Here we detail about the four crucial activities of money in economics.

1. Circular Flow of Money:

We know that economic activities have a circular flow. There are three streams moving in the economy—income, output and expenditure.

All the three are measured in terms of money. Thus, money has a circular flow. Circular flow of money implies that the money put in the income stream must not be hoarded and should continue to How to maintain a certain level of economic activity (income). It depends on the fundamental fact that one man’s income is another man’s expenditure and that each transaction has a dual nature; while it is income to one, it is expenditure to another.

The money that consumers pay to retailers is passed on to wholesalers and manufacturers and then again to consumers in the form of income payment like rents, wages, interest and profits smooth flow of money is a very necessary conditions for the smooth functioning of the economy. The moment this smooth flow of money is interrupted, the economic system is thrown out of equilibrium, disturbances start appearing, resulting in overproduction and unemployment.

ADVERTISEMENTS:

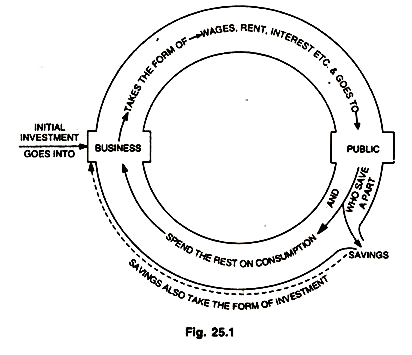

There are producers as well as consumers in the economy. In a sense every consumer is a producer and every producer is a consumer; when the owners of different factors of production sell their services to production units, they in turn receive income which they spend on consumption goods. In this way, the circular flow of money is maintained as shown in the Fig. 25.1.

In the Fig. 25.1, the initial investment (expenditure) which goes into business takes the form of income, when distributed to the factors of production, like rent, wages, interest and profits. The public spends that income on consumption and that part which is not so spent is saved (Y = C + S).

If this saving takes the form of investment-expenditure, as it does in the above diagram (i.e., if S – I), the circular flow of income expenditure is maintained (Y = C + I) and there is no disequilibrium in the economy. If, however, savings do not take the form of investments, circular flow of money will be interrupted and income levels are likely to fall. This circular flow of money is maintained not only in two sector but also in three sector and four sector open economy.

2. Dangers of Money:

Money, however, is not an unmixed blessing. It has no doubt the merit of solving many difficulties by facilitating exchange and lubricating the wheels of production, at the same time it has created many problems too. Money is a good servant but a bad master. It is good in so far as the society can be spared of its curses. Money has been aptly compared with an elephant, who serves many purposes and whose presence in a circus makes the show highly attractive and glamorous. Should this animal go amuck, lot of damage may be caused to all concerned.

Similarly, if money goes out of control of the monetary authorities it may create chaotic conditions. Its dangers in a capitalist economy are great and still greater in a developing and mixed economy. Some people dread the bad effects of money so much that they strongly advocate its complete abolition. According to Marxian economists money is a source of all perils. John Stuart Mill felt that there could not be a more insignificant thing than money in the economy.

The chief dangers of money are as follows:

Instability in the Value of Money:

One of the grave defects of money is that its value or purchasing power does not remain stable. Fluctuations in its value affect various sections of the society differently. A rise in prices (i.e., a fall in the value of money) will adversely affect the fixed income groups while businessmen and entrepreneurs will gain. Income will shift from high consuming groups (labour and middle class) to low consuming groups (rich men), thereby influencing the propensity to consume in an unfavorable manner, thus, lowering the overall propensity to consume and hence effective demand which, in turn, adversely affects income, output and employment.

Breeds Inequality of Incomes:

ADVERTISEMENTS:

Another danger of money is that it perpetuates gross inequalities in income distribution. Marx, Lenin and other socialist leaders displayed great hostility towards money. They believed it was a chief source of exploitation of labour and the working classes, inasmuch as it caused surplus value to accrue to the owners of the means of production and divided the society into the ‘haves’ and the ‘have-nots’.

Causes Trade Cycles:

Money has been responsible for causing fluctuations in business activity (trade cycle) and promoting speculative transactions. During the period of ‘boom’, when the marginal efficiency of capital is high, businessmen outbid one another to secure the services of the factors of production by offering them higher payments. The entrepreneurs pay labour advance wages in anticipation of the sale of their products at a later stage.

In a monetary economy, however, there is no guarantee that the real goods and services are being produced as fast as money wages are being paid. The result is that purchasing power in the hands of labour exceeds the supply of goods in the market resulting in an outcry and unrest. Prices rise in sympathy with other prices, wages lag behind the rise in prices and this cumulative process takes the shape of a ‘price spiral’ resulting in a good deal of hardship. Speculators indulge in large scale speculative transactions with a view to getting rich over-night by gaining from the fluctuations in prices.

Discourages Capital Formation:

Money affects not only the distribution of income but also the creation of real wealth through capital formation. Whether there is inflation, or deflation, it undermines the confidence which is the basis of contract and business activity in a modern industrial economic order. Keeping the role of money smooth and under control is like walking on a razor’s edge. If there is inflation, money gives rise to speculative activity and attracts resources away from productive channels.

On the other hand, if there is deflation, the whole economic machine goes out of gear and spreads misery all around. According to Prof. Robertson, “a prolonged rise in the value of money by injuring and disheartening those who are in charge of the commercial and industrial machines, retards the creation of wealth and play havoc with individual lives…… Thus, money which is a source of so many blessings to mankind, becomes, also, unless we can control it, a source of peril and confusion.”

Social Disadvantages:

Again, many social disadvantages are associated with the use of money, because it has been responsible for large-scale corruption in modern societies. The possessor of wealth and money has certain advantages, which others do not have. According to Ruskin, “the devil of money has come to possess our souls. No religion or philosophy seems to have the power of driving it out.” Von Mises, the German economist, remarked: “Money is regarded as the cause of theft and murder, of deception and betrayal. Money is blamed when the prostitute sells her body and when the bribed judge perverts the law.” Lord Keynes spoke of the love of possession of money as “disgusting morbidity, one of those semi-criminal, semi-pathological propensities which one hands over with a shudder to the specialist in mental disease.”

These dangers of money seem to have been exaggerated as it is clearly wrong to attribute greedy conduct and human weaknesses in general to money. If a person goes mad after it and follows highly questionable methods to get it, the fault lies with him and not with the use of money.

It is surprising how a writer like J.S. Mill made illogical remarks about money. Far from being insignificant, money is now, more than ever before, a dire necessity, a social virtue and source of many comforts to mankind. It is a basic institution of the modern industrial economy. “In ordinary life, we may take money, like the air we breathe, too much for granted, but we become painfully aware of its enormously important role in economic life when something goes wrong with it.”

3. Control of Money:

A study of economic history of the last century furnishes ample evidence to show that money does go wild at times and causes untold suffering. Whether Balghot remarked, “Money will not manage itself.” There is, thus, a great need to control the variation in the quantity of money by the monetary authorities.

ADVERTISEMENTS:

When there is general unemployment of the factors of production, an expansion of the stock of money is employed to increase the purchasing power in the hands of the public so that additional demand is created for the idle resources, leading to an increase in income, output and employment. On the other hand, in a period of full employment and high prices a reduction in the money supply is needed to prevent an upward, pressure on prices.

It may be realized that money will prove a great blessing if its circular How in the economic system is maintained. One man’s income is another man’s expenditure. So long as the circular flow of money through the income-expenditure stream is maintained, economic system runs smoothly.

No sooner is the smooth flow of money interrupted than the entire economy gets into a state of disequilibrium as it happened during the Great Depression of the 1930s. An interruption in money flow will manifest itself either in the increase or decrease in the flow of money, which needs to be controlled by the government and monetary authorities to avoid the pitfalls of the use of money. Hence, money need not be condemned without which life will become extremely boring and business a tough proposition. What is needed is the maintenance of the circular flow of money and its proper control by the Central Bank of a country.

4. Value of Money:

The term value of money implies the number of goods and services which a unit of money can buy. According to Prof. Robertson, “By the term value of money we mean the amount of thing in general which will be given in exchange for a unit of money.”

ADVERTISEMENTS:

The larger the amount of goods and services money can buy, the greater is the purchasing power of money, or its value. The value of money, therefore, depends upon the prices of goods and services. The higher the prices the smaller the purchases of goods and services; the lower the prices the higher the purchases of goods and services.The value of money (or its purchasing power) is the opposite of the price level.

According to Prof. Irving Fisher, value of money refers to the purchasing power of money. “The purchasing power of money is the reciprocal of the level of prices so that the study of the purchasing power of money is identical with the study of price level.” Judged in this way, prices of goods indicate the value of money, which stands in inverse relationship to the general price level.

Thus, the conception of the value of money is relative as it always expresses the relationship of a given unit of money and the amount of goods and services that can be exchanged for it. Some economists, however, reject the relative concept of the value of money and favour an absolute concept of the value of money.

According to Prof. B.M. Anderson, the value of money depends upon the commodity value of money— upon the material used for money. Thus, the value of money lies not in its direct want satisfying power, but in its buying capacity. “Money as such has no utility except what is derived from its exchange value, that is to say, from the utility of the things which it can buy.”

ADVERTISEMENTS:

Prof. G. Crowther expressed the view that the term value of money does not make definite sense as there are many values of money depending upon the uses to which it may be put. Any exact definition of the value of money, according to him, is somewhat a complicated affair. He says, “The wholesale value of money is the value of money to a person who happens to be concerned only with those commodities that are traded in wholesale on a public market. The retail value of money is its value to a family that happens to buy exactly those things which it has been established by enquiry that the average family does buy. And the labour value of money is its value to a man or a business firm that wants to hire every variety of labour.” On arbitrary assumptions Crowther feels that we can have three different values of money, no doubt, these will be arbitrary but “where there is such infinite variation, some degree of arbitrariness is necessary.”

It may, however, be understood that the value of money differs from the value of other things in one fundamental respect, namely the fact that the value of money indicates general purchasing power over goods and services. It implies that a change in the value of money affects our general ability to get goods and services in exchange. There are some economists who have rejected the concept of the general value of money and called it a mere abstraction.

Von Hayek said, “When we investigate into all influences of money on individual prices, quite irrespective of whether they are or not accompanied by a change of the price level, it is not long before we begin to realise the superfluity of the concept of the general value of money conceived as the reverse of some price level.”

The value of money, however, does not remain constant over time, it rises and falls. Changes in the value of money affect not only individual owners of the units of money but also the entire economy. Moreover, variations in the value of money inject an element of instability into the economy as a whole. It is on account of these reasons that the investigation of the factors which govern the value of money becomes of great theoretical and practical importance. We must, therefore, admit that the absolute value of money cannot be measured. But we are interested in the measurement of changes in the value of money over a period of time, rather than in its absolute value.

As Crowther has aptly put it, “What needs to be measured is not so much the value of money itself as changes in the value of money.” The value of money does not remain stable over time. It rises and falls and is inversely related to the changes in price level. A rise in the price level implies a fall in its value and vice versa. Changes in the value of money have far-reaching effects on different sections of the community. One of the oldest explanations of the determination of the value of money is the quantity theory of money. It says that the value of money depends upon the quantity of money and will fluctuate whenever the quantity of money changes.

According to this theory, money is treated like a commodity and the value of money is determined like the value of any other commodity by the forces of demand for and supply of money. According to Prof. Robertson, “Once more we can keep on the right lines if we start by remembering that money is only one of many economic things. Its value, therefore, is primarily determined by exactly the same two factors as determine the value of any other things, namely, the conditions of demand for it, and the quantity of it available.”

ADVERTISEMENTS:

However, money is characterized by certain features not found in other commodities, for example, money is a means whereas other commodities, are an end, changes in the demand for and supply of money effect the general price level, whereas changes in the demand for and supply of a commodity affect the price of that commodity only and not the general price level.

On the basis of the law of supply and demand, it can be generalized that an increase in the demand for money (supply remaining unchanged), will lead to a rise in its value, i.e., to a fall in the general price level, and vice versa. Moreover, the velocity of money affects the total supply of money. It is on account of these reasons that the oldest explanation of the changes in the value of money (depending upon its demand and supply) has to be considerably modified before it can be adopted as a successful explanation of the factors determining the value of money.