Let us make an in-depth study of the short-run and long-run effects of a tax.

We now consider how a firm responds to a tax on output.

We assume that the firm uses a fixed-proportion production technology.

Suppose for the moment that the output tax is imposed only on a particular firm in the industry, and, thus, does not affect the market price of the product.

ADVERTISEMENTS:

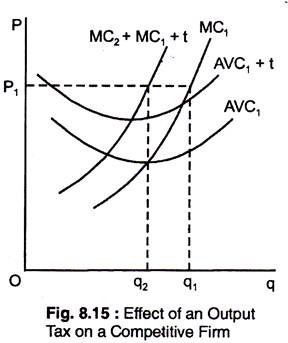

Fig. 8.15 shows the relevant short-run cost curves for a firm enjoying positive economic profit by producing an output q1 and selling its product at the market price P1. Because the tax is a unit tax, it raises the firm’s MC curve from MC1 to MC2 = MC1 + t, where t is the tax per unit of the firm’s output. The tax also raises the AVC curve by the amount t.

The output tax can have two possible effects, as Fig. 8.15 shows:

(i) if the tax is less than the firm’s profit margin, the firm maximises its profit by choosing an output at which its MC + t = P. The firm’s output falls from q1 to q2, and the impact of the tax is to shift the firm’s short-run supply curve upward,

ADVERTISEMENTS:

(ii) If the tax is greater than the firm’s profit margin, then the AVC will rise, and if the minimum AVC is greater than the market price, the firm will choose not to produce.

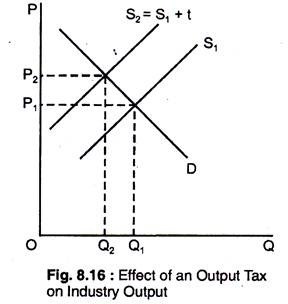

Now suppose an output tax is placed on all firms in a competitive market which will shift the short-run supply curve for the industry upward by the amount of the tax. This raises the market price of the product and lowers the total output of the industry as Fig 8.16 shows.