The AS curve which is derived from the Phillips curve shows the relation between the past price level (Pt) and the output level.

The AS curve is relatively flat because wages are sticky, therefore, the effect of change in output and employment on wages will be less.

Effect of Monetary expansion:

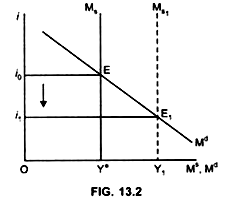

(i) Initially the economy is in equilibrium at point E

Interest rate is – i0

ADVERTISEMENTS:

output level is – Y* → The economy is operating at full employment level.

(ii) If money supply is increased from Ms to Ms1

Ms curve will shift to the right.

As a result interest rate will fall from i0 to i1 (Fig. 13.2) and, Investment will increase.

ADVERTISEMENTS:

As Investment is a component of AD, AD will increase. With AS remaining constant AD will be greater than AS.

Impact: will be different in the short run, medium term and long run.

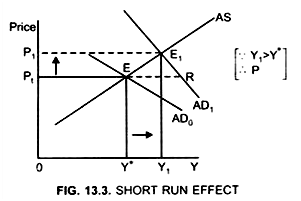

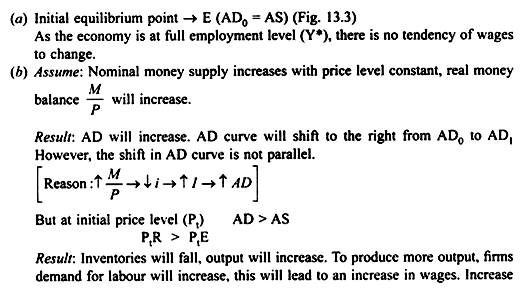

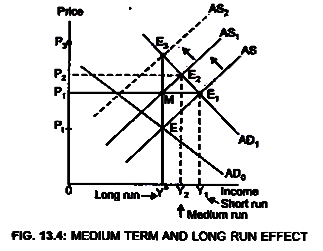

(a) In the short run – Both price level and output will increase but

Y1 > Y*

(b) In the medium term – Price will increase further, but output will decrease. Output in the medium term will be greater than Y* but less than output in short run.

(c) In the Long run – Price will increase further, but output will return back to the full employment level.

I. Short Run Impact:

II. Medium term adjustment:

III. Long Term Adjustment:

(e) In the long run output will always be at the full employment level, therefore, if output in the long run is above the full employment level, it will fall till the full employment level is not reached at point E3.

... Y2 > Y* (Actual output > Full employment output level)

ADVERTISEMENTS:

Result:

There will be over production and over employment. According to Phillips curve: when employment increases, that is, unemployment decreases, wages will increase. As a result, price level will rise. Therefore, AS curve will shift upwards to the left till the full employment equilibrium income level is attained. This is at point E3.

At point E3 → AS2 = AD1 (Fig. 13.4)

output level – Y* (full employment level)

ADVERTISEMENTS:

Price level increases to P3.

At E3 price level increases in the same proportion as the nominal money stock. Therefore, the real money stock (M/P) will be again at the initial level. The interest rate will fall back to the initial level.

As a result, in the long run AD will fall and come back to the original level where the full employment level of output is reached.

Thus, in the long run, there is no change in aggregate demand, output and employment level. Increase in money supply in the long run will only lead to increase in prices.

ADVERTISEMENTS:

Neutrality of Money:

Thus, in the long run, money is neutral, that is, it has no real effects, only the price level is affected. But in the short run, money is not neutral because in the short run, increase in the money supply will lead to an increase in both the price level and the output. However, even though money is neutral in the long run, the monetary policy will have an important effect on the output level in the short run.