The lack of clear connection between macroeconomics and microeconomics has long been a source of controversy and discontent among economists. K. J. Arrow (1967) called it a ‘major scandal’ that neo-classical price theory cannot account for such macroeconomic phenomenon as unemployment.

R. Lucas and T. Sargant (1979) argued that Keynesian Macroeconomics is ‘fundamentally flowed’ by its lack of firm micro foundation. Over the years, macroeconomic theorists and practitioners alike have complained of the schizophrenic nature of a discipline whose two major branches project radically different views of the world.

In recent years, the quest for micro foundations has been a mainspring of development in macroeconomic theory. So, the distinction between the two branches of economics is getting blurred. And considerable work in recent years has gone into investigating the ‘microeconomic foundations of macroeconomics’ and much current research in macroeconomics has a distinctly micro-flavour.

Still, the goal of macroeconomics seems to be to understand and predict the behaviour of aggregate economic variables—consumption, investment, employment, etc. — rather than understand a single economic unit or market in isolation. So, this difference in focus may serve as a distinguishing characteristic.

ADVERTISEMENTS:

New macroeconomics—which has a strong micro-foundation—rides on two wheels:

(1) New classical economics and

(2) New Keynesian economics.

1. New Classical Approach:

The new classical approach assumes that rational agents are always optimising. In other words, it has rigorous micro foundations in the sense that it is based on analysis of utility-maximising behaviour of agents interacting in clearing markets.

ADVERTISEMENTS:

A new branch of classical economics, called New Classical Macroeconomics, was developed by Robert Lucas, Thomas Sargant and Robert Barro. It emphasises the role of flexible wages and prices, but it adds a new feature—called rational expectations—to explain the effectiveness or ineffectiveness of policy measures.

Rational Expectations:

New classical economics relies on rational expectations hypothesis. According to this hypothesis, people make unbiased forecasts. In addition, economic agents such as households and investors use all available information in making consumption and investment decisions. The key assumption here is that because of rational expectations, the government cannot fool the people with systematic economic policies.

Real Business Cycles:

ADVERTISEMENTS:

Business cycles are equilibrium economic phenomenon, driven largely by productivity stocks, caused by changes in technology. In the RBC approach, shocks to technology, investment or labour supply change the potential output of the economy.

According to the RBC theory, short-run economic fluctuations should be explained while assuming that prices are fully flexible, even in the short run. Almost all microeconomic analyses are based on the premise that prices adjust to clear markets. Advocates of RBC theory argue that macroeconomic analysis should be based on the same assumption. RBC theory has a strong micro foundation.

This bears evidence from the following:

i. Inter-Temporal Substitution of Labour:

RBC theory emphasises that the quantity of labour supplied at any given time depends on the incentives that workers get. A worker is inclined to work longer hours when he is well rewarded and is willing to work fewer hours when he is paid low wage. Sometimes, if the reward for working is sufficiently small, workers choose to forgo working altogether—at least for a short period of time. This willingness to reallocate hours of work over time is called the inter-temporal substitution of labour.

When real wage is perceived to be high relative to future real wage(s) workers try to work more hours today, and take more leisure later when the real wage falls again. Such a willingness to work more hours when the incentive to work is relatively high and fewer hours when the incentive to work is relatively low is called an inter-temporal substitution of labour and is a key feature of the RBC transmission mechanism and ensures that current period output rises.

As an example, consider a student who needs to (i) study, and (ii) earn money to save for the future. Studying seriously and earning money at the same time is difficult. So the choice is between either working in the summer and studying in winter or working in the winter and studying in summer.

If the student works in summer and gets paid at the end of summer, then at the end of winter he will have Ws (1 + r/2) rupees — the sum of his summer wage and the interest for half a year that he would earn by saving the money in a bank. If the student works in winter, then at the end of winter he will have Ww rupees.

The real relative wage between summer and winter is thus equal to

The higher this quantity, it is more likely that the student will choose summer rather the winter work. Thus the incentive to work hard how—accept lots of overtime, say—depends on three factors: the current wage, the expected future wage, and the real interest rate. Increases in the first and the third tend to lead people to postpone recreation and other non-work uses of time to the future.

Increases in the second tend to lead people to work less. If people are strongly desirous of shifting their hours of work from season to season or from year to year, then one would expect substantial fluctuations in employment.

RBC theory uses this concept to explain why employment and output fluctuate. Shocks to the economy that cause the interest rate to rise or the wage rate to be temporarily high cause workers to work for long periods; the increase in work effort varies employment and production. The converse is also true.

ii. Technology Shocks:

ADVERTISEMENTS:

The RBC theory assumes that economy experiences fluctuations in technology and these fluctuations cause fluctuations in output and employment. When the available technology improves over time, the economy produces more output, and real wages rise.

Due to inter-temporal substitution of labour, the improved technology also creates more employment. This leads to further rise in output. The converse is also true. Output and employment fall during recessions because the available production technology deteriorates, lowering output and reducing incentive to work.

iii. Wage-Price Flexibility:

RBC theory assumes that wages and prices adjust quickly to clear markets. This means that the market imperfection or sticky wages and prices is not important for understanding economic fluctuations. It is felt that the assumption of flexible prices is superior methodology to the assumption of sticky prices, because it ties in macroeconomic theory more closely to microeconomic theory.

2. New Keynesian Economics:

ADVERTISEMENTS:

Critics of RBI theory believe that short-run fluctuations in output and employment represent deviations from the natural levels of the variables. They feel that these deviations occur because wages and prices are slow to adjust to changing economic conditions.

This stickness makes the short-run aggregate surplus curve upward sloping rather than vertical. Consequently, fluctuation in the aggregate demand causes short-run fluctuations in capital and output. New Keynesian economics has attempted to explain price stick-ness by examining the microeconomics behind short-run price adjustment. By doing so, it attempts to put the conventional theories of short-run fluctuations on a much stronger foundation.

Small Menu Cost and Aggregate Demand Externalities:

One reason for price stick-ness or sluggish price adjustment is the existence of menu costs, or the costs of changing prices. Such costs lead firms to adjust prices at discrete time periods and not every now and then. No doubt menu costs are very small but they are not inconsequential. Even though such costs are small for the individual firm, they can have large effects on the economy as a whole.

A typical large manufacturing firm sells differentiated products and employs different types of labour. Changing prices and wages in response to every minor fluctuation in demand is a costly and time-consuming activity. Firms find it optimal to keep their price lists (menus) constant for long periods of time.

Since all manufacturing firms are operating in imperfectly competitive markets, they have some pricing discretion. Hence it may be optimal for firms to react to small changes in demand by holding prices constant and responding with changes in output and employment. If many firms behave in this way, output and employment will respond to changes in aggregate demand.

ADVERTISEMENTS:

One reason for slow adjusting of prices in the short run is that there are externalities to price adjustment. A price cut by one firm benefits other firms in the economy. By lowering its price, a firm lowers the average price level, at least marginally and thereby raises real money balances.

The increase in real money balances expands aggregate demand (by shifting the LM curve to the right). The economic expansion in turn raises the demand for the products of all firms. This macroeconomic impact of one firm’s price adjustment on the demand of all other firms’ products is called aggregate demand externality.

Staggering of Wages and Prices:

Since all unions and firms do not set wages and prices at the same time, we find staggering of wage and price adjustment in the economy. Due to lack of synchronization of the activities of different unions and firms staggering occurs, i.e., individual wages and prices change frequently even though the overall level of wages and prices adjust slowly and gradually (or show sluggishness). The reason is that every firm prefers to wait and watch the actions of others. No firm wishes to take the lead, i.e., to be the first to announce a substantial price increase.

There is staggering in labour market, too. This affects wage determination. If, for instance, the money supply falls, aggregate demand will fall. This, in turn, requires a proportionate fall in the nominal wages to ensure full employment. If all wage rates fall, proportionally, each worker would willingly accept a lower nominal wage.

But each worker is reluctant to be the first to accept a wage cut because this means a temporary fall in his real wage. The staggered setting of individual wages makes the overall level of wages sticky.

ADVERTISEMENTS:

Recession as Coordination Failure:

Coordination failure occurs in the setting of wage and prices because those who set them must anticipate the actions of other wage and price setters. Trade unions negotiating wages are concerned about high wages and favourable terms and conditions other units will secure. Firms setting prices are watchful of the prices other firms will charge.

An Example:

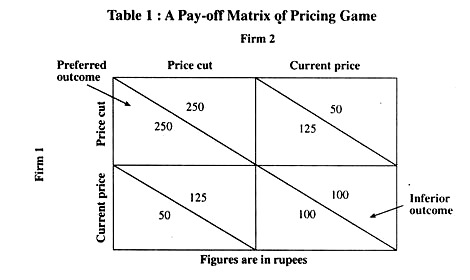

A simple example will explain how a recession could arise from coordination failure. Suppose there are just two firms in an economy. After a fall in money supply, each firm has to decide whether to cut its price, if its objective is profit maximisation. Each firm’s profit, however, depends not only on its own pricing decision but also on the decision by the other firm. The choice in terms of a simple duopoly game problem faced by each firm is shown in Table 1, which shows how the profits of the two firms depend on their actions.

The situation described above is typical of duopoly. The lesson to be learned from the above example is that each firm’s decision influences the set of outcomes available to the other firm. When one firm cuts its price, it improves the position of the other firm since money supply goes up. So the other firm can then act to avoid a recession. The favourable effect of one firm’s price cut on the other firm’s profit opportunities arises due to an aggregate demand externality.

ADVERTISEMENTS:

Two opposite outcomes are possible in this economy. On the one hand, if each firm expects the other to cut its price, both will cut prices, resulting in the best possible outcome in which each earns Rs 250. On the other hand, if each firm expects its only rival to maintain its current price, both will maintain their prices, in which case each makes Rs 100. Each outcome is possible. So there is multiple equilibria problem.

The inferior outcome, in which each firm earns Rs 100, is an example of coordination failure. If the two firms could coordinate their pricing decision they would both cut their price and reach the preferred outcome. In the real world, in which there are a large number of firms, coordination is really difficult. Thus the main message of this example is that prices can be sticky simple because people expect them to be sticky, although stickiness is not in the interest of anyone.

NK vs. RBC:

Economists in the New Keynesian (NK) tradition believe that wages and prices are sticky. Therefore, monetary and fiscal policies should be used to stabilise the economy. Price stickiness at the micro-level is a type of market imperfection, and it leaves open the possibility that government policies can raise social welfare.

By contrast, RBC theory suggests that the government’s influence on the economy is limited and that even if the government could stabilise the economy, it should not try to do so. According to this theory, the ups and downs of the business cycle are the natural and efficient response of the economy to changing technological possibilities.

The standard RBC model does not include any type of market imperfection. It is essentially a model of equilibrium business cycle in the sense that the invisible hand of the market guides the economy in such a fashion that there is an optimal allocation of resources.

ADVERTISEMENTS:

Efficiency Wages:

Another important recent development, fusing elements of both new classical and new Keynesian economics, is called efficiency Wage theory. This approach developed by Edmund Phelps and J. Stiglitz explains the rigidity of real wages and the existence of involuntary unemployment in terms of a firm’s attempts to keep wages above the market-clearing level in order to increase labour productivity.

As firms raise their wages to increase productivity, job seekers may be willing to stand in line for these high-paying jobs, thereby producing involuntary wait unemployment. The startling feature of this theory is that involuntary unemployment is an equilibrium phenomenon and will not disappear over time. The new classical approach seeks to explain why there could be a labour market equilibrium in which there is an excess supply of labour at the going wage.

Microeconomics of Wage Behaviour:

R. G. Lipsey has provided a micro foundation of cyclical behaviour of wages. In his view, firms tend to absorb cyclical demand fluctuations by varying their outputs rather than their prices. The overall microeconomics of wage behaviour is thought to be as follows: when demand falls, oligopolistic firms reduce their outputs and their demands for labour, holding their markup approximately constant. The unemployment does not lead to a sharp fall in money wage rates. So firms’ unit costs, and, hence, their prices, fall no faster than their productivity is rising.

There will also be some downward pressure on money wages (particularly in non-unionized sectors) and on prices in more competitive markets and the result will be a slow downward drift of the price level. When demand rises above the potential output, firms try to expand output by hiring more labour and labour shortages that develop cause wages to rise. As costs rise, firms pass these on in higher prices. This is a continuous process, which goes on as long as excess demand holds GDP above its potential level.

Micro Foundation of Inflation Theory:

If the proportion of price-setting systems in the economy increases, the SRAS curve becomes more elastic. This implies a shift of the AD curve to the right which will cause moderate rather than sharp inflation.

Micro Foundation of Investment and Consumption Functions:

There are two other micro foundations of macroeconomics. These are the consumption function and the investment function.

Consumption Function:

Since the time of Keynes, economists expressed their interest in knowing how individuals decide how much of their income to consume today and how much to save for the future. This is essentially a microeconomic question because it addresses the behaviour of individual decision-makers. Yet its answer has important macroeconomic consequences. In fact, household’s consumption decisions affect the way the economy as a whole behaves both in the short run and in the long-run.

The consumption decision of households is essential in long-run analysis because of its role in economic growth. The Solow-model of economic growth shows that the saving rate is a key determinant of the steady-state capital stock and thus of the level of economic well- being.

The consumption decision of households is crucial for short-run analysis because of its role in determining aggregate demand. Consumption is the major component of aggregate desired expenditure. So fluctuations in consumption are a key element of booms and recessions. The IS-LM model shows that changes in consumer spending plans can be a source of shocks to the economy and the MPC is a determinant of the fiscal policy multipliers.

Fisher-Model:

While Keynes hypothesized that a person’s current consumption depends largely on his current income, the Fisher model says, instead, that consumption is based on income the consumer expects over his entire lifetime.

A change in the rate of interest affects aggregate consumption expenditure. Two microeconomic concepts—income effect and substitution effect—are used to explain how a consumer reacts to a change in the rate of interest.

Modigliani-model:

For those consumers who would like to borrow but cannot, consumption depends on a person’s lifetime income. F. Modigliani emphasised that income varies systematically over people’s lives and that saving allows consumers to more income from those times in life when income is high to those times when it is low. This interpretation of the consumer behaviour forms the basis of the life cycle hypothesis.

Individual and Aggregate Consumption Functions:

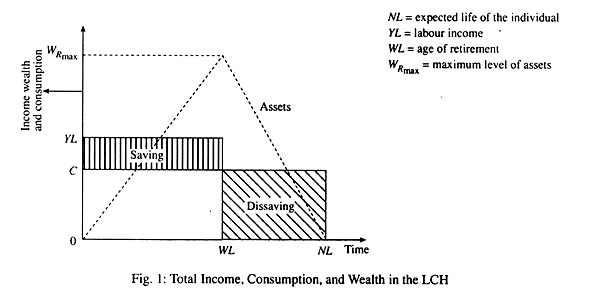

According to LCH, an individual saves during his working years to maintain consumption after retirement. This saving motive has important implication for the consumption function. The main message of the LCH is that aggregate consumption, like that of an individual, depends on both wealth and income.

The most important prediction of the hypothesis is that saving rises over a person’s lifetime. If a person enters the job market with no wealth, he will accumulate wealth during his working years and then run down his wealth during his retirement years.

M. Friedeman’s PIH is based on the assumption that forward-looking consumers have their consumption decisions not only on their current income, but also on the income they expect to receive in the future. Thus PIH highlights that consumption depends on people’s expectations.

The rational expectations hypothesis states that people use all available information to make optimal forecasts about the future. If the PIH is correct and if consumers have rational expectations, then changes in consumption over time should be unpredictable.

In other words, changes in consumption reflect ‘surprises’ about lifetime income. If consumers are using optimally all available information then they should be surprised only by events that were entirely unpredictable. Therefore, changes in their consumption should be unpredictable as well.

Rational Expectations Model:

The rational expectations approach to consumption has implications for the analysis of economic policies. If consumers go by the permanent income hypothesis (PIH) and have rational expectations as well, then also unexpected policy changes influence consumption. These policy changes become effective when they change expectations.

This means that if consumers have rational expectations, policymakers influence the economy not only through their actions but also through the public’s expectations of their actions. Since it is not possible to observe expectations directly, it is difficult to know how and when changes in fiscal policy alter aggregate demand.

Investment Function:

By adding the investment functions of individual profit-maximising firms we arrive at the aggregate investment function. Thus there is micro foundation of aggregate investment function. And aggregate investment is the second important component of aggregate desired expenditure.

Investment fluctuations lead to short-term income fluctuations or business cycles. Investment is affected by two main factors, viz., the expected rate of return on new investment (the marginal efficiency of capital) and the rate of interest. Any change in expected rate of return on new investment will lead to change in the volume of investment and cause national income to rise or fall.

The Demand for Money:

The Baumol-Tobin model explains the amount of money held outside of banks. But we can interpret the model more broadly. Let’s suppose a person who holds a portfolio of monetary assets (currency and demand deposits) and non-monetary assets (stocks and bonds).

Monetary assets can be used for transactions but they offer a low rate of return. Let i be the difference in return between monetary and non-monetary assets and let F be the cost of transferring nonmonetary assets into monetary assets, such as brokerage fee. The decision about how often to pay the brokerage fee is quite similar to the decision about how often to make a trip to the bank.

Therefore, the Baumol Tobin model describes a person’s demand for monetary assets. By showing that money demand depends positively on expenditure (K), and negatively on the interest rate (i), the model provides a microeconomic rationale for the Keynesian money demand function:

(M/P)d = f(Y,i)

Conclusion:

It is interesting to speculate on whether or not the quest for a micro foundation of macroeconomics will continue to play an important role in the future development of macroeconomics. The disunity between micro and macro that has motivated so many contributors is shrinking rapidly on the frontiers of research.

It is also questionable whether the microeconomic principles of equilibrium and rationality that have been applied so fruitfully in the development of macroeconomics can be of more service. By themselves they are no more than organising devices; they yield no meaningful empirical propositions in the absence of a great money supporting hypotheses.