In this article we will discuss about the Macro-Economics:- 1. Goals of Macro-Economic 2. Policy to Achieve Macro-Economics Goals 3. Distinction between Stocks and Flows.

Goals of Macro-Economic:

Two important macroeconomic goals are:

ADVERTISEMENTS:

(1) An efficient allocation of resources, and

(2) An equitable distribution of income. Macroeconomic goals are related to the above four key macro variables.

In fact, four important macroeconomic goals are:

(a) Full employment,

ADVERTISEMENTS:

(b) A satisfactory rate of growth of output,

(c) Price level stability and

(d) A satisfactory exchange rate and balance of payments.

The first three are primary objectives.

ADVERTISEMENTS:

The fourth objective is secondary. When a country has managed to reach the first three goals, it is said to have reached internal balance. When it reaches the last goal, it is said to have attained external balance. There are, of course, conflicts between the two.

Policy to Achieve Macro-Economics Goals:

The major policies available to the government to achieve macroeconomic goals are monetary (credit) and fiscal (budgetary) policies. These are directed toward altering aggregate effective demand with a view to enabling an economy achieve full-employment growth in the absence of price level stability.

Fiscal policy works through a change in the government’s own expenditure or tax total or both. Monetary policy works through a change in the lending policies of commercial banks and thus through a change in the stock of money in circulation. This is why they are called ‘demand management policies’.

However, these are not enough and are supported by certain ‘supply management policies’; which seek to influence the total output that the private sector can, and will produce. The possible macroeconomic policies are too numerous.

It suffices here to note that supply-side policies are designed to cause rightward shifts in the supply curves in various individual markets. Suppose, for example, that the government reduces the rates of personal income taxes. This may induce people to work harder then before.

If this happens, then the increased supply of labour will increase the economy’s full-employment output. Similarly, a large tax exemption for research and development may lead to a spurt in scientific invention and innovation.

This will lead to increase in the volume of goods and services that are affected by scientific research. If individual supply curves in various markets shift, the aggregate supply of all goods (or GNP) will also increase significantly.

Distinction between Stocks and Flows in Macro-Economic:

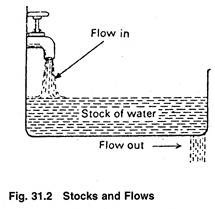

In macroeconomics it often becomes necessary to draw a distinction between stocks and flows. The distinction is usually based on the time dimension. A flow has a time dimension such as the flow of labour services per unit of time. A stock does not have any time dimension such as the stock of land in a typical village of Maharashtra or the stock of capital goods in India’s corporate private sector at a fixed point of time.

Examples of stocks are the quantity of circulating capital, or the quantity of fixed capital or the amount of money you have in the bank. Similarly, the change in circulating capital per unit of time, and the amount that you add to your bank balance every year are all examples of flows.

ADVERTISEMENTS:

Let us take a more simple example. The amount of water in the bathtub is a stock, while the amount entering through the tap and flowing out through the drain are flows. In macroeconomics the amount entering the tub is called injection and the amount leaving through the drain is called a leakage. See Fig. 31.2 which is self-explanatory.