Essay on Disinvestment Policy in India!

The policy of the government on disinvestment has evolved over a period often years. It started with selling of minority shares in 1991-92 and continues today with emphasis on strategic sale. According to the ministry of Disinvestment, the implementation of the present policy has shown tremendous benefits of privatization to the taxpayers, the economy, the stock market and the employees. We shall briefly review the policy statements made by different governments in the last ten years in a chronological order.

The Initial Phase:

1. Interim Budget 1991-92:

The policy as enumerated in the interim budget 1991-92 of Chandrashekar Government (November 1990 – June 1991) was to divest up to 20 per cent of the government equity in selected PSEs in favour of public sector institutional investors The objective of the policy was stated to be as follows – It has been decided that the government would disinvest up to 20 per cent of its equity in selected public sector undertakings, in favour of mutual funds and financial or investment institutions in the public sector. The disinvestment, which would broad base the equity improve management and enhance the availability of resource for these enterprises, is also expected to yield Rs. 2,500 crores to the exchequer in 1991-92.

2. Industrial Policy Statement July 1991:

ADVERTISEMENTS:

The Industrial Policy Statement of July 1991 of Narasimha Rao Government stated that the government would divest part of its holdings in selected PSEs, but did not place any cap on the extent of disinvestment.

Nor did it restrict disinvestment in favour of any particular class of investors. The objective for the disinvestment was stated to be to provide further market discipline to the performance of public enterprise In the case of selected enterprises, part of government holdings in the equity share capital of these enterprises will be disinvested in order to provide further market discipline to the performance of public enterprises.

3. Budgets 1991-92 to 1995-96:

In the budget 1991-92 pronouncements, the cap of 20 per cent for disinvestment was reinstated and the eligible investors’ universe was again modified to consist of mutual funds and investment institutions in the public sector and the workers in these firms. The objectives too were modified, the modified objectives being: “to raise resources, encourage wider public participation and promote greater accountability”.

All the five budgets of Manmohan Singh (1991-92 to 1995-96) aimed at:

ADVERTISEMENTS:

(a) Stabilisation of the economy

(b) Structural adjustments and

(c) Strengthening of the social sector, Singh began with the Big Bang policy of economic reforms highlighted by the Shock Therapy of devaluation, together with liberalization and globalisation and ended with the strategy of ‘Gradualism’ and emphasized the necessity of giving a human face to the reform process. He succeeded in creating a credible space for the process of reforms in India.

Inspired by the basic philosophy of the New Economic Policy, the government of India visualized in the 8th Five Year Plan (1992-93 to 1996-97) that the State would play the role of a ‘facilitator’. The plan assumed that in a competitive and market-friendly economy, the private enterprise-based manufacturing sector would play a crucial role in achieving an overall industrial growth rate of 7.5 per cent per annum. It laid emphasis on competitive efficiency and qualitative improvement.

4. Rangarajan Committee on Disinvestment:

ADVERTISEMENTS:

The Rangarajan Committee on the ‘Disinvestment of shares in PSEs’ (April 1993) emphasized the need for substantial disinvestments. The major recommendations of the committee were: It stated that the percentage of equity to be divested could be up to 49% for industries explicitly reserved for the public sector.

It recommended that in exceptional cases, such as the enterprises, which had a dominant market share or where separate identity has to be maintained for strategic reasons, the target public ownership level could be kept at 26%, that is, disinvestments could take place to the extent of 74%.

In all other cases, it recommended 100% divestment of government stake. Holding 51% or more equity by the government was recommended only for six Schedule industries, namely:

(i) Coal & Ignite,

(ii) Mineral oils,

(iii) Arms, ammunition and defence equipment,

(iv) Atomic energy,

(v) Radioactive minerals and

(vi) Railway transport.

ADVERTISEMENTS:

Criteria for Valuation of Shares:

Among the three criteria viz. Net asset value, profit earning value and discounted cash flow value, the discounted cash flow has the greatest relevance, though it is the most difficult operationally. Each company would need to be studied carefully with the help of a merchant banking firm taking into account factors such as value of assets, its market share potential, profit earning capacity and the prevailing price in the market for shares of similar enterprises in the private sector.

Preparatory Steps:

The preparatory steps recommended by the Committee include conversion into company form, wherever necessary, deciding the desirable level of equity and restructuring the financials with a proper debt/equity gearing, assessing the ongoing plans of PSEs and examining the scope.

ADVERTISEMENTS:

Modus Operandi of Disinvestment:

The Committee has recommended that once a reasonable market price established in a normal trading atmosphere over a reasonable period of time, the fixed price method would be appropriate. In all other cases, the auction method with wide participation may be adopted.

Standing Committee on Public Enterprise Disinvestment:

ADVERTISEMENTS:

The committee has suggested that the government may consider creating a Standing Committee on Public Enterprise Disinvestment to recommend enterprise-specific action for reform, restructuring and disinvestment as well as monitoring and evaluating the process of implementation.

5. The Common Minimum Programme 1996:

The highlights of the policy formulated by the United Front Government were as follows:

To carefully examine the public sector non-core strategic areas,

To set up a Disinvestment Commission for disinvestment related matters

To take and implement decisions to disinvest in a transparent manner

To assure job security, opportunities for retraining and redeployment

ADVERTISEMENTS:

No disinvestment objective was, however, mentioned in the policy statement

P. Chidambaram continued the same directions of the economic reforms as was initiated by Manmohan Singh. United Front Government’s Common Minimum Programme overshadowed his two budgets. The main message of both the CMP and the budgets was that the government would pursue economic policies, which will promote growth with social justice and lead to a greater self-reliance.

As a prelude to disinvestment, profitable PSEs were given more financial and managerial autonomy. The nine PSEs chosen for this purpose were: IOC, ONGC, HPCL, BPCL, IPCL, VSNL, BHEL, SAIL and NTPC, referred to as “Navaratnas” in the 1997-98 budget. The budget envisaged realizing Rs. 4,800 crores through disinvestment.

He also introduced certain measures like: replacing FERA (Foreign Exchange Regulation Act) with FEMA (Foreign Exchange Management Act), increasing the limit of portfolio investment of the Foreign Institutional Investors (FIIs) and Non-Resident Indians (NRIs) from 24% to 30%, boosted the economic reforms started by Singh.

6. Recommendations of Disinvestment Commission (Feb1997-Oct 1999):

In pursuance of the Common Minimum Programme of the UFG, a public sector Disinvestment Commission was constituted in August 1996 initially for a period of three years. The composition of the Commission was made up of G.V. Ramakrishnan as full-time Chairman, four other members and a full-time Secretary.

Five lists of PSEs, with 40 in September 1996, 10 in March 1997, 10 in July 1998, 8 in January 1999 and 4 again in January 1999 respectively totaling to 72 PSEs were referred to the Commission. The Commission submitted its recommendations in twelve reports between February 1997 and August 1999. It recommended disinvestment modalities on 58 PSEs.

The Broad Terms of Reference of the Disinvestment Commission:

(i)To draw a comprehensive overall long-term disinvestment programme within 5-10 years for the PSUs referred to it by the Core Group,

ADVERTISEMENTS:

(ii) To determine the extent of disinvestment (total/ partial indicating percentage) in each of the PSU.

(iii) To prioritize the PSUs referred to it by the Core Group in terms of the overall disinvestment programme,

(iv) To recommend the preferred mode(s) of disinvestment (domestic capital markets/international capital markets/ auction/private sale to identified investors/any other) for each of the identified PSUs. Also to suggest an appropriate mix of the various alternatives taking into account the market conditions.

(v) To recommend a mix between primary and secondary disinvestments taking into account Government’s objective, the relevant PSU’s funding requirement and the market conditions,

(vi) To supervise the overall sale process and take decisions on instrument, pricing, tuning, etc. as appropriate

ADVERTISEMENTS:

(vii) To select the financial advisers for the specified PSUs to facilitate the disinvestment process

(viii) To ensure that appropriate measures are taken during the disinvestment process to protect the interests of the affected employees including encouraging employees’ participation in the sale process,

(ix) To monitor the progress of disinvestment process and take necessary measures and report periodically to the Government on such progress,

(x) To assist the Government to create public awareness of the Government’s disinvestment policies and programmes with a view to developing a commitment by the people,

(xi) To give wide publicity to the disinvestment proposals so as to ensure larger public participation in the shareholding of 0» enterprises; and (xii) To advice the Government on possible capital restructuring of the enterprises by marginal investments, if required, so as to ensure enhanced realization through disinvestment. Source: Ministry of Industries, DPE Resolution No. 11013/3/96-Adm.dated 23rd August 1996.

Disinvestment Modalities Recommended in Reports I to XIII and action taken by the Government:

Status of Government Decision Modalities of disinvestment No. Names Accepted Implemented Being implemented Awaited Trade Sale 9 ITDC, MFIL, HCIL, MFIL HCIL, R-Ashok PHL, PEC R-Ashok, PHL, MSTC, U-Ashok, ITDC, SIIL, PEC MSTC, SIIL Strategy Sale 30 HTL, ITL BALCO, BALCO, HTL, MECON, KIOCL, ITI, MFL, BRPL, KIOCL, MFL, IBP, HZL, PPL IPCL, BRPL, MFL, HPL, HSCL, EIL, IBP, HPL, NEPA, HCL SCI NEPA MOIL, RITES HZL PPCL NFL, FACT, PPCL, NFL, AI, EIL, FACT, RINL IPCL, HCL, SCI, HSCL, STC, MMTC, HIL AI, STC, MMTC, HLL, RCFL PPL, MECON, HIL, RCFL, RINL, MOIL, RITES, NLC Offer of Shares 7 GAIL, CONCOR, MTNL, CONCOR, MTNL, NALCO, HOCL NMDC, BHEL, NALCO, NMDC, BHEL, GAIL, HOCL Disinvestments deferred 8 OIL, ONGC NTPC OIL, ONGC, CEL, MECL NHPC, POWERGRID, NTPC, NHPC, SAIL, CEL, MECLPGCL, SAIL, HLL Closure/Sale of assets 4 EPIL, ET&T, HVOC, RICL ET&T, HVOC EPIL, RICL TOTAL 58 7 11 25 15 Source: Ministry of Industries, DPE Resolution No. 11013/ 3/96-Admn.dated 23rd August 1996.

The Second Phase (1998-99 to 2004-2005):

The policy of the National Democratic Alliance (NDA) on disinvestment of the PSEs is reflected in its National Agenda (NA) for governance and its Swadeshi Philosophy which is centered on nationalism, indigenisation and self-reliance. Yashwant Sinha presented his government’s budgets with a belief that it is not merely a jugglery of numbers; it should reflect the economic philosophy of the party in power.

ADVERTISEMENTS:

In a resolution on January 12, 1998, the Department of Public Enterprises made some modifications in the terms of reference of the Disinvestment Commission as follows:

In partial modifications of this Ministry’s Resolution No. 11013/3/96-Admn. dated 23-8-96 constituting the Public Sector Disinvestment Commission, Paras 3, 4 and 5 thereof are deleted and substituted by the following:

3(i) The Disinvestment Commission shall be an advisory body and its role and function would be to advise the Government on Disinvestment in those public sector units that are referred to it by the Government.

3(ii) The Commission shall also advise the Government on any other matter relating to disinvestments as may be assigned to it by the Government.

3(iii) in making its recommendations, the Commission will also take into consideration the interests of workers, employees and others stake-holders, in the public sector unit(s).

3(iv) the final decision on the recommendations of the Disinvestment Commission will vest with the Government.

Budget 1998-99:

In the 1998-99 budget, the government accorded high priority to boosting private investment, including foreign investment in industry. The government de-licensed Coal and Ignite and Petroleum products. The government decided to disinvest specific portions of equity from IOC, SAIL, VSNL and CONCOR.

“As a part of the overall strategy, government decided to restructure Indian Airlines and to undertake a phased divestment over three years bringing the government’s equity holding down to 49%. When an unreviable unit is closed, the government decided to provide a safety net to the workers of enterprises destined for closure by providing a liberal and attractive compensation package prior to closure.”

It was proposed to make applicable the benefits of VRS package, namely 45 days wages for each completed year of service. Added to this was 60 months or 5 years salary or wages as compensation in the case of those completing 30/more years of service.

A separate fund was being constituted for this purpose. ” The government had also decided that in the generality of cases, the government shareholding in PSEs would be brought down to 26%. In case of PSEs involving strategic considerations, government will continue to retain majority holding. The interest of the workers will be protected in all cases.”

Budget 1999-2000:

The government’s strategy towards PSEs continued to encompass a judicious mix of strengthening strategic units, privatizing non-strategic ones through gradual disinvestment or strategic sale and devising viable rehabilitation strategies for weak units.

The Disinvestment Commission so far had submitted 8 reports for 43 PSEs. In 1999-2000 the budget proposed to raise 10,000 crores through disinvestment programme to help the government to fund the requirements of social and infrastructure sectors.

Budgetary support under VRS scheme so far restricted to loss-making units, were extended to marginally profit making ones to reduce manpower to remain viable. In order to reduce the burden on budget, the government encouraged PSEs to issue bond to workers opting for VRS, with a guarantee to repay through RBI with interest payments.

The Finance Minister, Yaswant Sinha promised to speed up “public sector disinvestment”, that is the selling off of PSEs to investors who will then transform them into profitable companies. Sinha set a target of Rs. 100 billion in the current fiscal year and hoped to raise Rs. 80 billion through disinvestment. He announced that the government was already processing rec- billion through disinvestment.

He announced that the government was already processing recommendations for the disinvestment of 43 PSEs, and that proposals to sell off several other units would soon be referred to the Disinvestment Commission. Singh also announced a series of measures aimed at facilitating foreign investment including speeding up the processing of applications for regulatory approval and setting up a Foreign Investment Implementation Authority (FIIA).

On 16th March 1999, the government classified the Public Sector Enterprise into strategic and non-strategic areas for the purpose of disinvestment. It was decided that the Strategic Public Sector Enterprises would be those in the areas of Arms and ammunitions and the allied items of defence equipment, defence air crafts and warships; Atomic energy (except in the areas related to the generation of nuclear power and applications of radiation and radioisotopes to agriculture medicine and non-strategic industries); Railway transport.

All other Public Sector Enterprises were to be considered non-strategic. For the non-strategic Public Sector Enterprises, it was decided that the reduction of government stake to 26% would not be automatic and the manner and pace of doing so would be worked out on a case-to- case basis. A decision in regard to the percentage of disinvestment i.e. government stake going down to less than 51% or to 26%, would be taken on the following considerations-

Whether the industrial sector requires the presence of the public sector as a countervailing force to prevent concentration of power in private hands and whether the industrial sector requires a proper regulatory mechanism to protect the consumer interests before Public Sector Enterprises are privatized.

Department of Disinvestment:

The NDA Government set up an independent Department of Disinvestment to deal with all matters relating to disinvestment in public sector enterprises, headed by Information and Broadcasting Minister, Arun Jaitly. This was the first time a department had been created for disinvestment. Defending the Government privatization moves while taking over the additional independent charge, Arun Jaitley said that the Government could not impose a burden of millions of rupees on taxpayers to revive sick PSEs.

Arun Jaitley said that the previous Governments, including those headed by Chandra Shekar and the United Front (UF) had talked of disinvestment but his Government had the courage and conviction to carry our economic reforms.

The Chandra Shekar Government had initiated a 20 percent disinvestment of PSEs to mutual funds and financial institutions. The UF Government had provided for the setting up of a Disinvestment Commission and referred several companies to it.

All the PSEs working under various ministries were to report to the new department in matters relating to disinvestment and pricing of their shares. Earlier, the Department of Public Enterprises was coordinating between various PSEs and the Government on disinvestment matters. The Department was renamed Ministry of Disinvestment and Arun Shourie replaced Arun Jaitley and was appointed Minister of Disinvestment from September 6, 2001.

Budget 2000-2001:

The highlights of the policy for the year 2000-01 were that for the first time the Government made the statement that it was prepared to reduce its stake in the non-strategic PSEs even below 26% if necessary, that there would be increasing emphasis on strategic sales and that the entire proceeds from disinvestment / privatisation would be deployed in social sector, restructuring of PSEs and retirement of public debt.

The main elements of the policy were reiterated as follows:

To restructure and revive potentially viable PSEs;

To close down PSEs which cannot be revived;

To bring down Government equity in all non-strategic PSEs to 26% or lower, if necessary;

To fully protect the interests of workers;

To put in place mechanisms to raise resources from the market against the security of PSEs’ assets for providing an adequate safety-net to workers and employees;

To establish a systematic policy approach to disinvestment and privatisation and to give a fresh impetus to this programme, by setting up a new Department of Disinvestment;

To emphasize increasingly on strategic sales of identified PSEs;

To use the entire receipt from disinvestment and privatisation for meeting expenditure in social sectors, restructuring of PSEs and retiring public debt.

Address by the President of India to Parliament in the Budget Session (February, 2001)

“The public sector has played a vital role in the development of our economy. However, the nature of this role cannot remain frozen to what it was conceived fifty years ago a time when the technological landscape, and the national and international economic environment were so very different. The private sector in India has come of age, contributing substantially to our nation-building process. Therefore, both the public sector and private sector need to be viewed as mutually complementary parts of the national sector. The private sector must assume greater public responsibilities just as the public sector needs to focus more on achieving results in a highly competitive market. While some public enterprises are making profits, quite a few have accumulated huge losses. With public finances under intense pressure, Governments are just not able to sustain them much longer. Accordingly, the Centre as well as several State Governments are compelled to embark on a programme of disinvestment. The Government’s approach to PSUs has a three-fold objective: revival of potentially viable enterprises; closing down of those PSUs that cannot be revived; and bringing down Government equity in non-strategic PSUs to 26 percent or lower. Interests of workers will be fully protected through attractive VRS and other measures. This programme has already achieved some initial successes. The Government has decided to disinvest a substantial part of its equity in enterprises such as Indian Airlines, Air India, ITDC, IPCL, VSNL, CMC, BALCO, Hindustan Zinc, and Maruti Udyog. Where necessary, strategic partners would be selected through a transparent process”.

The government took a step to de-link disinvestment from the annual budget exercise, which has a negative impact in the pricing of shares. Consequently, in a departure from past practice, the Finance Ministry would not assume any receipt from PSE disinvestment in the main budget 2000-2001. The Finance Minister began his budget speech with the following proclamation:

Our Public Sector has expanded in almost every year of economic activity. In many ways, it has served the nation well; capability has been developed all round and a strong industrial base built up. These enterprises must now be strengthened to compete and prosper in the new environment.

Financial and business restructuring plans of a number of PSEs including SAEL and HMT had been approved. Government decided to close down 8 non-viable PSEs during the current year. A package of measures for revival and closure of the various mills of National Textiles Corporation has also been approved.

To maximize returns to government, the approach had changed from the disinvestment of small lots of shares to strategic sales of blocks of shares to strategic investors. The government had approved privatisation of 27 companies including VSNL, Air India and Maruti Udyog Limited, in which the process of disinvestment was expected to be completed during the course of 2000-01.

The budget announced the setting up of a Department of Disinvestment to accelerate the process of privatisation. The Department (Ministry) of Disinvestment was formed on December 10, 1999.

The target proceeds to be realized from disinvestment during the next year was Rs 12,000 crores out of which Rs 7000 crores would be used for providing restructuring assistance to PSEs, safety net to workers and reduction of debt burden. The balance of Rs 5(XX) crores would be used to provide additional budgetary support for the plan primarily in the social infrastructure sector.

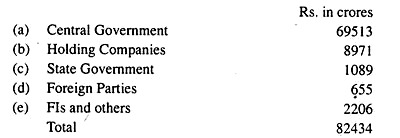

Sources of Equity Investment in PSEs as on 31st March 2000 were as follows:

The Central Government’s direct involvement and involvement through holding companies was of the order of Rs. 78484 crore (Table 4.3). Prior to 31st March 2000 most of the equity sales were through sale of minority shares in the market. The policy changed around 31st March 2000 and subsequently all the sales have been strategic sales i.e. with change in management. The benefits of disinvestment through the two policies need to be analyzed.

Other than the Lagan Jute Machinery Company Limited and Modem Food Industries (India) Limited; only minority stakes in different PSEs were sold till 2000. The Government has now modified its policy to emphasize on strategic sales. During the last quarter of 2000-01, 51% shares of BALCO have been sold to a strategic investor. The disadvantages of sale of minority stakes by the Government have been found to be as follows:

Lower realizations, because the management control is not transferred. Moreover, it signals lack of commitment to efficient governance of PSEs. With the limited holding remaining with the Government after minority sales, only small stakes can be offered to the strategic partner, if it is decided to go for a strategic sale subsequently.

This depresses the possibility of higher realizations from the strategic partner, especially since the latter has to offer the same price to other shareholders also through an open offer. The minority sales also give the impression that the main objective of the Government is to obtain funds for reducing its fiscal deficit.

Budget 2001-02:

The objectives of this budget was to use the proceeds for providing restructuring assistance to PSUs, Safety nets to workers. Reduction of debt burden and Additional budgetary support for the Plan, primarily in the social and infrastructure sectors (contingent upon realization of the anticipated receipt.)

Given the advanced stage of the process of disinvestment in many of these companies, I am emboldened to take credit for a receipt of Rs 12000 crore from disinvestment during the next year. An amount of Rs 7000 crore out of this will be used for providing restructuring assistance to PSUs, safety net to workers and reduction of debt burden.

A sum of Rs 5000 crore will be used to provide additional budgetary support for the Plan primarily in the social and infrastructure sectors. This additional allocation for the plan will be contingent upon realization of the anticipated receipts. In consultation with Planning Commission I shall come up with Sectoral allocation proposals during the course of the year.

On July 24 2001, the Ministry of Disinvestment, in a Resolution, reconstituted the Public Sector Disinvestment Commission, initially for a period of two years. Dr. R.H. Patil was appointed chairman of the commission.

The broad terms of reference of the Commission are as follows:

It shall be an advisory body and its role and function would be to advise the Government on Disinvestment in those public sector units that are referred to it by the Government. It shall also advise the Government on any other matter relating to disinvestment as may specifically be referred to it by the Government, and also carry out any such other activities relating to disinvestment as may be assigned to it by the Government.

In making its recommendations, it will also take into consideration the interest of workers, employees and other stakeholders, in the public sector unit(s). The final decision on the recommendations of the Disinvestment Commission will vest with the Government.

The Government of India had also decided that ‘non-strategic’ Public Sector Undertakings including subsidiaries (excluding IOC, ONGC & GAIL) stand referred to Disinvestment Commission for it to prioritize, examine and make recommendations to the Government.

While doing so, the Commission would take into consideration the existing Government policy, as articulated on 16th March, 1999 and the budget speeches of the Finance Minister from time to time (reproduced in “Disinvestment Policy & and Procedures”), and make the prioritization on the following criteria.

(i) Where disinvestments in PSE would lead to large revenues to the Government,

(ii) Where disinvestments can be implemented with minimum, impediments and in a relatively shorter time span, and

(iii) Where continued bleeding of Government resources can be stopped earlier.

Budget 2002-03:

The Finance Minister, Jaswant Singha in his budget strategy said that he had laid out a comprehensive agenda for second-generation reforms. ‘My aim is to consolidate and implement these policies at all levels. I propose to take this process further at the State level through a strategy of reform linked to public funding. It was a budget for consolidating, widening and deepening the reform process, and devoted to development’.

In the petroleum sector, Administered Price Mechanism (APM) was dismantled from April 1, 2002. The pricing of petroleum products was to be market determined. In the banking sector, reforms were to be continued to enhance the efficiency and competitiveness. Foreign banks were permitted to operate in India as fully owned branches with specific permission of the RBI.

The budget emphasized that industrial and other companies required restructuring on a continuous basis to deal with forces of competition. The Finance Minister announced the appointment of a High Level Expert Group to develop a new pension scheme.

The budget announcement said that disinvestment of 6 more companies and the remaining hotels of HCI and ITDC would be completed in one-year time. Disinvestment receipts for the year were Rs 3,348 crore excluding the special dividend from VSNL of Rs 1,887 crore as against the target of Rs 12,000 crore (a shortfall of 72 per cent). The Finance Minister announced a target of Rs 13,200 crore for 2003-04.

In the financial year 2002-03, the country could not rein in its finances and keep the fiscal deficit according to its budget figures. The fiscal deficit was at Rs. 1454.7 billion as against a budgeted figure of Rs. 1,355 billion, an overshooting y about 7 per cent. The deficit as a measure of the GDP was 5.9 per cent as against a budgeted 5.3 per cent.

Budget 2003-04:

The focus of the union budget was clearly on growth through a big push to infrastructure- related activities. The budget had specific provisions aimed at catalyzing meaningful private investment in activities that had hitherto been the exclusive preserve of Government. The Public Private Partnership (PPP) initiative was expected to transform the role of Government from being a provider of public services to being a purchaser on behalf of users.

A major concern was the disinvestment proceeds. The actual till the end of February 2004 was Rs. 1,458 crore as against the target of Rs. 13,200 crore. The idea of using disinvestment proceeds to retire Government debt, announced with so much fanfare in the Union budgets a couple of years ago, had been forgotten. But suddenly, m March 2004, there was an unprecedented success in the realization of proceeds to the tune of Rs. 14,500 crore through six big disinvestments.

It was proposed to finalize in early 2003-04 the details about the Disinvestment Fund and Asset Management Company to hold residual shares in post disinvestment period. Foreign Direct Investment (FDI) limit in banking companies was raised from 49 per cent to 74 per cent.

Budget 2004-05:

This was the first Union budget under the UPA Government, which assumed power under the Prime Minister ship of former Finance minister, Manmohan Singh. It was a reformist budget, growth oriented and populist. It was old wine in new bottle.

It was extensively based on the UPA’s Common Minimum Programme (CMP). The sharper focus on agriculture and rural poor articulated in the CMP was reflected in the budget. According to the Finance Minister, the CMP was the guiding light for the budget.

Finance Minister, P. Chidambaram had kept his options open on the disinvestment front. While keeping a modest target of Rs 4,000 crore as disinvestment proceeds, compared with Rs 15,322 crore garnered by the NDA Government in 2003-04, Chidambaram stated that disinvestment and privatization were useful economic tools and that his Government would selectively use these tools consistent with the declared policy. The budget had further emphasized the views of Manmohan Singh that the reforms must continue, but with a ‘human face’.

The Finance Minister announced the setting up of Board for Reconstruction of Public Sector Enterprises (BRPSE), which would advise the Government on the matter of sick PSEs as well as its disinvestment programme. He also announced the sale of equity in NTPC and some other cases, which were under examination. He laid stress on the manner in which disinvestment proceeds would be used.

Policies of Left Front on Disinvestment:

The Left parties (CPM, CPI etc.) have been consistently critical of the reform policies of both. Congress as well as NDA Governments. Their election manifestos of 1991, 1998, 1999 and 2004 have claimed that economic reforms require a different orientation. They have advocated an alternative set of policies for self-reliant economic development.

Land reforms as key to progress;

Development of agriculture with increased public investment, comprehensive insurance scheme, expansion of credit facilities etc.;

Industrial development with increased investment in infrastructure, review of power and telecom policies, strengthening of public sector, protection to domestic industry, encouragement of small-scale industries etc.

Financial sector reforms by strengthening LIC and GIC, to make banks accountable and restore social priorities, to regulate capital flows etc.

The Left Front had called for a withdrawal of all ‘anti-national’ economic policies of the NDA Government. It was opposed to the disinvestment of PSEs particularly profit-making ones. According to their manifestos, the sale of Public sector assets meant a transfer of public resources to private hands, which is dangerous to the country’s development. In this context, the Left parties had demanded scrapping of the disinvestment ministry.

Policy Regarding Profit making Enterprises:

The loss-incurring enterprises were historically loss-incurring private enterprises that were nationalized in the 1970s. The problems with the loss-incurring ones will continue unless they are closed down. Only those who have positive market value can be sold; it is also true with those that have eroded their net worth but the assets can be sold as a block.

Profit making PSEs are privatized on two grounds:

(1) They fetch better prices; and

(2) Unless an enterprise is in the strategic sector and unless the market structure is a monopoly, profit making is an argument for disinvestment.

The Ministry of Disinvestment holds that the ‘profitable PSEs should be the first targets for disinvestment. After all, if they can turn even a modest profit suffering from government mismanagement and chronic under-investment, think how profitable they could become in private sector hands.

That would mean more taxes to support government, and more jobs as the businesses expand. Just because a PSE looks healthy does not mean that it cannot grow even bigger, healthier and more profitable. It is followed by the government that once all the impediments like government intervention, mismanagement etc., of a PSE are removed, it will perform better than before.

And a profit making enterprise is more attractive to potential investors who can make it work better, increase production and provide goods and services to consumers at lower costs than before. Extracts from the Budget Speech for 2002-03 of the Finance Minister.

Privatization:

‘With the streamlined procedure for disinvestment and privatization, I am happy to report that the Government has now completed strategic sales in 7 public sector companies and some hotels properties of the Hotel Corporation of India (HCI) and the India Tourism Development Corporation (ITDC).

The change in approach from the disinvestments of small lots of shares to strategic sales of blocks of shares to strategic investors has improved the price earnings ratios obtained. We expect to complete the disinvestment in another 6 companies and the remaining hotels in HCI and ITDC this year.

Disinvestment receipts for the present year are estimated at Rs 5,000 crore excluding the special dividend from VSNL of Rs 1,887 crore. Encouraged by these results, I am once again taking credit for a receipt of Rs 12,000 crore from disinvestment next year’.

According to Philip Jackson, who has advised many governments on privatising their regulated industries and companies, privatization is a complicated process and a full analysis of the implications needs to be undertaken before acting on it. He stated that you needed clear regulation, good governance and sustainable dividends for the privatisation exercise to succeed.

“Privatisation takes longer than you think and the complexities of the process are such that we should not be surprised by its pace”, Jackson argued that we should take a long term view and the analysis process should be designed in an action-oriented process. Jackson was involved in the privatisation of Balco and the Andhra Pradesh State Electricity Board. He said that privatisation was first and last a political act with an economic consequence.

According to him, the privatisation of Balco was a healthy precedent. He further stated that Nalco, another PS aluminum giant, should also be privatized even though that process might be delayed. His logic of privatisation was simple. For a public sector organisation to stay competitive, it needs to have access to the same financial weaponry that its private sector competitor has.

Public sector companies can only be on an equal footing with the private sector if their shareholders give them the desired flexibility. Therefore, the public good is the best served if the government focuses on providing a stable, clear and effective regulatory system and gets out of the business of running industries. The author is professor of economics and principal, St. Xavier’s College, Kolkata.