Keynes’ Theory of Employment!

Introduction:

In the early thirties of the 20th century when the capitalist countries suffered from severe depression and involuntary unemployment, J.M. Keynes put forward a theory of employment.

Keynes’ theory of employment provides a reasonably good explanation of what determines level of employment in a free market economy and what causes involuntary unemployment in it.

According to Keynes, level of employment is determined by aggregate demand and aggregate supply. When aggregate demand is not sufficient to buy the aggregate supply of output at full-employment level of resources, the problem of demand deficiently arises which causes a fall in level of output and employment.

ADVERTISEMENTS:

Classical economists denied the very existence of involuntary unemployment as they believed in Say’s Law of Markets according to which every supply output creates its demand and therefore output will be expanded to the extent when all resources including labour are fully employed. Besides, they thought if at any time unemployment in the economy occurs, wages and prices will change in a way that employment expands and involuntary unemployment is eliminated.

Thus, according to the Classical economists, wage-price flexibility ensures automatic corrections of forces to restore full employment. But classical theory collapsed in 1929-33 when severe depression took place in the Western industrialised countries and rate of involuntary unemployment shot up to around 25 per cent of labour force in the United States.

Besides, there was a drastic decline in Gross National Product (GNP) which fell from 315 billion dollars in 1929 to 222 billion dollars in 1933, that is, national income declined by 30 per cent during these four years period. This reflects a dismal picture of the American economy during the period of Great Depression.

In England as well as in other European countries also such a grave situation of severe recession and huge unemployment prevailed during this period. Before 1929-33 and even after it, recessions have occurred in these economies but they have not been as severe as that took place during 1929-33.

ADVERTISEMENTS:

Classical economists had no valid explanation of such a severe depression and large-scale cyclical unemployment of labour. A.C. Pigou and other economists of his view attributed this situation to the high wage rates kept by trade unions and Government. Pigou, therefore, suggested all-round cut in wages to increase employment and to remove depression and unemployment.

However, this solution of the problem was neither logically sound nor practical to be implemented. Keynes challenged this view of the classical economists and put forward a different explanation of depression and cyclical unemployment which was accepted by many as logical and correct.

He explained his viewpoint in his now noted work, ‘General Theory of Employment, Interest, and Money’. He not only gave a sound and valid explanation of depression and its associated problem of cyclical unemployment but also suggested effective policy measures to cure them.

According to Keynes, it is true that supply does create demand for goods and services because various factors of production earn their incomes in the process of production by helping to create additional supply of output. When factors of production are employed to produce goods, they get their reward in the form of wages, rents, interest and profit. But from this it does not follow that the entire supply of national output will always be demanded by them.

ADVERTISEMENTS:

The incomes of the factors of production are necessarily equal to the value added in the productive process, but it does not mean that the entire income will be automatically spent on goods and services created in a given time period. A part of income will be saved so that this part of income is not available to create demand for goods and services.

Unless investors are willing to invest to an equivalent extent of intended savings, the total effective demand which consists of demand for consumer goods and producer goods (C + I) will not be sufficient to absorb the entire available supply of output. And if it happens, then producers will not be able to sell their entire output, their profits will fall and they will cut their production and this will create unemployment.

In a given period, consumers are planning to spend a given part of their income and save the rest. Similarly, entrepreneurs are planning to invest in factories, machines, etc., to a given extent. The total effective demand is the sum of the consumption and the investment demand.

Savers are saving for different reasons than the investors whose investment is determined by different factors and in a completely free market economy there is no mechanism to ensure that what savers are planning to save is just equal to what investors are planning to invest.

If there is any discrepancy between planned saving and investment, output, income and employment will change to correct this discrepancy. If planned investment is greater than planned saving, the current output will not be sufficient to meet the emerging demand and hence income, output and employment will increase and vice versa.

Thus, we see that the basic weakness of Say’s law arises because of lack of any agency to ensure automatically that intended investments are just equal to intended savings. Since savings and investments are undertaken by different persons and for different reasons a discrepancy between the two is bound to arise and when it arises the necessary mechanism to correct it is through changes in the volume of employment and income.

What Causes Depression or Cyclical Unemployment?

According to Keynes, the cause of depression and cyclical unemployment in the industrialized capitalist countries was a sharp decline in private investment due to the adverse business expectations about profit making. There was a wave of pessimism prevailing among investors. The decline in private investment due to fall in marginal efficiency of capital (that is, expected rate of return) caused a fall in aggregate demand and resulted in less than full-employment equilibrium.

Consequently, level of output and employment fell drastically and involuntary unemployment came to prevail on a large scale. The involuntary unemployment that prevails in times of recession/depression is called cyclical unemployment and, as we have seen above, according to Keynes, it is due to deficiency of aggregate demand.

Large fluctuations in investment, according to Keynes, are due to the uncertain basis of profit expectations on which investment decisions are made. To quote him,” We have to admit that our basis of knowledge for estimating the yield ten years hence of a railway, a copper mine, a textile factory, the goodwill of a patent medicine… amounts to little and sometimes to nothing. ”

ADVERTISEMENTS:

In view of this uncertainty of future. Keynes stressed that investment decisions were greatly influenced by how optimistic or pessimistic investors feel. He used the term animal spirits to describe these pessimistic or optimistic expectations of the investors about profit earning from investment projects.

The term animal spirits implies that there may be no good or intelligent basis for expectations on which investors base their decisions. Thus involuntary unemployment emerges due to fall in aggregate demand. Therefore, the cause of depression or cyclical involuntary unemployment is the deficiency of aggregate demand.

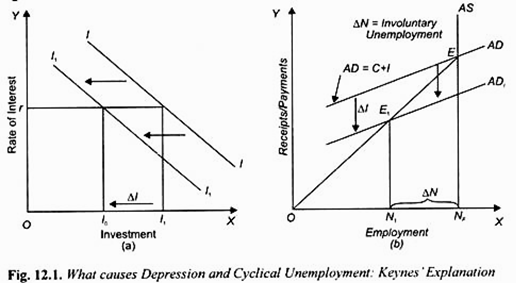

It will be useful to explain through a diagram how a fall in investment causes a decline in level of output and employment and results in cyclical unemployment. This is illustrated in Figure 12.1. It will be seen from Figure 12.1 (a) that due to adverse profit expectations or pessimism of investors, investment demand curve shifts to the left from II to I1I1. With this it will be seen that investment falls from I1 to I0 at a given rate of interest. This fall in investment demand by I1I0 causes a downward shift in the aggregate demand curve from AD to AD1 [See Figure 12.1(b)].

As a result, the equilibrium between aggregate demand and aggregate supply which was initially at full employment level NF (which corresponds to point E where the two curves intersect) falls to the new equilibrium level of employment ON1. Thus involuntary unemployment equal to NfN1 or ∆N emerges due to fall in aggregate demand.

ADVERTISEMENTS:

Therefore, the cause of Keynesian cyclical unemployment is deficiency of aggregate demand. It should also be noted that the decline in the level of employment following the fall in investment and aggregate demand also results in decrease in GNP or national income of a country. The emergence of large-scale unemployment and drastic decline in level of output and national income represents a situation of depression.

It is also important to note that with the help of his theory of investment multiplier Keynes showed that the fall in the level of employment and income is not merely due to the decline in investment but by a multiple of it due to the inverse working of multiplier. In fact during the period of recession in the early 1930s, it, happened so in the advanced capitalist countries such as the US.

In the US between 1929 and 1933 the fall in investment was 47.5 billion US dollars whereas national income declined from 315 billion US dollars to 222 billion US dollars during the same period that is, a fall by 93 billion US dollars and as a result unemployment in the US rose from 3.2 per cent of labour force to 25 per cent during this period.

ADVERTISEMENTS:

The multiplier effect of decline in investment on employment can be seen from Figure 12.1 (b). The fall in investment by ∆l has led to be a much larger decline (∆N) in employment from NF to Nt due to reverse operation of multiplier.