In this essay we will discuss about the National Bank for Agricultural and Rural Development. After reading this essay you will learn about: 1. Introduction to NABARD 2. Functions of NABARD 3. Working 4. Revamping of Co-Operative Credit Structure 5. Agriculture Debt Waiver and Debt Relief (ADWDR) Scheme 2008 6. Other Plans.

Contents:

- Essay on the Introduction to NABARD

- Essay on the Functions of NABARD

- Essay on the Working of NABARD

- Essay on the Revamping of Co-Operative Credit Structure of NABARD

- Essay on the Agriculture Debt Waiver and Debt Relief (ADWDR) Scheme

- Essay on the Other Plans of NABARD

Essay # 1. Introduction to NABARD:

Another landmark in respect of rural credit in recent years is the setting up of the National Bank for Agricultural and Rural Development in 12th July 1982. From the very beginning, Reserve Bank of India (RBI) was extending the agricultural credit through state level co-operative banks and land development banks.

Later on, the Agricultural Refinance Development Corporation (ARDC) was also set up by RBI in 1963 for meeting the long-term credit requirement of rural areas. But after the formation of NABARD, it took over all the agricultural credit functions of RBI and the refinance functions of ARDC after its merger with NABARD.

ADVERTISEMENTS:

NABARD has an authorised share capital of Rs 500 crore and paid-up capital of Rs 100 crore which is contributed equally by the RBI and the Government. RBI nominates three of its Central Board Directors as a member of the board of NABARD and a Deputy Governor of RBI is appointed as a Chairman of MABARD.

Essay # 2. Functions of NABARD:

The following are some of the important functions performed by NABARD:

1. The National Bank is working as an apex body for meeting the credit requirements of the rural sector in the form of production and investment credit to agricultural, small scale and village industries, rural crafts, artisans and other allied economic activities.

2. The Bank provides short-term, medium-term and long term credit to state co-operative banks, RRBs, land development banks and commercial banks for its investment in agricultural and other allied sectors.

ADVERTISEMENTS:

3. The Bank gives long-term assistance to state Governments (up to 20 years) for subscribing to the share capital of co-operative credit institutions.

4. The Bank has the responsibility of inspecting state cooperative banks and RRBs.

5. It provides long term loans to the institutions which are approved by the Central Government or may contribute to the share capital or invest in securities of any type of institution connected with agriculture and rural development.

6. The Bank is also coordinating the activities of central and state Governments, the Planning Commission and all other all-India and State level institutions which are entrusted with the development of small scale, village and cottage industries, rural crafts and other industries in the tiny and unorganised sector.

ADVERTISEMENTS:

7. The Bank also maintains a Research and Development Fund in order to promote research in agriculture and rural development, and also to formulate and design projects and programmes to suit the requirements of different areas.

Essay # 3. Working of NABARD:

NABARD is playing an important role in augmenting the flow of credit for the promotion of agriculture, small scale and cottage industries, handicrafts and other rural crafts and various other allied activities in rural areas of the country.

NABARD does not help the farmers and other rural people directly rather it flows the credit to these people through co-operative banks, commercial banks, RRBs, etc. It is thus working as an apex body dealing with policy, planning and other operational aspects of rural credit for the all-round development of rural economy.

During the last ten years, NABARD played an important role in developing the rural economy and performed all its various functions smoothly and efficiently. Accordingly, the Bank sanctioned short-term credit limits to the extent of Rs 3,020 crore in 1990-91 for financing seasonal agricultural operations (at 3 per cent below the bank rate) as against Rs 2,807 crore in 1989-90.

NABARD also sanctioned medium-term credit limits to the extent of Rs 46 crore in 1989. During 1990-91, the bank advanced medium term and long term credit to the extent of Rs 210 crore. NABARD also pursued its policy for the promotion of investment in agricultural sector in the less developed and under banked states.

In 1989-90 Rs 737 crore was disbursed in these states. The Bank also provided refinance assistance for different purposes.

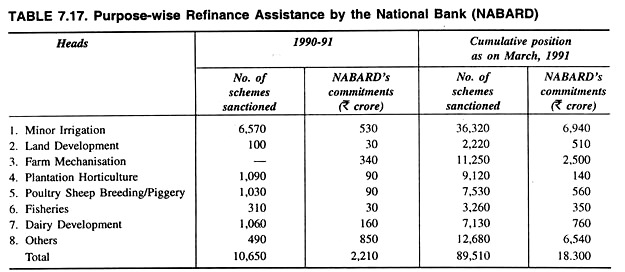

The purpose-wise refinance assistance advanced by NABARD can be seen from the Table 7.17.

Table 7.17 shows that during -1990-91, NABARD sanctioned all total 10,650 schemes which involved its commitment of Rs 2,120 crore. Moreover, up to the end of March 1991, NABARD along with erstwhile ARDC sanctioned 89,510 projects for which it made a total commitment of Rs 18,300 crore.

ADVERTISEMENTS:

Purpose-wise, NABARD sanctioned largest number of schemes on minor irrigation works which has more than 60 per cent (6,750 schemes) of the total schemes sanctioned in 1990-91 and again on cumulative basis as on March 1991, about 36,320 schemes, out of total 89,510 schemes, were sanctioned for minor irrigation works.

Moreover, NABARD has introduced a rehabilitation programme for the weak Central Co-operative Banks (CCBs) and State Co-operative Banks (SCBs) of the country. As on June 30, 1988, about 175 CCBs and 7 SCBs were covered under this rehabilitation programme.

In order to promote integrated rural development and also to attain prosperity of rural areas, NABARD also advanced financial assistance to 76 RRBs for setting up or strengthening their Technical Monitoring and Evaluation (TME) cells. Besides, about 13 SLDBs and 2 SCBs got financial assistance from this fund.

The Government has established a Rural Infrastructural Development Fund within NABARD from April 1995. The Fund will provide loans to State Governments and State owned Corporations for completing ongoing project, relating to medium and minor irrigation, soil conservation watershed management and other forms of rural infrastructure.

ADVERTISEMENTS:

This Rural Infrastructural Development Fund (RIDF) has been set up with the corpus of Rs2, 000 crore. With the establishment of RIDF, 2,249 projects with a loan of about Rs 1,827 crore was sanctioned by NABARD to eighteen states. These projects are expected to create an additional irrigation potential of 15.5 lakh hectares.

Thus, NABARD provides refinance facility to the state land development banks, state co-operative banks, scheduled commercial banks and regional rural banks, although the ultimate beneficiaries of investment credit include individuals, partnership concerns, companies, state owned corporations etc.

During 1996-97, NABARD sanctioned short-term credit limits aggregating Rs 789.9 crore (as on September 1996), which consist an amount of Rs 552.2 crore for seasonal agricultural operations (SAO) and an amount of Rs 146.68 crore for other seasonal agricultural operation (SAO) in respect of 103 RRBs. The outstanding refinance under SAO and other short term limits for RRBs stood at Rs 833.11 crore as on end-Septembers, 1996.

Again the aggregate sanctions by the National Bank for Agriculture and Rural Development (NABARD) touched an all time high of Rs 14,000 crore in 1997-98, registering a growth of 17 per cent compared to 1996- 97. The disbursements by NABARD during the year, including short, medium and long term, to various agencies were Rs 11,110 crore.

ADVERTISEMENTS:

The term credit sanctioned by NABARD to commercial banks, co-operatives and to the newly set up agricultural development finance companies was Rs 4,160 crore in 1997-98 compared to Rs 3,801 crore in the previous year. The sectors which contributed to agricultural production such as minor irrigation, plantation and horticulture activities absorbed as much as Rs 1,790 crore during the year.

In January 2006, Government announced the package for revival of Short-Term Rural Cooperative Credit Structure involving financial assistance of Rs 13,590 crore, NABARD has been designated as the implementing agency for the purpose.

States are recognised to sign MoU with NABARD committing to implement the legal, institutional and other reforms as envisaged in the revival package. So far 21 states have signed MoU with the Government and NABARD.

Essay # 4. Revamping of Co-Operative Credit Structure of NABARD:

In order to revamp the co-operative credit structure, the Government announced a package in January 2006 for revival of Short-term Rural Co-operation Credit Structure involving financial assistance of Rs 13,596 crore. NABARD has been designated as the implementing agency for the purpose. A Department for Cooperative Revival and Reforms has been set up in NABARD for facilitating the implementation process.

States are required to sign a MoU with NABARD committing to implement the legal, institutional and other reforms as envisaged in the revival package. So far 25 states and 3 UTs have agreed to implement the package; out of which 17 states have signed MoU with the Government of India and NABARD.

A total sum of Rs 1,073 crore has been released by NABARD as Government of India’s share under the package to Andhra Pradesh, Madhya Pradesh and Haryana. The Task Force has also submitted its report for revival of Long Term Cooperatives Credit Structure. Steps have been initiative for implementing the suggestion given in this report.

ADVERTISEMENTS:

This package covers 96 per cent of the primary agricultural cooperative societies (PACS) and 96 per cent of the central cooperative banks (CCBs) in the country. As of November 2010, an amount of Rs 8009.75 crore has been released by NABARD as Government of India share for recapitalization of 49,983 PACS.

Essay # 5. Agriculture Debt Waiver and Debt Relief (ADWDR) Scheme 2008:

NABARD is the nodal agency for the implementation of the Agriculture Debt Waiver and Relief (ADWDR) Scheme 2008 in respect of cooperative credit institutions and Regional Rural Banks. NABARD has already released Rs 25,113.92 crore towards debt waiver and Rs 3,986.02 crore towards Debt Relief Claims as on 31st December 2011.

Thus the total amount of release of fund by NABARD under ADWDR Scheme as on 31st December 2011 was Rs 29,099.94 crore.

Agri-Clinic and Agri-Business Schemes of NABARD:

In the mean time, NABARD has already decided to launch its agri-clinic and agribusiness centre scheme with an aim to strengthen the transfer of technology for generating employment in agri and allied sector. The concept of agri-clinic is envisaged to provide export services and counseling to farmers on cropping practices, technology dissemination, crop protection from pests and prices of crops in the market.

The objectives of both agri-clinic and agri-business centres are to supplement the efforts of the government’s extension services to make available supplementary sources of input supply and services to needy farmers.

The scheme has been aimed at providing gainful employment to agriculture graduates (those youths acquiring knowledge in agriculture and on the lookout for scope) in new emerging areas in agriculture and allied sectors. The scheme is open to all agricultural graduates in subjects like horticulture, animal husbandry, fishery, dairy, veterinary, poultry farming, pisciculture and other allied activities.

ADVERTISEMENTS:

According to NABARD, the salient feature of the agri-clinic and agribusiness centres include 100 per cent refinance support to banks and automatic refinance facility up-to Rs 15 lakh.

If in case, the prospective borrowers are not able to provide the required money, the same can be supported out of the soft loan “margin money assistance fund” of the NABARD, subject to maximum cap of 50 per cent of the margin prescribed by banks.

Such loans to banks will be interest free, but banks may charge service charges at three per cent per annum. The project can be taken up by the agriculture graduates either individually or on group basis and the ceiling for the cost of the project by individual is Rs 10 lakh and by group is Rs 50 lakh, as fixed by NABARD.

Essay # 6. Other Plans of NABARD:

In order to reduce the farmers’ distress, NABARD has designed a Rs 2,000 crore plan aimed at helping them earn a supplementary income. As part of the Strategy, a National Milk Plan has been launched in 325 districts across the country with help from National Dairy Development Board to ensure that every farmer gets a regular daily subsidiary income to overcome distress during crop failures.

NABARD has also launched an innovative village adoption scheme in July 2007 for integrated and holistic development of villages. Initially, NABARD proposes to adopt 400 villages which would become a model for development and also rope in the lead banks to expand this initiative. It is expected that every year 1,200 villages are expected to be developed by NABARD and lead banks once this scheme works successfully.

In order to give support to the development of micro finance, NABARD would be setting up an institution with a corpus of Rs 500 crore in 3 years. These measures are aimed at alleviating the suffering of debt ridden farmers, some of whom even resort to suicide and ensure a regular income during adverse situations besides attaining overall development of villages.

Current Assistance by NABARD:

ADVERTISEMENTS:

In recent years, the amount of assistance sanctioned by NABARD has been increasing. The amount of loan sanctioned by NABARD increased from Rs 1,68,67.2 crore in 2004-05 to Rs 29,596 crore in 2005-06 and then to Rs 35,243 crore in 2006-07. Against which the amount of loan disbursed by NABARD was Rs 12,894 crore in 2004-05, Rs 25,345 crore in 2005-06 and Rs 28,139 crore in 2006-07.