E. Phelps is a Nobel Laureate for the same work in 2006. Simple Original Phillips Curve does not take into account expected or anticipated inflation while fixing wage and price.

It simply showed that there exists inverse relationship between growth rate of money wages and unemployment rate but the Modern Phillips Curve given by Friedman and Phelps shows the relationship between rate of inflation (rate of increase in price) to the unemployment rate.

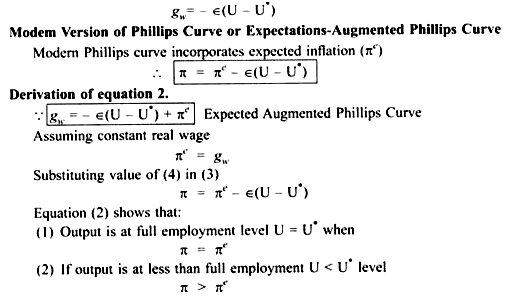

Friedman and Phelps introduced an adjustment in Phillips curve with respect to anticipated or expected inflation (πe) as a factor influencing the growth rate of money wage. As the modern Phillips curve incorporates the expected inflation, therefore, when workers and firms enter into wage negotiations while fixing the wage and price they bargain over the real wages, and both sides are willing to adjust nominal wage for any inflation expected during the contract period.

Higher the expected inflation (πe) greater is the demand by workers to increase the wages. Firms are willing to give high wage because they expect that prices will increase which will lead to increase in their profit. Thus, Modern Phillips curve showed that unemployment depends not only on the level of inflation but also on the excess of inflation over the expected value.

ADVERTISEMENTS:

Simple Phillips Curve relationship:

Thus Modern Phillips curve shows that unemployment depends on:

(i) The level of inflation, and

ADVERTISEMENTS:

(ii) Excess of wage inflation over expected inflation (gw – πe)

Properties of Modern Phillips curve:

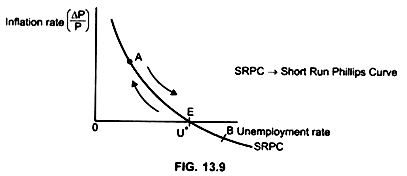

1. In the Short Run, Phillips Curve (SRPC) shows an inverse relationship between unemployment rate and the inflation rate. Due to an increase in the aggregate demand, the economy will move up to the left above the short run Phillips curve and inflation results.

Initially, the economy is in equilibrium at point E (Fig. 13.9)

ADVERTISEMENTS:

π = 0

Unemployment is at NRU that is, (U = U*) => 5.5%

If AD increases:

economy moves up to point A; unemployment decreases. But the economy will not stay at A because:

Increase in demand leads to an increase in demand for labour. Therefore, Wages will increase, price will increase, real money supply will decrease leading to a decrease in AD and the economy moves back to point E.

2. SRPC shows that when actual inflation and expected inflation are equal, that is, π = πe, the economy is at NRU (U*)

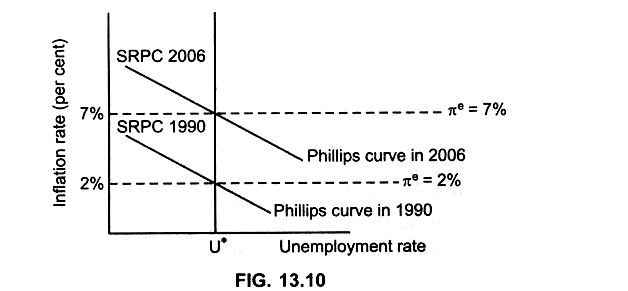

3. The height of short run Phillips curve depends on the level of expected inflation (πe). SRPC will move up and down over time in response to the changing expectations of firms and workers to the expected inflation rate. If expected inflation rate rises, SRPC will move up and thus the Phillips curve will move upwards and vice versa.

Both SRPC1990 and SRPC2006 curves in Fig. 13.10 have 2 properties:

ADVERTISEMENTS:

(i) Short run trade off between unemployment and inflation rate are same because the slopes are equal. The gap between the two curves is because of expected inflation (πe).

(ii) The SRPC of 2006 and 1990 are relatively flat. In 1990, full employment occurred when the annual inflation was 2% but, in 2006, full employment occurred at 7% inflation, as a result, SRPC of 1990 lies below SRPC of 2006. The rate of πe in moving the Phillips curve adds automatic adjustment mechanism to the aggregate supply side of the economy.