can achieve the desire effect under the stimulus of certain incentives. Price incentives may bring about balanced growth to some extent. It is further promoted by monetary and other effects.

ADVERTISEMENTS:

(C) W.A. Lewis Views on the Theory of Balanced Growth:

W.A. Lewis has advocated the theory of balanced growth on the basis of the following two reasons:

Firstly, in the absence of balanced growth, prices in one sector may be higher than the prices in the other sector. On account of unfavourable terms of trade in the domestic market, they might suffer heavy losses. As a result no investment will be made there in and their growth will be halted. Because of balanced growth equality in comparative prices in all the sectors will be made and thereby all the sectors will continue to grow.

Secondly, when the economy grows, then several bottlenecks appear in different sectors. As a result of economic development, income of the people also increases. Due to increase in income, demand of those goods rises whose demand is income-elastic. If the production of these goods does not increase, there may appear several bottlenecks. However, in case of balanced growth, it is possible to increase production of those goods whose income elasticity of demand is more. Thereby, chances of bottlenecks in different sectors will be quite remote.

In case it is not possible to increase production simultaneously in agricultural and industrial sectors, then Prof. Lewis suggested that the strategy of balance between domestic and foreign trade should be adopted. If industrial sector is not developing, then the agricultural produce should be exported and industrial products should be imported. On the other hand if agricultural sector is not developing, then the industrial goods should be exported and agricultural products should be imported.

However, Lewis does not favour a strategy for growth which totally dependent on increase exports. In his opinion, such a policy may turn the terms of trade against the country which pursues it. According to Lewis, “All sectors of the economy should be developed simultaneously so that balance is maintained between industries and agriculture, production for domestic consumption and production for exports”.