The Elasticity of Demand is the ratio of change in quantity demanded due to change in the invariants affecting demand. These invariants may be price of a commodity, income of the consumer and the prices of other related goods etc.

This article will help you to understand the following things:- 1. Meaning of Elasticity of Demand 2. Definition of Elasticity of Demand 3. Types 4. Measurement 5. Importance of the Concept 6. Criticism.

Meaning of Elasticity of Demand:

The concept which explains the quantitative change in demand due to changes in its invariants is known as ‘Elasticity of Demand’.

Therefore, the Elasticity of Demand is a quantitative measurement of the response of demand for a commodity to some change in its price, income of the consumer’s or the prices of other related commodities.

ADVERTISEMENTS:

Further, the concept of elasticity of demand refers to the responsiveness of demand for a commodity to changes in its determinants. Demand for goods varies with price. But the extent of variation is not uniform in all cases. In some cases the variation is extremely wide; in some others it may be just nominal. That means sometimes demand is greatly responsive to changes in price, at other times, it may not be so responsive.

The extent of variation in demand is technically expressed as elasticity of demand. According to Marshall the elasticity (or responsiveness) of demand in a market is great or small, depending on whether the amount demanded increases much or little for a given fall in price; and diminishes much or little for a given rise in price.

Definition of Elasticity of Demand:

The Elasticity of Demand is the ratio of change in quantity demanded due to change in the invariants affecting demand. These invariants may be price of a commodity, income of the consumer and the prices of other related goods etc.

1. According to Marshall – “The elasticity or responsiveness of demand in a market is great or small according as the amount demanded increases much or little for a given fall in price and diminishes much or little for a given rise in price.”

ADVERTISEMENTS:

2. According to Stonier and Hague – “Elasticity of Demand is the technical term used by the economists to describe the degree of responsiveness of the demand for a commodity to fall in the price.

3. As Mrs. Joan Robinson has said – “The Elasticity of Demand at any price or at any output, is the proportional change of amount purchased in response to a small change in price, divided by the proportional change in price.”

4. According to Prof. Boulding – “The Elasticity of Demand may be defined as the percentage change in the quantity demanded which would result from one percent change in its price.”

5. Mr. A. L. Meyers has said – “The Elasticity of Demand is a measure of the relative change in amount purchased in response to relative change in price on a given demand curve.”

ADVERTISEMENTS:

From the study of the above definitions, it is clear that Elasticity of Demand is the statistical explanation of the proportional change in demand due to the factors that affect it. It is the responsiveness of demand due to change in price.

Types of Elasticity of Demand:

There are three main types of elasticity of demand:

1. Price Elasticity of Demand:

(i) Perfectly elastic demand,

(ii) Perfectly inelastic demand,

(iii) Unit elastic demand,

(iv) Less elastic or less than unit elastic demand,

(v) More elastic or more than unit elastic demand.

2. Income Elasticity of Demand:

ADVERTISEMENTS:

(i) Zero income Elasticity of Demand,

(ii) Negative income Elasticity of Demand,

(iii) Unitary income Elasticity of Demand,

(iv) Income Elasticity of Demand greater than unity.

ADVERTISEMENTS:

(v) Income Elasticity of Demand less than unity.

3. Cross-price Elasticity of Demand or just cross elasticity:

(i) Positive Cross Elasticity of Demand

(ii) Negative Cross Elasticity of Demand.

1. Price Elasticity of Demand:

ADVERTISEMENTS:

Price Elasticity of Demand enjoys such a significance in economics as most of the definitions of Elasticity of Demand have been referred to price. The credit of defining price Elasticity of Demand goes to Prof. Alfred Marshall and has written as such—”The elasticity (or responsiveness) of demand in market is great or small according to the amount demanded increases much or little for a given fall in price and diminishes much or little for a given rise in price.”

This definition explains both the conditions whether an increase in price or decrease in it has its effect on the quantity demanded less and more as the case may be. When the price of a commodity falls and as a result of it and if the demand rises unexpectedly high, it is highly elastic demand. On the other hand when even an unprecedented fall in price does not increase much or increases the demand a little, it is inelastic demand. If as a result of fall or rise in price, if the demand changes proportionately, it is unit elasticity.

The most simple method to measure the Elasticity of Demand is:

EP = Percentage (Proportionate) change in quantity demanded / Percentage (Proportionate) change in price

According to this method, if percentage change in quantity demanded in more than the percentage change in price, the demand is said to be more elastic. But if the percentage of change in demand is less than the percentage change in price, the demand is less elastic. If the percentage change in the quantity demanded is exactly in the same percentage change in price it is known as unit elasticity.

Types of Price Elasticity of Demand:

ADVERTISEMENTS:

The price and quantity demanded relationship compel us to deduce the various types of price elasticity of demand. According to this relationship there are five types of price elasticity.

They are as follows:

(i) Perfectly Elastic Demand:

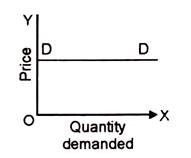

This demand refers to that situation where there is only un-perceptible change in price but demand changes unexpectedly; we call it perfectly elastic demand. Its demand curve is parallel to axis of X. The numerical co-efficient of such elasticity of demand is infinity. In perfect competition model the demand curve is perfectly elastic. However, such situation is very rare in whole-sale market and stock and share market where a small change brings unprecedented demand.

(ii) Perfectly Inelastic Demand:

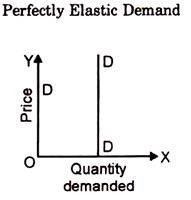

When there is considerable change in price, but the quantity demanded does not show any change, we call it perfectly inelastic demand. Such a situation rarely occurs in practice. At the most salt may be regarded as the only commodity with almost perfectly inelastic demand for most of the consumers. Its demand curve will be parallel to the Y-axis.

Here, Demand Curve DD is vertical. It suggests that demand remains unchanged at any price.

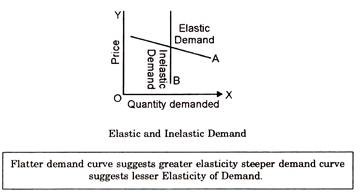

Diagrammatically, the perfectly inelastic demand is represented by a vertical straight line demand curve as shown in the figure Perfectly Inelastic Demand above. Further, Elasticity of Demand refers to the responsiveness of sensitiveness of demand to a change in price. When the demand responds very much to the given change in price, it is called elastic demand. When the demand responds very little to the given change in price, the demand is called inelastic.

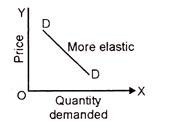

In the case of elastic demand, the demand curve flatter, as curve A in the figure ; while in the case of inelastic demand, the demand curve is steeper, as curve B. The demand for luxury goods (like face powder) is usually elastic, while the demand for necessities (like food-grains) is usually inelastic.

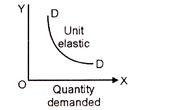

(iii) Unit Elastic Demand:

If change in the quantity demanded changes proportionately to change in price it is called unit elastic demand. Its curve is called Rectangular Hyperbola. The numerical value of the co-efficient of Elasticity of Demand in unity.

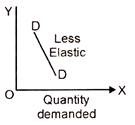

(iv) Less Elastic or Less than Unit Elastic Demand:

When the quantity demanded changes proportionately less than the change in price, it is less than unit elastic demand. The numerical value of the co-efficient of elasticity is less than unity.

(v) More Elastic or More than Unit Elastic Demand:

When the quantity demanded changes more than the proportionate change in price, it is called more elastic demand. The numerical value of the co-efficient of elasticity is more than unity.

It should be remembered that the same elasticity is not available throughout the length of a particular demand curve. The above classification of the price Elasticity of Demand applies to the different segments of a demand curve.

ADVERTISEMENTS:

A demand curve will have different elasticities at different points. But the first three cases given above i.e., perfectly elastic, perfectly inelastic and unit elastic possesses the one elasticity throughout the entire length of a demand curve. These are general exception to the Elasticity of Demand.

2. Income Elasticity of Demand:

Income Elasticity of Demand for a commodity shows the extent to which a consumer’s demand for that commodity changes as a result of a change in his income. It shows the responsiveness of a consumer’s purchases of that commodity to a change in his income.

It may be defined:

“As the ratio of proportionate change in the quantity demanded of the commodity to a given proportionate change in the income of the consumer.”

It can be measured by the application of the following formula:

EY = Proportionate change in the quantity demanded of the commodity / Proportionate change in the income of the consumer

[Ey here stands for Income Elasticity of Demand]

Kinds of Income Elasticity of Demand:

There are five types of income elasticity:

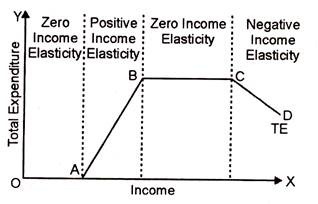

(i) Zero Income Elasticity of Demand:

This refers to the situation where a given increase in consumer’s money income does not result in any increase or decrease in the quantity demanded of the commodity. The quantity bought of the commodity remains constant, despite the increase in the consumer’s income and in that case Total Expenditure remains constant. Symbolically, zero income elasticity of demand is expressed as Ey = 0.

(ii) Negative Income Elasticity of Demand:

This refers to that situation where a given increase in the consumer’s money-income is followed by an actual fall in the quantity demanded of the commodity. This happens in the case of economically inferior goods. Here the total expenditure declines with the increase in income. Symbolically negative income elasticity of demand is expressed as Ey < 0.

(iii) Unitary Income Elasticity of Demand:

This refers to the situation where the proportion of the consumer’s income spent on the commodity in question is exactly the same both before and after the increase in income. The income elasticity of demand here is equal to unity. Total expenditure increases in a constant ratio, proportionate to increase in income. Symbolically, unitary income elasticity of demand is expressed as Ey = 1.

(iv) Income Elasticity of Demand Greater than Unity:

This refers to the situation where the consumer spends a greater proportion of his money-income on the commodity in question when he becomes richer and more prosperous. The income-elasticity of demand is greater than unity in the case of luxuries. In this total expenditure increases more proportionate than the increase in income. Symbolically, it is expressed as Ey > 1. If the value of Ey is greater than one, income Elasticity of Demand is said to be highly elastic.

(v) Income Elasticity of Demand Less than Unity:

This refers to the situation where the consumer spends a smaller proportion of his money-income on the commodity in question when he becomes richer and more prosperous. The income elasticity of demand is less than unity in the case of necessaries, the expenditure on which increases in a smaller proportion when the consumer’s money income goes up. Symbolically, it is expressed as Ey < 1. If the value of Ey is less than one, income elasticity of demand is said to be low.

Further, it can be said that commodities differ widely from each other in their income elasticities. Gold, jewellery, precious stones, motor cars etc., are examples of commodities whose income elasticities tend to be high. In contrast vanaspati ghee, soap, salt, matches etc., are examples of commodities whose income elasticities tend to be low. The proportion of consumer’s income spent on a commodity is a major determinant of its income elasticity.

3. Cross Elasticity of Demand:

This demand is the ratio of the proportionate change in the quantity demanded of a commodity X in response to a given proportionate change in the price of some related commodity Y.

It may be calculated from the following formula:

Cross elasticity of demand of X and Y

= Proportionate change in the amount demanded of X / Proportionate change in price of Y

The cross elasticity of demand depends on the nature of cross demand between the two commodities under consideration X and Y. They may be either substitutes or complementary goods. In case the commodities X and Y are substitutes, cross Elasticity of Demand will always be positive; because a rise in the price of X will lead to a rise in the demand for Y ; price of Y and demand for X change in the same direction. The numerical value of the elasticity here will depend upon the substitutability of the two commodities.

On the other-hand in case the commodities X and Y are complementary to each other, cross elasticity of demand will be negative; because a rise in the price of Y will lead to a fall in the demand for X. Here the price of Y and demand for X change in opposite direction. Since cross elasticity of demand refers to the degree of substitutability of one commodity for another, as the price of one of them changes, it may also be called substitution Elasticity of Demand.

Measurement of Elasticity of Demand:

There are four methods of measuring Elasticity of Demand:

1. Total outlay method.

2. Percentage method.

3. Arc method.

4. Point method.

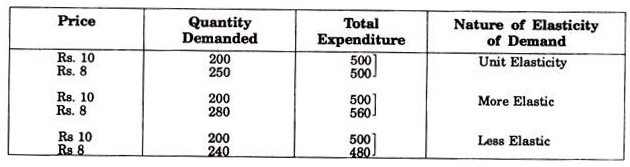

1. Total Outlay Method:

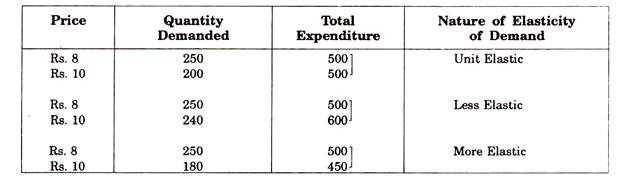

Prof. Marshall formulated this method. According to this method we can know the Elasticity of Demand from the effect on total expenditure as a result of changes in price which can be in two forms—(a) fall in price, and (b) rise in price.

(a) Fall in Price:

If total expenditure is more than before, it is elastic demand, if it is constant, unit elasticity of demand. If the total expenditure is reduced, the demand is less elastic.

For example:

(b) Rise in Price:

If as a result of increase in price the total expenditure remains constant, it is unit elasticity of demand; if increases, it is less than unit elastic; if the total outlay decreases, it is more elastic.

For example:

Thus, Elasticity of Demand is greater than unity, or more elastic when the total outlay increases with a fall in price and decreases with a rise in price. Elasticity of Demand is equal to unity when the total outlay remains the same with rise or fall in price. Elasticity of demand is less than unity or less elastic when the total outlay (or expenditure) decreases with a fall in price and increase with a rise in price.

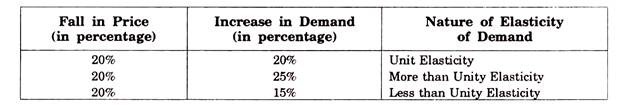

2. Percentage Method:

The pioneer of this method is Prof. Flux. According to this method if the percentage increase in demand is exactly equal to the percentage fall in price, the elasticity is unity or unit. If the percentage increase in demand is less than the percentage decrease in price, demand is less elastic or less than unity. On the other-hand, if it is more than percentage decrease in price, the elasticity is more than unity.

It can be explained by the following example:

Remember:

The percentage method is used when the changes are expressed in the form of percentages only otherwise it may lead to fallacious results as it can be illustrated by the following example:

In the above case the fall in price is 20% whereas the instance in demand is 25%. If we use the percentage method then it is a case of elastic demand. In case we use Total Outlay method or Arc Method the nature of elasticity of demand is unity. Therefore, it has been suggested by economists that percentage method be used with great care.

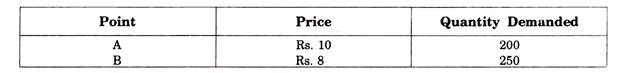

3. Arc Method:

According to this method the Elasticity of Demand is measured between two points in the same demand curve. Thus, by this method both new and old demand and price are studied.

The formula to measure the Elasticity of Demand is as follows:

For example:

If we denote original demand with Qo and the changed demand with Q1 and in this way, original price we call Po and changed price P1, the formula for the elasticity of demand will be:

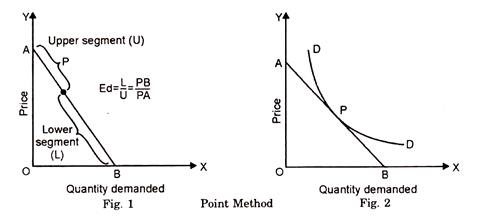

4. Point Method or the Geometric Method:

Marshall also suggested another method called the geometrical method of measuring price elasticity at a point on the demand curve. The simplest way of explaining the point method is to consider a straight line (linear demand curve). Let the straight line demand curve be extended to meet the two axes.

When a point is taken on the straight line demand curve, it divides the straight line demand curve into two segments (parts). The point elasticity is thus measured by the ratio of the lower segment of the curve below the given point to the upper segment (the upper part) of the curve above the point.

In fig. 1, PB/PA at point P measures the point elasticity.

In fig. 2 AB is a tangent drawn at point P to the demand curve DD. PB/PA measures the point elasticity at P.

In fig. 1 above; AB is a straight line demand curve, P is a given point. Thus, PB is the lower segment, PA is the upper segment. If after the actual measurement of the two parts of the demand curve we find that PB = 3 cm and PA = 2 cm; the elasticity at point P is 3/2 = 1.5.

If, however, the demand curve is non-linear, then draw a tangent at the given point, extending it to intercept both the axes as indicated in fig. 2 above. Point elasticity is, thus measured by the ratio of the lower part of the tangent below the given point to the upper part of the tangent above the point. The elasticity at point P in figure PB/PA.

Importance of the Concept of Elasticity of Demand:

The concept of elasticity of demand is of great significance in economic analysis. It serves as a tool in framing certain economic policies.

The importance can be divided under two heads:

1. Theoretical importance, and

2. Practical importance.

Theoretical Importance:

1. Poverty Amidst Plenty:

The concept of elasticity of demand explains the paradox of poverty amidst plenty. A bumper crop of food-grains, the demand for which is inelastic, might spell economic disaster instead of bringing prosperity among the producers because a rich harvest will bring less and not more money to the farmers.

According to Prof. M. M. Bober—”If the demand for corn is inelastic a large crop will dictate a precipitously reduced price to the consumer, so that total revenue to the farmer may be less than from a smaller crop.”

2. Theory of Distribution:

Elasticity of demand is useful in the determination of relative shares of the various factors of production. If the demand for a factor of production is less elastic, its share in the national dividend is higher and vice-versa. If elasticity of substitution is high, the share will be low.

3. Incidence of Taxes:

This concept is used in explaining the incidence of indirect taxes like sales tax and excise duty. Less is the elasticity of demand higher the incidence and vice-versa. In case of inelastic or less elastic demand, the consumers have to buy the commodity and must bear the tax.

Practical Importance:

The practical importance’s are as follows:

(1) Business Decisions:

The concept of price elasticity of demand has important practical applications in managerial decision-making. Often a business executive has to consider whether a lowering of price will lead to an increase in the demand for his product and if so to what extent and whether his profits would increase as a result there of ? Here, the concept of elasticity of demand becomes vital in answering such questions.

(2) In Framing the Economic Policies:

A knowledge of the consumer’s demand and also of the elasticity of demand is required by the government in formulating its economic policies. In controlling business cycles, removing inflationary and deflationary gaps in the economy and in directing the economy from one line of production to another, the government must have information as regards to the trends in demand, elasticity of demand etc.

(3) In deciding Price Policy:

The study of elasticity of demand is not only important for the price policies of the producers, it is equally important in determining the factor rewards in a free enterprise economy.

For instance:

If the demand for labour is elastic the efforts of the trade unions to raise wages of the workers will meet with failures. On the contrary, if the demand for labour is relatively inelastic, it will be easy to raise worker’s wages.

(4) In the Determination of Public Utilities:

This concept is also of paramount importance in enabling the government to decide as to which particular industry should be declared as Public Utilities and consequently owned and operated by the state. Public Utilities are vested with a public interest and hence it is desirable that those industries for whose products the demand is inelastic and which are controlled by private monopoly interests should be declared Public Utilities and taken over by the Government.

(5) Importance to Producer:

From the point of view of an individual producer, the total demand for the commodity which he is producing has a major influence and controls the volume of production which he can sell at the different possible prices. But he will have to consider the elasticity of the total demand curve when he is contemplating a change in price because the elasticity of demand will show the responsiveness of his sales to the change in his price.

(6) Importance in Free Enterprise Economy:

The entire output in a free enterprise economy is directed and controlled by the nature of consumer’s demand. If production is to be profitable, then the total output of goods and services produced must be adjusted determining influence upon the producers total demand for the different factors of production.

(7) In Determination of Taxation Policies:

Elasticity of Demand is also of great help to the government in enabling it to formulate appropriation taxation policy. Taxes impose burden upon the tax payers and this burden should be equitably distributed between the different groups of tax payers.

(8) In Determination of International Trade Policies:

This concept is also of great significance in international trade policies, i.e., in the calculation of the terms of trade. By terms of trade we mean the rate at which a unit of domestic commodity will be exchanged for unit of another commodity of another country. The terms of trade are determined by reference to the mutual elasticities of demand of the two countries for each other goods. It is also helpful in solving the problem of devaluation of the currency of a country.

(9) Monopoly Price Determination:

A monopolist has to consider the elasticity of demand for his product when he determines its price or changes the existing price. If the elasticity of demand for his product is highly elastic, he will maximise his profits by fixing a lower price; because of a lower price he is able to increase his sales. If the elasticity of demand for his product is less elastic or highly inelastic, he is in a position to fix a high price for the commodity.

(10) In the Determination of Exchange Rate:

This concept of Elasticity of Demand is of great help in enabling the government to fix a proper rate of foreign exchange for its currency that will keep her balance of payments in equilibrium. At the time of taking decision to devalue or revalue the currency, the government should carefully study the nature of the elasticity of demand and supply of its exports as well as for its imports.

Criticism of Elasticity of Demand:

This concept has been criticized by a well-known American economist Professor Samuelson who regards the concept of elasticity as essentially arbitrary and of ‘no consequence’. According to him, the concept has no importance except as a ‘mental exercise for beginning students’.

His plea for treating the concept of elasticity as useless is based upon two arguments:

(i) Since most economic laws are qualitative and ordinal, the problem of dimensions has no consequence.

(ii) While the elasticity co-efficient remain invariant when we change the scales, they do not remain invariant when we change the origin. Since there are no neutral zeros from which we measure economic magnitudes, the elasticity co-efficient are essentially arbitrary. Thus, we have in economic analysis such concepts as exports, net purchases, quantity of the inputs supplied etc., all of which are differences measured from arbitrary bases.

Further, Prof. Samuelson has said that:

“Not only are elasticity expressions more or less useful, but in more complicated systems, they become an actual nuisance converting symmetrical expressions into asymmetric ones and hiding the definiteness of quadratic forms.”

(iii) Next, it is based upon the partial equilibrium analysis. For instance, while calculating the price elasticity of demand of a commodity, the prices of other commodities, income of the consumers etc., are assumed to be constant.

(iv) It is unrealistic—It is very difficult to compare a meaningful co-efficient of elasticity of demand for foreign exchange in the face of the fact that foreign exchange is demanded to purchase in numerable goods as well as foreign securities.