Let us make an in-depth study of the Concept of Rate of Interest:- 1. Subject Matter of the Concept of Rate of Interest 2. Gross and Pure Rate of Interest 3. Why is Interest Paid?

Concept of the Rate of Interest # Subject Matter:

The nature of interest and its determination has been the subject of controversy since long.

The concept of rate of interest has been changing with the development of interest rate theories.

History of economic thought shows more of controversy and debate on the determination and role of the rate of interest than on any other factor reward. This is due to the peculiar nature of ‘capital’ as compared to other factors.

ADVERTISEMENTS:

Capital is the fruit of non-consumption of income and is reproducible. It is a non- human factor of production but it is accumulated through human decisions and as such it must be paid a minimum reward to be maintained or reproduced.

The origin and service of capital is distinctly different from that of the other factors. As such it requires a separate treatment. A major difficulty in building up a complete and general theory of the rate of interest is the lack of an all-acceptable definition of Capital.

Anyhow, economists have sought to resolve the difficulty through various means. Before we undertake an exposition of the major attempts at explanation of the determination of the rate of interest, it is necessary to be clear about the distinction between gross and net rate of interest, or ‘pure’ rate of interest as it is called.

Concept of the Rate of Interest # Gross and Pure Rate of Interest:

In common language, the term ‘rate of interest’ is used to denote the ‘contract’ or the ‘gross’ rate of interest. The gross rate of interest includes payment for not only the use of money but also administrative cuts and some insurance for the risk of default.

ADVERTISEMENTS:

The rate of interest charged on loans of different types in the market are gross rates of interest reflecting, besides the payment for the use of money capital, the appropriate payment for the cost of management of the loan and the payment covering the risk of the loan being not paid back.

Since the administrative costs of managing the loan and its recovery as well as the degree of risk involved differs from loan to loan, the gross rate of interest also differs accordingly.

The Gross rate of interest is made of three components:

(1) The pure rate of interest,

ADVERTISEMENTS:

(2) The administrative costs of managing the loan, and

(3) The premium for risk of default.

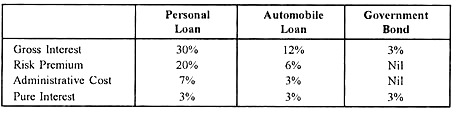

Let us study each of them in detail by taking examples of three different types of loans with different types of security: a personal loan, an automobile loan and a government bond with gross rates of interest of 30, 12 and 3 per cent respectively.

In these three types of loans, the security, the liquidity and the marketability of the credit paper differs. As a result, gross rates of interest also differ. Let us study the components of the gross rate of interest by taking the three examples.

(a) The Pure Rate of Interest:

The pure rate of interest is the charge for the use of the money capital loaned out. Since the various units of money lent out by different creditors are perfectly homogeneous, the pure rate of interest is the same in all types of loans.

The pure rate of interest is that charged on loans which are totally riskless and have no administrative costs. Government securities or bonds (loans) bear the lowest rate of interest because a loan given to government is riskless; the loan is sure of being paid back on maturity date and is quite liquid in that it can be sold out in the market at any time.

The government floats loans on so large a scale that the cost of administration of the bond is virtually nil. We may, therefore, take the rate of interest paid on government bonds as representing the pure rate of interest. In the three types of loans referred to above, we can say that the pure rate is 3 per cent and the balance represents the payment due to other considerations about the nature of the loan.

(b) Payment for Risk of Default:

Two considerations weigh with the lender in assessing the degree of risk involved in a loan: the time for which the loan is given and the nature of security offered for the loan. The greater is the time for maturity of the loan the greater is the degree of risk involved. The degree of risk also differs with the liquidity of the claim or security obtained by the lender against the loan.

Since among the three loans referred to above, the government bond is riskless and most liquid, it has no payment for the risk of default. Since the automobile loans are less risky and more liquid than the personal loan the payment as premium for the risk in the latter may be 20 per cent.

(c) Administrative Costs:

ADVERTISEMENTS:

The cost of administering the loan differs from one lender to another. It also depends on the nature of loan. The cost of administering a personal loan is the highest because of the need to have a pronote or any such court paper. It is, in our example, 7 per cent. The cost of administration of an automobile mortgage loan is 3 per cent and that of a government bond is virtually nil. Thus, the gross rates of interest vary with the type of the loan whereas pure rates of interest are identical.

This is shown in the three types of loans thus:

It should be said that the various theories of interest which we are to study here deal with the determination and payment of pure rate of interest. This is because once we know the process of determination of the pure rate, the structure of gross rates of interest is automatically explained by the varying degree of risk on various loans and their liquidity.

Concept of the Rate of Interest # Why is Interest Paid?

ADVERTISEMENTS:

Payment of the pure rate of interest is variously accounted for by different theorists. Payment of interest is necessary to induce those persons who have money capital to turn it over to those who wish to use it.

A person who is having wealth in liquid form—that is in the form of ready money—has three general alternatives: he can spend upon consumption, he can hold it in liquid form; or he can make it available for use to the producers or government. In making a decision on the choice of one of these alternatives, the person considers the rates of interest prevailing in the market.

In other words, the pure rates of interest may be regarded as payment to induce people to save instead of consume, or as a payment to part with liquidity and money wealth available for use in production. The classical economists regarded interest as a payment to induce persons to save rather than spend on consumption.

Keynes, however, thought it more appropriate for analytical purposes to regard it as compensation for parting with liquidity—that is, for making money available to others rather than holding it idle. Keynes pointed out that the act of saving docs not in itself enable a person to obtain interest; he must make his money available for use, and thus part with liquidity in order to do so.

ADVERTISEMENTS:

It is clear, however, that the decisions about consumption and savings are of importance for interest rate determination, and must not be ignored. A complete and realistic explanation of interest rate determination must take all these factors into account.