The following points highlight the four main types of elasticity of demand. The types are: 1. Price Elasticity of Demand 2. Cross Elasticity of Demand 3. Income Elasticity of Demand 4. Advertising or Promotional Elasticity of Demand.

Type # 1. Price Elasticity of Demand:

The elasticity of demand is the degree of responsiveness of demand to change in price.

In the words of Prof. Lipsey:

“Elasticity of demand may be defined as the ratio of the percentage change in demand to the percentage change in price.”

ADVERTISEMENTS:

Mrs. Robinson’s definition is more clear:

“The elasticity of demand at any price…. is the proportional change of amount purchased in response to a small change in price, divided by the proportional change of price.”

Thus, price elasticity of demand is the ratio of percentage change in amount demanded to a percentage change in price.

It may be written as:

ADVERTISEMENTS:

EP = Percentage change in amount demanded/Percentage change in price

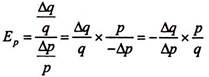

If we use Δ (delta) for a change, q for amount demanded and p for price, the algebraic equation is

Ep, the coefficient of price elasticity of demand is always negative because when price changes demand moves in the opposite direction. It is, however, customary to disregard the negative sign. If the percentages for quantity and prices are known the value of the coefficient Ep can be calculated.

ADVERTISEMENTS:

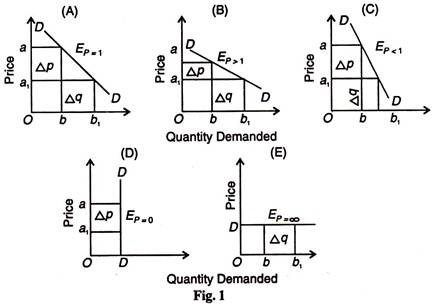

Price elasticity of demand may be unity, greater than unity, less than unity, zero or infinite. These five cases are explained with the aid of the following figures.

Price elasticity of demand is unity when the change in demand is exactly proportionate to the change in price. For example, a 20% change in price causes 20% change in demand, EP = 20%/20% =1. In the diagrams of Figure 1, Δp represents change in price, Δq change in demand, and DD the demand curve. Price elasticity on the first demand curve in Panel (A) is unity, for Δq/Δp = 1.

When the change in demand is more than proportionate to the change in price, price elasticity of demand is greater than unity. If the change in demand is 40% when price changes by 20% then EP = 40%/20% = 2, in Panel (B),i.e. Δq /Δp> 1. It is also known as relatively elastic demand.

If, however, the change in demand is less than proportionate to the change in price, price elasticity of demand is less than unity. When a 20% change in price causes 10% change in demand, then EP = 10%/20% = 1/2 =<1, in Panel (C), i.e. Δq/Δp < 1. It is also known as relatively inelastic demand.

Zero elasticity of demand is one when whatever the change in price, there is absolutely no change in demand. Price elasticity of demand is perfectly inelastic in this case. A 20% rise or fall in price leads to no change in the amount demanded, EP = 0/20% = 0, in Panel (D), i.e. 0/ΔP = 0. It is perfectly inelastic demand.

Lastly, price elasticity of demand is infinity when as infinitesimal small change in price leads to an infinitely large change in the amount demanded. Visibly, no change in price causes an infinite change in demand, E = ∞/0 = ∞, in Panel (E), at OD price, the quantity demanded continues to increase from Ob to Ob1…….np. It is perfectly elastic demand.

Type # 2. Cross Elasticity of Demand:

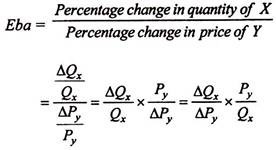

The cross elasticity of demand is the relation between percentage change in the quantity demanded of a good to the percentage change in the price of a related good. The cross elasticity of demand between good X and Y

Where, Qx = Quantity of good X, PY = Price of good Y and Δ = change.

ADVERTISEMENTS:

Given the price of X, this formula measures the change in the quantity demanded of X as a result of change in the price of Y.

The cross elasticity of demand for good X may be positive, negative or zero which depends on the nature of relation between the goods X and Y. This relation may be as substitutes, complementary or unrelated goods.

1. Substitute Goods:

If X and 7 are substitute goods, a fall in the price of good Twill reduce the quantity demanded of good X. Similarly, an increase in the price of good Y will raise the demand for good X. Their cross elasticity is positive because, given the price of X, a change in the price of Twill lead to a change in the quantity demanded of X in the same direction as in the price of Y.

ADVERTISEMENTS:

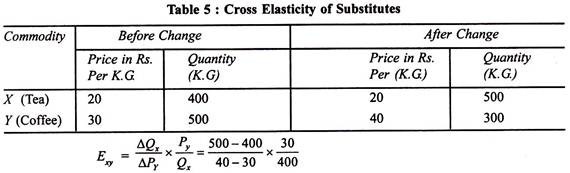

The cross elasticity of substitute goods is explained in Table 5.

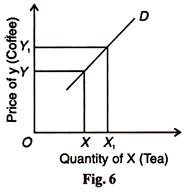

It is clear from the above that the coefficient of cross elasticity of substitute goods such as tea (X) and coffee (Y) is positive (+0.75) when with the rise in price of coffee, the price of tea being constant, the demand for tea also increases.

ADVERTISEMENTS:

This is shown in Fig. 6 where the quantity of good X (tea) is taken on X-axis and the quantity of good Y is plotted on Y-axis. When the price of Y increases from OY to OY1, the quantity demanded of X rises from OX to OX1. The slope of the demand curve downwards to the right shows positive elasticity of both the goods.

2. Complementary Goods:

If two goods are complementary (jointly demanded), rise in the price of one leads to a fall in the demand for the other. Rise in the prices of cars will bring a fall in their demand together with the demand for petrol. Similarly, a fall in the prices of cars will raise the demand for petrol. Since price and demand vary in the opposite direction, the cross elasticity of demand is negative.

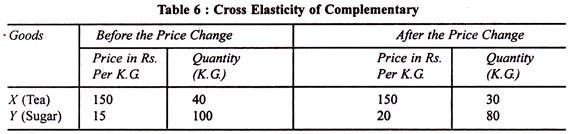

The cross elasticity of complementary goods is explained in Table 6.

ADVERTISEMENTS:

In this case, the cross elasticity coefficient of complementary goods such as tea and sugar or car and petrol is negative.

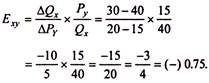

This is explained in Fig.7 where with the rise in the price of Y (Sugar) from OY to OY1 the demand for X (tea) falls from OX to OX1. The slope of the demand curve downwards to the right indicates negative cross elasticity.

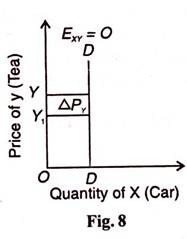

If the two goods are unrelated, a fall in the price of good Y has no effect whatsoever on the demand for good X. In such a case, the cross elasticity of demand is zero. For example, a fall in the price of tea has no effect on the quantity demanded of car. The cross elasticity of demand for unrelated goods is shown in Fig. 8. Even an increase in the price of good Y from OY to OY1, the demand for good X remains the same as OD. Hence, the cross elasticity of demand for unrelated goods is zero.

Some Conclusions:

We may draw certain inferences from this analysis of the cross elasticity of demand.

ADVERTISEMENTS:

(a) The cross elasticity between two goods, whether substitutes or complementaries, is only a one-way traffic. The cross elasticity between butter and jam may not be the same as the cross elasticity of jam to butter. A 10% fall in the price of butter may cause a fall in the demand for jam by 5%.

But a 10% fall in the price of jam may lower the demand for butter by 2%. It shows that in the first case the coefficient is 0.5 and in the second case 0.2. The superior the substitute whose price changes, the higher is the cross elasticity of demand.

This rule also applies in the case of complementary goods. If the price of car falls by 5%, the demand for petrol may go up by 15%, giving a high coefficient of 3. But a fall in the price of petrol by 5% may lead to a rise in the demand for cars by 1%, giving a low coefficient of 0.2.

(b) Cross elasticities for both substitutes and complementaries vary between zero and infinity. Generally, cross elasticity for substitutes is positive, but in exceptional circumstances it may also be negative.

(c) Commodities which are close substitutes have high cross elasticity and commodities with low cross elasticities are poor substitutes for each other. This distinction helps to define an industry. If some goods have high cross elasticity, it means that they are close substitutes.

Firms producing them can be regarded as one industry. A good having a low cross elasticity in relation to other goods may be regarded a monopoly product and its manufacturing firm becomes an industry by determining the boundary of an industry. Thus cross elasticities are simply guidelines.

Application of Cross Elasticity in management:

The cross elasticity of demand has much practical importance in the solution of various business problems.

ADVERTISEMENTS:

1. In Production:

A firm wants to know the cross elasticity of demand for its goods while considering the effect of change in the price of its competitor’s goods on the demand for its own goods. It is important for a firm to have a knowledge of it while making its production plan.

2. In Demand Forecasting and Pricing:

Its knowledge helps the firm in estimating the potential impact of the pricing decisions of its competitors and associates on its sales so that it prepares its pricing strategies.

3. In International Trade and Balance of Payments:

ADVERTISEMENTS:

The utility of this concept is significant in the area of international trade and balance of payments. The government wants to know how the change in domestic prices affects the demand for imports.

Domestically produced goods being close substitutes if the cross elasticity of demand for imports is high and if the prices of domestic goods increase due to inflation, the demand for imports will increase substantially which will deteriorate the balance of payments position.

Type # 3. Income Elasticity of Demand:

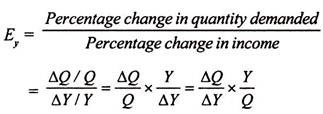

The concept of income elasticity of demand (E) expresses the responsiveness of a consumer’s demand (or expenditure or consumption) for any good to the change in his income. It may be defined as the ratio of percentage change in the quantity demanded of a commodity to the percentage change in income. Thus

Where Δ is change, Q quantity demanded and Y is income.

The coefficient Ey may be positive, negative or zero depending upon the nature of a commodity. If an increase in income leads to an increased demand for a commodity, the income elasticity coefficient (Ey) is positive. A commodity whose income elasticity is positive is a normal good because more of it is purchased as the consumer’s income increases.

On the other hand, if an increase in income leads to a fall in the demand for a commodity, its income elasticity coefficient (Ey) is negative. Such a commodity is called inferior good because less of it is purchased as income increases. If the quantity of a commodity purchased remains unchanged regardless of the change in income, the income elasticity of demand is zero (Ey =0).

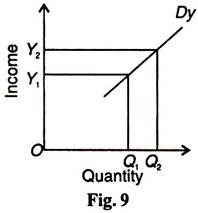

Normal goods are of three types necessaries, luxuries and comforts. In the case of luxuries, the coefficient of income elasticity is positive but high, Ey >1. Income elasticity of demand is high when the demand for a commodity rises more than proportionate to the increase in income.

Assuming prices of all other goods as constant, if the income of the consumer increases by 5% and as a result his purchases of the commodity increase by 10%, then Ey = 10/5 = 2(>1). Taking income on the vertical axis and the quantity demanded on the horizontal axis, the increase in demand Q1Q2 is more than the rise in income Y1 Y2, as shown in Figure 9. The curve Dy shows a positive and elastic income demand.

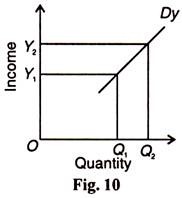

In the case of necessities, the coefficient of income elasticity is positive but low, Ey <1. Income elasticity of demand is low when the demand for a commodity rises less than proportionate to the rise in the income. If the proportion of income spent on a commodity increases by 2% when the consumer’s income goes up by 5%, Ey = 2/5(<1) Figure 10 shows a positive but inelastic income demand curve Dy because the increase in demand Q1 Q2 is less than proportionate to the rise in income Y1 Y2.

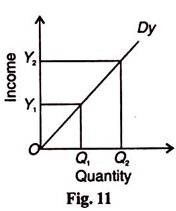

In the case of comforts, the coefficient of income elasticity is unity (Ey =1) when the demand for a commodity rises in the same proportion as the increase in income. For example, a 5% increase in income leads to 5% rise in demand, Ey =5/5 = 1. The curve Dy in Figure 11 shows unitary income elasticity of demand. The increase in quantity demanded Q1 Q2 exactly equals the increase in income Y1 Y2.

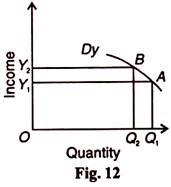

The coefficient of income elasticity of demand in the case of inferior goods is negative. In the case of an inferior goods, the consumer will reduce his purchases of it, when his income increases. If a 5% increase in income leads to 2% reduction in demand, Ey = -2/5 (<0). Figure 12 shows the Dy curve for an inferior goods which bends upwards from A to B when the quantity demanded decreases by Q1 Q2 with the rise in income by Y1 Y2.

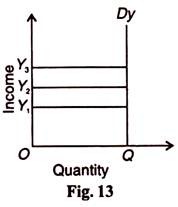

If with increase in income, the quantity demanded remains unchanged, the coefficient of income elasticity, Ey = 0. If, say, with 5% increase in income, there is no change in the quantity demanded, then Ey = 0/5 = 0. Figure 13 shows a vertical income demand curve Dy with zero elasticity.

Measuring Income Elasticity of Demand: The Engel Curve:

Each Dy curve expresses the income-quantity relationship. Such a curve is known as an Engel curve which shows the quantities of a commodity which a consumer would buy at various levels of income.

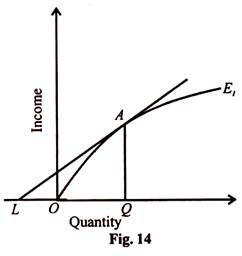

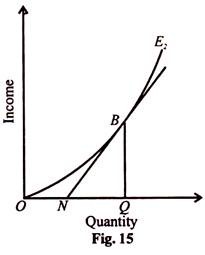

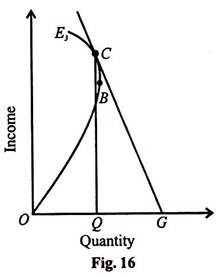

In Figure 9, we have explained income elasticity of demand with the help of linear Engle curves. Income elasticity in terms of non-linear Engel curves can be measured with the point formula. In general, the Engel curves look like the curves E1, E2 and E3, as shown in Figures 14, 15 and 16.

(1) Consider Figure. 14 where LA is tangent to the Engel curve E1 at point A. The coefficient of income elasticity of demand at point A is

This shows that the curve E1 is income elastic over much of its range. When the Engel curve is positively sloped and Ey >1, it is the case of a luxury goods.

(2) Take Figure 15 where NB is tangent to the Engel curve ED2 at point B. The coefficient of income elasticity at point B is

This shows that the income elasticity of E2 curve over much of its range is larger than zero but smaller than 1. When the Engel curve is positively sloped and Ey <1, the commodity is a necessity and is income inelastic.

(3) In Figure 16, the Engel curve E3 is backward-sloping after point B. In the backward-sloping range, draw a tangent GC at point C. The coefficient of income elasticity at point C is

This shows that over the range the Engel curve E3 is negatively sloped. Ey is negative and the commodity is an inferior good. But before it bends backward, the Engel curve E3 illustrates the case of a necessary good having income inelasticity over much of its range.

Determinants of Income Elasticity of Demand:

There are certain factors which determine the income elasticity of demand.

1. The Nature of Commodity:

Commodities are generally grouped into necessities, comforts and luxuries. We have seen above that in the case of necessities, Ey< 1, in the case of comforts, Ey = 1, and in the case of luxuries, Ey> 1.

2. Income Level:

This grouping of commodities depends upon the income level of a country. A car may be a necessity in a high-income country and a luxury in a poor low-income country.

3. Time Period:

Income elasticity of demand depends on the time period. Over the long-run, the consumption patterns of the propel may change with changes in income with the result that a luxury today may become a necessity after the lapse of a few years.

4. Demonstration Effect:

The demonstration effect also plays an important role in changing the tastes, preferences and choices of the people and hence the income elasticity of demand for different types of goods.

5. Frequency:

The frequency of increase in income also determines income elasticity of demand for goods. If the frequency is greater, income elasticity will be high because there will be a general tendency to buy comforts and luxuries.

Use of Income Elasticity in Business Decisions:

The income elasticity of a product has great significance in long-term planning and in the solution of strategic problems, particularly during trade cycles.

1. Planning of the Firm’s Growth:

The knowledge of income elasticity of demand is very important for both the firms and the government. Firms whose demand function is income elastic, the scope of their growth is generally wide in an expanding economy but they are very insecure during recession. So such firms must consider their all economic activities and their potential growth rate in future.

On the contrary, firms whose products are less income elastic, they will neither obtain more profit with the expansion of the economy nor will they incur specific loss during recession in the economy. Such firms consider it necessary to bring variety in different products or in a different industry.

For example, agricultural products are less income elastic while industrial products are income elastic. Moreover, since the coefficient of income elasticity of inferior goods is negative, the sale of such products will decline with economic growth.

2. In Formulation of Farm Policy:

Farmers’ products are less income elastic because they cannot generally bring variety in their products like income elastic products. Hence, in the coming years the danger of such agricultural problems is likely to remain particularly in developing countries. Therefore, the Government of India has considered it necessary to continue and increase various agricultural subsidies.

3. In Forecasting Demands:

The concept of income elasticity can be used in forecasting future demand provided the firm knows the growth rate of income and income elasticity of demand for the good. It is often believed that the demand for goods and services increases with the rise in GNP that depends on the marginal propensity to consume.

But it may be proved true in the context of aggregate national demand while it is not necessary to be true for a particular good. For this, the income of the related income class should be used. It is also useful for avoiding the problem of over-production or under-production.

4. In Formulating Marketing Strategies:

The income elasticity of demand of potential buyer class for products affects the number, nature and location of sales centres, nature and level of advertising and the policies related to other sales promotion activities.

For instance, the sales centres of ice-creams will be located in the prosperous town areas where the people have sufficient income and their incomes are likely to increase sufficiently in future. Here, the expected rise in demand in the context of increased income has been discussed. But this rise will be compensated in more or less quantity by the expected fall in demand with the increase in price.

Type # 4. Advertising or Promotional Elasticity of Demand:

In the modern competitive or partial competitive market economy, advertising has a great significance. Under advertising, various visible or verbal activities are done by the firm for the purpose of creating or increasing demand for its goods or services. Informative advertising is very helpful for the consumer in making rational purchase decisions.

But the extension of demand through advertising can be measured by advertising or promotional elasticity of demand (EA) which measures the expected changes in demand as a result of change in other promotional expenses. The demand for some goods is affected more by advertising such as the demand for cosmetics. Following is the formula for advertising elasticity,

EA = ΔQ/ΔA x A/Q

Where, Q = quantity sold of good X; A = units of advertising expenses on good X;

ΔQ = change in quantity sold of good X; and ΔA = change in advertising expenses on good X.

The elasticity of demand for a good should be positive because there is the possibility of extension of demand and market for the good with advertising expenditure. The higher the value of this elasticity, the greater will be the inducement of the firm to advertise that product. It is on the basis of advertising elasticity that a firm decides how much to spend on advertising a product.

Factors Influencing Advertising Elasticity of Demand:

The main factors influencing advertising elasticity are as follows:

1. Stage of Product’s Development:

The advertising elasticity of demand for a product may vary with different levels of sales of the same product. It is different for new and established products.

2. Degree of Competition:

The advertising effect in a competitive market is also determined by the relative effect of advertising by competing firms.

3. Effects of Advertising in Terms of Time:

The advertising elasticity of demand depends upon the time interval between advertising expenditure and its effect on sales. This depends on general economic environment, selected media and type of the product. This time interval is large for durable goods than for non-durable goods.

4. Effect of Advertising by Rival Firms:

The advertising elasticity also depends as to how other rival firms advertise in comparison to the advertisement of the firm. This, in turn, depends on the levels of advertisement and advertisements done in the past and present by rival firms.

Application of Elasticity in Managerial Decisions:

Now we shall consider the application of concepts of elasticity. Economists measure how responsive or sensitive consumers are to change in the price or income or a change in the price of some other product. Managerial economists measure the degree of elasticity by the elasticity co-efficient. Managerial decisions aim at the best alternative.

Managerial decisions are of two types: programmed decisions and non-programmed decisions. But the decision making process may be required in four areas of work: location decision, growth decision, financial decision and operating decision. The price- quantity relationship comes under operating decision.

1. Managerial Decision and Income Elasticity:

Income elasticity measures the ratio of percentage change in quantity demanded to percentage change in income. A positive income elasticity suggests a more than proportionate increase in expenditure with an increase in income. If income elasticity is negative it implies that the commodity is inferior.

Among the several income concepts, the most commonly used term is the personal disposable income per head. The other income concepts important for durable goods are that of transitory income i.e., fluctuation in the short run income and discretionary income i.e., that part of the income which is left over after deductions.

Economic development will be closely associated with increase in the sales of quality goods. An efficient businessman is really interested in knowing whether the sale of his goods will lead to economic development.

The relationship between demand and income changes is not always positive. It depends on the permanent change in income. If the income elasticity is greater than one, the sales of his goods will increase more quickly than general economic development. If the income elasticity is greater than zero but less than one, sales of the goods will increase but at a lower rate than economic development.

2. Managerial Decision and Industry Elasticity:

From the managerial point of view, it is thought useful to explain industry elasticity. We know from the law of demand that when the price of a commodity falls, the quantity demanded increases and vice versa. The relation of price to sales is known in economics as the demand.

The relation of price to demand or sales has been a major interest of economist for a long time. If we like to have a good knowledge of their relations, it gives better results to management. The industry elasticity means that there is a change in complete industry sales with a change in the general level of prices for the industry. The industry demand has elasticity due to competition from other industries.

3. Managerial Decision and Expectation Elasticity:

Expectation elasticity indicates the responsiveness of sales to buyers guesses about the future values of demand determinants. In most companies, a knowledge of condition in the immediate future is essential for evolving a suitable production policy. Formulating suitable production policy is necessary to avoid the problem of over production or the problem of short supply.

Once the demand potential is assessed it will be easier for the company to engage in long term planning. Like the future price of a commodity or of its substitute, future income of buyers, prospects of easy availability or otherwise in the future or future outlays, price and income expectations are the most important among them.

4. Managerial Decision and Market Share Elasticity:

As regards a particular firm, the market share elasticity is most important. This is influenced by rival’s changes in prices and promotional efforts both qualitative and quantitative.

A thorough knowledge of market share elasticity will help the managerial economist to the profitable results of the concern. The market share elasticity indicates that there has been a change in company’s wide sales to the price differential between the company’s price and the industry-wide price level.

5. Managerial Decision and Promotional Elasticity:

Many of the firms spend huge amounts every year on advertising their products to boost up sales. There is a direct relationship between the extent of advertisement and volume of sales.

The promotional elasticity of demand is also called the advertising elasticity of demand. It measures the responsiveness of demand to change in advertising. The reason for finding out the advertisement elasticity of demand by the company manager is to determine the effects of advertisement on sales.