In this article we will discuss about the classical theory of income and employment.

The basic contention of classical economists was that “given flexible wages and prices, a competitive market economy would operate at full employment. That is, economic forces would always be generated to ensure that the demand for labour would always equal its supply”.

In the classical model the equilibrium levels of income and employment were supposed to be determined largely in the labour market. The demand curve for labour shows the relationship between the real wage (equal to the value of the marginal product of labour in a competitive economy) and the demand for labour by employers.

The lower the wage rate, the more the workers will be employed. This is why it is downward sloping. The supply curve of labour is upward sloping for obvious reasons. The higher the wage rate, the greater the supply of labour.

ADVERTISEMENTS:

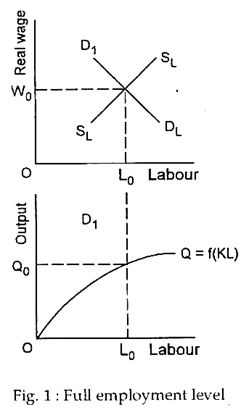

Fig. 1 shows the labour market situation. The equilibrium wage rate (W0) is determined by the demand for and the supply of labour. The level of employment is OL0. The lower graph shows the relation between total output and the quantity of the variable factor (labour).

The graph actually shows the short-run production function which may be expressed as Q =f (KL), where Q is output, K is the fixed quantity of capital and L is the variable factor labour. Total output is OQ0 when OL0 units of labour are employed.

According to classical economists this equilibrium level of employment is the ‘full employment’ level. So, the existence of unemployed workers was a logical impossibility. Any unemployment which existed at the equilibrium wage rate (OW0) was attributable to frictions or restrictive practices in the economy or was voluntary in nature.

ADVERTISEMENTS:

The classical economists assumed flexibility of wages and prices (or of real wages). They believed that if the wage rate was flexible a competitive economy would always be able to maintain full employment. In other words, aggregate demand would be sufficient to absorb the full capacity output OQ1.

In fact, “whatever the full employment level of output, the income created in producing it will necessarily lead to spending which will be sufficient to purchase the goods produced”. In other words, the classical economists denied the possibility of under-spending or overproduction. True enough, the classicists had faith in Say’s Law, named after the French economist J. B. Say (1767-1832).

Say’s Law. Say’s Law is the simple notion that the supply of goods and services creates its own demand, i.e., the very act of producing goods and services generates an amount of income equal to the value of the goods produced. That is, the production of any good would automatically provide the wherewithal to take the output off the market.

The essence of the Law—that supply creates its own demand—can be envisaged most easily in terms of a simple barter economy. A farmer, for example, produces or supplies wheat as a means of buying (or demanding) the shoes, shirts and other things produced by shoe-makers and craftsmen. The farmer’s supply of wheat is equivalent to his demand for other goods.

ADVERTISEMENTS:

This is true for other producers and for the whole economy. Demand must be the same as supply. In fact, the circular flow model of the economy and national accounting both suggest this sort of relationship. For instance, “the income generated from the production of any level of total output would, when spent, be just sufficient to provide a matching demand”.

Say’s Law is equally applicable in a modern economy which uses money as a medium of exchange and store of value. Here any excess supply of money possessed by an individual implies excess demand for goods and vice versa. So, for the economy to be in equilibrium the sum of the excess supply functions must be zero.

If the composition of output is in accord with the tastes and preferences of consumers, all markets would be cleared of their outputs. Thus all that businessmen need to do to sell a full-employment output is to produce that output; “Say’s Law guarantees that there will be sufficient consumption spending for its successful disposal”.

Saving, Investment and the Rate of Interest:

There is, of course, a serious omission in Say’s Law. If the recipients of income in this simple model save a portion of their income, consumption expenditure will fall short of total output and supply would no longer create its own demand. Consequently, there would be unsold goods, falling prices, cutbacks in production, unemployment and falling incomes.

However, the classical economists ruled out this possibility by suggesting that saving would not really in a deficiency of total demand, because each and every rupee saved would be automatically invested by business firms. That is, investment would occur to fill any consumption ‘gap’ caused by saving leakage.

In fact, businessmen produce not only consumption goods for sale to households but investment (capital) goods for sale to other firms (or to one another). The latter constitute a considerable portion of society’s total output. In other words, investment spending by business will add to the income-expenditure stream.

This may fill any consumption gap arising from saving. Thus, if private business firms as a group intend to invest as much as households want to save, Say’s Law will hold and the levels of national income and employment will remain constant.

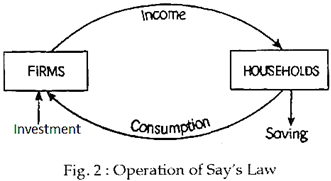

To illustrate Say’s law consider Fig. 2. It shows a simplified version of the circular flow of income diagram. There are only two sectors—households and private business firms. Households receive income exactly equal to the value of goods and services produced.

Part of this income is spent on consumption goods, the balance is saved. Thus consumption demand falls short of the total value of production (GNP) by the amount of saving, which is made up by demand for capital goods (i.e., investment demand). Thus so long as investment and saving are equal, aggregate demand (i.e., consumption demand plus investment demand) will always be equal to the total value of production.

Thus, “weather or not the economy could achieve and sustain a level of spending sufficient to provide a full-employment level of output and income therefore would depend upon whether businesses were willing to invest enough to offset the amount households want to save”.

The Money Market:

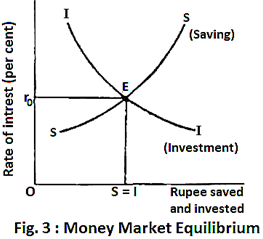

The classicists also argued that capitalism contained a very special market—the money market—which would ensure saving investment equality and thus would guarantee full employment. According to them the rate of interest (the price paid for the use of money) was determined by the demand for and the supply of capital. The demand for capital is investment and its supply is saving.

ADVERTISEMENTS:

So the rate of interest is determined by the saving-investment mechanism. The equilibrium rate of interest is one which brings about S-I equality. Any imbalance between S and I would be brought about by changes in the rate of interest (r). If S exceeds I, r will fall. This will stimulate investment. The process will continue until and unless the equality is restored. The converse is also true. See Fig. 3, which is self-explanatory.

Price-Wage Flexibility:

ADVERTISEMENTS:

The classicists also argued that the level of output which producers can sell depends not only upon the level of aggregate demand but also upon the levels of product prices. Thus even if the interest rate fails to equate the desired S of the household sector with the desired I of private business firms, any resulting decline in total spending would be neutralised by proportionate decline in the price level.

That is, Rs. 100 will buy two shirts at Rs. 50, but Rs. 50 will buy the same number of shirts provided their price falls to Rs. 25. Therefore, if households somehow succeeded in saving more than what business firms were willing to invest, the resulting fall in total spending would not result in a decline in real output, real income, and the level of employment provided product prices also declined in the same proportion as aggregate expenditure.

According to classical economists competition among sellers would ensure price flexibility. A general decline in demand in product market will force competing producers to lower their prices to clear their accumulated surpluses.

Thus the result of excess saving would be to lower prices. This will raise the value of money and permit non-savers to acquire more goods and services with a fixed money income. Saving would, therefore, lower prices but not output and employment.

Wage-Price Flexibility:

But this is not perhaps the whole truth. A fall in product prices would reduce resource prices—particularly wage rates—in the process. Thus wage rates have to decline significantly to permit businesses to produce profitably at the new lower prices.

ADVERTISEMENTS:

The classical economists thought that & decline in product demand would automatically be translated into a fall in demand for labour and other resources. The immediate result would be an excess supply in the labour market, i.e., unemployment at the existing wage rate. The wage rate will fall.

The producers who were reluctant to employ all workers at the original wage rate will now find it profitable to employ extra workers at lower wage rate. And competition among unemployed workers would force them to accept lower wages rather than remain unemployed. The process would come to a halt only when the wage rate falls enough to clear the labour market. So a new lower equilibrium wage rate would be established.

Thus, involuntary unemployment was a logical impossibility in the classical model. Anyone willing to work at the market determined wage rate would be able to find jobs readily and people would have substantial choice of jobs.

How the Product Market Adjusts:

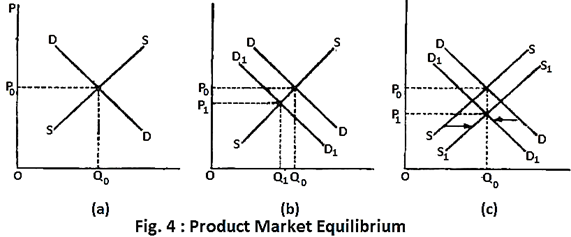

Equilibrium in a typical market, of which there are many in the economy, is shown in part a of Fig. 4. The intersection of the product demand curve (DD) and the product supply curve (SS) determine the equilibrium price (P0) and equilibrium output (Q0).

A fall in aggregate demand is reflected in a leftward shift in product market demand curves throughout the economy. This is shown in part b, where the aggregate demand curve shifts to the left to D1D1. The equilibrium price falls from P0 to P1 and the equilibrium output from Q0 to Q1. This also occurs in other product markets. Producers now cut back output and reduce their employment of labour and the purchase of other resources.

ADVERTISEMENTS:

The reluctant workers are now involuntarily unemployed because they are willing to work at the yet unchanged wage rates. They will, therefore, compete for the available jobs by bidding down wages. Similarly, suppliers of raw materials will lower their prices to reduce their surpluses.

The lowering of wages and resources prices causes product market supply curves to shift upward. This process continues until the initial output levels in product markets are restored and all available workers are once again fully employed.

This is shown in part c, where the product market supply curve has shifted from S1S1 to the position S2S2. The initial output of Q0 is restored, but at a lower equilibrium price P2, determined by the intersection of D1D1 and S1S1.

The economy is once again operating at full employment output level. Wage-price flexibility would always ensure this result.

Conclusion:

ADVERTISEMENTS:

So to sum up, however, the classical system depends upon three central propositions:

(a) S and I depend on the rate of interest;

(b) Wages, prices and interest rates are flexible; and

(c) The economy is characterised by competitive forces in both product and resource markets. Given these conditions, there would be neither deficiency of aggregate demand nor over-production. The end result would be full employment.

The Classical Theory Summed Up:

In truth, the classical economists maintained that the economy would operate at its full employment output level without the need for continually falling wages and prices. Say’s law assumed that the unfettered forces of free markets and laissez faire capitalism would guarantee full employment with price stability.

ADVERTISEMENTS:

If there were disturbances that caused investment or saving curves to shift, or shifts in demand and supply curves in any other market, adjustments in wages, prices and the interest rate would always return the economy to a position of full employment equilibrium.

Keynes’ Criticism:

Keynes criticised the classical theory on three main grounds:

(a) Saving depends on national income and is not affected by changes in interest rates. Investment may, of course, be influenced by it, although it depends on future profit expectations. Thus S-I equality through adjustment in interest rate is ruled out. So, Say’s Law will no longer hold.

(b) The labour market is far from perfect because of the existence of trade unions and government intervention in the form of imposition of minimum wage laws. Thus, wages are unlikely to be flexible. Trade unions may succeed in raising wages even when there is no excess demand for labour, rather there is excess supply.

Wages are more inflexible downward than upwards. So, a fall in demand (when S exceeds I) will lead to fall in production and employment. The problem is not one of involuntary idleness of resources including manpower.

(c) Keynes also argued that’ even if wages and prices were flexible a free enterprise economy would not always be able to achieve automatic full employment. In a depression economy monetary policy would lose its effectiveness and would be unable to influence the rate of interest and thus the volume of investment and the level of income. The interest inelasticity of investment has been a subject matter of much debate and controversy.