Let us make an in-depth study of the Classical Theory of the Rate of Interest:- 1. Subject Matter 2. Real Rate and the Market Rate of Interest.

The Classical Theory # Subject Matter:

The classical theory of the rate of interest is the result of the contributions of many writers of the classical school.

According to this theory, the rate of interest is determined by the supply of and demand for savings.

The rate of interest is that rate which is earned from risk- free, easily manageable loans.

ADVERTISEMENTS:

The factors behind the demand for savings and supply of savings were variously interpreted but the idea common to all classical writers was that both the demand and supply of savings are interest-elastic. Some writers called the interest rate the reward for a saver’s abstinence from consuming Iris income while others called it a charge for the borrower’s preference for the present consumption.

Supply of savings was supposed to depend upon different considerations by different writers. Some classical authors laid stress on the ‘waiting’ or ‘abstinence’ found necessary for saving. They held the rate of interest to be an inducement for the act of saving and the supply of saving. Other classical writers would emphasize time-preference as the primary consideration of savers.

In their view, saving which is used for investment is made available by those who are prepared to postpone their consumption of their present income to some future date, thereby making the purchasing power or the resources available to those who want to invest.

Saving can be obtained by the investors only if they are prepared to pay the savers a rate of interest high enough to overcome their time preference. Obviously, higher is the rate of interest; greater is the number of persons whose rates of time preference are covered.

ADVERTISEMENTS:

The supply schedule of saving was assumed to be interest-elastic and made to depend only on changes in the rate of interest. As rate of interest rises, the savers are induced to save more; while the abstinence or time-preference of more people is covered, the number of people doing saving also increases.

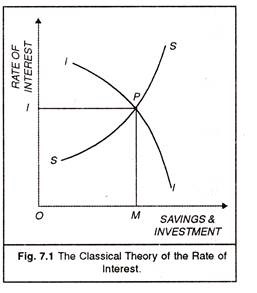

In this way, as the offered rate of interest rises, volume of saving forthcoming also rises. The supply curve of savings, thus, slopes from left upward to the right, as has been shown in Fig. 7.1 given above.

Demand for savings was thought to come from producers for investment. The act of investment was the expenditure on the purchase of capital goods which could be used to produce some other goods expected to be sold to earn profit. It was argued by the classical writers that since capital is productive and it can be built out of real saving only, the demand for saving depends upon the productivity of capital.

ADVERTISEMENTS:

Every type of capital asset has a particular rate of productivity for the future which the producer estimates before purchasing the capital asset. Capital assets were also thought to be subject to diminishing returns like any other factor of production; as producers demand more and more of a particular type of capital goods, their marginal productivity diminishes.

Thus the rate of return from the investment of more and more savings was supposed to fall due to the falling marginal productivity of capital.

The classical writers assumed perfect competition to prevail in the factor market; their contention was that a producer would hire capital up to the point at which the marginal cost (= price) of capital is equal to the marginal productivity of capital.

They regarded the marginal productivity of capital to be the marginal productivity of savings invested to produce the capital assets. Rate of interest in their view, was the cost of procuring the necessary saving for producing a capital asset.

The investor, they argued, would continue to make investments in capital assets as long as their marginal productivities are greater than the cost of borrowing for them which is the rate of interest. As more investment is done in particular types of capital assets, the cost of borrowing needed for financing them could rise while its marginal productivity would continue to fall.

An investor was thus assumed to invest up to the point at which the marginal cost of borrowing—the rate of interest—is equal to the marginal productivity of the capital asset. Since the marginal productivity curve of a capital asset was assumed to be downward-sloping and the demand for capital assets was thought to depend only upon their marginal productivity, the various points on the marginal productivity curve at which an investor would equate the marginal productivity to the rate of interest he paid for borrowing, were supposed to give the demand curve for capital or saving.

The demand curve for saving (investment) was thus assumed to slope from left down to the right as shown in Fig. 7.1.

Given the supply curve and the demand curve for saving, equilibrium rate of interest is that at which the volume of saving demanded for investment equals the savings coming forth at that rate of interest. In Fig. 7.1 Oi is the equilibrium rate. In other words, the equilibrium rate of interest is that which equates the cost of borrowing with the marginal productivity of capital on the one hand and on the other induces the marginal saver to save.

His saving is the addition to the volume of saving which makes it equal to the volume of demand for them. At any other rate of interest, the volume of saving induced will be more or less than the amount of investment the producers wish to undertake.

The Classical Theory # Real Rate and the Market Rate of Interest:

The classical theory of the rate of interest was further developed by Irving Fisher. Fisher’s contribution rests fundamentally on a distinction between two interest rates: the real rate and the market rate. The real rate of interest is the interest rate measured in terms of goods.

ADVERTISEMENTS:

That is, it is the rate that will prevail in the market if the general price level remained stable. Under such circumstances, if you lend a friend Rs. 100 today with the understanding that he will repay you Rs. 105 worth of goods a year from to-day, you give up Rs. 100 worth of goods now for what you expect will be Rs. 105 worth of goods a year from now. The real rate of interest is therefore 5 percent.

According to the classical writers, this rate is established by real economic forces of demand and supply. The “real demand” for funds by business is determined by the productivity of borrowed capital. The greater its productivity, the larger the amount of funds which businessmen will want to borrow.

The “real supply” of funds by households is determined by the willingness of consumers to abstain from present consumption. The greater their willingness, the larger the amount of funds which households will want to lend.

ADVERTISEMENTS:

The market rate of interest is the actual or money rate that prevails in the market at any given time. Unlike the real rate which is not directly observable, the market rate is the one we actually see in the markets. This is because the market rate reflects the quantity of loans measured in units of money, not goods. Hence it is the rate people ordinarily have in mind when they talk about the rate of interest.

A crucial point in classical theory is that the real rate and the market rate usually are not equal. Only if borrowers and lenders expect the general price level (that is, the value of a unit of money) to remain constant will both rates be the same. This does not ordinarily happen. People are always expecting prices either to rise or to fall.

Therefore, the market rate of interest will depart from the real rate, depending on either of the two conditions:-

1. Anticipated Inflation:

If people believe that prices will rise—and hence that the purchasing power of a unit of money will decline—the market rate of interest will be higher than the real rate. For example, if the lenders and borrowers expect the price level to rise 5 percent per year, the market rate of interest will be the real rate plus 5 percent.

ADVERTISEMENTS:

This “inflation premium” is necessary to compensate lenders for their loss in purchasing power. At the same time, borrowers will be willing to pay the premium because they will be repaying their loans with money worth 5 percent less per year than the money they borrowed.

2. Anticipated Deflation:

If people believe that prices will fall—and therefore that the purchasing power of a unit of money will rise—the market rate of interest will be below the real rate. Tire difference is a “deflation discount” (or negative inflation premium).

This is necessary to compensate borrowers for their loss in purchasing power. At the same time, lenders will be willing to grant the discount because they will be repaid with money worth 5 percent more per year than the money they initially lent.

Real rate of interest = Market rate – expected rate of inflation

These ideas can be summarised briefly:

In classical theory, the market rate of interest may be greater than equal to, or less than the real rate. The difference depends on whether households and businesses expect the general price level to rise, remain constant, or decline.

ADVERTISEMENTS:

Any differential between the market rate and the real rate represents the amount necessary to compensate lenders or borrowers for adverse changes in purchasing power resulting from anticipated inflation or deflation.