In this article we will discuss about the relation among poverty, inequality and economic growth.

Most LDCs experience growing inequality in income distribution with a majority of people remaining in poverty while a small elite captures a disproportionate share of gains from economic growth. Poverty and inequality imply absence of social justice.

Moreover, growing inequality and poverty create various socio-political problems, suet) as dissatisfaction and frustration among the poor, which often culminate in disruption and civil war and destroy the social and political basis of economic activities.

Income inequality among households is measured by the distribution of incomes according to size (or level) of income per household. The distribution across income-size classes is called ‘the size distribution of income’. The higher the income share of high-income classes and the lower the share of low-income classes, the more unequal income distribution is supposed to be.

ADVERTISEMENTS:

In general, the size distribution of income is determined by both the distribution of income between labour and capital assets (functional distribution) and the distribution of assets across the income-size classes. However, in today’s industrially advanced countries, assets owned by the employees are very significant.

They own not only tangible assets, but also intangible assets such as knowledge and skill accumulated through human capital formation. This is why changes in income distribution in the process of economic development cannot be correctly judged through the analysis of the functional distribution alone.

Indicators of Inequality:

Two standard measures of inequality are:

Lorenz Curve and the Gini Coefficient.

ADVERTISEMENTS:

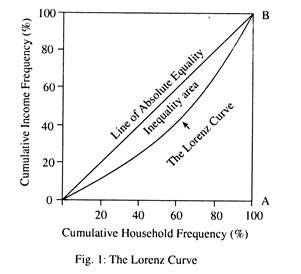

In Fig. 1 we show cumulative percentage distribution of household incomes (On the vertical axis) corresponding to cumulative distributions of the number of households (On the horizontal axis) ranked on the basis of household incomes from the bottom to the top.

The Lorenz curve coincides with the diagonal line OB in the case of perfect equality in which all the households receive the same income. At the other extreme is the case of perfect inequality in which one household monopolises all the income while the other households receive no income.

The Lorenz curve would follow the right angled line OAB. Thus the larger is the gap between the area between the line OB and the Lorenz curve in the extent of income inequality. The Gini-coefficient is measured by the ratio of the inequality area to the area of triangle OAB. It measures inequality within the range from 0 for perfect equality to 1 for perfect inequality.

Concepts and Measurement of Poverty:

ADVERTISEMENTS:

Poverty refers to deprivation from certain basic things of life such as food, cloth, decent accommodation, safe drinking water, health care and minimum educational opportunities.

Poverty is of two types:

(i) Absolute poverty and

(ii) Relative poverty.

(i) Absolute Poverty:

It is expressed in terms of someone’s economic status relative to a certain absolute level of economic welfare. It is defined as a status of a person whose material well-being is below a certain minimum level treated as reasonable by the standard of society to which he belongs.

The level of material well-being is commonly conceptualized as ‘the standard of living’ which is measured by the aggregate market value of private goods and services consumed by the person (not including public goods). By using the yardstick poverty in a society is measured in terms of the number of persons whose living standards are below a certain minimum, as well as their distances from the minimum level.

(ii) Relative Poverty:

ADVERTISEMENTS:

It concerns questions such as what percentage of total income is received by the bottom 10% of households and how far their standards of living are as compared with those of richer people. Relative poverty is essentially the problem of inequality in income distribution.

Patterns of Changes in Inequality:

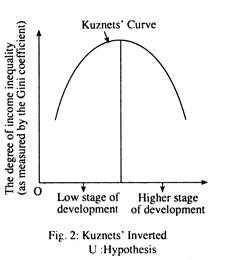

Simon Kuznets observed on the basis of historical data that inequality initially increase with economic development. But at a later stage of economic development, as affluence arrives in a modern mixed economy, inequality falls. From this emerges the inverted-U hypothesis. The Kuznets’ curve shows growing inequality at a low stage of development as is measured by the Gini- coefficient, showed on the vertical axis, in Fig. 2.

It has been difficult to statistically confirm the inverted U-shape pattern by the time-series data. But stronger support has been provided for the hypothesis on the inter-country (cross-section) data.

Poverty and Economic Growth:

ADVERTISEMENTS:

If inequality in income distribution, as measured by such indicators as the Gini-coefficient, remains the same, increases in PCI are sure to reduce the incidence of poverty. However, if inequality is bound to rise along the rising of the inverted- U shaped-curve, low-income economies may have to experience an increased incidence of poverty-when they begin to experience economic growth as measured by increase in real PCI. As in the case of inequality, this relationship between poverty and economic growth in the early stage of development can be confirmed by cross-section data and not time-series data.

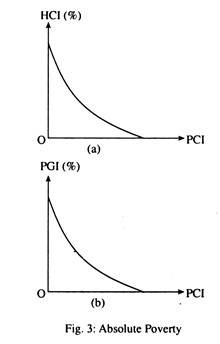

Fig. 3 (a) compares poverty index and average PCI. The upper section of this figure represents a comparison in terms of the headcount index (HCI) as measured by the percentage of poor people below the poverty line—set equal to one US dollar—in purchasing power parity (PPP), whereas the lower section presents a comparison in terms of the poverty gap index (PGI) measured by the sum of differences in poor people’s consumption expenditures or income from the poverty line.

However, in addition to the level of PCI, the distribution of income matters in determining the prevalence and severity of poverty. The monotonically decreasing trend in poverty corresponding to rise in PCI, as observed in Fig. 3 (b), indicates the income-in-equalising effect of economic growth. However, large inequality due to other factors might also have serious effect on the incidence of poverty.

Causes of Inequality:

ADVERTISEMENTS:

Statistical evidence does not give ample support to the inverted U-hypothesis regarding changes in inequality with economic development. Yet, some factors are likely to cause income distribution in developing countries to become less equal and thus preventing poverty from being effectively reduced in the early stage of their development.

The main causes are:

(i) Changes in Factor Shares:

In the early stage of development the income shares of capital falls and that of labour increases. However, in all those countries where industrialisation starts late there is, a general tendency to borrow capital-using and labour-saving technology. Therefore, the share of capital is likely to rise further in today’s developing economies than is observes from the histories of advanced economies.

ADVERTISEMENTS:

This tendency has been aggregated by the adoption of policies by the developing countries to promote highly capital-intensive basic and heavy industries such as iron and steel, petrochemicals, heavy engineering, coal, oil, etc. which are of strategic significance to such countries at the early stage of industrialisation.

The aim is to catch up with the advanced economies at maximum speed. For achieving this goal, developing countries have frequently adopted policies favouring large-scale industries based on capital-intensive technology at the expense of small and medium enterprises based on labour-intensive technology—by such means as import controls, rationing of foreign exchange, and overvalued exchange rates.

(ii) Dual Economic Structure:

Many developing countries promote in which labour is an abundant factor large-scale highly capital-intensive industries even at the early stage of development. This gives birth to dual economic structures. In such economies wide gaps in labour productivity and wage rate are found among large, small and medium scale industries. Such dual economic structure is a serious source of inequality in today’s developing countries.

To be more specific, only in the so-called ‘formal sector’—consisting of large enterprises and government agencies—there is job security. Moreover, the wage rates are high since workers are protected by labour laws. The entry to the formal sector is closed to labourers in the informal sector, who make a living as employees in small enterprises, casual labour on a daily basis, small traders and self-employed manufacturers.

Due to such barriers to entry labour cost in large enterprises is high in spite of the availability of cheap labour in the informal sector. So there is a strong incentive among entrepreneurs in the informal sector to increase capital intensity by adopting labour-saving technology. Consequently employment in the formal sector increases much less than the increase in output and labour productivity.

ADVERTISEMENTS:

So the income gap tends to widen cumulatively between employees in the formal sector who can achieve a satisfactory rise in wages through collective bargaining and labourers in the informal sector, who continue to live at or near the subsistence level.

(iii) Income Difference between Agricultural and Non-Agricultural Sectors:

One major cause of growing inequality in the early stage of development is the widening income gap between the farm and non-farm sectors. With the introduction of modern industries in a traditional subsistence-based economy, there emerges a major intersectoral difference in productivity. This difference tends to widen as productivity in the modern industrial sector increases faster (due to relative ease in borrowing technology) than that in agriculture at the early stage of development.

One reason for growing farm-non-farm income gap in developing economies today is the weak-labour absorptive capacity of the modern sector. This is mainly attributed to the institutional factors that strengthen the dual economy structure by encouraging the introduction of labour-saving technologies. Another reason is growing pressure of population on farmland which reduces per capita land availability. As a result, the law of diminishing returns starts operating quite early.

Achieving Equality:

(i) Taxes and Transfers:

Equality in the distribution of income and assets can be achieved with the adoption of standard means such as progressive tax, inheritance tax (death duty/estate duty) and a comprehensive social security system. However, these taxes and transfers are not much effective for equalizing income distribution in developing economies when the majority of the population remains engaged in self- employment and casual hard work in agriculture and urban informal sector.

ADVERTISEMENTS:

(ii) Agrarian Reforms:

Inequality in developing countries is also said to be connected with land reforms. Such reforms aim at redistributing farmlands from landowners to tenants and landless agricultural labourers. However, whether land reforms contribute to increased agricultural productivity is not much transparent.

However, there is no denying the fact that the establishment of egalitarian agrarian societies consisting of homogeneous small landholders increases social and political stability which is essential for achieving rapid development.

On the other hand, land reform Acts have prompted landlords to adopt such evasive measures as evicting tenants and hiring labourers to cultivate under landlords’ direct management and planting trees in arable land to change the latter’s classification. Such practices have made the labour power and managerial abilities of tenants partly redundant.

(iii) Land Tax:

ADVERTISEMENTS:

A potentially more effective policy instrument is taxation of land assets in proportion to the asset value, called ‘land tax’. In developing economies today, the frontiers of cultivation have been pushed to less productive land by population pressure, resulting in increase in Ricardian differential rents. As a consequence, the income gap between land-owing and landless people has been widening.

The equalising effect of land tax would be especially large if increased rent incomes could be taxed and used as a source for public investment in irrigation and agricultural technology development in order to counteract population pressure. The tax revenue would achieve a very high pay-off in promoting both growth and equality if allocated to the promotion and strengthening of general education.

However, effective land taxation requires establishment of a land registry system. Once the system is completed the government will be able to continue raising a stable tax revenue at moderate administrative cost without distorting agricultural production incentives.

By using such tax revenue it is possible to adopt modernisation measures including education, research and physical infrastructure—such as roads and potts. The land registry system reduces the cost of land transactions and greatly facilitates mobilisation of credit for long-term investment, using land as collateral.

So establishment of the land taxation system should represent a high pay-off investment opportunity for developing economies to promote both efficiency and equity. Yet few developing economies have intre-shed land tax, partly because of the huge initial investment required and partly because of strong opposition from landlords and open powerful groups in rural areas even though high land tax could be less harmful to such countries than distortive taxes such as excise duty and export duty.

(iv) Policy Change:

The policy bias towards promoting infrastructure of capital-using technology should be corrected to prevent capital’s share from rising sharply in developing countries.

(v) Adjusting Borrowed Technology:

A major effort must be devoted to adjust borrowed technology to the underlying resource endowment in developing economies. Since the technology being used in advanced economies was developed as an optimum (minimum cost) technology under the condition of low capital cost relative to labour cost, reduction in both production cost and capital’s relative share can be achieved by adjusting it in the labour- using direction.

(vi) Altering Dualistic Economic Structure:

The government should stop intervention into market such as means import licensing and foreign exchange allocations that favour large- scale enterprises. They should also make necessary endeavours to assist small and medium enterprises through development and diffusion of appropriate technology and provision of technical and managerial know-how, including market information. Laws and regulations for the protection of labourers may be applied relatively loosely but as widely as possible to reduce segmentation of the labour market between the formal and informal sectors.

(vii) Promoting Progress in Land-Saving Technology:

Due to strong pressure of population on land, an extremely rapid rate of progress in labour-saving technology is required to prevent labour productivity in agriculture from falling faster than that in industry. It is possible to achieve this type of technological progress only by adequately exploiting the potential of science- based agriculture.

However, the potential cannot be realised without major public investments in farmers education, agricultural research, irrigation, roads and other infrastructures. Whether developing economies eager to achieve rapid industrialisation allocate their limited budget to make investment for agricultural development will have a decisive effect on the trend in income distribution.

By identifying poverty reduction as an immediate goal instead of a consequence of economic growth, modern development economists like Amartya Sen and J. Stiglitz advocate that a greater share of public resources be allocated for the delivery of social services to the poor rather than for strengthening the productive capacity of the economy.

The focus should be on improving the quality of life of the poor through redistribution of income in their favour. The importance of delivering social services to the poor for improving the quality of their lives cannot be over-emphasised.

Growth and Equity:

Typically, the majority of poor people live mainly on returns to their labour applied in agriculture, small-scale manufacture and petty trade. Only by increasing the productivity and profitability of these sectors is it possible to achieve a sustainable reduction in poverty. Poverty reduction will be sustainable only through wide differentiation of primary education and health care.

This will lay an indispensable foundation for upgrading the productive capacity of the people. Stress should be laid on vitally important vocational education and training to support the development of agriculture, small-scale manufacturing and commerce.

The critical need for public investment in production-oriented infrastructure in general should be properly emphasised. There is also the need for agricultural and industrial research and extension to produce and disseminate profitable technologies to small farmers and manufacturers, for irrigation and rural electricity to make water and power available to them, and for road and communication systems by which producers and traders in remote areas can have access to wide markets. All such investments generate economic growth which, at the same time, contributes directly to the reduction of poverty. In this case there is no trade-off between growth and equity.

Broad-based growth of low income countries is possible only when public programmes supply profitable production opportunities for poor people. Indeed, the failure of both import- substituting industrialisation and structural adjustment programme in providing sufficient support to these productive activities underlie their failures in achieving both economic growth and poverty reduction in low income economies over the past half century. The success of East Asia, on the other hand, in supporting the production activities of poor people, distinguishes it from other regions such as Africa and underlies its economic miracle.