It remained for Keynes to construct a satisfactory theory of the determinants of income. It is a general theory which can explain the determination of output and prices in less- than-full employment and full employment situations. Keynes’ income theory of money includes – (a) income expenditure approach, and (b) saving investment approach.

Basically, these two approaches are identical and convey the same meaning:

A. Income-Expenditure Approach:

Main propositions of Keynes’ income-expenditure theory of money are given below:

1. Money Income (Y) is Equal to the Money Value of Aggregate Real Output (PO):

ADVERTISEMENTS:

Y = PO

Money income (Y) is defined as the total income received by the factors of production in the form of rent, wages, interests and profits during a period. It represents money value of aggregate real output during that period. Real income (O) refers to the total volume of goods and services produced by the community during a period. In this way, money income and real income are the two sides of the same coin.

Money value of real income i. e., real income (O) multiplied by the prices level (P) is the money income. The nature of the productive process in a capitalist economy is such that, when it increases output and employment, it also generates money income sufficient enough to buy the output at the current prices.

2. Prices (P) are determined by the Ratio of Money Income (Y) and Real Income (O):

ADVERTISEMENTS:

P = Y/O

Prices change with the change in the ratio of money income and real income. If money income rises more rapidity than real income, prices will tend to rise. If, on the contrary, real income rises more rapidly than real income, prices will tend to fall.

3. Money Income (Y) is Spent on Consumer Goods (C) or Saved (S):

Y = C + S

ADVERTISEMENTS:

People spend their income on consumer goods and the balance, if any, is saved. Saving is that portion of income which is not consumed (S = Y – C); it is nothing but unconsumed output.

4. Real Income (O) Depends upon Aggregate Demand (AD) or Total Expenditure (E):

O = AD = E

Real income or output depends on the availability of real resources and their employment in the productive processes. In an economy that level of output is produced and that quantity of labour is employed which is the most profitable. The most profitable output and employment level depends on aggregate demand or total expenditure on goods and services. Aggregate supply (AS) adjusts itself to aggregate demand (AD).

5. Total Expenditure (AD = E) Comprises of Consumption Expenditure (C) and Investment Expenditure (I):

AD = E = C + I

Total spending is made on consumer goods and investment goods. The former is determined by the level of real income and the propensity to consume of the income earner. The latter is determined by the marginal efficiency of capital (i.e., the profitability of capital) and the current rate of interest.

6. Total Money Income (Y) is Equal to Total Expenditure (C + I):

Y = C + I

ADVERTISEMENTS:

Total income and total expenditure are equal because one person’s expenditure is another person’s income. In fact, there is a circular flow between income and expenditure through which both determine and multiply each other. A’s expenditure becomes B’s income; B’s expenditure becomes C’s income and so on. Thus, expenditure generates income and income generates further expenditure and so on.

7. Money Income is the Strategic Variable determining Output and Prices:

Money income determines aggregate expenditure. An increase in the money income increases the purchasing power in the hands of the people who will spend it on buying larger quantities of goods and services than before. The demand for goods and services will go up.

Now, there are three possibilities:

ADVERTISEMENTS:

(a) If the production is perfectly elastic, the increase in aggregate demand will raise the level of output and employment without affecting the price level,

(b) If the production is relatively inelastic due to the existence of some bottlenecks i.e., due to the shortage of raw materials, labour, etc., the increase in aggregate demand will partly increase production and partly increase prices.

(c) If the production is perfectly inelastic, i.e. it cannot be increased further due to full employment of resources, the increase in the aggregate demand will proportionately increase prices without affecting production of the economy.

The quantity theory of money established a wrong causal link between the money supply and the aggregate expenditure. According to the quantity theory, it is the quantity of money and its velocity which determines the aggregate expenditure. According to the income theory, it is the, flow of expenditure which determines the quantity of money and its velocity.

ADVERTISEMENTS:

An increase in the flow of total expenditure on final goods and services will necessitate an increase either in money or in its velocity or in both. It is like saying that, if a man grows fat, he will require a larger belt. But, according to the quantity theory, if you first arrange a large belt, you will in consequence of this action necessarily grow fat.

This, however, does not mean that the income theory of money denies an important role to the money supply. An increase in money supply can cause an increase in spending. But the income theory stresses the point that there is no direct route from quantity of money to the level of expenditure or income.

Whether increased money supply leads to an increase in expenditure depends upon many in between links such as, (a) the interest elasticity of the investment function, (b) the sensitiveness of the consumption function to shifts in the rate of interest, and (c) the interest elasticity of the liquidity preference function. Ultimately the role of a money depends upon what part does money play in income determination.

Conclusion:

Thus, the income theory of money leads to two conditions:

(i) It is the money income and the volume of expenditure, and not the money supply, that determines the price level (or the value of money) and output.

ADVERTISEMENTS:

(ii) The extent of change in the price level as a result of change in the volume of expenditure depends upon the degree of elasticity of production:

(a) If the output is perfectly elastic, the increased expenditure will proportionately increase output without changing the price level.

(b) If the output is relatively inelastic, the increased expenditure will partly increase output and partly increase prices.

(c) If the output is perfectly inelastic, the increased expenditure will proportionately increase prices leaving the output unchanged.

B. Saving-Investment Approach:

Saving-Investment Equality:

Keynes’s income theory is also called saving-investment theory. In his analysis, saving-investment equality (S = I) is the basic condition for general equilibrium. This equality is derived from the equality of aggregate demand and aggregate supply (Y = C + I). Thus, the income-expenditure equality (Y = C + I) is the same thing as the saving-investment equality (S = I); the former may be called the front door approach and the latter may be called the back door approach.

ADVERTISEMENTS:

Keynes’ saving-investment equality can be visualised in two ways:

1. Accounting equality, and

2. Functional equality.

1. Accounting Equality:

Saving and investment have been so defined that they are necessarily equal to each other; saving and investment are equal by definition. In equilibrium, aggregate income (Y) is equal to aggregate expenditure (C + I),

Y = C + I or Y – C = I

ADVERTISEMENTS:

But aggregate income (Y) is either spent on consumer goods (C) or saved (S),

Y = C + S or Y – C = S

Hence, S = I

Thus, it is clear that by definition, investment is equal to the total expenditure on goods other than that on consumer goods (I = Y – C). Similarly, saving is defined as the excess of income over consumption expenditure (S = Y – C).

Hence, S = I.

The accounting equality of saving and investment is of little analytical use partly because it throws no light on the causal factors that determine saving, investment and income and partly because it provides the condition that must be fulfilled in order to reach the general equilibrium of the economy, but tells nothing about how this condition is fulfilled. Since, saving and investment decisions are taken separately by households and firms and with different motives, one fails to understand how these decisions are reconciled.

ADVERTISEMENTS:

2. Functional Equality:

Functional equality explains the actual behaviour of saving and investment and provides the dynamic mechanism through which they are equalised. The equality between saving and investment is brought about by the changes in income. Whenever investment exceeds saving, aggregate demand increases and income level rises. As a result, saving increases and becomes equal to investment. Similarly, if saving exceeds investment, aggregate demand decreases and income level falls. As a result, saving decreases and becomes equal to investment.

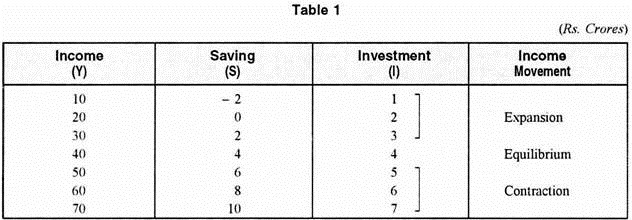

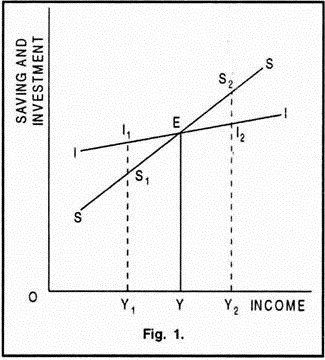

In Figure 1, saving schedule (SS), which indicates various amounts of saving corresponding to different levels of income, is a positive function of income { S = S (Y) }. Similarly, investment schedule (II), which indicates the various amounts of investment corresponding to different levels of income, is also a positive function of income {I = I(Y)}. There is a unique level of income (Rs. 40 crores or OY) at which saving (Rs. 4 crores or EY) is equal to investment (Rs. 4 crores or EY). This is also the equilibrium level of national income.

The economy is in disequilibrium if income is OY1 (Rs, 30 crores) because investment (Rs. 3 crores or I1 Y1) is greater than saving (Rs. 2 crores or S1Y1). Income must increase to bring about equality of saving and investment. Similarly at income level OY2 (Rs. 50 crores), the economy is also in disequilibrium because investment (Rs. 5 crores or I2Y2) ie less than saving (Rs. 6 crores or S2Y2) Income must fall to bring about equality of saving and investment.

Functional equality indicates that the equality of saving and investment does not mean that the two are necessarily in equilibrium. Savings and investment though equal by definition, are not always in equilibrium because of expenditure and productions lags. They are both equal and in equilibrium when these lags have been worked through.

In actual practice, both saving and investment are influenced by such a large number of factors, that lags in the adjustment of the two are bound to exist and therefore it is very difficult to state a clear- cut mechanism effecting the equilibrium between the two.

A Dynamic Model of Saving-Investment Equality:

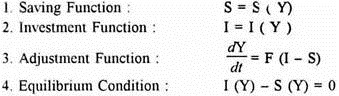

The equilibrium between saving and investment as brought about by changes in the income through time can be understood with the help of an equation model:

Equations (1) and (2) indicate that saving and investment are the functions of income. Equation (3), which shows that the ratio of change of income dY/dt is a function of the difference between intended investment and intended saving (I – S), makes the system dynamic. Excess intended investment lead to multiple increase in income through time and excess intended saving leads to a multiple decrease in income through time. This process of change in income through time (t = t1, t2,………….. , tn) will continue until the necessary condition of equilibrium, S = I, (as shown by Equation 4 ) is reached.

S = I Means Y = C + I:

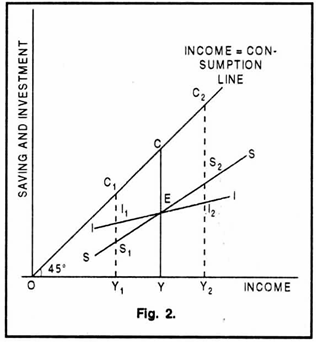

The equality between saving and investment (S = I) has been derived with the help of the general equilibrium condition of income expenditure equality (Y = C + I). The equilibrium level of national income (Y = C + I) is determined by the point of intersection of the aggregate demand function and aggregate supply function (AD = AS), called effective demand. Thus, S = I is the same thing as

Y = C + I and the saving and investment approach and the income and expenditure approach are identical. This is shown in Figure 2.

In Figure 2, the equilibrium level of income is OY where saving (EY) is equal to investment (EY) and income (OY) is equal to consumption (CE) plus investment (EY). Hence, S = I is the same thing as Y = C + I. The economy is in disequilibrium at OY1, because investment (I1Y1) is greater than saving (S1Y1) and income (OY1 or C1Y1) is less than consumption (C1S1) plus investment (I1Y1). Thus, income must rise from OY1 to OY so that S = I and Y = C + I. Similarly, the economy is also not in equilibrium at OY2 because saving (S2 Y2) exceeds investment (I2Y2) and income (OY2 or C2Y2) is greater than consumption (C2S2) plus investment (I2 Y2). Income must fall from OY2 to OY so that S = I and Y = C + I.

Saving-Investment Inequality:

At the equilibrium level of income, S = I or Y = C + I, the output and the price level in the economy tend to be stable. But saving and investment decisions are made by diverse groups of people and with different motives. Thus, there is every possibility of saving-investment disequilibrium taking place in the economy.

Sometimes, investment may exceed saving and sometimes saving may exceed investment. This disequilibrium in saving and investment causes changes in output and prices.

a. Investment Exceeding Saving:

To start with, let us assume a saving investment equilibrium. Also assume that the investment expenditure increases in the economy without an equal reduction in the consumption expenditure. This is a case of an excess of investment over saving. This excess of investment over saving may be possible by an expansion of money through credit creation by commercial banks or by the dishoarding of wealth by the people.

This excessive investment increases the money income of the consumers due to increased employment resulting from increased investment. The consumers in turn spend more on consumer goods. It raises the prices of the consumer goods and hence the profits of the producers manufacturing consumer goods. They tend to increase their investment in anticipation of still higher profits. This cumulative process of expanding investment continues.

During depression, as a result of the expansion of investment, employment of idle resources and money income for the people will increase. There will be some increase in prices but it will not be a steep rise because of a simultaneous increase in output. Once full employment is reached, the prices will rise in proportion to the rise in money supply.

But the saving-investment disequilibrium will not last long. When income rises as result of investment exceeding saving, saving being a function of income also starts rising. This reduces the gap between investment and saving and once again saving- investment equality is achieved. This new equilibrium is at higher levels of income, output, employment and prices.

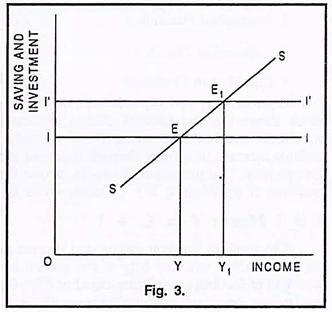

In Figure 3 original saving-investment equilibrium is at E where the investment curve (II) intersects the saving curve (SS). The equilibrium Level of income is OY. As a result of increase in investment, the investment curve shifts upward to I’I’ which intersects the saving curve at the new equilibrium point E1. OY1 is the new and higher equilibrium level of income.

b. Saving Exceeding Investment:

Excess of saving over investment may arise in two ways:

(i) According to Keynes, saving function remaining unchanged, the excess of saving over investment is the result of a sudden fall in the marginal efficiency of capital unaccompanied by proportional fall in the rate of interest. This generally happens during the boom period of the trade cycle. The excessive saving results in a decline in the expenditure on consumer and investment goods. The demand and the prices of the consumer goods fall. The actual profits of the producers fall short of the expected profits.

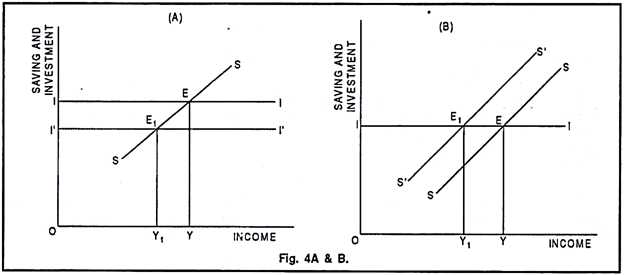

Consequently, they reduce the employment, output and income. But when income falls, saving, being a function of income, also falls. This reduces the gap between saving and investment and a new saving investment equilibrium is reached at lower levels of output and prices. In Figure 4-A, original saving-investment equilibrium is at point E with an income of OY. Excess of saving over investment is depicted by a shift in investment curve from II to IT. The new equilibrium is at point E1 with a reduced income of OY1.

(ii) Investment function remaining unchanged, the excess of saving over investment is the result of an upward shift of saving function. In this case too, the new equilibrium will be at a lower level of income and prices. In Figure 4-B the original a saving-investment equilibrium is at point E with an income of OY. Excess of saving over investment is represented by a shift in saving curve from SS to S’S’. The new equilibrium is established at point E1 with a reduced income of OY1. Thus, whenever saving exceeds investment it initiates a process of cumulative decline in income, prices and economic activity. It is in this sense that Keynes regarded saving as a private virtue but a public vice.

According to Keynes, saving function remains more or less stable in the short period. Hence, the business fluctuations in the economy are largely due to investment. An increase in investment leads to a rise in income, output, employment and prices and a decrease in investment causes a fall in the income, output, employment and prices.

Conclusion:

According to the saving investment theory of money, it is the inequality between saving and investment that causes price fluctuations (or the changes in the value of money) through changes in the level of income:

(a) If saving and investment are in equilibrium (S = I), the price level will tend to be stable.

(b) If investment exceeds saving, the price level will rise,

(c) If saving exceeds investment, the price level will fall.

Thus, contrary to the quantity theory of money, the income theory of money emphasises that fluctuations in the price level are due to the changes in income rather than in the quantity of money.