The below mentioned article provides notes on Keynes’ theory of business cycle.

Explanation to the Theory:

J.M. Keynes in his seminal work ‘General Theory of Employment, Interest and Money’ made an important contribution to the analysis of the causes of business cycles.

According to Keynes theory, in the short run, the level of income, output or employment is determined by the level of aggregate effective demand.

In a free private enterprise, the entrepreneurs will produce that much of goods as can be sold profitably. Now, if the aggregate demand is large, that is, if the expenditure on goods and services is large, the entrepreneurs will be able to sell profitably a large quantity of goods and therefore they will produce more. In order to produce more they will employ a larger amount of resources, both men and materials. In short, a higher level of aggregate demand will result in greater output, income and employment.

ADVERTISEMENTS:

On the other hand, if the level of aggregate demand is low, smaller amount of goods and services can be sold profitably. This means that the total quantity of national output produced will be small. And a small output can be produced with a small amount of resources. As a result, there will be unemployment of resources, both labour and capital.

Hence, the changes in the level of aggregate effective demand will bring about fluctuations in the level of income, output and employment. Thus, according to Keynes, the fluctuations in economic activity are due to the fluctuations in aggregate effective demand. Fall in aggregate effective demand will create the conditions of recession or depression. If the aggregate demand is increasing, economic expansion will take place.

Now the question arises:

What causes fluctuations in aggregate demand? The aggregate demand is composed of demand for consumption goods and demand for investment goods. Thus aggregate demand depends on the total expenditure of the consumers on consumption goods and entrepreneurs on investment goods.

ADVERTISEMENTS:

Propensity to consume being more or less stable in the short run, fluctuations in aggregate demand depend primarily upon the fluctuations in investment demand. Keynes shows that the fundamental cause of fluctuations in aggregate demand and hence in fluctuations in economic activity is the fluctuations in investment demand. Investment demand is very unstable and volatile and brings about business cycles in the economy.

Let us start from the phase of economic expansion to explain Keynes’ theory of business cycles. We first explain how in Keynesian theory expansion comes to end and recession or depression sets in. During an economic expansion two factors eventually work to cause investment to fall.

First, during the expansion phase increase in demand for capital goods due to large-scale investment activity leads to the rise in prices of capital goods due to rising marginal cost of their production. Higher prices of capital goods raise the cost of investment projects and thereby reduce marginal efficiency of capital (that is, expected rate of return).

Secondly, as income rises during expansion phase, the demand for money increases which raises interest rate. Higher interest rate makes some potential projects unprofitable. Thus, fall in marginal efficiency of capital on the one hand and rise in interest rate on the other cause decline in investment demand.

ADVERTISEMENTS:

Declining trend of investment, according to Keynes, raises doubts about the prospective yield on capital goods which is more important factor determining marginal efficiency of capital than cost of investment projects and rate of interest. When among businessmen pessimism sets in about future profitability of investment projects stock prices tumble.

The crash in stock prices worsens the situation and causes investment to fall even more. Besides, fall in prices of shares reduces wealth of households. Wealth, according to Keynes, is an important factor determining consumption. Thus, the decline in stock prices reduces autonomous consumption demand of households.

With the fall in both investment and consumption demand aggregate demand declines which results in accumulation of unintended inventories with the firms. This induces the firms to cut production of goods.

It follows from above that besides the rise in cost of capital goods and rise in rate of interest towards the end of the expansion phase, it is the fall in expected prospective yield that reduces the marginal efficiency of capital and causes investment demand to fall. This induces a wave of pessimistic expectations among businessmen and speculators.

These pessimistic expectations cause stock prices to tumble which work like adding fuel to the fire. They cause a further fall in the marginal efficiency of capital. The turning point from expansion to contraction is thus caused by a sudden collapse in marginal efficiency of capital.

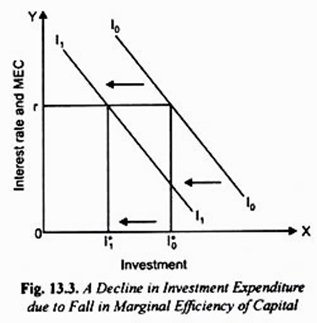

In terms of graph, a sudden fall in the marginal efficiency of capital causes leftward shift in the investment demand curve, for example from I0I0 to I1I1 in Figure 13.3 resulting in decline in investment from I0* to I1* at the given rate of interest. Note that decrease in investment does not automatically decrease in rate of interest to offset the fall in the marginal efficiency of capital.

However, an additional factor that makes Keynes’ business cycle theory potent is the working of multiplier which was an important discovery of J.M. Keynes. According to Keynes, a decrease in investment expenditure causes a decline in income which in turn reduces consumption expenditure. The reduction in consumption expenditure further reduces income and this process of reduction in income continues further. The total fall in income (∆Y) due to an initial decline in investment (∆I) will be equal to ∆I x 1/1 – MPC where 1/1 – MPC is the value of multiplier.

If marginal propensity to consume is 0.75, the multiplier will be equal to 4. Thus, a decline in investment by 100 crores will lead to the decline in income by 400 crores. Note that multiplier here works in reverse. Thus, the multiplier process magnifies the effect of decline in investment expenditure on aggregate demand and income and further deepens the depression.

ADVERTISEMENTS:

As income and output are falling rapidly under the multiplier effect, the employment also goes tumbling down. Thus, the Keynes theory of income multiplier plays a significant role in causing magnified changes in income, output and employment following a reduction in investment.

It is important to note that, in Keynes’ views, wages and prices are not flexible enough to offset the decline in investment expenditure and thereby restore full employment. This is in sharp contrast to the classical theory where changes in wages and prices ensure continuous full employment.

In Keynes’ model wages and prices are “sticky” downward which implies that though wages and prices do not remain constant but when demand falls wages and prices will fall but not sufficient to restore full employment in the economy.

Since wage and price flexibility does not ensure the recovery of the economy out of the state of depression, Keynes thinks that marginal efficiency of capital must rise to stimulate investment. During depression investment falls to a very low level, capital stock begins to wear out and requires replacement.

ADVERTISEMENTS:

Further, some existing capital equipment become technologically obsolete and have to be abandoned. This generates demand for replacement investment. A long period of time is necessary for existing capital to depreciate because most capital goods are durable as well as irreversible. By durability of capital goods we mean that they last for a long time and by irreversibility we mean that they cannot be used for purposes other than those for which they are meant.

Thus, just as the collapse of marginal efficiency of capital is the main cause of the upper turning point, similarly the lower turning point, i.e., change from recession to recovery, is due to the revival of the marginal efficiency of capital, that is, expected rate of profit. Restoration of business confidence is the most important, yet the most difficult factor to achieve.

Even if the rate of interest is reduced, the investment will not increase. This is because of the fact that in the absence of confidence the profitability of investment may remain so low that no practicable reduction in the rate of interest will stimulate investment.

The interval which will elapse between the upper turning point and the start of recovery is conditioned by two factors:

ADVERTISEMENTS:

(i) The time necessary for wearing out of durable capital assets, and

(ii) The time required to absorb the excess stocks of goods left over from the boom.

Just as the expected rate of profit was pushed down by the growing abundance of capital during the period of boom, similarly as the stocks of capital goods are depleted and there grows a scarcity of capital goods, then the expected rate of profit rises thereby inducing the businessmen to invest more. When the level of investment increases, income increases by a magnified amount due to the multiplier effect. So the cumulative process starts upward.

Thus, over time as depreciation of capital stock occurs without replacement and also some existing capital equipment become technologically obsolete, the size of capital stock declines. New investment must be undertaken even to produce reduced depression level of output. Thus with the emergence of scarcity of capital, marginal efficiency of capital rises which boosts investment.

Once investment increases, it induces further rise in income and consumption demand through the multiplier process. Now, the multiplier works to magnify the effect of increase in investment on raising aggregate demand. The mood of businessmen changes from pessimism to optimism which drives up stock prices. All these factors work to lift the economy out of depression and puts it on the road to prosperity.

However, it is noteworthy that the recovery process from depression takes a very long time. Keynes argued that Government should not wait for long for the natural recovery to occur. This is because persistence of depression creates a lot of human sufferings.

ADVERTISEMENTS:

He, therefore, advocated for the active intervention by the Government to raise aggregate demand through fiscal policy, that is, stepping up its expenditure or reducing taxes. Thus, he argued for the adoption of policy of deficit budget to boost aggregate demand so that economy is lifted out of depression.

It may be noted that Keynes’ business cycle theory is self-generating. In it the economy passes through a long phase of expansion. But eventually some forces automatically work, for example, the growing abundance of capital stock, which reduces marginal efficiency of capital. Pessimism overtakes businessmen. This causes reduction in investment which is responsible for bringing about downswing in the economy.

The idea that it is the fluctuations in investment that bring about the fluctuations in the level of economic activity is an important contribution made by Keynes. Of course, even before Keynes, it was believed that the fluctuations in the investment demand have something to do with the business cycles, but a systematic exposition was lacking.

Keynes propounded a definite relationship between a change in investment and the resulting change in income and employment. This relationship is embodied in his famous theory of multiplier.

The Critical Appraisal of Keynes’ Theory:

J.M. Keynes has made three important contributions to the business cycle theory:

First, it is fluctuations in investment that cause changes in aggregate demand which brings about changes in economic activity (i.e., income, output, and employment).

ADVERTISEMENTS:

Secondly, fluctuations in investment demand are caused by changes in expectations of businessmen regarding making of profits (that is, marginal efficiency of capital).

Thirdly, Keynes put forward an important theory of multiplier which tells us how changes in investment bring about magnified changes in the level of income and employment.

But the Keynesian theory of multiplier alone does not offer a full and satisfactory explanation of the trade cycles. A basic feature of the trade cycle is its cumulative character both on the upswing as well as on the downswing, i.e., once economic activity starts rising or falling, it gathers momentum and for a time feeds on itself. Thus, what we have to explain is the cumulative character of economic fluctuations.

The theory of multiplier alone does not prove adequate for this task. For example, suppose that investment rises by 100 rupees and that the magnitude of multiplier is 4. From the theory of multiplier we know that national income will rise by 400 and if multiplier is the only force at work, that will be the end of the matter, with the economy reaching a new stable equilibrium at a higher level of national income.

But in real life this is not likely to be so, for a rise in income produced by a given rise in investment will have further repercussions in the economy. This reaction is described in the principle of the accelerator. According to the principle of acceleration, a change in national income will tend to induce changes in the rate of investment.

While multiplier refers to the change in income as a result of change in investment, the acceleration principle describes the relationship between a change in investment as a result of change in income.

ADVERTISEMENTS:

In the above example, when income has risen by 400 rupees, people’s spending power has risen by an equivalent amount. This will induce them to spend more on goods and services. When the demand for goods rises, initially this will be met by overworking the existing plant and machinery.

All this leads to an increase in profits with the result that businessmen will be induced to expand their productive capacity and will install new plants, i.e., they will invest more than before. Thus, a rise in income leads to a further induced increase in investment.

The accelerator describes this relation between an increase in income and the resulting increase in investment. Thus, Samuelson combined the accelerator principle with the multiplier and showed that the interaction between the two can bring about cyclical fluctuations in economic activity.