In this essay we will discuss about Consumer’s Surplus. After reading this essay you will learn about: 1. Concept of Consumer’s Surplus 2. Consumer’s Surplus in Terms of Indifference Curve Analysis: Hicks’ Formulation 3. Criticisms of Marshall’s Consumer Surplus 4. Practical Usefulness of the Concept.

Contents:

- Essay on the Concept of Consumer’s Surplus

- Essay on the Consumer’s Surplus in Terms of Indifference Curve Analysis: Hicks’ Formulation

- Essay on the Criticisms of Marshall’s Consumer Surplus

- Essay on Practical Usefulness of the Concept

Essay # 1. Concept of Consumer’s Surplus:

The price which a consumer pays for a commodity is always less than what he is willing to pay for it, so that the satisfaction which he gets from its purchase is more than the price paid for it and thus he derives a surplus satisfaction which Marshall calls Consumer’s Surplus (CS).

In the words of Marshall, The excess of the price which he would be willing to pay rather than go without the thing, over that which he actually does pay, is the economic measure of the surplus satisfaction. It may be called “consumer’s surplus.”

ADVERTISEMENTS:

Instances of commodities from which we derive consumer’s surplus in our daily life are salt, newspapers, postcard, matches, etc. Consumer’s surplus, according to Marshall, is a part of the benefit which a person derives from his environment or conjuncture.

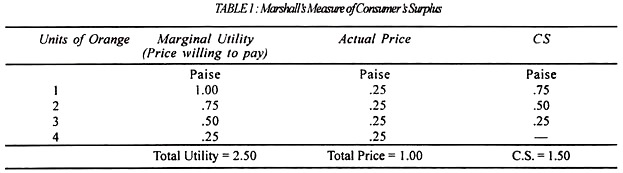

To illustrate, let us suppose that a consumer is willing to buy 1 orange if its price were Re 1, 2 oranges if the price were 75 paise, 3 oranges at 50 paise and 4 oranges if it were 25 paise. Suppose the market price is 25 paise per orange. At this price, the consumer will buy 4 oranges and enjoy a surplus of Rs 1.50 (.75 + .50 + .25). This is shown in Table 1

The consumer’s surplus can also be defined as the difference between what a consumer is willing to pay for a commodity and what he actually does pay for it. Our hypothetical consumer is prepared to pay Rs. 2.50 (= 1.00+.75+.50+ .25) for four oranges but actually pays Re 1, and therefore derives a surplus of Rs. 1.50 (Rs 2.50-1.00).

ADVERTISEMENTS:

It can also be expressed as: CS = Total Utility-Marginal Utility or (price) x No. of Units of the commodity. On the basis of this formula, consumer’s surplus of Rs 1.50 = 2.50 [Total Utility] -1.00 (= .25 x 4). It is based on the assumption that the price of the commodity equals its marginal utility.

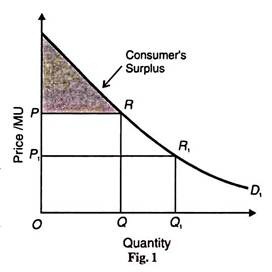

Consumer’s surplus is represented diagrammatically in Figure 1 where DD1 is the demand curve for the commodity. If OP is the price, OQ units of the commodity are purchased and the price paid is OP x OQ = area OQRP. But the total amount of money he is prepared to pay (total utility) for OQ units are OQRD.

Therefore, CS = OQRD — OQRP = DRP. If the price of the commodity falls to OP1 the consumer’s surplus increases to DR1F1 and conversely a rise in price would diminish it. In other words, consumer’s surplus is the area between the demand curve (DD1) and the price line (PR or P1R1) and is equal to the triangle that is formed under the demand curve.

Essay # 2. Consumer’s Surplus in Terms of Indifference Curve Analysis: Hicks’ Formulation:

The Marshallian measure of consumer’s surplus is beset with numerous difficulties due to the unrealistic assumptions of the utility analysis. But the two basic assumptions which underlie the doctrine of consumer’s surplus are that utility is quantitatively measurable and marginal utility of money remains constant.

ADVERTISEMENTS:

Utility is something subjective which cannot be expressed in cardinal numbers and therefore, it is not possible either to add or subtract it. The indifference curve technique avoids this difficulty by measuring utility in ordinal numbers.

Consumer’s satisfaction is based on his scale of preferences shown on an indifferent map; all points on an indifference curve represent equal satisfaction. The assumption of constancy of marginal utility of money is also not acceptable for it ignores the income effect of the change in the price of a good.

The method of measuring consumer’s surplus with the aid of the indifference curve technique is superior to the Marshallian measure, for it studies the effect of price changes and income changes on their consumer’s surplus.

The credit for rehabilitating the concept of consumer’s surplus in terms of the indifference curve technique without assuming cardinal measurement of utility and the constancy of marginal utility of money goes to Prof. J.R. Hicks. We study below the two formulations given by Hicks.

1. The Marshallian Measure with Constant Marginal Utility of Money:

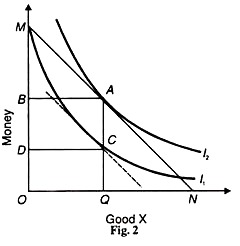

First, Hicks measures the Marshallian consumer’s surplus with constant MU of money in terms of the indifference curve analysis. Take Figure 2 where money is measured along the vertical axis and good X along the horizontal axis.

Suppose the budget line of the consumer is MN. Its slope equals the price of good X, assuming that the price of one unit of money is equal to I. Given the price of good X, the consumer is in equilibrium at point A where the indifference curve I2 is tangent to the budget line MN. At this point A, he has the combination of OQ quantity of good X and OB of money. He thus spends BM of his income in buying OQ quantity of X.

In order to find out the amount of money which the consumer would be willing to spend for OQ quantity of good X rather than go without it, we draw an indifference curve I1 from point M which is vertically parallel to the indifference curve I2 at point C, as shown by the dotted line drawn parallel to the line MN. Thus the two curves have the same slope at OQ quantity of X. The indifference curve I1 shows that the consumer is prepared to spend DM amount of money for OQ quantity of X.

ADVERTISEMENTS:

But in actuality, he spends BM on buying the same quantity of X. Hence DM – BM = DB = CA is the consumer’s surplus. It may be noted that Marshall assumed constant MU of money in his concept and to explain the Marshallian measure, Hicks assumed vertically parallel indifference curves. Thus when the slopes of indifference curves I1 and I2 at points С and A are equal, the assumption of constant MU of money is fulfilled.

2. The Marshallian Measure with Diminishing MU of Money:

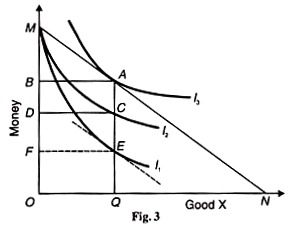

Hicks have demonstrated that the Marshallian consumer’s surplus can be measured by discarding the assumption of constant MU of money. This is illustrated in Figure 3 where initially the consumer is in equilibrium at point A when his budget line MN is tangent to the indifference curve l3. The consumer spends BM sum of money to buy OQ of X.

In order to find out the amount of money which the consumer would be willing to spend on the same quantity OQ of good X rather than go without it, draw an indifference curve 12 through M. This curve passes through the line AQ at point С where its slope is flatter than the slope of the curve I3 at point A.

It shows diminishing MU of money. The consumer is prepared to spend DM amount of money for OQ quantity of X. Thus the consumer’s surplus is DM —BM – DB = CA.

ADVERTISEMENTS:

To compare this Hicksian measure of consumer’s surplus with that of Marshall’s measure, draw another indifference curve I1, through M which is vertically parallel to the curve I3, at point E on the line AQ. This is clear from the dotted line parallel to the line MN.

This shows constancy of MU of Money. Now the Marshallian consumer’s surplus is FB which is larger than the Hicksian consumer’s surplus DB. Thus the Hicksian measure is similar to the Marshallian measure of constant MU of money.

So far we have studied the individual consumer’s surplus which is the sum total of the surplus from a number of commodities he buys, with a given money income. By adding up consumer’s surplus from any one commodity enjoyed by a number of individuals, the market consumer’s surplus for that commodity can be known.

ADVERTISEMENTS:

The demand schedule so formed will be the market demand curve. But it presupposes the non-existence of inter-personal differences in customs, habits and incomes of the consumers.

Superiority of Hicks’ Measure of CS over Marshall’s:

Hick’s measure of measuring consumer’s surplus is superior to Marshallian measure in the following ways:

1. Hicks does not measure utility cardinally because utility is subjective. Instead, he measures it in terms of indifference curve technique and removes the difficulty of measuring utility quantitatively.

2. Hicks does not regard marginal utility of money to be constant because when a consumer spends his income, the marginal utility of money with him increases.

3. Hicks’ measure is superior because it studies the effect of price and income changes in consumer s surplus.

Essay # 3. Criticisms of Marshall’s Consumer Surplus:

ADVERTISEMENTS:

Marshall’s measure of consumer’s surplus has been subjected to scathing criticisms from Ulisse Gobbi, Cannon, Nicholson, Taussig, Hicks, Sumuelson and others. Prof. Hicks is justified in saying that the doctrine of Consumer’s Surplus has caused more trouble and controversy than anything else in Book (iii) of Marshall s Principles. This ‘trouble and controversy’ have arisen from the assumptions on which this concept is based.

We discuss them below:

1. Utility not Measurable:

The concept of consumer’s surplus is based on the assumption that utility is quantitatively measurable. The moment we recognise that utility is not a measurable quantity, the doctrine of consumer’s surplus becomes misleading. Moreover, when we translate utility into monetary terms, e conclusions that follow are not in accord with common sense.

As pointed out by Prof. Knight it may be true that a starving millionaire may be willing to give £ 100,000 for a six penny loaf, but it is a little difficult to believe that when he gets it for 6d, he gains £99,999 -19s.- 6d. of surplus satisfaction.

2. MU of Money not Constant:

The doctrine of consumer’s surplus presupposes that the marginal utility of money remains constant throughout the process of exchange. This assumption undermines the very validity of this concept. For, when a consumer spends his given money income on the purchase of a commodity, the amount of money left with him is correspondingly reduced and its marginal utility to him increases.

While calculating consumer’s surplus we do not take into consideration this change in the marginal utility of money.

3. Neglects Complementary Goods:

ADVERTISEMENTS:

Marshall further assumes the utility of a good as dependent upon the supply of that good alone. He neglects the problem of complementarity of goods and thus considers one good as independent of the other. This assumption follows from the constancy of the marginal utility of money.

The utility of good X is dependent not only on its own supply but also on the supply of the related good Y. In other words, consumer’s surplus from the expenditure on good X will be different if only X is purchased and none of Y, and Y is bought after purchasing X, and X is bought first and Y afterwards. In all such situations, consumer’s surplus will be difficult to measure accurately.

4. Neglects Substitutes:

This concept assumes the absence of substitutes of the commodity from which the consumer derives the surplus, because the presence of substitutes like tea and coffee would make the measurement of consumer’s surplus difficult.

If there were neither tea nor coffee, the loss in utility would be much greater than if either tea or coffee were available. To evade this difficulty, Marshall grouped the two substitutes as one commodity under a common demand schedule. But this assumption makes the concept unrealistic, for it is not possible to find a commodity which has no substitutes at all.

5. Neglects Tastes and Sensibilities:

Marshall also assumes that the differences of wealth and sensibilities should be neglected in calculating consumer’s surplus. This is an arbitrary and unrealistic assumption because every consumer is prepared to pay more or less for the same commodity according to his tastes, sensibilities and income.

Even if the incomes of all the consumers were the same, their tastes and sensibilities would differ. The above criticisms are levelled against the assumptions of the doctrine. Critics are, however, not lacking in pointing out some other defects.

6. A Consumer does not pay more than the Actual Price:

ADVERTISEMENTS:

It has been pointed out by critics that since wants are unlimited and the means to satisfy them are limited a consumer cannot pay more than the actual price of the commodity. If he is not in a position to get a particular commodity at the current price, he will have some other substitute commodity.

Thus the very notion of consumer’s surplus is imaginary and unrealistic. What a consumer actually obtains when he is prepared to pay for a commodity Rs 20 instead of its actual price Re 1, it is the ‘psychic satisfaction’ of Rs 19, even though he does not possess this much of money.

7. Zero Consumers’ Surplus:

According to Ulisse Gobbi, if consumer’s surplus is regarded as the difference between the potential price and the actual price then in the ultimate analysis this surplus is reduced to zero. As a result, the consumer does not enjoy any surplus at all.

8. Utility Diminishes:

Prof. Patten questioned the correctness of the demand curve on which Marshall based this concept. As a consumer buys additional units of a commodity, his intensity for the earlier units diminishes which leads to the diminution of their utility for the consumer. Marshall failed to take into account this diminution of utility while calculating consumer’s surplus.

9. Not Possible to know the Prices Consumer is Willing to Pay:

Another difficulty relating to the demand curve is that it is not possible to know the entire demand schedule on which it is based. It is impossible to know what prices the consumer is prepared to pay for every unit of the commodity.

Therefore, consumer’s surplus from it cannot be calculated accurately. In Figure 1 consumer’s surplus represented by the area DRP can be measured only if the demand schedule from D to R is known. This can be known by mere guesswork or conjecture.

10. Consumer’s Surplus from Necessaries Indefinite:

ADVERTISEMENTS:

All critics agree on at least one point that the consumer’s surplus from necessaries is indefinite and unascertainable. The prices of necessaries are very low whereas utility derived from them is very high. Therefore, consumer’s surplus from them is infinite and indefinite. Rather than starve, a thirst person may be prepared to pay everything he possesses for a glass of water.

11. Not Measurable for Luxury Goods:

Prof Taussig criticised the doctrine on the plea that consumer’s surplus cannot be measured in the case of luxury goods or prestige articles. A fall in the price of articles like diamonds reduces their utility to their possessors, thereby reducing consumer’s surplus. In terms of Figure 1, it is not possible to draw the portion below R on the demand curve DD.in the case of luxury goods.

12. Hypothetical, Unreal and Imaginary:

Prof. Nicholson criticised the concept of consumer’s surplus by asking Marshall, “Of what avail is it to (say) that the utility of an income of (say) £ 100 a year is worth (say £ 100 a year)?” Nicholson’s contention was that. This concept is hypothetical, unreal and imaginary. It is so undoubtedly due to its unrealistic assumptions and an ingenious device of calculating it.

13. A Misnomer:

Critics have even questioned the very name of this notion “Consumer’s Surplus”. According to Prof. Boulding, since this concept is related to the purchase of a good, it is, therefore, the “buyer’s surplus”. To call it consumer’s surplus is a misnomer because surplus always accrues from the production of a commodity rather than from its consumption. But this terminological controversy in no way undermines the concept itself.

Conclusion:

The current trend is to discard the study of this concept from economic theory. Prof. Hicks attempts to rehabilitate it have failed to change the views of economists both in England and America. Prof. Robertson is mild when he considers it as “both intellectually respectable and useful as a guide to practical action” with a warning if “You do not expect too much of it.”

Prof. Samuelson is however, more sceptical about its utility in economic theory, when he says; “The subject is of historical and doctrinal interest with a limited amount of appeal as a mathematical puzzle. The economist had best dispense with it. It is a tool which can be used only by one who can get along without its use, and not be all such.”

Essay # 4. Practical Usefulness of the Concept:

Though severely criticised and beset with numerous difficulties of measurement, the concept of consumer’s surplus is of great practical utility in economic theory.

1. Environmental Benefits:

It emphasises the importance of the benefits which a person derives from his environments or conjunctures. A person living in a developed area (or country) enjoys greater consumer’s surplus than a person living in a remote or backward area (or country) because the former is able to get all the amenities of life cheaply and easily.

The conjectural or environmental advantages derived by people also enable us to compare the standard of living of the people living in different parts of the world.

The standard of living of the Asians (excluding the Japanese) is low as compared to the Europeans, as the former do not have the privilege to buy a large number of commodities. Either the modern amenities of life are not available to them, or if available, they are very costly.

2. To the Monopolist:

It is of practical importance to the monopolist in fixing the price of his commodity. If the commodity is such that the consumers are willing to pay more for it, they will enjoy large surplus if its price is kept low. In such a case, the monopolist can raise the price without affecting his sales.

If, however, he is a discriminating monopolist, he will fix the price low to enable consumers to enjoy some surplus. Thus the monopolist is guided by the knowledge of the consumer’s surplus in fixing the price of his product.

3. Distinction between Value-in-Use and Value-in-Exchange:

The concept of consumer’s surplus helps us in understanding the distinction between value-in-use and value-in-exchange of a commodity. Value-in-use means utility and value-in-exchange means the power of a good to exchange other goods.

The latter also implies the price of a good. Commodities like salt, postcards, matches etc. possess large consumer’s surplus because we are prepared to pay much more than their price. Though these commodities are priced low, their utility is immense to the buyers. Thus the concept of consumer’s surplus tells us that commodities which have a large value-in-use possess small value-in-exchange.

4. Water-Diamond Paradox:

It has been a paradox among economists and the general people over years as to why diamond is dearer than water. Water is necessary for life. It is so useful that it is not possible to live without it. Although diamond is beautiful and useful for some industrial processes but it is not essential for life.

Still, there is a paradox in the market that a less useful commodity like diamond is very costly while a more useful good like water is very cheap. This paradox is based on the concept of consumer’s surplus. Marginal profit or marginal appraisal of a commodity indicates how much money a consumer is willing to pay for that product. It shows consumer’s marginal utility or value-in-use for that product.

Marginal profit or marginal appraisal of per litre water for a consumer is less because the actual supply of water in the market is more while marginal utility or marginal profit of diamond is more because the actual supply of diamond is very low.

The market price of a product is determined not by its value-in-use or total utility but by its marginal utility or marginal profit, which depends upon the actual available quantity of that product.

The total value-in-use or total utility that a consumer obtains from the amount of a product is equal to the actually paid amount and consumer’s surplus. In the case of water, its market price is based on its marginal utility which is low while consumer’s surplus from that is very high. In the case of a diamond, due to its scarcity, its marginal utility are price and very high, whereas consumer’s surplus from diamond is very low.

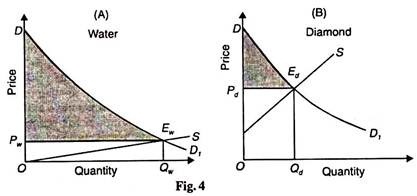

Fig. 4 (A) and (B) depict this water-diamond paradox.

In Panel (A), the supply curve of water S intersects its demand curve DD1 at point Ew from which OQw quantity of water is supplied at its low price OPw. Consequently, consumer’s surplus is DEw Pw. In Panel (B), the supply curve of diamond S intersects its demand curve DD1 at point Ed.

As a result, at a high price OPd (than under water)) less quantity of diamond OQd (than under water OQw) is bought and less consumer s surplus DEd Pd is obtained than under water, DEw Pw.

5. In Cost-Benefit Analysis:

The concept of consumer’s surplus is very useful in cost-benefit analysis of investment done on a bridge, dam, railway, park, canal etc. In decision making for such projects, expected consumer’s surplus is an important factor. In cost-benefit analysis, cost and benefit mean not only money cost and money profit but also real cost and real profit in terms of resources and satisfaction.

This analysis is related to social profit in terms of resources and satisfaction. This analysis is related to social profit and social cost. For example, the profit from government projects such as bridge is estimated from the expected saving of time by all the visitors using the new bridge, and of the cost of fuel used by the car owners. The concept of cost benefit is, in fact, derived from the concept of consumer’s surplus.

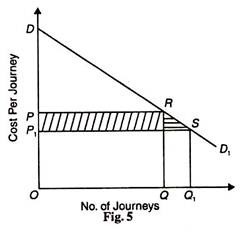

Consumer’s surplus is a personal profit that is received by the project users. In the cost- benefit analysis of a project, the concept of consumer’s surplus is shown in Figure 5. In the figure, the number of journeys through that particular bridge is plotted on the horizontal axis and per visit cost or price on the vertical axis.

DD1 is the demand curve for the visit. Before the bridge if per visit current cost on that road is OP, the number of visits is OQ.

It is clear from the demand curve that the car owners are willing to pay money equal to the area of ODRQ for OQ number of visits. Hence in the figure, by making OQ journeys, the consumer’s surplus is equal to triangle PDR. Suppose with the construction of the bridge, the cost of per visit is reduced from OP to OP1, the car owners make OQ1 journeys. As a result, they receive PRSP1 more consumer’s surplus than before.

6. In Gain from International Trade:

We can measure the gain from international trade with the idea of consumer’s surplus. Suppose that before entering into trade with another country, we were prepared to pay Rs 35,000 for a computer. But after establishing trade relations we get it for Rs 25,000.

The difference between what we were prepared to pay for the computer and what we now pay is the consumer’s surplus which in fact measures the gain from international trade. It is Rs 10,000 per computer according to our example. The larger the consumer’s surplus from imported articles, the more is the gain from international trade to the country.

7. Welfare Economics:

The concept of consumer’s surplus is an important tool in welfare economics in the following ways.

(a) In his partial analysis, Marshall deals with the surplus of all the consumers in a market.

(b) Further, the effects of price-quantity variations of commodities on the welfare of the community are also being worked out with the aid of this concept.

(c) Similarly, the gain which accrues to the community from a new product and the loss from the total disappearance of a product from the market are some of the other problems which are being explained with the idea of consumer’s surplus.

8. Effects of a Tax on Consumer’s Surplus:

A tax on a commodity raises its price and reduces consumer’s surplus. But it brings revenue to the state. A tax is justified only if the gain in state revenue is greater than the loss in consumer’s surplus. However, the effect on price and hence on consumer’s surplus will differ according as the industry is operating under the law of increasing returns, diminishing returns or constant returns.

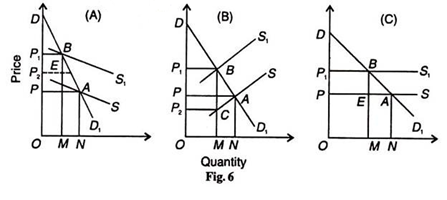

In Panels (A), (B), and (C) of Figure 6, DD1 is the demand curve and S is the original supply curve. They intersect at point A where at OP price, ON quantity of the commodity is, bought. The area under the demand curve and the price line, the triangle DAP is the consumer’s surplus before the imposition of the tax.

Let us take Panel (A) which illustrates the case of increasing returns or diminishing cost industry. St is the new supply curve after levying the tax. The distance between the two supply curves S and S, is the amount of tax per unit of commodity.

With the imposition of this tax, the price rises to OP1 (= MB), and as a consequence the demand for the commodity shrinks to OM. These two effects of the tax lead to a loss in consumer’s surplus by PABP! (DAP-DBP1 = PABP1).

Against this, the gain in revenue to the state is equal to the quantity sold after the imposition of the tax multiplied by the tax per unit of commodity, i.e., OM*BE= P2 EBP, where P2 E = OM. If we compare the gain to the state and loss to the consumers we find that under increasing returns or diminishing cost industry, the former is less than the latter, PABP1> P2EBP1.

Such a tax is not justified in the interests of both the state and the people.

To illustrate the effect a tax on diminishing returns or increasing cost industry, let us take Panel (B) of Figure 6. Here the loss in consumer’s surplus = DAP —DBP1 = PABP1 .Gain in the state revenue is OM x BC = P2CBP1 .Since P2CBP1 > PABP1 the tax is justified, for the state gains more than the loss incurred by consumers.

Panel (C) shows constant returns or cost industry, where the loss in consumer’s surplus PABP1 > PEBP1 the gain in state revenue, the levying of a tax is also not justified in the case of constant returns.

9. Effects of a Subsidy on Consumers Surplus:

Subsidy or bounty is the monetary help given by the state to reduce the high cost of production so that it may be possible for the producer to sell his commodity at a lower price and thus to push his sales. A subsidy is justified only if the gain in consumer’s surplus is greater than the loss to the state.

A subsidy is given at the rate of the difference between the old and the new supply curve. In this case S represents the old supply curve and S’ the new supply curve after the grant of subsidy to the industry. A subsidy has the effect of reducing the price of the product and consequently raising the demand and consumer’s surplus.

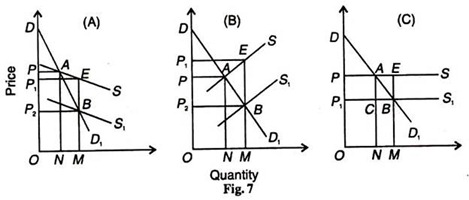

Let us illustrate the effect of a subsidy on community welfare under different cost industries with the help of Figure 7 (A), (B), and (C).

Take Panel (A) first; where initially ON amount of commodity is sold at OP price, and the consumer’s surplus is DAP. After the grant of subsidy, the price falls to OP2 (=MB) and the quantity sold increases to OM. As a result of the fall in price and increase in the quantity bought, consumer’s surplus increases to DBP1 Thus the net gain in consumer’s surplus is PABP2 = (DBP2 DAP).

The amount paid on subsidy is P1EBP1 Here, the consumer’s surplus PABP2>P1EBP2, the subsidy given by the state. Thus a subsidy is justified in the case of decreasing cost industry for it increases the community’s welfare.

In Panel (B), the effect of subsidy on increasing cost industry is shown, where the price falls from OP to OP after subsidy is paid. Consumer’s surplus rises from DAP to DBP. The net gain in consumer’s surplus is PABP2 (=DBP -DAP) which is less than P1EBP2 the amount of subsidy given.

Panel (C) shows the production of commodity under constant cost industry. The grant of PACP1 subsidy leads to PABP1 of net gain in consumer’s surplus which is less than the subsidy. Therefore, the grant of a subsidy to both the increasing cost and the constant cost industries is not justified because it fails to increase economic welfare.

We may conclude that for increasing the welfare of the community, the state should tax commodities being produced under diminishing returns and utilise the revenue so obtained in subsidizing the products of increasing returns industries. Thus the Marshallian concept of consumer’s surplus is a very serviceable tool in partial welfare analysis and it is not merely of historical and doctrinal interest.