Keynes’ Liquidity Preference Theory of Interest Rate Determination!

The determinants of the equilibrium interest rate in the classical model are the ‘real’ factors of the supply of saving and the demand for investment. On the other hand, in the Keynesian analysis, determinants of the interest rate are the ‘monetary’ factors alone.

Keynes’ analysis concentrates on the demand for and supply of money as the determinants of interest rate. According to Keynes, the rate of interest is purely “a monetary phenomenon.” Interest is the price paid for borrowed funds. People like to keep cash with them rather than investing cash in assets. Thus, there is a preference for liquid cash.

People, out of their income, intend to save a part. How much of their resources will be held in the form of cash and how much will be spent depend upon what Keynes calls liquidity preference, Cash being the most liquid asset, people prefer cash. And interest is the reward for parting with liquidity. However, the rate of interest in the Keynesian theory is determined by the demand for money and supply of money.

Demand for Money:

Demand for money is not to be confused with the demand for a commodity that people ‘consume’. But since money is not consumed, the demand for money is a demand to hold an asset.

ADVERTISEMENTS:

The desire for liquidity or demand for money arises because of three motives:

(a) Transaction motive

(b) Precautionary motive

ADVERTISEMENTS:

(a) Transaction Demand for Money:

Money is needed for day-to-day transactions. As there is a gap between the receipt of income and spending, money is demanded. Incomes are earned usually at the end of each month or fortnight or week but individuals spend their incomes to meet day-to-day transactions.

Since payments or spending are made throughout a period and receipts or incomes are received after a period of time, an individual needs ‘active balance’ in the form of cash to finance his transactions. This is known as transaction demand for money or need- based money—which directly depends on the level of income of an individual and businesses.

ADVERTISEMENTS:

People with higher incomes keep more liquid money at hand to meet their need-based transactions. In other words, transaction demand for money is an increasing function of money income.

Symbolically,

Tdm = f (Y)

Where,Tdm stands for transaction demand for money and Y stands for money income.

(b) Precautionary Demand for Money:

Future is uncertain. That is why people hold cash balances to meet unforeseen contingencies, like sickness, death, accidents, danger of unemployment, etc. The amount of money held under this motive, called ‘Idle balance’, also depends on the level of money income of an individual.

People with higher incomes can afford to keep more liquid money to meet such emergencies. This means that this kind of demand for money is also an increasing function of money income. The relationship between precautionary demand for money (Pdm) and the volume of income is normally a direct one.

Thus,

Pdm = f (Y)

(c) Speculative Demand for Money:

ADVERTISEMENTS:

This sort of demand for money is really Keynes’ contribution. The speculative motive refers to the desire to hold one’s assets in liquid form to take advantages of market movements regarding the uncertainty and expectation of future changes in the rate of interest.

The cash held under this motive is used to make speculative gains by dealing in bonds and securities whose prices and rate of interest fluctuate inversely. If bond prices are expected to rise (or the rate of interest is expected to fall) people will now buy bonds and sell when their prices rise to have a capital gain. In such a situation, bond is more attractive than cash.

Contrarily, if bond prices are expected to fall (or the rate of interest is expected to rise) in future, people will now sell bonds to avoid capital loss. In such a situation, cash is more attractive than bond. Thus, at a low rate of interest, liquidity preference is high and, at a high rate of interest, securities are attractive. Now it is clear that the speculative demand for money (Sdm) varies inversely with the rate of interest. Thus,

Sdm = f (r)

ADVERTISEMENTS:

Where, Y is the rate of interest.

Total Demand for Money:

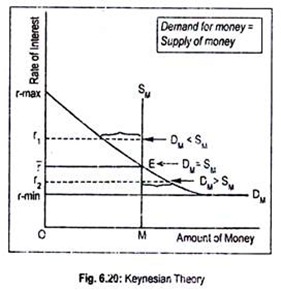

The total demand for money (DM) is the sum of all three types of demand for money. That is, Dm = Tdm + Pdm + Sdm. The demand for money has a negative slope because of the inverse relationship between the speculative demand for money and the rate of interest.

However, the negative sloping liquidity preference curve becomes perfectly elastic at a low rate of interest. According to Keynes, there is a floor interest rate below which the rate of interest cannot fall. This minimum rate of interest indicates absolute liquidity preference of the people.

This is what Keynes called ‘liquidity trap’. In Fig. 6.20, Dm is the liquidity preference curve. At minimum rate of interest, r-min, the curve is perfectly elastic. However, there is a ceiling of interest rate, say r-r-max, above which it cannot rise. Thus, interest rate fluctuates between r-max and r-min.

ADVERTISEMENTS:

Money Supply:

The supply of money in a particular period depends upon the policy of the central bank of a country. Money supply curve, SM, has been drawn perfectly inelastic as it is institutionally given.

Determination of Interest Rate:

According to Keynes, the rate of interest is determined by the demand for money and the supply of money. OM is the total amount of money supplied by the central bank. At point E, demand for money becomes equal to the supply of money. Thus, the equilibrium interest rate is determined at or. Now, suppose that the rate of interest is greater than or.

In such a situation, supply of money will exceed the demand for money. People will purchase more securities. Consequently, its price will rise and interest rate will fall until demand for money becomes equal to the supply of money.

On the other hand, if the rate of interest becomes less than or, demand for money will exceed supply of money, people will sell their securities. Price of securities will tumble and rate of interest will rise until we reach point E.

Thus, the rate of interest is determined by the monetary variables only.

Limitations:

ADVERTISEMENTS:

Even Keynes’ liquidity preference theory is not free from criticisms:

Firstly, like the classical and neo-classical theories, Keynes’ theory is an indeterminate one. Keynes charged the classical theory on the ground that it assumed the level of employment fixed.

Same criticism applies to the Keynesian theory since it assumes a given level of income. Keynes’ theory suggests that Dm and SM determine the rate of interest. Without knowing the level of income we cannot know the transaction demand for money as well as the speculative demand for money. Obviously, as income changes, liquidity preference schedule changes—leading to a change in the interest rate.

Therefore, one cannot, determine the rate of interest until the level of income is known and the level of income cannot be determined until the rate of interest is known. Hence indeterminacy. Hicks and Hansen solved this problem in their IS-LM analysis by determining simultaneously the rate of interest and the level of income.

It is indeed true also that the neo-classical authors or the pro-pounders of the loanable funds theory earlier made attempt to integrate both the real factors and the monetary factors in the interest rate determination but not with great successes. Such defects had been greatly removed by the neo-Keynesian economists—J.R. Hicks and A.H. Hansen.

Secondly, Keynes committed an error in rejecting real factors as the determinants of interest rate determination.

ADVERTISEMENTS:

Thirdly, Keynes’ theory gives a choice between holding risky bonds and riskless cash. An individual holds either bond or cash and never both. In the real world, it is the uncertainty or risk that induces an individual to hold both. This gap in Keynes’ theory has been filled up by James Tobin. In fact, today people make a choice between a variety of assets.

Conclusion:

Despite these criticisms, Keynes’ liquidity preference theory tells a lot on income, output and employment of a country. His basic purpose was to demonstrate that a capitalist economy can never reach full employment due to the existence of liquidity trap.

Though the liquidity trap has been overemphasized by Keynes yet he demolished the classical conclusion the goal of full employment. Further, his theory has an important policy implication. A central bank is incapable of reviving a capitalistic economy during depression because of liquidity trap. In other words, monetary policy is useless during depressionary phase of an economy.