Stagflation means simultaneous presence of high unemployment (“stagnation”) and high inflation rate. Stagflation occurs when inflation rate is rising while output is falling or at least not rising (stagnant).

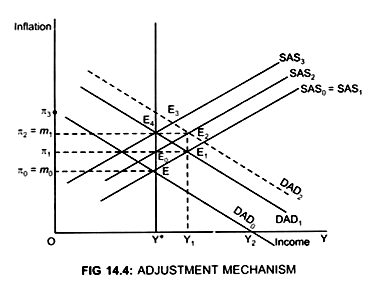

Therefore, during stagflation, there exists an inverse relationship between inflation and output because of shifts in SAS curve caused by change in expected inflation. (Given Fig. 14.4)

Movement from E2 to E3 (Fig. 14.4.) shows output is falling (Y2 < Y1) but inflation rate is rising (π3 > π2). E3 is the stagflation point. Thus, during stagflation people expect inflation in future therefore, the short run Phillips curve will move up from PC1 to PC2.

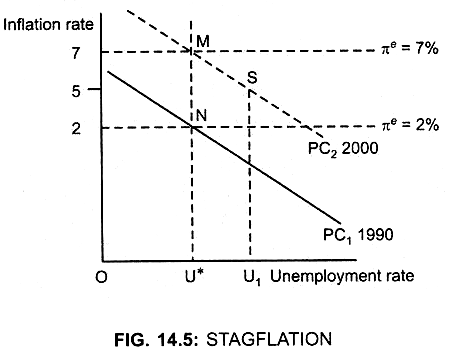

Stagflation occurs when there is recession along a short run Phillips curve based on high expected inflation.

In the figure (14.5) point S is the stagflation point. Once the economy is on short run Expectation Augmented Phillips Curve, which includes expected inflation, a recession will push actual inflation down below the expected inflation.

For example, in 2000 unemployment was U1 > U* and the inflation rate was 5%. Increase in unemployment implies fall in output.

Economy will move from point M to S due to recession which shows higher inflation rate that is, absolute level of inflation will remain high. Inflation will be less than expected (5 < 7) but well above zero.

ADVERTISEMENTS:

If the role of expected inflation in the Phillips curve is ignored then we conclude that periods in which output level and inflation rates move in opposite directions or periods in which both inflation and unemployment increases at the same time are impossible.

Stagflation would not occur if the unemployment rate (U*) corresponding to point N was the natural rate. In that case expected inflation will be equal to the actual inflation and as a result there will be no upward shift in the Phillips curve.