In the price setting process, cost data are most important element. Hence, cost must be relevant to the pricing decision and under-estimation and exaggeration must be avoided. Besides costs, there are also other factors that require consideration. An increase in the demand may make an increase in prices possible even without an increase in costs. Pricing is like a tripod having three legs.

In addition to costs there are other two legs if market demand and competition. As we cannot say definitely which of the legs supports the tripod, similarly, we cannot assert which of the above three factors determines the price. Demand is at times more important than even cost. If cost is increased, the price is to increase even if the demand does not permit to do so.

i. It is the Price that Determines Cost that may be Incurred:

The product ultimately goes to the public and their capacity to pay is known. Given the price we arrive at the cost working backwards from the price, consumer can afford to pay. If the quality of the product is to be improved this may be possible only when customers are willing to pay higher price because cost will naturally go up.

ii. If Costs were to Determine Price:

Why do so many factories report losses? Different producers have different costs of production. But in the market, prices are close together for a somewhat similar product. Therefore costs are not the determining factor for the pricing. Again it is also difficult to measure costs accurately as they are apportioned. Costs are affected by volume and volume is affected by price. The management has to assume some desired price and volume relationship for determining costs.

ADVERTISEMENTS:

The above discussion does not purport to indicate that costs should be ignored altogether while setting prices. Costs have to be taken into consideration like many other factors. In the long run if costs are not covered manufacturers will withdraw themselves from the market and the supply will be curtailed and prices will be raised. All this goes to show that cost is not the only factor in setting prices.

iii. Relevant Costs:

For managerial decisions in the short run, direct costs are more relevant. In a single product firm all costs are direct. The management would try to cover all the costs. But problems are more complex in a multi-product firm. Relevant costs are those costs that are directly traceable to an individual product. Selling price must cover all direct costs variable and fixed that are attributable to the product.

In addition, it must include some profit. But in short period of time, it is tolerable if the price of a product has to do no more than cover its direct costs only (only the direct variable costs).

Example:

ADVERTISEMENTS:

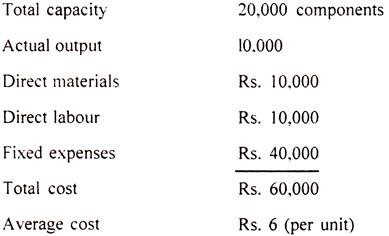

During recession, a firm manufacturing a certain component was operating at 50% of its capacity. A foreign importer offered to purchase 5,000 units of the component at Rs. 5 per unit. The average cost of the product is Rs. 6. The question was whether the order should be accepted.

The cost data were as follows:

On analysis of the above data, we find the additional cost of producing 5,000 units would be only Rs. 10,000 (Rs. 5,000 for material and Rs. 5,000 for labour). The incremental revenue would be Rs. 25,000 and the firm would gain Rs. 15,000 by accepting this order.

ADVERTISEMENTS:

In the same way, while making quotation for tenders in and highly competitive situation the more important is that at least the direct costs must be covered. But before accepting this order considerations have to be made. If other customers learn that the component is being sold at a lower price they may also demand a similar price cut or else threaten to cancel their orders. What is essential for the firm is that the acceptance of this order should be kept a guarded secret.

In the long run the aggregate revenues from all products must cover not only the direct costs but also contribute towards common costs. Ideally, each product should make a significant constitution to common cost but it is not possible to state any general rule for determining satisfactory or unsatisfactory contributions.

If a competitive price does cover direct cost and yields some contribution to common cost, the question arises how high must that contribution be to justify the long run continuance of a particular product in a company’s product line? If the product is discontinued, will any other product be substituted for it? What effect will the discontinuance of the product have on the demand for the other products in the line? Product pricing decisions should be made with a view to maximise company’s profits in the long run.

Another problem that has to be faced is “How can the common costs be covered, if individual prices are set in consideration of, direct cost only?” The point is that covering of direct costs is only a starting point in the pricing decision. Factors of supply and demand and competition may allow price that will give very substantial contribution to common costs.

If the economic determinants of price are such that the combined price for all of a company’s products is not sufficient to cover common costs in the long run the conclusion is not that the individual prices are wrong but rather that the firm is economically inefficient. Such a firm must either improve its working efficiency or cease working and wind up.

iv. Demand Elasticity and Price Policy:

The price policy of a firm will depend upon elasticity of demand as well. If the demand is inelastic, it will not be profitable for the firm to reduce its prices. But, if the demand of the product is less elastic then the firm should take care not to fix very high price. In that case a policy of price rise would not pay.

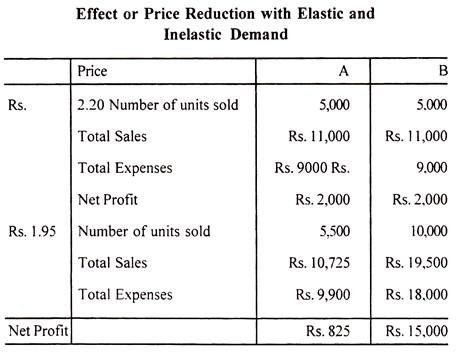

If the demand is elastic, it is a policy of price reduction rather than the policy of price increase. These price strategies are illustrated by the following example relating to two products A and B, former having a very little elastic demand and the latter a highly elastic demand.

From the above it is quite clear that price reduction for expanding sale would be profitable for product B with highly elastic demand and not for product A with little elastic demand.

v. Cost Reduction, Elasticity or Demand and Price Policy:

A firm able to reduce its costs will have to decide if the prices are to be reduced or not. We have to note here the elasticity of demand. If the demand is elastic, a reduction in price will be less profitable than the maintenance of the price itself. This becomes clear from table given above.