Neo-classical Theory or Loanable Funds Theory:

An improved version of classical interest rate theory was provided by neo-classical economists like K. Wicksell, D. H. Robertson. This theory has come to be known as the loanable funds theory. This theory holds that the rate of interest—like any other price—is determined by the demand for and supply of loanable funds.

This theory further holds that the rate of interest is not determined alone either by real factors as assumed by the classicists or by monetary factors as assumed by Keynes. In fact, both real and monetary factors determine interest rate.

Now we consider sources of supply and demand for loanable funds:

1. Supply of Loanable Funds:

By loanable funds we mean money available for lending in financial markets.

ADVERTISEMENTS:

There are three sources of supply of loanable funds:

(a) Savings

(b) Dishoarding of money from past savings

(c) Bank created money

ADVERTISEMENTS:

(a) Savings:

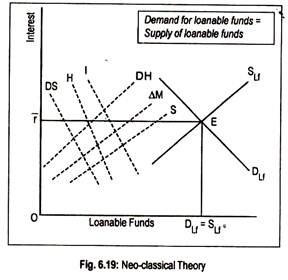

Households and firms supply loanable funds in the capital market out of their savings. Savings are the surplus over consumption. This theory assumes that, given the level of income, savings vary directly with the rate of interest. In Fig. 6.19, savings have been represented by the ‘S’ curve which is interest-elastic.

ADVERTISEMENTS:

(b) Dishoarding from Past Savings:

Individuals hoard cash from their previous incomes. If now these hoarded wealth are dishoarded, idle money (i.e., hoarded money) now becomes active money and, therefore, the supply of loanable funds rises. If more interest is given, people will be induced to dishoard their wealth in order to earn more interest income. The curve ‘DH’ represents this element of loanable funds.

(c) Bank Money:

Commercial banks provide money in the economy. Banks advance loans to the public by creating credit. Obviously, more money will be injected into the economy if banks earn more interest income. At a low rate of interest, the willingness to lend money by the banking system declines. The supply curve of money has been represented by the ‘∆M’ curve;

By lateral summation of all these sources of loanable funds, we obtain total supply of loanable funds in the financial markets:

SLf = S + DH + ∆M

Where SLf represents supply of loanable funds. The curve SLf of Fig. 6.19 is the supply curve of loanable funds. This curve has an upward slope indicating that its volume rises as interest rate rises.

2. Demand for Loanable Funds:

Like supply of loanable funds, demand for loanable funds arises from three sources.

These are:

ADVERTISEMENTS:

(a) Investment

(b) Dis-saving

(c) Hoarding.

(a) Investment:

ADVERTISEMENTS:

In the loanable funds theory, investment demand is governed by the marginal revenue productivity of capital. Since the productivity curve has a negative slope, investment demand is inversely related to the rate of interest. The ‘T’ curve represents this element of demand for money.

(b) Dis-saving:

Demand for loanable funds arises from consumption. People take loans to finance their consumption activities. Dis-saving, or consumption, is inversely related to the rate of interest. ‘DS’ curve represents this element of demand for loanable funds.

(c) Hoarding:

ADVERTISEMENTS:

Hoarding is another source of demand for loanable funds. Demand for hoarding money arises from preference for liquidity or in short, liquidity preference. As liquid cash is attractive, people hoard money. Demand for hoarding money also depends on the interest rate.

At a higher rate of interest, willingness to hoard money on the part of individuals, business firms, etc. declines while willingness to lend money rises. Such relationship between hoarding of money and interest is depicted by the curve ‘H’ in Fig. 6.19.

By summing up all these sources of demand for loanable funds, we obtain total demand for loanable funds. Thus,

DLf = I + DS + H

Where DLf represents total demand for loanable funds. The curve DLf represents this.

In Fig. 6.19, DH, A M and S curves are upward sloping curves showing a positive relationship between them and interest rate. When all these elements are added together we get positive sloping SLf curve. Similarly, negative sloping DLf curve has been drawn on the basis of summation of DS, H and I curves.

ADVERTISEMENTS:

These two curves intersect at point E and the equilibrium rate of interest, thus determined, is or. This interest rate brings demand for and supply of loanable funds in balance.

Limitations of Neo-classical Theory:

One of the chief merits of this neo-classical loanable funds theory is that it is an improvement over the classical theory of interest rate determination. Unlike the classical theory, it does include not only savings as the sources of loanable funds, but it considers monetary factors like bank money and dishoarding as the two major sources of loanable supply of funds.

Keynesian interest rate theory is purely a monetary theory. Neo-classical loanable funds theory again scores over the Keynesian theory as this theory emphasises on real factors, such as savings, marginal productivity of capital or investment to determine interest rate. But this does not mean that this theory is fault-free.

It too has Certain Strong Limitations.

These are:

Firstly, like the classical theory, this theory assumes a fixed money income. Given income, a change in interest rate brings about a change in savings and investment. As interest rate rises, savings rises. But Keynes argued that an increase in interest rate means a fall in investment. Fall in investment leads to a fall in income and, hence, ultimately fall in savings.

ADVERTISEMENTS:

Secondly, Keynes charged this theory on the ground that, like the classical theory, it cannot provide a determinate solution to the interest rate determination.

Without knowing the income level the supply of loanable funds remains unknown and, without knowing the supply of loanable funds, rate of interest remains indeterminate. In other words, we cannot determine the rate of interest unless we know the level of income. Hence indeterminacy.

Thirdly, The theory is based on unrealistic assumption of full employment of resources. Finally, Savings in modern days is often influenced by habit and custom as well as security—irrespective of the rate of interest. However, this theory assumes a direct relationship between savings and interest.

In view of these reasons, the loanable funds theory has little to say in policy formulation.