Read this article to learn about the classical theory of the rate of interest.

The theory of the rate of interest, as given by classical writers like Ricardo, Marshall and Pigou, is called the classical theory of the rate of interest.

Others who subscribe to this theory are: Cassel. Walras, Carver, Taussing and Prof. Knight. The rate of interest according to this theory is determined by the supply of and demand for capital under free and perfect competition.

In the classical view, the demand for capital is a function of the productivity of capital; the supply of capital is a function of thrift or abstention from consuming current output.

ADVERTISEMENTS:

According to classical economists, interest arises because capital is ‘productive’ and ‘scarce’ in relation to the demand for it. Had capital been as plentiful as air, water or sunshine, there would have been no economics and perhaps no problem of interest on capital. It is because of its scarcity that it is subject to alternative uses and is first put to more productive use.

As the amount of capital increases, additional units of capital are put to less productivity uses, thereby diminishing its marginal productivity as more of it is employed. An individual producer will push his investment of capital to a point where the productivity of capital equals the rate of interest prevailing in the market. This shows that at higher rates of interest producers use less capital and at lower rates they demand more capital.

Therefore, the demand curve for capital (investment demand schedule) slopes downwards to the right. It was J.B. Say who explained the rate of interest in terms of productivity of capital. Later, J.B. Clark developed the concept of marginal productivity. To him, interest always corresponded to the marginal productivity of capital. Later, it corresponded to net productivity of capital.

Supply of capital, on the other hand, at any given time, depends upon a number of factors and is very complex matter. It depends upon a large number of psychological and institutional factors included under what we call in Economics ‘will to save’ and ‘power to save’. On the supply side the theory was stated more or less in terms of time-preference, i.e., those who supply capital, prefer present to future.

ADVERTISEMENTS:

When they lend they postpone their present wants to some future date, which involves a sacrifice, for which rate of interest must be paid. Senior stated the theory in terms of abstinence, though the use of this term was severely criticized later on. Marshall and Cassel explained it in terms of waiting. Bohm Bowerk and Irving Fisher developed the premium theory of interest.

According to them, present commodities being more important than future commodities, the present goods command a technical superiority over future goods. According to classical economists, therefore, a very important determinant of the amount of savings inter alia, is the rate of interest.

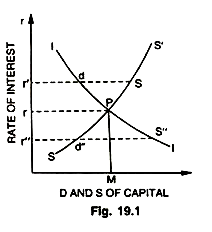

People will be induced to save more at a higher rate than at a lower rate of interest. Hence, the supply curve of capital (supply schedule) slopes upwards from the left to the right. As a matter of fact, on the side of supply, the rate of interest must be high enough so as to induce the marginal saver to save, i.e., the one whose savings, when added to the total savings, will make the supply of capital equal to its demand. The classical position is shown in the Fig. 19.1.

II’ is the demand schedule for capital and SS’ supply schedule of capital. Or (PM) is the equilibrium rate of interest, which prevails in the market under free and perfect competition. There is disequilibrium at a higher rate of interest (Or’) as the supply of capital exceeds the demand for capital by ds. Similarly, at lower rate of interest (Or”) demand for capital exceeds supply of capital by d”s”. Hence a self-regulatory process of adjustment and readjustment will start and ultimately the equilibrium rate of interest (Or) will prevail in the market.

ADVERTISEMENTS:

The classical economists called this equilibrium rate of interest at the natural rate of interest. They held that if the market rate of interest was higher than the natural or the equilibrium rate of interest, the supply of savings would exceed the demand and the market rate of interest must fall to the natural rate. Similarly, if the market rate of interest is lower than the natural rate, the demand of savings will exceed the supply, till it rises to become equal to the natural rate of interest.

Thus, the classical theory did not think of the possibility of a divergence between the market rate of interest and the natural rate of interest—this was the direct result of a view which allowed money only a passive role. The classical economists firmly believed that the introduction of money did not alter the real process of production—it simply increased the efficiency of barter economy.