Let us make in-depth study of the subject matter, importance and development of macroeconomics.

Subject Matter of Macroeconomics:

There is no clear-cut division between micro- and macro-economics. The scope of macroeconomics can be stated by giving a list of most important problems with which it is concerned.

Macroeconomics is concerned with the behaviour of the economy as a whole.

The subject matter of macroeconomics is income and employment, inflation, balance of payment problems etc. which occur in milder forms all the time.

ADVERTISEMENTS:

The purpose of macroeconomics is to present a logical framework for the analysis of these phenomena. What does determine income and employment? What does determine the price level? How are these related?

What policies can be used to affect them and how do they work? These are some of the questions the analytical framework presented here is meant to handle. Real income, employment, the price level and the balance of payments are determined by the interaction of decisions made by the individuals when solving their economic problems; decisions about the consumption and investment, decisions about the allocation of wealth among alternative assets, decisions about how much labour to hire and supply, and many others.

Though these decisions are interdependent, it is useful to subdivide the economy into various sectors of decision-making in order to examine what forces operate in each sector before looking at the interdependence among them.

The division between micro and macro is a matter of convenience. It is convenient to make distinction, because (1) the method of analysis is different and (2) the problems are also different. The basic microeconomic problem is the determination of structure of relative prices and the basic theory is that of demand and supply. The basic macroeconomic problem is the determination of the flow of income and the basic theoretical structure is the model of the circular flow of income.

ADVERTISEMENTS:

For this reason, we should know the circular flow of income concept:

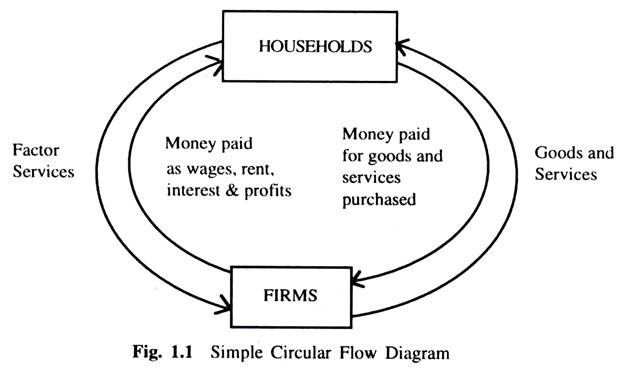

We assume that, in the economic system, production takes place in the firm sector and the individuals consume what is produced in the firm sector. The individual owners of factors of production supply factor services to the firms and receive income in return. They spend this income to buy goods and services from firms.

These transactions generate flow of goods and services in one direction and a flow of money in the other direction. Money in return flows from firms to households in return for factor services provided by households. Money also flows to firms in return for the output purchased from firms. These flows are given in Fig. 1.1

ADVERTISEMENTS:

In such a simple economy, there are only two groups of decision-takers, households and firms. Each group earns all its income by selling goods and services to the other groups and each group spends all of its income by buying goods and services from the other group. Households earn their income by selling the services of the factors of production — land, labour, capital and enterprise — to firms and they spend all their incomes on purchasing goods and services produced by firms. Firms sell all their goods and services to households and receive money in return.

All of the money received by firms is in turn paid out to the households. This is called the circular flow of income. Macroeconomics is concerned with explaining various aspects of this flow of income between firms and households and discuss about the determinants of this flow. It also explains the causes of its expansion or contraction.

The circular flow gives an idea of the general economic activity of the economy. When the size of the circular flow increases, the level of income and employment also increases. Similarly, when the size of the flow decreases, the level of income and employment also decreases.

Since modern macroeconomics is concerned with policy issues, debates on economic policies, viz, monetary and fiscal policies, and also exchange rate policies in open economics, have enriched the development of macroeconomic analysis.

Importance of Macroeconomics:

Macroeconomics has become an important branch of economics because of the following reasons:

Firstly, it provides us with tools to judge the performance of the economy as a whole. The performance of the economy is judged by the Gross Domestic Product (GDP) of the economy and this aggregative concept is discussed in macroeconomics. Again, the economic growth is determined by the size of the per capita real income. Thus, to know the economy is working, an elementary knowledge of macroeconomics is essential.

Secondly, macroeconomics is also useful to the government for formulating appropriate policies. In a modern economy, the government interferes in economic activity. For this the government adopts different policies such as fiscal and monetary policies and so on. Such macroeconomic policies influence the entire economy. What policies — fiscal or monetary — would be undertaken by the government depends on the phase of the trade cycle or business cycle.

If the economic activity is increasing (i.e. the economy is in boom), government policy will be different from its policy when the economic activity is decreasing (i.e. the economy is moving to depression). To know the nature of the trade cycle and to make forecasts about business cycle, a knowledge of macroeconomics is necessary. Hence macroeconomics helps the government to take an appropriate policy.

Thirdly, for any business firm, the knowledge of macroeconomics is necessary, because the demand for many firm products is a function of income. The demand increases or decreases along with the increase or decrease in the level of the economic activity. Thus, to make a forecast about the demand for its product, the firm must be able to make an estimate about the level of the economic activity which requires the knowledge of macroeconomics.

ADVERTISEMENTS:

Fourthly, we know that economy suffers from many problems such as unemployment, inflation etc. Why do such problems arise in the economy? Can such problems be automatically corrected? Is there any automatic mechanism within the economic system to solve these problems? These are some of the theoretical problems which require the knowledge of macroeconomics to understand and deal with them.

From the above analysis, it is clear that the study of macroeconomics is useful. Though macroeconomics is useful, it is not without limitations: Firstly, many propositions which are true for individuals may not be true for the economy as a whole. For example, an individual can borrow from another individual during a period of time, but the community as a whole cannot borrow from itself. There are many other examples which could be true for an individual, but may not be necessarily true for the community as a whole. Thus, it is difficult to generalise in macroeconomic theory.

Secondly, in macroeconomics, we deal with aggregates and these aggregates are taken as homogeneous entities. But this is not true.

Thirdly, all aggregates are not useful. Only those aggregates which can be functionally related happen to be useful.

ADVERTISEMENTS:

Fourthly, the major part of the macro theory is applicable for a developed capitalist economy. It is not suitable for less developed economies. The problems of the developing economies are not same as those of the developed economics. Hence, the macroeconomic models built for the developed economies are unlikely to be suitable for the developing economies.

Development of Macroeconomics:

Modern macroeconomics started with the major concern for unemployment that dominated thinking in the developed industrial world in the 1920s and 1930s. The theoretical breakthrough was attributed to Keynes and is often called the Keynesian revolution.

While there is no doubt that there was a Keynesian revolution and that Keynes was the leading economist of us generation, it is worth knowing that he was not alone in contributing to our understanding of the subject. Many economists in the 1930s had important contributions to make on the subject.

The origin of macroeconomics can be traced back to the mercantilist writers who were concerned with the problem of economic growth of a country. Though they wrongly thought that the greater the gold and silver possessed by a country, the richer it could be. They also thought that the country could have economic prosperity only if it had a favourable balance of trade. But the first theoretical macroeconomic model can be seen in the writings of Physiocrats.

ADVERTISEMENTS:

The Tableau Economique developed by Quesnay in 18th century France gave a circular flow model of total product among three classes of people. Quesnay’s tableau gave the idea of circular flow product and income which was later emphasised by Keynes. The Physiocrats thought that the economic growth depended on the net product produced by the agricultural sector.

According to the Physiocrats, the agricultural sector was the only productive sector in the economy capable of producing a surplus. They thought that industry and trade are unproductive, incapable of generating a surplus.

The next step in the development of macroeconomics was taken by classical economists such as Adam Smith, David Ricardo, Robert Malthus, J. B. Say etc. The classical economists investigated the real relations of production in bourgeois society. Classical economists also believed in the Say’s law of markets.

The idea of classical economists are summarised in the classical model of income and employment. They believed that in a free enterprise economy, each economic unit would try to maximise its own interest and there was a harmony of individual interests. A basic result of the classical economics is that, given the flexibility of wages and prices, a competitive market would automatically operate at full employment level of output and employment.

That is the economic forces would always be generated to ensure that the demand for labour would always equal its supply. So long as there is unemployment money wages and prices would fall, output would increase and I he additional supply of output creates its own demand (Say’s law) and there can be no overproduction.

In this way, full employment would be automatically reached and there could be no involuntary unemployment. The economy could temporarily deviate from full employment level but market forces would operate to restore the full employment equilibrium.

ADVERTISEMENTS:

The Great Depression of the 1930s in all the capitalist countries of the world rudely shattered the belief of the self-correcting mechanism of the capitalist economic system as propounded by the classical economists. In his book, “The General Theory of Employment. Interest and Money” published in 1936, Keynes vehemently criticised the postulates of the classical theory and provided a new theory of employment and income. Modern macroeconomic theory is largely based on the idea of Keynes work.

The main result of the Keynesian theory is that the level of real national income and, therefore, employment, is determined largely by the level of aggregate demand. This is very different from the classical theory where supply creates its own demand. In the Keynesian theory, it is the demand which determines how much is to be supplied.

He argued that if firms find that they are producing more than is being demanded, they will observe an involuntary increase in their inventories of unsold goods and will so rectify this by cutting back on production and laying-off workers. National income will then fall until the value of what is produced is equal to the value of aggregate demand.

If firms find that they are not producing enough to satisfy demand, they will experience an unwanted fall in their inventories and so will attempt to increase production and hire more workers.

There will be one level of national income at which the aggregate demand is equal to the total value of production. This is called the equilibrium level of income. An important point to remember is that, in the Keynesian theory, the equilibrium level of income is not necessarily a full employment income. Even in equilibrium, some amount of involuntary unemployment may be present in the economy.

This is the reason he called his theory a general theory and he regarded the classical theory as a ‘special case’ where the equilibrium and full employment level of income coincide. Another contribution of Keynes is to break the classical dichotomy and to integrate the price theory with the monetary theory. He showed how all the variables — real and monetary — were simultaneously determined in an economic system in which the money was used both as a medium of exchange and as a store of value.

ADVERTISEMENTS:

Keynes’s theory has policy implications which are different from the classical theory. Classical economists do not like government intervention in the economy and they think that the government is likely to make things worse by intervening. Thus, they favour monetary policy. On the other hand, Keynes was not in favour of monetary policy. He saw an useful role for the government and recommended the use of fiscal policy for full employment and economic stability.

The influence of Keynes in the development of modern macroeconomics is really profound. Much of the modern macroeconomics is based on Keynes’ work and has been developed by post-Keynesian economists such as Hicks. Hansen, Modigliani, Tobin etc. Post-Keynesian economists have refined and developed some of the ideas introduced by Keynes.

In the post-Keynesian period, macroeconomics have developed in two directions. One school of thought believes that markets work best if left to itself; the other believes that government intervention can significantly improve the performance of the economy. In the 1960s, the debate on these questions involved monetarists on the one side and Keynesians on the other.

In the 1970s, the debate on the same issues brought to the fore a new group — the new classical macroeconomists who, by and large, replaced the monetarists in keeping up the argument against active government intervention to improve economic performance. The new classical macroeconomics remains influential even today. On the other side, the new Keynesians — mostly trained in the Keynesian tradition — are moving beyond it. They do not believe that markets clear all the time but seek to understand and explain why markets may fail.