Let us make an in-depth study of choosing output in the long-run.

In the long-run, a firm can vary all its inputs. It can decide to enter or exit out of the industry.

Since here we are concerned with competitive markets, we allow for free entry and exit. In other words, we are assuming that firms can enter or exit without any legal restriction or any special cost associated with entry.

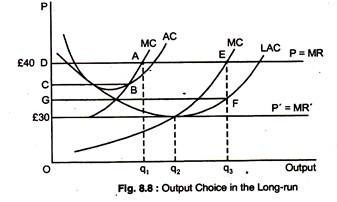

Fig. 8.8 shows how a competitive firm makes its long-run, profit-maximising output decision. It faces a horizontal demand curve, as in the short-run (where P = £40). Its short-run AC and MC are low enough to produce for the firm a positive profit represented by the area ABCD, at output level q1, where SMC = P = MR.

ADVERTISEMENTS:

The long-run AC curve LAC reflects the presence of increasing returns to scale up to output level q2 and decreasing returns to scale at higher level of output.

The LMC curve cuts the LAC curve from below at q2, the minimum point of LAC. If the firm believes that the market P will remain £40, it will produce q3 unit of output where its LMC = £40. When it produces q3 the firm’s profit margin will increase from AB to EF, and its total profit will increase from ABCD to EFGD. Output q3 is profit-maximising for the firm because, at any other output, MC ≠ MR.

At any output greater than q3, MC > MR, so extra output will reduce profit. In summary, the long-run output of a profit-maximising competitive firm is where LMC = P.

ADVERTISEMENTS:

At a price of £30, the profit-maximising output is q2 at the minimum point of MC curve where the firm earns zero economic profit because P -ATC.