Let us learn about the Trade-Off between Inflation and Unemployment.

A. W. Phillips, in his research paper published in 1958, indicated a negative statistical relationship between the rate of change of money wage and the unemployment rate. It was also shown that a similar negative relationship holds for rate of change of prices (i.e., inflation) and the unemployment level. This relation is usually generalized in the Phillips Curve.

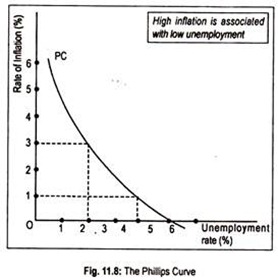

Phillips Curve drawn in Fig. 11.8 shows that as the unemployment level rises the rate of inflation falls.

Zero rate of inflation can only be achieved with a high positive rate of unemployment of, say, 5 p.c., or near-full employment situation can be attained only at the cost of high rate of inflation.

ADVERTISEMENTS:

Thus, there exists a trade-off between inflation and unemployment:

The higher the inflation rate, the lower is the unemployment level.

This Phillips Curve relation poses a dilemma to the policy makers. If the objective of price stability is to be attained, the country must accept a high unemployment rate or if the country designs to reduce unemployment, it will have to sacrifice the objective of price stability.

ADVERTISEMENTS:

However, towards the end of the 1960s, the stable relationship between the two began to look unstable as unemployment, wages, price all began to rise. All these developments resulted in the emergence of newer theories and, hence, economic policies.

Anyway, the policy conclusions generated by the Phillips Curve lost relevance in the 1970s and 1980s when both inflation and unemployment rose. This suggests the disappearance of trade-off between inflation and unemployment as envisaged by A.W. Phillips. Monetary economist headed by Milton Friedman challenged the concept of stable relationship between inflation and unemployment as shown in Fig. 11.8.

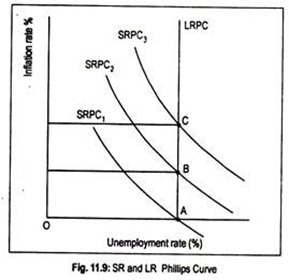

According to Friedman such trade-off— negative sloping Phillips Curve—can exist in the short run at least, but not in the long run. In the short run, Phillips Curve may shift either in the upward or downward direction as the relationship between these two macroeconomic variables is not stable. On the other hand, in the long run, according to Friedman, no trade-off exists between inflation and unemployment.

Regarding shifting of the Phillips Curve, Friedman considers influence of the ‘expectations’ on inflation. This is called theory of adaptive expectations—expectations that are altered or ‘adapted’ to experienced events. In the short run, people make incorrect expectations of the price changes because of incomplete information.

ADVERTISEMENTS:

That is why a trade-off relationship emerges. But, in the long run, actual and expected price changes become equal as expectation regarding price changes tend to become rational. This rational expectations view suggests that people guess the future economic events correctly.

Thus the impact of expectations, whether adaptive or rational, has an important bearing on the relationship between inflation and unemployment rate. It is because of expectation, Friedman argues, that there is no trade-off between inflation and unemployment in the long run.

To explain Friedman’s long run Phillips curve, we need to learn the concept of ‘natural rate of unemployment’. Unemployment is ‘natural’ when some people do not want to work at the going wage rate or their services are no longer required. Long run Phillips Curve has been shown in Fig. 11.9.

In this Figure, OA—the ‘natural rate unemployment’—is associated with zero inflation. The curve SRPC1 is the short run Phillips Curve showing low or zero expected inflation. For obvious reasons, SRPC3 describes high expected inflation. As people’s expectations regarding future price level changes, short run Phillips Curve shifts upwards showing trade-offs between inflation and unemployment.

Since, in the long run, expected inflation matches with the actual inflation, the long run Phillips Curve LRPC becomes vertical at the ‘natural rate of unemployment’. It follows then that, in the long run there is no trade-off. In the long run any rate of inflation can occur with a natural rate of unemployment or the ‘non- accelerating-inflation rate of unemployment’ (NAIRU).