This article provides an explanation to contemporary macroeconomics on the basis of neo-classical economics.

Counter Revolutions:

According to James Tobin the Keynesian revolution has evoked three counter-revolutions since 1965.

They are:

(1) Monetarism, propagated by Milton Friedman and his followers;

ADVERTISEMENTS:

(2) New-Classical Macro-economics, based on the theory of rational expectations, led by Muth or Robert Lucas ; and

(3) Supply-Side Economics (SSE) the most popular, yet the most vague among the three.

“Though the three counter-revolutions differ, they have in common conservative messages popular in today’s political climate; Government interventions, however, well intentioned, do harm and no good. They have led to inflation, instability, inefficiency, and declining productivity, Keynesian policies have failed, and the theories that supported them are discredited.”

As Supply-Side Economics lacks good text books explaining its theoretical foundations, and intellectual champions such as a Friedman or Lucas or Muth to expound its ideas, it remains more as a spirit, an attitude and ideology, rather than a coherent doctrine. Even this ideology is confined to national frontiers of the Western countries, and has rarely crossed over to cover international aspects of development.

ADVERTISEMENTS:

Modern Macroeconomics is no more a unified body of thought—several interpretations of the way the economy works are contending with each other for dominance. These include the income- expenditure approach, monetarism, the new classical economics with its rational expectations and Supply Side Economics and Post-Keynesian Economics. Alternative approaches to Macroeconomics have acquired good support amongst the economists. Broadly speaking, there are primarily three significant approaches—schools of thought —which now compete with each other as well as the basic Keynesian Macroeconomics.

Economists are in much less agreement today than they were 15 to 20 years ago about the nature and scope of the theoretical relationships that explain aggregate or macroeconomic behaviour of the economy. The ups and downs in the domain of economic field in recent years particularly in 1970s through the 1980s combined with clear-cut policies to solve macroeconomic problems like unemployment, inflation, low productivity, stagflation have led to search for new explanations, theories and new insights into the working of the economies.

Important ideas existed before the Keynesian Revolution (1936) also as to how the economy in the aggregate worked. Two of these ideas assume special significance as they reappear in recent years in new dress to pose serious challenge to the prevailing orthodox macroeconomics.

These ideas are:

ADVERTISEMENTS:

(i) Say’s Law, and

(ii) The Classical Quantity Theory of Money.

Say’s Law means—that ‘supply creates its own demand’— and that every act of production must necessarily represent the demand for something. This implies that all supply is essentially the demand for something and that there cannot be any over-production or deficiency of total demand in the economy as a whole.

If it is so, then, there cannot be involuntary unemployment because of over-production. Say’s Law is, therefore, of more than historic interest because it is also the foundation of contemporary Supply Side Economics and also in part the basis of the theoretical foundation of USA, President Reagan’s programme of economic recovery in USA (called Reagan economics).

The natural corollary of Say’s Law is the classical quantity theory of money—meaning thereby that the prime determinant of the price level is the supply of money but proved quite irrelevant in circumstances following Depression of 1929-30. New ideas and new theories of money were needed.

The General Theory of Keynes or what is called ‘Keynesian Revolution’ did provide new ideas. According to J.K. Galbraith, “The General Theory is the most influential book on economic and social policy……… the Keynesian revolution was one of the great modern accomplishments of social design”. The General Theory laid the basic foundation for what has become a highly developed body of economic theory and policy directed towards the most pressing problems of the economy as a whole- employment, unemployment, output, growth and inflation.

The policy counterpart of Keynesian macroeconomics is the concept of ‘demand management’—that is the idea, that should the need arise then through monetary and fiscal actions governments can manage the level of aggregate demand and generate high level of production and employment without excessive pressure on the price level. However, as a body macroeconomic theory it has been subjected to rigorous analytical scrutiny in recent times.

Nature and Scope of Alternative Approaches:

We intend to analyze these two additional challenges to Keynesian macroeconomics, these challenges are not only more recent than monetarism, but more radical in their nature, scope and implications. Monetarism no doubt attacks both the fundamental relationships and the basic policy conclusions of Keynes income-expenditure model; while it accepts the essential framework of that analysis including the role played by aggregate demand for the determination of output, employment and price level. But the challenges which have come in the form of ‘new-classical economics’ and ‘supply side economics’, go much farther in rejecting in a fundamental way the Keynesian approach and philosophy. They turn to the pre-Keynesian classical school for ideas and inspiration against which Keynes led a revolution.

The theories and concepts that make-up classical economics explain how an economy organized on the basis of free, competitive markets and the private ownership of all the means of production is supposed to work. According to classicals—a competitive market is one in which—neither buyers nor sellers can be their own actions determine or influence the prices which the market establishes through the interaction of the forces of demand (buyers) and supply (sellers).

ADVERTISEMENTS:

The classical economics as developed, modified and revised throughout the 19th century was really concerned with explaining in a formal way how Adam Smith’s invisible hand working through markets harnessed personal greed (self-interest) to the social good (the maximum production of things people need).

Classical employment theory consists of three basic propositions:

(a) The level of employment is determined by the total demand for and supply of labour—a corollary to this is that, once employment is determined, output is also determined because the production function ties the two together.

(b) Classical economics is based on Say’s Law of markets. Even though it asserts the supply creates its own demand and, therefore, demand equals to the value of the production—no general over production is possible. This law is valid as we have known in a barter economy but in a money using economy, matters are not so simple. Production creates money income for producers which may not be spent immediately and, therefore, may be saved but advocates of Say’s Law asserted that it works under barter economy as well as money economy.

ADVERTISEMENTS:

(c) This brings us to the third classical proposition, namely, the role of money. Basically the role of money is to make exchange in the economy more efficient and effective by avoiding difficulties of barter. Money serves as a medium of exchange and any change in the amount of money will result in more or less spending which will affect the price level (because resources are normally fully employed). The idea that prices are linked directly to the money supply is, of course, based on the quantity theory of money.

Classical economics, thus, did what any goods economic theory should do—it explained—how employment, output and prices were determined; it predicated—full employment would be the norm and it prescribed—governments should keep their hands off the economy.

Supply-Siders—Keynesians and Monetarists:

The SSE’s reject Keynesianism with vehemence; but the Keynesians accept basic SSE propositions as something new for old fashioned truths of classical microeconomics, valuable after full employment is attained and sustained. To cite Tobin again, “Almost all economists, Keynesian, classical agree that in the long run these supply factors (i.e., supply of labour, knowledge, capital equipment, technology, resources etc.) call the turn and demand adapts.” But for immediate problems during the 1980s their differences in approach and policy prescriptions are total and complete.

The Keynesians reject Say’s Law. For them, depression and stagflation are reflections of market failure to be rectified by ‘fine tuning’ the economy through budget deficit, surplus and aggregate demand management. Taxation of higher incomes and transfer of payments are important weapons in the arsenal to Keynesians. They accept some degree of trade-off between unemployment and inflation. They condemn inequality of incomes both on moral and practical grounds. They recommend government intervention as a policy variable. They fear that the private virtues of savings, when aggregated may turn into the public nightmare of depressions.

ADVERTISEMENTS:

The SSE’s are convinced that they are returning to the classical highway after being misled by Keynesians into blind alleys on account of too much importance given to and concentration on aggregate demand. They champion the validity of Say’s Law. For them, depressions and stagflation are indicators of government failure—that is, excessive governmental intervention.

They consider budget deficits to be reflections of governmental irresponsibility. They argue that transfer payments are counter-productive and will ultimately harm the tax-payers and recipients alike. They refuse to admit that any permanent trade-off could exist between unemployment and inflation. They uphold inequalities of income as part of a natural order, a result to reward for initiative, a necessity for promoting productivity and prosperity.

The most formidable challenges to Keynesian economics came from Prof. Milton Friedman and his Chicago School of Monetary experts along with A.J. Schwartz. He developed the basic thesis that money alone matters and that money is the single most important strategic variable that determines in the short-run the level of gross national product and employment. His theories are described as ‘Monetarism’ or the ‘Modern Quantity Theory’.

Friedman’s theory lays down:

(i) Since output and employment are influenced by money supply there is no need or justification to change them through taxes or government spending;

(ii) Variations in stock of money are chiefly responsible for economic fluctuations as warranted by the experience of USA economy—hence money creating authority must keep the money supply growing at a constant rate.

ADVERTISEMENTS:

But SSEs also differ from the monetarists. They dispute the monetarists preoccupation with aggregate demand for goods and services, and emphasize on the dynamic supply of new goods. Rather than emphasizing control over the supply of money; the SSE’s underscore the generation of demand for money through the production of goods.

Rather than dwelling on the quantity of money, as Gilder states it, the SSE’s stress on the quality of its anticipated worth in goods and services. “SSE’s seem to view that both Keynesianism and monetarism as two sides of the same tarnished demand-management coin. In their estimation, ‘demand side’ fiscal and monetary policies are responsible for the simultaneous occurrence of high unemployment and rapid inflation”.’

Reasons for Neo-Classical Approach:

The neo-classical approach emerged because of a substantial change in the mechanism of capitalist reproduction in the post-war period. Under these conditions, inflation was becoming more and more important problem, sharpening both the contradictions of reproduction and the social contradiction of capitalism. The second factor was the vast expansion of state interference in the economy, the very logic of whose development ran into the contradictions with the immediate interest of monopoly capital.

Moreover, the Keynesian revolution programme is charged with taking too superficial a view of the growth of government expenditures and budget deficits, which produced the danger of inflationary tendencies. Potential rate of growth is another reason for the evolution of neo-classical theory.

According to critics while the neo-classical theory of the factors of production is highly vulgar and apologetic as a theory of production and distribution of value, it has proved to be a convenient starting for the transition from the Keynesian growth model to the more complex model which has helped to analyze the quantitative and qualitative factors of potential economic growth.

One of the characteristics of macroeconomics is that it deals mainly with the techno economic, quantitative aspects of production, as a rule ignoring the socio-economic prerequisites, internal laws of development which are determined by the nature of property and which in turn ultimately determine many of the economic processes within the given economic system. Still, the theory can be used for apologetic conclusions, for an analysis of important techno-economic interconnections which are of great importance in regulating capitalist production.

ADVERTISEMENTS:

Thus, the emergence and formulation of neo- Keynesian theory of macro dynamics was natural result of the Keynesian theory of static equilibrium, and was given importance by R.F. Harrod, E.D. Domar, A.H. Hansen and Joan Robinson. This neo- Keynesian theory of macroeconomic dynamics by these learned economists resulted from a profound critical reworking of the character and the introduction of dynamic elements which made it possible to go on to an analysis of the conditions of equilibrium and disequilibrium in developing economic system.

The denial of the capacity of capitalism to adapt itself to the fullest use of economic resources marks the dividing line between Keynesian-minded economists and the neo-classicals, the modern advocates of free enterprise economy; who claim that the prices and profit mechanism is adequate for regulating capitalist economy, and all that the state has to do is to see that this mechanism is not disturbed by the trade unions, the monopolist or the state itself.

The New Classical Economics-Salient Features:

It is alleged that the failure of the Keynesian income-expenditure model of the economy to control inflation from mid-1960s and stagflation from 1970s led to the growth of contemporary monetarism. The same policy failures have also given rise to more fundamental challenge to the structure of contemporary macroeconomic theory and are known as—New Classical Economics.

Specifically, the policy failures which led to the development to these challenges are rooted in the collapse of the Phillip’s curve relationship. The roots of the classical economics can be traced back to a 1961 article by Professor J.F. Muth, now of Indiana University (USA).

In this article Professor Muth developed what could be known as the core idea of the new classical economics:

(a) The Theory of Rational Expectations. Initially, the theory was used to explain behaviour in financial markets, but subsequently it was applied to macroeconomics theory. The other proposition on which new classical economics is based is the

ADVERTISEMENTS:

(b) Theory of Continuous Market Clearing.

(a) Rational Expectations:

‘New Classical Economics’, or its related idea called Rational Expectations pose more serious challenge to prevailing Keynesian orthodoxy. Rational Expectations theorist believes that because people are rational they rightly anticipate the results of actions and behave accordingly. When combined with a Walrasian general equilibrium model which shows that markets always clear, rational expectations theory holds that a market system, if free from government intervention, will readily attain an equilibrium at full employment. They believe that no macroeconomic policy can significantly influence the course of economy.

The theory of rational expectations argues that all economic agents form expectations rationally by taking into account all relative information, including how policy will affect the economy. The result of this is that, unless a policy action is not foreseen the results of any policy will be anticipated and, therefore, the policy will be rendered ineffective. Since the advocates of rational expectations theory believe that the economy is inherently stable and because of the way in which they believe expectations are formed, they do not believe any policy action or intervention by the government can affect output, employment or the price level.

(b) The Theory of Continuous Market Clearing:

The theory of continuous market clearing is an important proposition of the ‘new classical economics’. It combines the older Walrasian general equilibrium theory with the more recent theory of efficient markets. The former was developed in the latter half of the 19th century by L. Walras (1834-1910), a French born economist.’ The latter theory emerged from Professor Muth’s seminal article (1961) in which he developed the concept of rational expectations.

Efficient market theory has been concerned primarily with prices and equilibrium in financial and, commodity markets—markets often described as ‘auction’ market. Walrasians developed a basic mathematical model to show how, in an economy characterized by competitive markets, a general equilibrium will be established in

L. Leon Walras was a 19th century economist, who developed mathematically a model of multi-market economy in which he demonstrated how markets could clear and there could be a simultaneous equilibrium in all markets. Walras’s analysis is usually described as a theory of general equilibrium, general in this sense means the entire economy which all prices are equilibrium prices and these prices are determined simultaneously.

ADVERTISEMENTS:

The prices so determined are neither equilibrium prices in the sense that there is neither excess demand nor excess supply in any market, including the market for labour. In order to explain how equilibrium is established Walras assumed the existence of a fictional auctioneer who cries out the price of the goods being traded and continues to do so until an equilibrium is established—that is, a market-clearing price is established for every goods traded in the market.

According to Walras the process is one of trial and error, is which eventually all trading takes place at equilibrium prices. Thus, the general equilibrium model of Walras necessarily involves full employment. In a way, the efficient market theory is a modification and refinement of Walrasian general equilibrium theory in the sense that it tells us something more about the nature of equilibrium prices in a Walrasian world. It is concerned with the relationship between prices and information.

A market is efficient when the prices established in the market reflect all the available information about the goods or services being traded. An efficient market not only processes all relevant information, but it also does the same quickly. That is why in the stock market, for example, one is really able to ‘beat the market’—that is, to profit from knowing something that no one else knows. Financial markets are presumed to be highly efficient in this sense because they quickly process all available information about the securities traded, and this information affects the prices of the securities. In this way, the theory of continuous market clearing is treated as one of the basic assumptions of the new-classical economics.

Out of two important elements of the new-classical economics—rational expectations and the theory of continuous market clearing—the latter is more crucial because its real meaning is that if, in effect, markets—including the labour market—do continuously clear, then full employment is always the norm. In the classical analysis the ‘natural’ rate of employment—and the corresponding natural rate of unemployment—is the level at which the quantity of labour demanded and supplied are in balance at an equilibrium real wage.

The idea of natural rate of unemployment originated with Milton Friedman, Friedman and the monetarists do not deny that the actual unemployment rate cannot differ from the natural unemployment rate of substantial periods ; but with the assumption of the new-classical economics that at each point in time markets clear and ‘agents’ in their own self-interest help it—the logical conclusion follows, that at the most, any deviation of the actual unemployment rate from the natural rate is rather short-lived.

Therefore, with continuous market clearing there is no room for any systematic policy action designed to influence the actual unemployment rate. But this theoretical conclusion faces a serious challenge, because it must be reconciled with the fact of the business cycle—those ups and downs in economic life which characterize the economy’s behaviour over real, calendar time.

Here, perhaps a word is in order about the meaning of the business cycle in this context. Presumably, there is a long-term trend path that the economy would follow for the real output if that output were always in balance with the economy’s productive potential. The latter is determined by the long-term growth and resources, especially labour and capital and changing technology. But we know, that the actual path of real GNP is seldom smooth, departing over time in both directions (up and down) from the trend representing potential output.

These departures in both directions from the trend path are not smooth, but there is, enough regularity in them to warrant the name of business cycle. Thus, new-classical economics claims that it is possible to explain business cycle—which they agree is a reality—without abandoning the essentials of classical equilibrium economics, namely, that all behaviour is rational and that markets clear continuously in the Walrasian sense. It also shows that basically the business cycle is a product of misinformation by economic agents who are supposed to act in a rational manner at all times.

This is particularly crucial for the problem of unemployment because the supply of labour is a function of the real wages—any withdrawal of labour from the market turns out to be voluntary resulting primarily from an informational lag. Thus, new-classical economics also recognizes the existence of business cycles but explain it not in terms of weaknesses of their theory but in terms of misinformation on the part of producers and wage earners who fail to see what is happening in specific market and thus temporarily supply more goods and labour than needed.

Neo-Classical Synthesis:

Once neo-classical theory began to tackle and dominate macroeconomic analysis Keynesianism was faced with a serious rival not only in the field of theory but also in the formulation of economic regulation programme. However, the differences and problems between the two did not result in the elimination of either of them, but in a blending, of the two into what is known as ‘neo-classical synthesis’, as their mutual criticism helped to improve their quantitative methods of analysis, to formulate conceptions explaining the various economic interconnections, and to specify the character of different economic situations in the short and in the long run.

The term “the neo-classical synthesis” was invented by Professor Paul Samuelson of M.I.T. to describe an economic world in which the classical principles of demand and supply for individual goods and services and competitive markets would apply, once Keynesian principles had been employed to ensure a level of aggregate demand sufficient for full employment. Monetary and fiscal policy can, if necessary, be used to attain this condition. In modern macroeconomic analysis this synthesis has been attained by grafting a classical model of the labour market into the general equilibrium model (the IS-LM framework) with flexible prices.

Neo-classical synthesis came to have important tasks before it because it involves a combination of the Keynesian theory of effective demand and the neo-classical theory of production and distribution. In an effort to overcome the bias of the Keynesians and the neo-classicists, the advocates of neoclassical synthesis seek to bring out the vices and virtues of state regulation and the uncontrolled market mechanism and to find out the best ways of combining these at various phases of the cycle and for different long-term targets in economic development.

The Keynesians specialize in analyzing the problems of effective demand and the conditions of realisation which determine the real level of production. They study the cycle and seek to formulate anti-cyclic policies. The neo-classicists specialize the factors which determine the potential level of production and creates their models for forecasting economic development and formulating long-term economic growth policies. But the synthesis is of no use as there are differences which tend to Hare up with fresh force when the contradictions of capitalist growth become more acute and the need arises to take urgent measures to deal with looming crisis or inflation (or the two together).

The growth of military-expenditure by the government and the military components of the economic system into a permanent factor of economic development, has had a fairly important role to play in the formulation of these theories. No wonder, therefore, the most reactionary circles of the monopoly capitalist look to the Keynesian theory, again and again, to justify their arms drive, huge deficits and military spending. This type of economy has failed to produce a scientific analysis of the exploitative nature of the capitalist mode of production.

Despite, this type of economy urges the need for understanding a whole range of quantitative inter-connections which characterize the process of simple and extended reproduction, the relation between supply and demand, the circulation of money and finance, the quantitative relations which determine the optimal use of resources within the framework of an enterprise or of the whole society.

That is why the capitalist economy even of the Keynesian mould has two functions—the ‘apologetic’ and the ‘practical’. Thus, there is some kind of continuity between the various capitalist theories of development, which do not develop in a vacuum, but are a natural outcropping of older theories or their adaptation to new conditions. From the critique of Keynes to the neo-Keynesian theory of growth, from the critique of the latter to the neo-classical theory of growth, and finally, the efforts to synthesise them shows the evolution of macroeconomic theory maintaining their apologetic and the so-called practical elements.

As we know by now the classical labour market embodies the demand schedule for labour described earlier in which the demand for labour (Nd) is an inverse function of the real wage (w/p). To this we must add the classical labour supply which holds that the supply of labour (Ns) is a positive function of the real wage (w/p). Thus, in equation form we have

Ns = ƒ(w/p).

The view that the number of workers seeking employment is a function of the real wage rests partly on the classical assumption that the worker, in offering his services in the labour market, seeks to maximize his income in the same way that the entrepreneur seeks to maximize his profit. Keynes, in speaking of this postulate of the classical analysis, said it means that the utility of the wage associated with a given volume of employment will be just equal to the disutility of that amount of employment.

Stated differently, the real wage represents that which is necessary to overcome the irksomeness (or disutility) of work and, thus, induce people to become employed. What this means is that there must be a “trade-off between work and leisure, a balancing of the gain to begotten from consuming the goods and services which the money wage will buy (the real wage) and the value of leisure to the individual. Since leisure has value, a rational person will give some or all of it up only if he or she is rewarded for so doing.

The functional relationship between the supply of labour and the real wage is also based upon the classical assumption that workers and other resources owners do not suffer from the money illusion. In other words, the monetary unit is believed to be stable in value, and thus, a rise in money income is considered, ipso facto, a rise in real income. Under these circumstances—that is, an economy suffering from the money illusion—the supply of labour could just as easily be a function of the money wage as the real wage. But this is not the classical view of the matter.

Money, to classical economists, is fundamentally a medium of exchange, a means to an end; they believe that the use of money should not obscure the fact that basically the economic process is concerned with an exchange of goods for goods. Money is significant only because it is more convenient to have a generally accepted medium of exchange than it is to resort to barter. The implication of such a view is that resource owners, including workers, will value the services of their resources in terms of the real returns they can command.

The Equilibrium Level of Employment:

The significance in the classical system of the two schedules discussed—the demand for labour and the supply of labour—is that, when brought together, they uniquely determine both the employment level and the real wage. Moreover, the classical demand and supply schedules for labour necessarily intersect at the level of full employment.

The equilibrium employment level determined by the intersection of the classical demand and supply schedules for labour has to be one or full employment (Yf). If any unemployment (aside from frictional unemployment) exists after equilibrium is obtained, it must be voluntary unemployment. This is true for essentially two reasons.

First, the classical analysis imply that, if non-frictional unemployment persists after the equilibrium situation, it must be because some workers are demanding wages too high in relation to the marginal productivity of labour. If these workers are unemployed because of their refusal to accept lower money wages, their unemployment must be regarded as voluntary. If they would accept a reduction in money wages, the real wage would decline, other things being equal, and more employment would be forthcoming.

The second reason why the employment level is one of full employment is simply that the theory maintains that money wage bargains between workers and entrepreneurs determine the real wage ; consequently, the workers in general are in a position to determine their real wage (through money wage bargains) and, therefore, the level of employment. If this is true, it necessarily follows that any unemployment that actually exists at a given level of real wages has to be voluntary unemployment.

The Complete Neo-classical Synthesis Model:

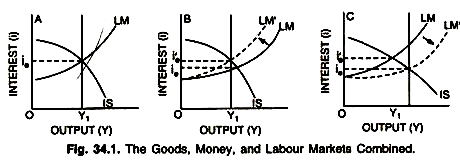

The next and final step is to incorporate the output level as determined by forces at play in the labour market into the IS-LM general equilibrium model of the aggregate economy. This is done in Fig. 34.1 given here. What we do is to add a vertical line to the standard Keynesian diagram at a point on the horizontal axis that is equal to the equilibrium, income level (Yƒ) determined by the labour market model.

In the Fig. 34.1, the labour-market determined full-employment line is shown for three different sets of circumstances. In Part A of the figure, the vertical line Yƒ is drawn so as to pass through the intersection of the IS and LM curves. In Part B it lies to the left of this point of intersection, whereas in Part C, it lies to the right.

What does this Figure shows us? In Part A we have a situation in which the three sets of forces at work in the economy—those that pertain to the goods market, those pertaining to the money market and those pertaining to the labour market—happen to be in unison in such a way that equilibrium in each of three spheres of the economy in compatible with full employment (Yƒ). But Parts B and C are different.

In Part B the intersection of IS and LM lies to the right of the full-employment output (Yƒ), a situation which implies that the combination of real and monetary forces which lie behind the IS and LM curves add up to a level of aggregate demand that exceeds the real capabilities of the economy. Part C, however, shows just the opposite, as the full-employment output (as determined in the labour market) lies beyond the intersection of IS and LM. What this means is that there is insufficient aggregate demand to get the economy to full-employment.

From the standpoint of effective economic performance, the only acceptable situation is the one depicted in Part A, a level of aggregate demand equal to full-employment as determined in the labour market sphere.

The thrust of Keynesian analysis has been that there is nothing inherent in the structure of a market economy that will bring the economy to this situation. On the contrary, Keynes believed that, if the economy got to such a situation without intervention by government, it would not only be a rare occurrence, but completely a matter of chance. The more normal condition of the market economy under a policy of laissez faire was that depicted in Pact C of the diagram, a situation in which aggregate demand is chronically deficient.

The foregoing, however, is not the conclusion reached by the neo-classical synthesis. Rather, this approach argues that the economy is inherently stable and market forces can be depended upon to push it either to a short-term full-employment output or to the output path determined by the growth of its productive potential. Thus, although the neo-classical model admits of the possibility of the economy being in the situation depicted by either Part B or C, it does not admit that it can remain there long. Market forces will push it to the situation shown in Part A.

The crucial question is—how? It is the mechanism of flexible wages and prices. In our earlier discussion we pointed out that shifts in the LM curve brought about by changes in the general level of prices would ensure intersection of the IS and LM curves at the full-employment income level. All that was lacking in the discussion at that point was a mechanism within the model that would determine the full-employment output level.

This mechanism is now supplied by the neo-classical synthesis by grafting a classical model of the labour market onto the basic IS-LM model with flexible prices—we have come full circle: The basic Keynesian argument that the economy is inherently us table and unlikely to attain a full-employment equilibrium on its own has been blunted. Instead, Keynesian mechanisms have been shown to be inherently stabilizing and self-adjusting if the classical condition of competitive markets and flexible wages and prices prevails.

To illustrate the foregoing point, consider what will happen if, momentarily, the economy finds itself in the situation depicted by B in Fig. 34.1. What the Figure shows is that the Keynesian equilibrium as determined by the intersection of IS and LM adds up to a spending total in excess of the output total determined by the production and equilibrium in the labour market. Something must give. That “something” is, of course, the price level.

The excess of demand pulls up prices, rising prices shift the LM curve to the left as the Figure indicates (LM’, interest rates climb ie‘) and we move backward along the IS curve—which indicates a downward adjustment in effective demand as determined by investment spending and the multiplier relationship. Simply put, the goods and money markets adjust to the conditions of equilibrium determined by forces at work in the labour market.

If the economy finds itself in the situation depicted in Part C of Fig. 34.1, the opposite will happen. When total spending as determined by IS-LM equilibrium falls short of output determined in the labour market, wages and prices will fall, shifting the LM curve to the right (LM’), which, in turn, brings the rate of interest down (ie’). The latter change will cause investment to rise, and total demand operating via the multiplier will rise until a full-employment equilibrium is attained.

Intellectually the neo-classical interpretation of the basic income-expenditure model developed earlier has had a strong appeal to many economists, the reason being that it provides a complete theoretical mode that integrates equilibrium in the goods, the money, and the labour markets. Furthermore, it is mathematically complete.

It shows that, with wage and price flexibility, the economy becomes self-adjusting, the equations of the labour market ensure that eventually market forces will push the economy to full-employment. As we have seen, the labour market dominates in determining output: the more purely Keynesian IS and LM equilibrium adjusts to conditions in the labour market, not the other way around.

As the level of pure economic theory, the meaning of the neo-classical synthesis is that continuing under-employment equilibrium becomes impossible, except under the special circumstances of downward rigidity in wages and prices or because of the existence of a liquidity trap. ‘Thus, the neo-classical model succeeded in turning Keynes’ original analysis upside down, marking it a special case in the more general context of an essentially classical view of the world in which the “natural” tendency of the economy is toward full-employment, given wage and price flexibility.

We should not conclude from the foregoing, however, that the neo-classical analysis does not allow room for an active monetary and fiscal policy. Quite the contrary. It is recognized that wages and prices are often sluggish— especially downward—and thus process through which the economy will adjust automatically toward a full-employment condition may, politically speaking, take much too long to attain.

Consequently, Keynesian-style fiscal and monetary policies are not only necessary but welcome. As one observer has phrased it, “the neo-classical synthesis permits the advocacy of an active full-employment policy to be consistent with an in-theory belief in the self-equilibrating nature of the economy.

Critical Evaluation:

The new-classical economics has a strong appeal—especially because by linking expectations to traditional classical ideas about rational behaviour, it seems to provide the bridge between micro and macroeconomics that economists have desired for so long. But as a theory capable of explaining the real world behaviour of complex market economies, it has serious limitations. The first being the assumption—that markets clear continuously.

In reality this is nothing more than a restatement of the old classical view that markets are purely competitive; that prices and wages are flexible and that the movement in the market is always towards an equilibrium of price and planned quantities. According to Professor Tobin—”the market-clearing assumption is just an assumption and nothing more than that—it is not justified by any new direct evidence that a Walrasian auctioneer process generates the prices observed from day-to-day or month-to-month or year-to-year”.

Since no satisfactory alternative model exists for dealing with fundamental issues of resource use and output composition, the Walrasian general equilibrium model holds great appeal, even though it is simply not possible to describe the real world in terms of continuous clearing in competitive markets. According to socialist critics the neo-classical theory/synthesis is based, first on the vulgar conception of the factors of production, each of which, in accordance with its marginal productivity, makes a contribution to the creation of the social product, and second, on the conception of stable equilibrium, which because of the mobility of price rules out any long-term or short-term departures from the state, that is, crises, unemployment and stagnation.

Other criticism applies to the theory or elements of rational expectations in new-classical economics because it is very difficult to say how expectations are formed in the real world economy? One main shortcoming in the rational expectations approach is that it requires that people know much more about how the economy works and the significance of all the data generated then can be reasonably expected.

Again, the critics of rational expectations point out that, even if valid, it has limited applicability because it can deal only with situations in which the economic events that enter into the formation of expectations involve situations of ‘risks’ and not ‘uncertainty’. Hence, say the critics that new-classical theory is based on weak elements like rational expectations and therefore, has no strong foundations.

Thus, even if it is granted that the logic and mathematical presentation of new-classical economics has a strong appeal to many economists, empirical evidence, which after all, is the ultimate test for the validity of any theory does not support the argument of the new-classical synthesis or school that all macro policy measures are ineffective. What has given some importance to the new-classical ideas or economics is the failure of conventional macroeconomic policies to cope with the problems of stagflation after 1970s.

The correct lesson of the experience of 1970s through the 1980s is that we do not yet have successful policies for attaining full employment—especially full-employment overtime— with stable prices. But the answer to this problem is not to give up the basic income-expenditure model to Keynes in favour of so called reinvented new-classical theories themselves found wanting in the past as well in the prevailing circumstances of world economics. Rather, the need of the hour is, to expand and improve the income-expenditure model by bringing into it elements which can account for the observed facts of rising prices and wages along with slack markets and excess capacity called ‘stagflation’.

Another offshoot as we have seen of the new classical economics on which it is based is called— supply side economics. It was the basis of President Reagan’s economics during 1980s in USA also called ‘Reagan-economics’. Its inspiration comes from Say’s Law. They believed that what holds back supply is unduly high taxes—which impair incentive to produce and depress production. Therefore, there is justification for tax cuts.

However, monetarism, rational expectationists and supply side have in common:

(i) The aversion to government actions and interventions even with the best of intentions

(ii) A strong faith in the efficacy of market and inherent stability of the economic system when left alone.