The below mentioned article provides a complete guide to Keynes’ theory of investment multiplier.

The Concept of Investment Multiplier:

The theory of multiplier occupies an important place in the modern theory of income and employment.

The concept of multiplier was first of all developed by F.A. Kahn in the early 1930s. But Keynes later further refined it. F.A. Kahn developed the concept of multiplier with reference to the increase in employment, direct as well as indirect, as a result of initial increase in investment and employment.

Keynes, however, propounded the concept of multiplier with reference to the increase in total income, direct as well as indirect, as a result of original increase in investment and income.

ADVERTISEMENTS:

Therefore, whereas Kahn’s multiplier is known as ’employment multiplier’, Keynes’ multiplier is known as investment or income multiplier. The essence of multiplier is that total increase in income, output or employment is manifold the original increase in investment. For example, if investment equal to Rs. 100 crores is made, then the income will not rise by Rs. 100 crores only but a multiple of it.

If as a result of the investment of Rs. 100 crores, the national income increases by Rs. 300 crores, multiplier is equal to 3. If as a result of investment of Rs. 100 crores, total national income increases by Rs. 400 crores, multiplier is 4. The multiplier is, therefore, the ratio of increment in income to the increment in investment. If ∆I stands for increment in investment and ∆Y stands for the resultant increase in income, then multiplier is equal to the ratio of increment in income (∆K) to the increment in investment (∆I).

Therefore k = ∆Y/∆I where k stands for multiplier.

Now, the question is why the increase in income is many times more than the initial increase in investment. It is easy to explain this. Suppose Government undertakes investment expenditure equal to Rs. 100 crores on some public works, say, the construction of rural roads. For this Government will pay wages to the labourers engaged, prices for the materials to the suppliers and remunerations to other factors who make contribution to the work of road-building.

ADVERTISEMENTS:

The total cost will amount to Rs. 100 crores. This will increase incomes of the people equal to Rs. 100 crores. But this is not all. The people who receive Rs. 100 crores will spend a good part of them on consumer goods. Suppose marginal propensity to consume of the people is 4/5 or 80%.

Then out of Rs. 100 crores they will spend Rs. 80 crores on consumer goods, which would increase incomes of those people who supply consumer goods equal to Rs. 80 crores. But those who receive these Rs. 80 crores will also in turn spend these incomes, depending upon their marginal propensity to consume. If their marginal propensity to consume is also 4/5, then they will spend Rs. 64 crores on consumer goods. Thus, this will further increase incomes of some other people equal to Rs. 64 crores.

In this way, the chain of consumption expenditure would continue and the income of the people will go on increasing. But every additional increase in income will be progressively less since a part of the income received will be saved. Thus, we see that the income will not increase by only Rs. 100 crores, which was initially invested in the construction of roads, but by many times more.

Derivation of Investment Multiplier:

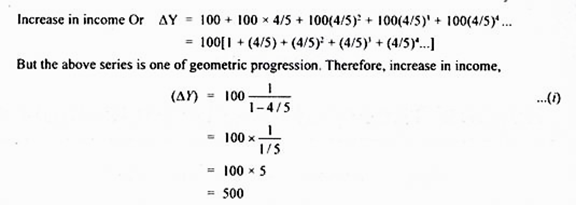

How much increase in national income will take place as a result of an initial increase in investment can be expressed in the following mathematical form:

It is thus clear that if the marginal propensity to consume is 4/5, the investment of Rs. 100 crores leads to the increase in the national income by Rs.500 crores. Therefore, multiplier here is equal to 5. We can express this in a general formula.

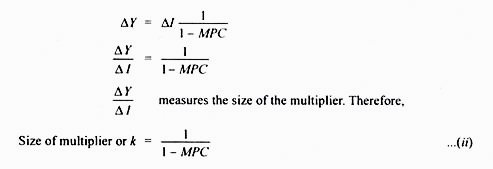

If ∆Y stands for increase in income, ∆l stands for increase in investment and MPC for marginal propensity to consume, we can write the equation (i) above as follows:

It is clear from above that the size of multiplier depends upon the marginal propensity to consume of the community. The multiplier is the reciprocal of one minus marginal propensity to consume. However, we can express multiplier in a simpler form. As we know that saving is equal to income minus consumption, one minus marginal propensity to consume will be equal to marginal propensity to save, that is, 1 – MPC = MPS. Therefore, multiplier is equal to 1/ 1- MPC =1/MPC.

Algebraic Derivation of Multiplier:

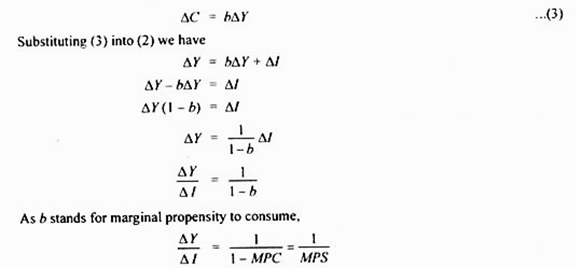

The multiplier can be derived algebraically as follows:

Writing the equation for the equilibrium level of income we have

Y = C + I … (1)

As in the multiplier analysis we are concerned with changes in income induced by changes in investment, rewriting the equation (1) in terms of changes in the variables we have

∆Y = ∆C + ∆I … (2)

ADVERTISEMENTS:

In the simple Keynesian model of income determination, change in investment is considered to be autonomous or independent of changes in income while changes in consumption are function of changes in income.

In the consumption function,

C = a + bY

where a is a constant term, b is marginal propensity to consume which is also assumed to remain constant. Therefore, change in consumption can occur only if there is change in income. Thus

ADVERTISEMENTS:

This is the same formula of multiplier as obtained earlier. Note that the value of multiplier ∆Y/∆I will remain constant as long as marginal propensity to consume remains the same.

The Size or Value of Investment Multiplier:

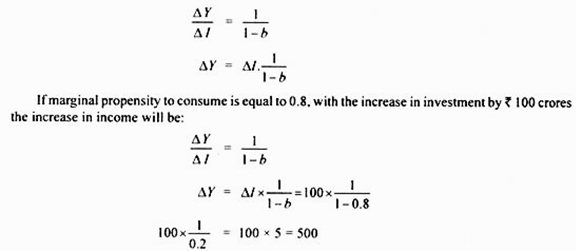

The multiplier tells us how much increase in income occurs when autonomous investment increases by Rs. 1, that is, investment multiplier ∆Y/∆I is and its value is equal to 1/1-b where b stands for marginal propensity to consume (MPC). Thus, multiplier =∆Y/∆I =1/ 1-b equals marginal propensity to save (MPS) the value of investment multiplier is equal to 1/1-b = 1/s where s stands for marginal propensity to save. In other words, the size of multiplier is equal to 1/1- MPC = 1/MPC Thus, the value of multiplier can be obtained if we know either the value of MPS or MPS.

Now, higher the marginal propensity to consume (b) (or the lower the value of marginal propensity to save (s), the greater the value of multiplier. For example, if marginal propensity to consume (b) is 0.8, investment multiplier is

ADVERTISEMENTS:

As mentioned above, the size or value of multiplier can be calculated using either the value of marginal propensity to consume (MPC) or the value of marginal property to save (MPS or s). In fact, the value of multiplier is the reciprocal of marginal propensity to save (∆Y/∆I = 1/MPS or 1/s) When marginal propensity to consume is 0.8, marginal propensity to save will be 1 – 0.8 = 0.2.

The multiplier will be 1/0.2 or 1/2/10 = Likewise if marginal propensity to consume (b) is 0.75, marginal propensity to save will be 1 – 0.75 = 0.25 and multiplier will be 1/0.25 = 1/25/100 = 4.

Given the size of multiplier we can find out the increase in income (∆Y) resulting from a certain increase in investment (∆I) by using the multiplier relationship. Thus

Two Limiting Cases of the Value of Multiplier:

ADVERTISEMENTS:

There are two limiting cases of the multiplier. One limiting case occurs when the marginal propensity to consume is equal to one, that is, when the whole of the increment in income is consumed and nothing is saved.

In this case, the size of multiplier will be equal to infinity, that is, a small increase in investment will bring about a very large increase in income and employment so that full employment is reached and even the process goes beyond that. “In such circumstances, the Government would need to employ only one road builder to raise income indefinitely, causing first full employment and then a limitless spiral of inflation.”

However, this is unlikely to occur since marginal propensity to consume in the real world is less than one. The other limiting case occurs when marginal propensity to consume is equal to zero, that is, when nothing out of the increment in income is consumed, and the whole increment in income is saved.

In this case, the value of the multiplier will be equal to one. That is, in this case, the increment in income will be equal to the original increase in investment and not a multiple of it. But in actual practice the marginal propensity to consume is less than one but more than zero (1 ˃ ∆C/∆Y ˃ 0). Therefore, the value of the multiplier is greater than one but less than infinity.

Working of Multiplier and its Assumptions:

In our above explanation of multiplier, we have made many simplifying assumptions. First, we have assumed that the marginal propensity to consume remains constant throughout as the income increases in various rounds of consumption expenditure. However, the marginal propensity to consume may differ in various rounds of consumption expenditure.

But this constancy of marginal propensity to consume is a realistic assumption, since all available empirical evidence shows that marginal propensity to consume is very stable in the short run. Secondly, we have assumed that there is a net increase in investment in a period and no further indirect effects on investment in that period occur or if they occur they have been taken into account so that there is a given net increase in investment.

ADVERTISEMENTS:

Further, we have assumed that there is no any time-lag between the increase in investment and the resultant increment in income. That is, increment in income takes place instantaneously as a result of increment in investment. J.M. Keynes ignored the time-lag in the process of income generation and therefore his multiplier is also called instantaneous multiplier. In recent years, the importance of time-lag has been recognized and concept of dynamic multiplier has been developed on that basis.

Another important assumption in the theory of multiplier is that excess capacity exists in the consumer goods industries so that when the demand for them increases, more amounts of consumer goods can be produced to meet this demand. If there is no excess capacity in consumer goods industries, the increase in demand as a result of some original increase in investment will bring about rise in prices rather than increases in real income, output and employment.

As we shall see later, Keynes’ multiplier was evolved in the context of advanced capitalist economies which were in grip of depression and in times of depression and there did exist excess capacity in the consumer goods industries due to lack of aggregate demand. The Keynesian multiplier effect is very small in developing countries like India since there is not much excess capacity in consumer goods industries.

In our above analysis of the multiplier process we have taken a closed economy, that is, we have not taken into account imports and exports. If ours were an open economy, then a part of the increment in consumption expenditure would have been made on imports of goods from abroad.

This would have caused increment in income in foreign countries rather than within the country. This will reduce the value of the multiplier. Imports are important leakage from the multiplier process and we have ignored them in our above analysis for the purpose of simplicity.

It is worth noting that multiplier not only works in money terms but also in real terms. In other words, multiple increment in income as a result of a given net increase in investment does not only take place in money terms but also in terms of real output, that is, in terms of goods and services.

ADVERTISEMENTS:

When incomes increase as a result of investment and these increments in income are spent on consumer goods, the output of consumer goods is increased to meet the extra demand brought about by increased incomes. Therefore, real income or output increases by the same amount as the increment in money incomes, since the prices of goods have been assumed to be constant.

Of course, we have assumed, that there exists excess productive capacity in the consumer goods industries so that when the demand for consumer goods increases, their production can be easily increased to meet this demand. However, if due to some bottlenecks output of goods cannot be increased in response to increasing demand, prices will rise and as a result the real multiplier effect will be small.

Diagrammatic Representation of Multiplier:

The level of national income is determined by the equilibrium between aggregate demand and aggregate supply. In other words, the level of national income is fixed at the level where C + I curve intersects the 45° income curve. With such a diagram we can explain the multiplier.

The multiplier is illustrated in Fig. 10.1. In this figure C represents marginal propensity to consume. Marginal propensity to consume has been here assumed to be equal to 1/2 i.e., 0.5. Therefore, the slope of the curve C of marginal propensity to consume curve C has been taken to be equal to 0.5. C + I represents aggregate demand curve.

It will be seen from Fig. 10.1 that the aggregate demand curve C + I which intersects the 45° line at point E so that the level of income equal to OF, is determined. If investment increases by the amount EH we can then find out how much increment in income occur as a result of this. As a consequence of increase in investment by EH, the aggregate demand curve shifted upward to the new position C + I’.

This new aggregate demand curve C + I intersects income line at point F so that the equilibrium level of income increases to OF As a result of net increase in investment equal to EH. the income has increased by Y2Y2It is seen from the figure that F, Y2 is greater than EH. On measuring it will be found that Y1 Y2 is twice the length of EH. This is as it is expected because the market propensity to consume is here equal to and 1/2 therefore the size of multiplier will be equal to 2.

ADVERTISEMENTS:

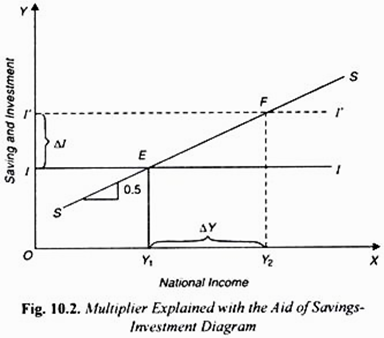

The multiplier can be illustrated through savings investment diagram also. The multiplier can be explained with the help of savings investment diagram, as has been shown in Fig. 10.2. In this figure SS is the saving curve indicating that as the level of income increases, the community plans to save more. II is the investment curve showing the level of investment planned to be undertaken by the investors in the community. The investment has been taken to be a constant amount and autonomous of changes in income.

This investment level OI has been determined by the marginal efficiency of capital and the rate of interest. Investment being autonomous of income means that it does not change with the level of income. Keynes treated investment as autonomous of income and we will here follow him. It will be seen from Fig. 10.2 that saving and investment curves intersect at point E, that is, planned saving and planned investment are in equilibrium at the level of income OY1Thus, with the given saving and investment curves level of income equal to OY1 is determined.

Now suppose that there is an increase in investment by the amount II”. With this increase in investment, the investment curve shifts to the new dotted position TF. This new investment curve II intersects the saving curve at point F and a new equilibrium is reached at the level of income OY2 A glance at Fig. 10.2 will reveal that the increase in income Y1 Y2 is greater than the increase in investment by II”.

On measuring these increments in income and investment it will be found that the increment in income Y1 Y2 is two times the increment in investment II. This is because we have here assumed that propensity to save is equal to 1/2 (Or marginal propensity to consume is equal to 1/2) Therefore, the slope of the saving curve has been taken to be equal to 1/2 or 0.5 Thus in this case multiplier is equal to 2.

Multiplier = ∆Y/∆I = Y1 Y2/II, 1/MPS =2

Since marginal propensity to save is here equal to1/2 the multiplier on the basis of our above formula, namely, k =1/ MPS will be equal to 2.

Leakages in the Multiplier Process:

We have seen above that as a result of increase in investment, the level of income increases by a multiple of it. In our above analysis, saving is a leakage in the multiplier process. Had there been no saving and as a result marginal propensity to consume were equal to 1, the multiplier would have been equal to infinity.

In that case as a result of some initial increase in investment, income would go on rising indefinitely. Since marginal propensity to consume is actually less than one, some saving does take place. Therefore, multiplier in actual practice is less than infinity.

But besides saving, there are other leakages in the process of income generation which reduce the size of the multiplier. Therefore, the increase in income as a result of some increase in investment will be less than warranted by the size of the multiplier measured by the given marginal propensity to consume. We explain below the various leakages that occur in the income stream and reduce the size of multiplier in the real world.

Paying off debts:

The first leakage in the multiplier process occurs in the form of payment of debts by the people, especially by businessmen. In the real world, all income received by the people as a result of some increase in investment is not consumed. A part of the increment in income is used for paying back the debts which the people have taken from moneylenders, banks or other financial institutions.

The incomes used for paying back the debts do not get spent on consumer goods and services and therefore leak away from the income stream. This reduces the size of the multiplier. Of course, when incomes received by the moneylenders, banks or institutions are again lent back to the people, they come back to the income stream and enhance the size of multiplier. But this may or may not happen.

Holding of idle cash balances:

If the people hold apart of their increment in income as idle cash balances and do not use it for consumption, they also constitute leakage in the multiplier process. As we have seen, people keep part of their income for satisfying their precautionary and speculative motives, money kept for such purposes is not consumed and therefore does not appear in the successive rounds of consumption expenditure and therefore reduces the increments in total income and output.

Imports:

In our above analysis of the working of the multiplier process we have taken the example of a closed economy, that is, an economy with no foreign trade. If it is an open economy as is usually the case, then a part of increment in income will also be spent on the imports of consumer goods. The proportion of increments in income spent on the imports of consumer goods will generate income in other countries and will not help in raising income and output in the domestic economy.

Therefore, imports constitute another important leakage in the multiplier process. Suppose marginal propensity to save of an open economy is 1/4, i.e., marginal propensity to consume is 3/4. Suppose further that marginal propensity to import is 1/4 , the size of the multiplier without imports will be equal 4 to equal to 4 but the size of the multiplier with the marginal propensity to import equal to 1/4 and the marginal propensity to consume equal to 3/4 will be smaller.

Multiplier in an Open Economy = 1/ 1 -(MPC-MPI) = 1/1 – MPC + MPI

where MFC stands for marginal propensity to consume and MP1 for marginal propensity to import.

In our example quoted above, where marginal propensity to consume is equal to 3/4 and marginal 3/4 propensity to import is equal to 1/4, the multiplier is:

K = 1/1- (3/4 – 1/4) = 1/1/2 =2

We, therefore, see that the size of multiplier instead of being equal to 4, as it would have been in the case of a closed economy, is equal to 2 in the open economy with — as the marginal propensity to import.

Taxation:

Taxation is another important leakage in the multiplier process. The increments in income which the people receive as a result of increase in investment are also in part used for payment of taxes. Therefore, the money used for payment of taxes does not appear in the successive rounds of consumption expenditure in the multiplier process, and the multiplier is reduced to that extent.

However, if the money raised through taxation is spent by the Government, the leakage through taxation will be offset by the increase in Government expenditure. But it is not necessary that all the money raised through taxation is spent by the Government as it happens when Government makes a surplus budget.

No doubt, if the Government expenditure increases by an amount equal to the taxation, it would not have any adverse effect on the increases in income and investment and in this way there would be no leakage in the multiplier process.

Increase in Prices:

Price inflation constitutes another important leakage in the working of the multiplier process in real terms. The multiplier works in real terms only when as a result of increase in money income and aggregate demand, output of consumer goods is also increased.

When output of consumer goods cannot be easily increased, a part of the increases in the money income and aggregate demand raises prices of the goods rather than their output. Therefore, the multiplier is reduced to the extent of price inflation. In developing countries like India the extra incomes and demand are mostly spent on food-grains whose output cannot be increased so easily.

Therefore, the increments in demand raise the prices of goods to a greater extent than the increase in their output. Besides, in developing countries like India, there is not much excess capacity in many consumer goods industries, especially in agriculture and other wage-goods industries.

Therefore, when income and demand increase as a result of increase in investment, it generally raises the prices of these goods rather than their output and therefore weakens the working of the multiplier in real terms. Thus, it was often asserted in the past that Keynesian theory of multiplier was not very much relevant to the conditions of developing countries like India. However, we shall discuss later that this old view about the working of Keynes’ multiplier is not fully correct.

The above various leakages reduce the multiplier effect of the investment undertaken. If these leakages are plugged, the effect of change in investment on income and employment would be greater.

Multiplier with Changes in Price Level:

In our above analysis of multiplier with aggregate demand curve, it is assumed that price level remains constant and the firms are willing to supply more output at a given price. How much national income or GNP increases as a result of any autonomous expenditure such as government expenditure, investment expenditure, net exports is determined by a shift in aggregate demand curve by the size of simple Keynesian multiplier when price level is fixed.

This implies a horizontal short-run supply curve. However, as studied above, short-run aggregate supply curve slopes upward as the firms are willing to supply additional output in the short run only at a higher price level. With short-run aggregate supply curve sloping upward, a rightward shift in aggregate demand curve raises new equilibrium GNP level not equal to the horizontal shift in the aggregate demand curve but less than it.

Consequently, the size of multiplier is smaller than that of simple Keynesian multiplier with a given fixed price level. This is because a part of expansionary effect of GNP of the increase in autonomous government expenditure is offset by rise in the price level.

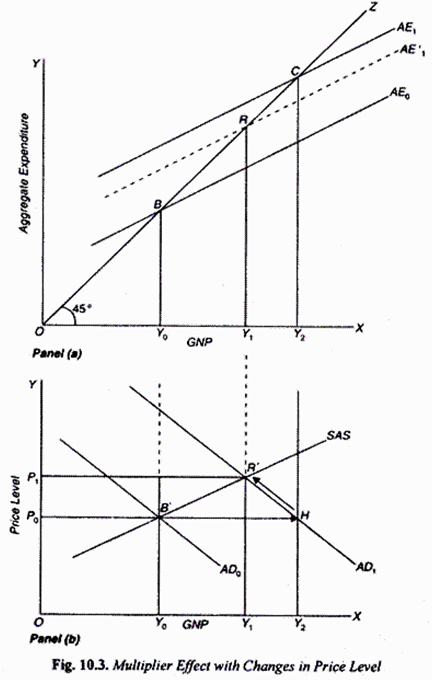

The multiplier effect in case of upward sloping curve is shown in Fig. 10.3. To begin with, in the top panel of Fig. 10.3 aggregate expenditure curve AE0 intersects 45° line at point Sand determines Y0 equilibrium level of GNP. In the panel at the bottom of Fig. 10.3 the corresponding aggregate demand curve AD0 and the short-run aggregate supply curve SAS intersect at B’ at the above determined GNP level K0. Now suppose autonomous investment expenditure (which is independent of changes in price level) increases by AI.

As a result, aggregate expenditure curve AE shifts upward to AE1 and determines new equilibrium GNP level equal to Y2. In the lower panel (b), due to the upward shift in aggregate expenditure curve, aggregate demand curve shifts rightward from AD to AD1The horizontal shift in the aggregate demand curve at a given price level is determined by the increase in aggregate expenditure multiplied by the simple Keynesian multiplier at the given fixed price level (B’H or ∆Y = ∆I 1/1- MPC) But given the upward sloping short-run aggregate supply curve SAS with new aggregate demand curve AD1, price level does not remain fixed. As will be seen from the lower panel (b) of Fig. 10.3, the aggregate demand curve AD1 intersects the short-run aggregate supply curve SAS at point R’ and as a result price level rises to P1.

Now, with this rise in price level to P1, aggregate expenditure curve in the upper panel (a) will not remain unaffected but will shift downward. This fall in aggregate expenditure curve is due to the adverse effects on wealth or real balances, interest rate and net exports. Much of wealth is held in the form of bank deposits, bonds and shares of companies and other assets.

With the rise in price level, real value or purchasing power of wealth possessed by the people declines. This induces them to spend less. As a result, consumption expenditure declines due to this wealth effect. Secondly, the rise in price level reduces the supply of real money balances (Ms/P) that causes a shift in money supply curve to the left.

Given the demand function for money (Md), the decline in the real money supply will cause rate of interest to rise. Now, the rise in interest will induce private investment expenditure to decline. Lastly, rise in price level in the domestic economy will adversely affect exports of a country causing net exports to fall.

Thus, as a result of negative effects of rise in price level on real wealth, private investment and net exports, in the upper panel (a) of Fig. 10.3 aggregate expenditure curve shifts downward to AE1 (dotted) so that it determines GNP level Y1 at which aggregate expenditure curve AE1 intersects 45° line. This also corresponds to the intersection of aggregate demand curve AD1 and short-run aggregate supply curve SAS point R’ in the lower panel (b) of Q 1. Fig. 10.3.

Thus with the upward sloping short-run aggregate supply curve SAS, the effect of increase in autonomous investment expenditure (or for that matter increase in any other autonomous expenditure such as Government expenditure, net exports, autonomous consumption) on the GNP level can be visualized to occur in two stages.

First, increase in investment expenditure shifts aggregate expenditure curve AE upward in the upper panel (a) of Fig. 10.3 and correspondingly aggregate demand curve in the lower panel (b) shifts to the right to AD1 and brings about increase in GNP level from Y0 to Y2with the given fixed price level Pr In the second stage due to the upward sloping short-run aggregate supply curve SAS, the rightward shift in the aggregate demand curve causes price level to rise from P0 to Pt and causes decrease in GNP from Y2to Y1

However, as shall be seen from Fig. 10.3, when price level effect is taken into account, the increase in investment expenditure has still a multiplier effect on real GDP but this effect is smaller than it would be if price level remained fixed. It may be further noted that steeper the slope of the short- run supply curve, the greater is the increase in the price level and smaller is the effect on real GNP.

Importance of the Concept of Multiplier:

Multiplier is one of the most important concepts developed by J.M. Keynes to explain the determination of income and employment in an economy. The theory of multiplier has been used to explain the cumulative upward and downward swings of the trade cycles that occur in a free-enterprise capitalist economy. When investment in an economy rises, it has a multiple and cumulative effect on national income, output and employment.

As a result, economy experiences rapid upward movement. On the other hand, when due to some reasons, especially due to the adverse change in the expectations of the business class, investment falls, then backward working of the multiplier causes a multiple and cumulative fall in income, output and employment and as a result the economy rapidly moves on downswing of the trade cycle. Thus, Keynesian theory of multiplier helps a good deal in explaining the movements of trade cycles or fluctuations in the economy.

The theory of multiplier has also a great practical importance in the field of fiscal policy to be pursued by the Government to get out of the depression and achieve the state of full employment. To get rid of depression and remove unemployment, Government investment in public works was recommended even before Keynes.

But it was thought that the increase in income will be limited to the amount of investment undertaken in these public works. But the importance of public works is enhanced when it is realised that the total effect on income, output and employment as a result of some initial investment has a multiplier effect. Thus, Keynes recommended Government investment in public works to solve the problem of depression and unemployment.

The public investment in public works such as road building, construction of hospitals, schools, irrigation facilities will raise aggregate demand by a multiple amount. The multiple increase in income and demand will also encourage the increase in private investment.

Thus, the deficiency in private investment which leads to the state of depression and underemployment equilibrium will now be made up and a state of full employment will be restored. If the multiplier had not worked, the income and demand would have risen as a result of some public investment but not as much as they rise with the multiplier effect.

Inspired by the Keynesian theory of multiplier, expansionary fiscal policy of increase in Government expenditure and reduction in income tax have been adopted by President John Kennedy and President George W. Bush in the United States of America to remove involuntary unemployment and depression. This had a great success in removing unemployment and depression and therefore, Keynesian theory of multiplier was vindicated and as a result people’s belief in it increased.

Numerical Problems on Multiplier:

Problem 1:

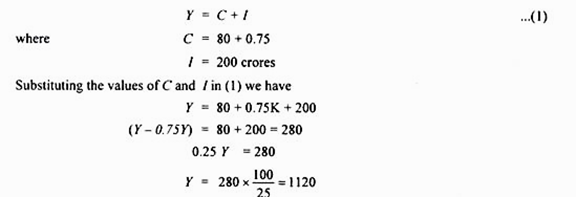

Suppose the level of autonomous investment in an economy is Rs. 200 crores and consumption function of the economy is:

C = 80 + 0.75Y

(a) What will be the equilibrium level of income?

(b) What will be the increase in national income if investment increases by Rs. 25 crores.

Solution:

(a) For equilibrium level of income,

Equilibrium level of income is therefore equal to 1120 crores.

(b) How much increase in income will occur as a result of increase in investment by Rs. 25 crores depends on the size of multiplier. The size of multiple is determined by the value of marginal propensity to consume. In the given consumption function (C = 80 + 0.75 F) marginal propensity to consume is equal to 0.75 or 3/4. Thus, multiplier = 1/1 – MPC = 1/1 – 3/4 = 4

Thus, with increase in investment by Rs. 25 crores, national income will rise by 25 x 4 = 100 crores.

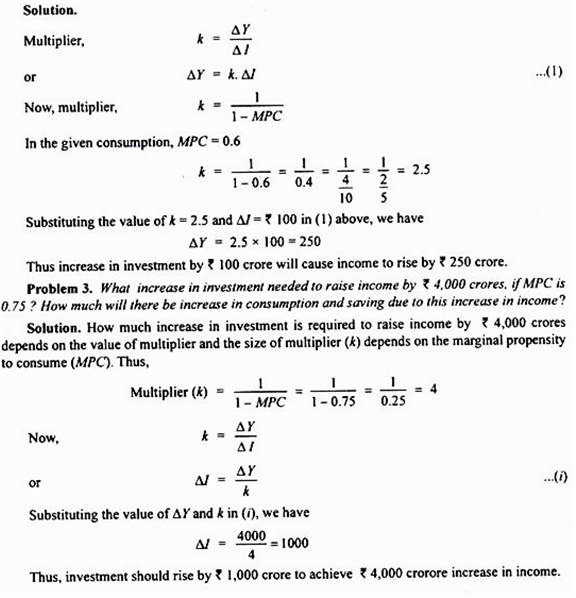

Problem 2:

Suppose in a country investment increases by Rs. 100 crore and consumption is given by C = 10 + 0.6Y (where C = consumption and Y = income). How much increase will there take place in income?

The Paradox of Thrift:

An interesting paradox arises when all people in a society try to save more but in fact they are unable to do so. The multiplier theory of Keynes helps a good deal in explaining this paradox. According to this paradox of thrift, the attempt by the people as a whole to save more for hard times such as impending period of recession or unemployment may not materialize and in their bid to save more the society in-fact may not only end up with the same savings (or, even lower savings) but also in the process cause their consumption or standard of living to decline.

Thrift (i.e., the desire to save more) is considered to be a virtue in most of the societies and it is regarded as an act of prudence on the part of individuals to save for a rainy day. According to a proverb, “a penny saved is a penny earned”. Further, according to classical economists, savings determine investment which plays a crucial role in accelerating the rate of economic growth.

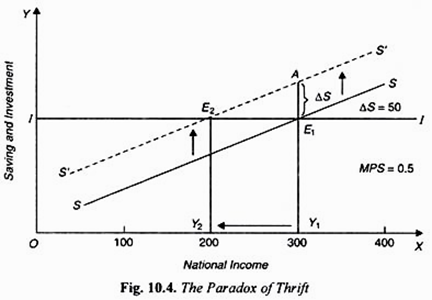

However, the paradox of thrift shows that the efforts to .save more, especially in times of depression, may actually deepen the economic crisis and cause output to fall and unemployment to increase. It goes to the credit of Keynes that with his multiplier theory he was able to resolve the paradox of thrift. Keynesian explanation of paradox of thrift has been shown in Fig. 10.4.

According to the Keynesian theory, the saying “penny saved is penny earned” is quite inappropriate for the economy as a whole when it is working at underemployment equilibrium, that is, when there prevails recession or depression. Keynes has showed that if all people in a society decide to save more, they may actually fail to do so but nevertheless reduce their consumption.

This is because, according to Keynes, the effort to save more by all in a society will lower the aggregate demand for goods and services resulting in a drop in the level of national income. At the lower level of national income, the savings fall to the original level but consumption will be less than before which implies that the people would become worse off.

Consider Fig. 10.4, where 55 is the saving curve with a slope equal to 0.5, and II is the planned investment curve. It will be seen that saving and investment curves intersect at point E and determine level of income equal to K, or Rs.300 crores. Now suppose that expecting hard times ahead all people try to save more by the amount of Rs. 50 crores which would cause an autonomous downward shift in the consumption function.

This downward shift in the consumption function brings about an upward shift by Rs. 50 crores or E A in the saving function curve to S’S’. This new saving function curve S’S’ cuts the planned investment curve II at point E2 according to which new equilibrium level of income falls to Y2 or Rs. 200 crores. It is important to note that level of income does not drop only by the amount (E1A or RS. 50 crores), that is, by the extent of reduction in consumption due to more saving but by a multiple of it.

With marginal propensity to save (MPS) being equal to 0.5 or 1/52, the value of multiplier would be 1/MPS= 1-1/2= 2. Further, the decline in consumption due to more saving would cause the multiplier to work in reverse, that is, the multiplier would operate to reduce the level of consumption and income by a magnified amount. The decline in consumption expenditure of the people by Rs. 50 crores in the first instance due to more saving by them implies that the producers and sellers of goods and services will find their income to fall by Rs. 50 crores. But the reverse process will not stop here.

Given the marginal propensity to consume being equal to 0.5 or the producers/sellers of goods and services in turn would spend Rs.25 crores less when they find their income has fallen by Rs.50 crores. It will be observed from Fig. 10.4 that this process of reduction of the level of income will continue till the new saving is equal to investment at the lower level of income Y2 (Rs.200 crores), that is, the level of income has declined by Rs. 100 crores (50 x 2) from its initial equilibrium level of income Y1 of Rs. 300 crores.

Thus the attempt by all people to save more has led to the decline in the equilibrium level of income to Y2 or Rs. 200 crores at which, with marginal propensity to consume remaining unchanged at 0.5 or ½, saving of the society will fall to the initial level of Y1E or Rs. 100 crores (200 x 0.5 = 100). This is clearly depicted in Fig. 10.4. With the decrease in planned saving by Rs. 50 crores at every level of income the saving function (SS) shifts upward.

This sets in motion the operation of the multiplier in the reverse and as will be seen from the 10.4, the new equilibrium is reached at the new lower level of income Y2 (Rs. 200 crores). It is important to observe that the saving which had risen to Y1A (Rs. 150 crores) has once again fallen to the original level of Rs. 100 crores (Y2E2 = Y1E1) due to reduction in consumption expenditure inducing the working of multiplier in the reverse which causes a decline in the equilibrium level of income from Y1 (Rs. 300 crores) to Y2 (Rs. 200 crores).

In other words, the increases in saving by Rs. 50 crores has led to the fall in income by Rs. 100 crores because the multiplier is equal to 2. This explains the paradoxical feature of an economy gripped by recession. This is paradoxical because in their attempt to save more the people have caused a decline in their income and consumption with no increase in the saving of the society at all.

In our analysis we have assumed that the planned investment is fixed, that is, determined outside the model. In other words, the investment has been assumed to be autonomous of income, that is, it does not vary with income.

Can We Avert the Paradox of Thrift?

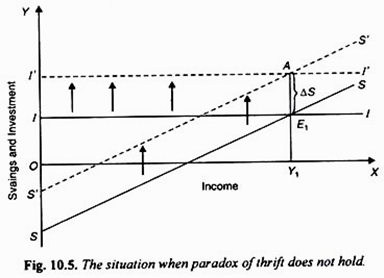

Paradox of thrift holds good when a free market economy is in the grip of recession or depression and investment demand is inadequate due to lack of profit opportunities. However, it has been pointed out by some economists that paradox of thrift can be averted if the extra savings that the people do for a rainy day are somehow channeled into additional investment through financial markets.

Indeed, the classical economists argued that the increase in the supply of savings would lead to the fall in the rate of interest which would induce increase in planned investment. If this happens, then in our saving-investment diagram the investment curve II would shift up to I’I’ and as will be seen from Fig. 10.5 the new equilibrium level of income may not fall and therefore the paradox of thrift is averted.

In Fig. 10.5, initially the saving curve (S1S1) and investment curve (II) intersect at point E1 and determine Y1 level of income. Now, if the people of the society expecting difficult times ahead,\ desire to save E1A more. If these extra savings, for reasons mentioned above, result in more investment, the investment curve will shift to I’I’, the new equilibrium will be at point A corresponding to the original level of income Y1. In this way the paradox of thrift has been averted.

However, according to the modern economists, especially the followers of Keynes, the empirical evidence does not support the above argument of averting the paradox of thrift. This is because at times of recession or depression, the prospective yields from investment are so small that no possible reduction in the rate of interest will induce sufficient increase in investment.

Thus, according to them, in a free-market and private enterprise economy without Government intervention paradox of thrift cannot be averted. Of course, if the Government intervenes as it does even in the present- day predominantly private enterprise economies of the USA and Great Britain, it can mobilise the extra savings of the people and invest them in some worthwhile projects and thus prevent aggregate demand and income from falling.

This can happen because the Government undertakes investment because it is not motivated by profit motive but by the considerations of promoting social interest and economic growth. It is because of this that the role of the Government has greatly increased for overcoming recession in the capitalist countries.

The Keynesian Explanation of Great Depression: The Impact of Multiplier:

During the 1930s the capitalist economies experienced severe depression which caused widespread involuntary unemployment, substantial loss of output and income and crushing hunger and poverty among the working classes. The classical economists attributed this unemployment and depression to the higher wage rates maintained by the trade unions and the Government.

However, this explanation did not prove to be valid. It was English economist J.M. Keynes who radically departed from the classical thought and put forward the view that it was the large decline in investment that caused the depression and substantial increase in involuntary unemployment.

According to Keynes, the investment was highly volatile and it was a drastic decline in it due to the pessimistic expectations of the entrepreneurs about the prospective profits from investment that brought about a decline in aggregate demand (expenditure) which through working of the multiplier in the reverse caused a magnified fall in income (output) and employment.

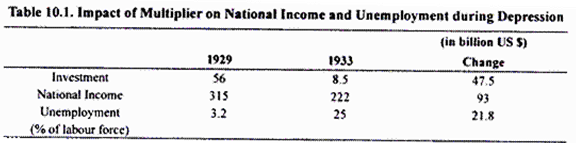

For example, during the first four years (1929-33) of depression in the USA the unemployment which was only 3.2 per cent in 1929 soared to 25 per cent in 1933, that is, one out of four in the labour force in the United States became unemployed. The level of national income dropped from $ 315 billion in 1929 to $ 222 billion in 1933 at 1972 prices, a decline of $ 93 billion in just four years. According to Keynes, this was caused by a drastic fall in investment from $ 56 billion in 1929 to $ 8.5 billion in 1993.

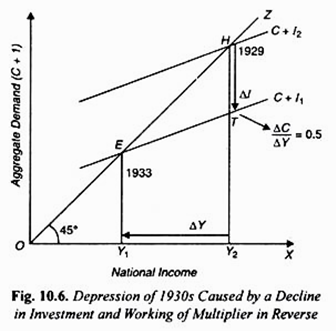

The huge decline in national income and the emergence of unemployment in the USA, UK and other industrialized capitalist countries during the period of depression is graphically shown in Fig. 10.6. It is assumed that to begin with, say in 1929, the aggregate demand curve C + I2 intersects 45° line at point H and determines equilibrium level of income at full-employment or potential output level OY1.

The sharp decline in investment by the amount HT due to the fall in profitability of investment following a crash in stock markets in 1929 and other unfavourable events caused a downward shift in the aggregate demand curve to C +I1 (where I1 < I2). This new aggregate demand curve C + I1 intersects the 45° line at point E and accordingly determines equilibrium level of income OY1 which is much lower than full-employment level OYF and thus represents a state of depression with a large unemployment of workers.

The important point made by Keynes was that income would not fall merely equal to the decline in investment but by a multiple of it. In fact, during the depression period of 1930s, it actually happened so and is evident from Table 10.1. It will be seen from Figure 10.6 that the decline in national income YFY1 is not equal to the fall in investment by HT by out by a multiple of it. YFY1 is twice that of HT.

This is due to the working of multiplier in the reverse. Further note that after taking into all leakages in the multiplier process it has been assumed that marginal propensity to consume is equal to 0.5 which yields the value of multiplier 1/1-MPC = 1/1-1/2 = 2, This is why fall in income by YFY1 is twice the decline in investment by HT.

Now, the historical record of this period about the various components of aggregate demand of the US economy shows that changes in net exports and Government expenditure were quite small and they mostly offset each other during the period 1929-33.

The drastic drop in private investment appears to be the basic reason for the huge fall in aggregate demand or spending. The private investment which was $ 56 billion in 1920 fell to only $8.5 billion in 1933 in the U.S.A., the decline of $ 47.5 billion in four years. But, as has been explained by Keynes, the decrease in aggregate expenditure was not merely equal to $ 47.5 billion, but by a multiple amount due to the operation of the multiplier in the reverse.

It has been estimated that taking into account all leakages in the multiplier process, the value of the multiplier was around 2 during the period. Therefore, as a result of sharp decline in investment by $ 47.5 billion and consequently operation of the multiplier in the reverse there was a fall in the induced consumption expenditure.

Thus, as a result of the sharp drop in private investment and resultant fall in induced consumption due to working of multiplier caused much bigger decrease ($ 93 billion) in the level of aggregate effective demand, income and output. This is in accordance with the value of multiplier being equal to around 2. Multiplier is here equal to

∆Y/∆I = 93/47.3 =1.96

Thus, the Keynesian theory of income determination provides a fairly accurate explanation of the first four years of the great depression. This looks rather simple but during the early 1930s it was not understood at all. Only after the Keynesian prescription to ward off depression and involuntary unemployment, namely, launching by the Government public works programme financed by the deficit budgets to raise aggregate demand, such as adopted under New Deal Policy in the U.S.A. proved to be a great success that economists and intellectuals were convinced about the validity of the Keynes’ explanation of depression.

An important result of the success of the Keynesian model was that fiscal policy as an instrument for controlling business cycles came into prominence. Further, it now became clear that the Government intervention, through the adoption of appropriate fiscal and monetary policies, can avert the collapse of the economy such as that happened during 1929-33.

Limitations of Working of Keynesian Multiplier in the Developing Countries:

The Old View:

In the early fifties an eminent Indian economist Dr. V.K. R.V. Rao and some others explained that in developing countries like India Keynesian multiplier did not work in real terms, that is, does not operate to increase income and employment by a multiple of the initial increase in investment.

He claimed that the concept of investment multiplier was valid in the context of the situation of depression in the industrialized developed economies of the UK and the USA where there existed a lot of excess productive capacity and a larger number of open involuntary unemployment. He argued that in such a situation of a depressed economy there was a high elasticity of supply of output to changes in demand for them.

Therefore, in the developed capitalist economies ridden with depression increase in investment leading to successive rounds of consumption expenditure raises aggregate demand. Due to the existence of large excess capacity and involuntary unemployment under conditions of depression aggregate supply of outputs highly elastic, increase in aggregate demand brings about increase in real income, output and employment which is a multiple of original increase in investment.

On the other hand, they claimed that in underdeveloped countries there was little excess capacity in consumer goods industries and therefore supply of output was inelastic. Therefore, when there is injection of investment, and as a result through successive rounds of the operation of multiplier, aggregate demand for consumer goods increases, it results mainly in rise in money income brought about through rise in prices and not an increase in real national income.

The second condition, according to Dr. Rao and his followers, for the working of multiplier in raising national income and employment was that the supply of raw materials, financial capital must be sufficiently elastic so that when aggregate demand increases as a result of multiplier effect of increase in investment the supply of output could be increased adequately to meet this higher demand for goods and services.

They argued that in underdeveloped countries like India due to under developed nature of their economies, there was acute scarcity of raw materials, other intermediate goods such as steel, cement and financial capital which put great obstacles for the working of multiplier in real terms.

The third condition required for the working of multiplier in real terms was that there should be involuntary open unemployment so that when aggregate demand for goods increases as a consequence of new investment, the adequate supply of workers must be forthcoming to be employed in the production processes of various industries.

They argued this condition too was not fulfilled in the under developed countries where there existed disguised unemployment, especially in the agricultural sector. The disguisedly unemployed workers who are supported by joint family system could not be easily shifted to be employed in the industries for expansion of output to achieve the multiplier effect.

Lastly, it was pointed out that the under developed countries like India had predominantly agricultural economies and income elasticity of demand for food grains was very high in these economies. In view of this when increase in investment leads to the rise in money incomes of the people, a large part is spent on food grains.

But the supply of agricultural products is inelastic because their production is subject to uncertain natural factors like monsoon and climate and further there was lack of irrigation facilities, improved seeds, fertilizers etc. Hence it was difficult to increase agricultural production in response to the increase in demand through the multiplier effect of increase in investment.

It follows from above that the Keynesian assumptions for the working of multiplier in real terms, namely:

(a) The supply of output of goods is elastic due to the existence of large excess capacity,

(b) The supply of raw materials and other intermediate goods can be adequately increased,

(c) There exist involuntarily unemployed workers searching for work and,

(d) Sufficiently elastic agricultural output.

In view of the earlier economists these assumptions for realizing the multiplier effect in terms of rise in real income and employment were not valid in case of under developed countries. Therefore, according to them, Keynesian multiplier did not operate in real terms in under developed countries and actually leads to the rise in price or inflationary conditions in them.

The Modern View:

We have explained above the views of some eminent Indian economists, such Dr. V.K.R.V. Rao, Dr. A.K. Dass Gupta, expressed during the early fifties regarding non-operation of the Keynesian multiplier in the under developed countries. But the situation in the present-day developing countries has substantially changed in the last 60 years.

There has been a lot of economic growth and structural transformation in the Indian economy during the last half a century so that supply conditions today have become significantly elastic. So in the present state of the Indian economy and also of some other developing economies, it cannot be said that Keynesian multiplier is not applicable in real terms in them.

However, it may be noted that even in the fifties and early sixties the view that Keynesian multiplier did not work in the under developed countries did not go entirely unchallenged. Thus commenting on Dr. Rao’s article, Dr. K.N. Raj remarked that “Discarding the Keynesian thesis as altogether inoperative in under developed countries is really throwing the baby away with the bath water”.

Similarly, Dr. D.R. Khatkhate wrote, “In conclusion we may state that the multiplier can operate in an under developed economy when it is associated with a carefully designed pattern of investment. The theory that the multiplier works in a backward economy only with reference to the money income is based on static assumptions and is, therefore, not correct”.

Likewise, Dr. Ashok Mathur writes:

“Our main objection against the view that Keynesian multiplier does not operate in the under developed countries is that it views the operation of multiplier process in a completely static setting and as a purely short-period concept, whereas the very rationale of economic development is long-run dynamic change. Once we relax these two restrictive assumptions, the essential content of the Keynesian multiplier, that is, increase of investment results in an increase in output which is much in excess of the original outlay on investment, holds true in case of the developing as much as in the developed economies”

At present, in the beginning of the new millennium as a result of economic growth both in the industrial and agricultural sectors the Indian economy has a widely diversified structure and supply of output has become quite elastic, at least in the industrial sector.

Besides, at times there is a lot of excess or unutilized capacity in several industries in India due to the deficiency of aggregate demand. The potential for increasing raw materials and intermediate products such as cement, steel and fertilizers has significantly increased to meet the rising demand for them.

If there is injection of investment it will result in manifold increase in output or real income and employment through the working of the multiplier. If the injection of new investment package is quite diversified and balanced, as is generally planned in our Five Year Plans, the investment and growth in several industries simultaneously will create not only additional demand for each other as was visualized by Nurkse but will also create productive capacities in them which will ultimately over a period of result in multiple increase in output and employment.

It is worth noting that in India today there is not only a lot of preexisting excess production capacity in the Indian industries but new investment every year also creates additional production capacity which with some time-lag will result in increase in real income or output, if adequate aggregate demand is forthcoming for its utilisation. Harrod-Domar in their famous dynamic growth models emphasized that investment not only creates demand but also new productive capacity.

Thus, if we look at increment in investment from the viewpoint of dynamics of development and take a longer time horizon, multiplier effect of new investment in the developing countries can become a reality. It is true that increase in money incomes and demand may tend to occur ahead of the increase in real income but subject to some time-lag between investment and consequent increase in production capacity, the latter would tend to catch up with the former.

The significant point to note is that investment not only creates demand but it also creates production capacity. Ultimately there is no reason as to why multiplier effect of new investment on real income or output may not materialize, though the actual period required for realisation of the multiplier effect depends on various time-lags in the process of income generation and capacity creation.

The wider the range to industries over which initial investment is undertaken, the greater will be the multiplier effect. This is because monetary demand or expenditure generated by investment in any one industry would be easily met by the increase in production capacity in a variety of industries. In this way increase in demand resulting from investment would not lead to rise in prices but will cause real output to rise.

Agriculture and Multiplier:

The argument for non-operation of multiplier in underdeveloped countries was also partly based on the inelastic nature of supply of agricultural output especially food grains as it was pointed out that a large part of monetary demand or money incomes generated by investment would be spent on food grains.

Inability to meet the rise in demand for food grains would cause rise in price level or inflation in the economy rather than increase in real output. It may be pointed out that thanks to the spread of green revolution technology expansion in irrigation facilities in various states of India, food grain production can be adequately increased in response to rising demand for food grains.

Furthermore, it was asserted by Dr. Rao, the existence of disguised unemployment in underdeveloped countries instead of Keynesian type involuntary open unemployment also prevented the working of multiplier in real terms.

In the Indian economy today there are a large number of involuntarily unemployed workers crying out for employment. So this argument for failure of multiplier to work in real terms no longer holds good in the present economic situation.

Conclusion:

To conclude, in the present economic situation of the Indian economy with a lot of excess production capacity in several consumer goods industries and a large potential for expanding agricultural production, increase in investment would produce a real multiplier effect on increasing real income and output without causing inflationary pressures in the economy.

Multiplier effect of new investment can be further increased, if investment package is quite diversified covering a large number of industries (including agriculture) so that monetary demand and income generated by any one industry can be adequately met by increase in output capacity in other industries.

Further, even when there is no preexisting excess capacity in the industries increase in investment leads to the increase in demand for consumption goods which in turn causes further rise on investment to meet that consumption demand. The effect of increase in consumption demand on expansion in investment is generally referred to as accelerator. Indeed, the combined working of multiplier and acceleration, which is called super-multiplier, leading to manifold increase in output can take place in the growth process in the developing countries like India.