Read this article to learn about the neo-classical theory of rate of interest.

A slight variant of the classical demand for and supply of capital theory of interest is called the neoclassical (Loanable Funds) theory of the rate of interest.

According to this theory, the rate of interest is determined by the demand for and supply of loanable funds.

The loanable funds theory was first enunciated by a Swedish economist, K. Wicksell. Other Swedish economists who refined his ideas include G. Myrdal, Lindahl and B. Ohlin. In England D.H. Robertson developed the theory. It includes the monetary as well as the non-monetary aspects of interest.

ADVERTISEMENTS:

The classical theory did not take into consideration the importance of monetary factors like cash, credit, hoardings etc. The fact that the demand for money may also arise from the desire to hoard, was not given any heed in the classical theory of the rate of interest. It regarded interest as the function of saving and investment and may be expressed as i = ƒ (S, I). The loanable funds theory takes into account the role of the credit and hoarding, and considers the rate of interest to be the function of four variables—saving (S) investment (I), the desire to hoard (L) and the amount of money (M), expressed as : i = f(S, I, L, M). The supply of loanable funds comes from four basic sources namely, savings, dishoarding, bank credit and disinvestment.

Savings:

Savings by individuals or households constitute the most important source of loanable funds.

Savings are visualized in two ways:

Firstly, as ex-ante savings, i.e., savings planned by individuals at the beginning of the period in the hope of expected incomes and expected expenditures on consumption.

ADVERTISEMENTS:

Secondly, savings are thought of in the Robertsonian sense i.e., the difference between the income of the preceding period and the consumption of the present period. In either case the quantum of savings varies at different rates of interest.

At a given level of income, the larger would be the savings, the higher is the rate of interest and vice versa. Like individuals and households, business firms also save. A part of the profits of these business houses is distributed as dividend and the rest constitutes corporate savings. Such savings depend partly on the current rate of interest. A higher rate of interest stimulates business savings as a substitute for borrowing from loan market. But such corporate savings are often invested by the firms themselves and, therefore, do not constitute loanable funds.

Dishoarding:

This is another important source of loanable funds. It means bringing out hoarded money of previous periods and making it available for investment. At a low rate of interest there is no encouragement to lend and people hoard money to fulfill their desire for liquidity. But at a higher rate of interest people dishoard money and add to the loanable funds for investment purposes.

Bank credit:

Bank credit of bank money constitutes yet another source of loanable funds. Banks advance loans to business houses by creating credit which is an addition to the supply of funds. Other things remaining the same, the banks have a tendency to lend more at higher rates of interest and vice versa.

Disinvestment:

ADVERTISEMENTS:

Loanable funds are also provided sometimes through disinvestment. It takes place when due to structural changes the existing stock of capital equipment is allowed to wear out without being replaced. When this happens, part of the revenue from the sale of the products instead of going into capital replacement, goes into the market for loanable funds. This kind of disinvestment is encouraged when the rate of interest is high.

Similarly, the demand for loanable funds comes from three sources.

Investment:

A major part of the demand for loanable funds comes from business houses which borrow funds for various business purposes like the purchases of raw materials, capital equipment or building up inventories. They will demand more funds in case the rate of interest is low. The demand for loanable funds for investment purposes, therefore, is interest elastic.

Consumers:

Another major source of demand for loanable funds comes from consumers who want to borrow funds for consumption purposes. People want to borrow more funds when they want to spend more than their current income or resources, e.g., consumers may ask for more loans to spend on durable goods like cars, scooters, etc. A lower rate of interest will naturally stimulate the demand for loanable funds for consumption purposes and vice versa.

Liquidity:

The third source of demand for loanable funds comes from those who want to hold idle cash balances for satisfying their desire for liquidity. At higher rate of interest, people will hold less on account of the higher loss involved in holding cash balances while at a lower rate of interest people will hold more money because the loss involved is not much.

Thus, in the market there are lenders who supply loanable funds and there are borrowers who demand loanable funds. Rate of interest will be such as will bring the demand for and supply of loanable funds into equilibrium. The loanable funds theory filled in the deficiencies of the old classical theory of interest by taking into consideration the role of credit on the rate of interest.

By linking it with liquidity preference (L), quantity of credit (M), saving and investment, the theory has generated greater realism because the supply of loanable funds is not the same thing as the supply of saving, for, in addition to saving, account must also be taken of the changes in the quantity of money as a result of expansion and contraction of bank credit.

The neo-classical formulation of loanable funds theory of interest represents an improvement on the classical theory, in as much as the term ‘loanable funds’ is wider in scope and includes, in Robertsonian language, not only voluntary savings (i.e., savings out of disposable income as used by Pigou) but also borrowed bank funds and activated idle balances (dishoarded money). There is, therefore, to all intents and purposes, not much difference between the two theories except that the term ‘loanable funds’ replaces the terms ‘saving’ or ‘capital’.

Actually speaking, the Pigovian supply schedule of savings amounts to the same thing as the Robertsonian or Swedish supply schedule of loanable funds. The classical theory of interest—the time preference theory—is the real theory of interest, while the neo-classical theory known as the loanable funds theory, is a monetary theory of interest. Except for this, there is no material difference and it is unnecessary to distinguish any more between the two theories; they can, therefore, be used interchangeably.

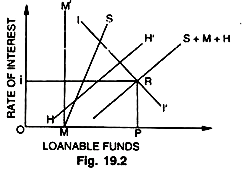

Fig. 19.2 shows that II’ is the demand curve for loanable funds and shows the demand for investment in durable capital and consumer goods. MM ‘is the total supply of bank money Which is determined by the monetary authority and is assumed to be independent of interest rate and is more or less fixed for h purposes of simplification, therefore, MM’ is vertical (according to loanable fund theorists, M is regarded as a variable dependent on the rate of interest and the curve showing the quantity of money could be upward sloping showing the dependence of M on the rate of interest; whereas, according to strict Keynesian version, M is an independent variable and is represented by a vertical curve showing that the quantity of money is more or less fixed by the central bank).

S curve is the supply curve of current savings (out of disposable income). It is somewhat elastic to changes in interest rates though not very elastic (because savings depend upon income). The curve HH’ is the supply curve of funds resulting from dishoarding. It is supposed to be elastic to changes in interest rates (in accordance with liquidity preference theory).

Thus, by adding the three curves, we get a curve S + M + H called the supply curve of loanable funds. Where the demand (II’) and supply curves S + M + H intersect, the rate of interest is determined i.e., RP = Oi. Again, let us note that II’ curve in the above diagram could also be shown as I + L curve to include the demand for idl cash balances in the total demand for loanable funds, which Wick-sell did not take into account while analyzing the demand for loanable funds. II’ curve in the figure may, therefore, be interpreted to include the demand for idle balances.