The following points highlight the top eight specific problems of pricings. The problems are: 1. Pricing Over the Life Cycle of the Product 2. The rate of Market Growth 3. The Erosion of Distinctiveness 4. The Significance of Cost 5. Post-Skimming Strategies 6. Mixed Strategies 7. Pricing in Maturity 8. Pricing Products in Decline.

Problem # 1 – Pricing Over the Life Cycle of the Product:

Every product has its own life cycle and its sales and profitability change over time. The product life cycle hypothesis was developed in an attempt to recognize formally distinct stages in the sales history of representative products.

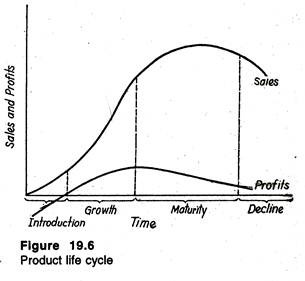

As the product passes through each of these stages, the strategies and problems of pricing must be varied accordingly. Figure 19.6 illustrates the most common type of product life cycle pattern, shown as the S-shaped sales curve. There are four phases of a product’s life cycle: introduction, growth, maturity and decline. Sales and profit patterns vary during these stages.

The introducing (or launching) phase is characterized by relatively low levels of sales, slow rate of growth of sales, and negative or minimal profits. The second growth phase is characterized by two features — rapid acceleration in sales and considerable improvements in product profitability.

The third (or maturity phase) involves a slowing down of the sales growth and a stabilization of profits. The final (or decline) phase is the period during which sales start falling and profits once again start declining. It is to be noted that there is no clear-cut rule as to where each of the stages begins or ends, and the exact demarcation of these stages has to be subjectively determined.

Another important qualification to the model is that all products do not necessarily exhibit the typical S-shaped product life-cycle as shown in Figure 19.6. Some products (such as electronic watches or pocket calculators) show quite rapid growth only in their early life; thereby they move past (or skip) the introductory phase. For other products, there is undue prolongation of the introductory phase.

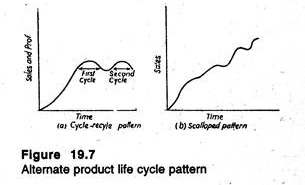

Moreover, some products actually pass through several different life-cycles. By studying 754 drug manufacturers, William E. Cox, Jr., has discovered six different life-cycle patterns, with the most common pattern being the ‘cycle- recycle’ pattern shown in panel (a) of Figure 19.7.

ADVERTISEMENTS:

This typical cycle-recycle pattern is justified by the traditional promotion and price push that is given to many products as they approach the declining phase of their life cycle. Cox has also noted another common life cycle pattern as in panel (b) in Figure 19.7. The proximate cause of the scalloped pattern seems to be the implementation of new strategies with regard to market penetration and development.

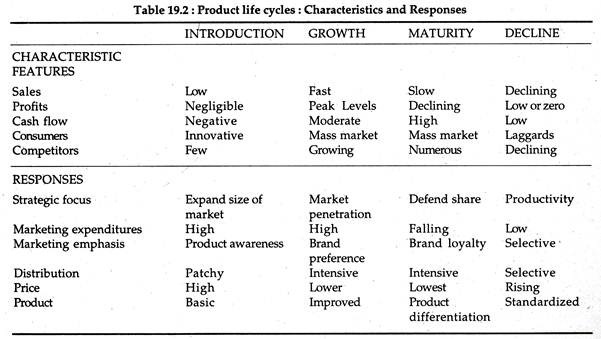

Against this backdrop, we may now describe the characteristics and response of the product life cycle and place price in the context of being one of the several variables that fluctuate over the life cycle. (See Table 19.2.) As a product passes through each stage, there is a corresponding change in the applicable pricing decisions.

In the product launching (introductory) phase, the manager in charge of pricing has to decide whether to adopt a market penetration or a price skimming strategy and, in the growth phase, management can probably be more aggressive in pricing to improve profits.

However, as a general rule, the maturity and decline stages are characterised by vigorous competition. Moreover, pricing decisions can lead to the cycle-recycle pattern noted in Figure 19.6. Thus, the point that emerges from our discussion so far is that pricing responses required of management vary according to the stage in the product life cycle and are related to diverse marketing and production decisions.

ADVERTISEMENTS:

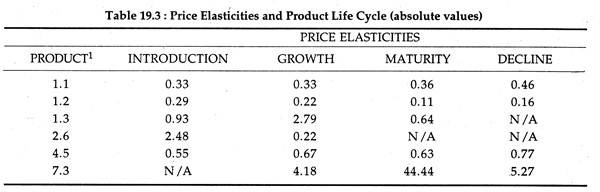

In his study of 43 products in 7 different markets, Herman Simon identified important relationships between the price elasticity of demand and product life-cycles. These elasticity estimates are listed in table 19.3 above. The diverse elasticities give a clear indication that the pricing strategy has to differ over the entire life cycle of the product.

The pricing implication of the elasticity values is that there should be low mark-up during the early phases since demand seems to be more price elastic in these phases. By contrast, high mark-up may be added to costs in arriving at a price during the maturity and decline phases when demand appears to be fairly inelastic.

Dean has analysed the problem of choice between a skimming price in case of new products and a penetration price in case of mature products. In choosing between these two alternatives, the producers should consider several major factors.

Problem # 2 – The Rate of Market Growth:

This itself is often influenced by pricing policies. In practice, some products are inherently less likely to gain rapid market than others. These products are, therefore, unsuitable for a penetration price policy, involving initially low, and perhaps even negative, margins.

Problem # 3 – The Erosion of Distinctiveness:

The second factor is the likely rate of erosion of the distinctiveness of the pioneer product. This will, in turn, depend upon the number of competitive products entering the market and the extent to which they can reproduce the characteristics of pioneer products.

The possible lead time enjoyed by the initial producer may be obtained from an analysis of his strengths and weakness vis-a-vis potential competitors’, in terms of technical know-how (which may be supported by patents), access to channels of distribution, and the financial strength of potential rivals.

If the lead time is very long, then a skimming price would be appropriate. But if the lead time is short, a penetration price might be required “to build up as wide a market as possible before the onset of the competitive onslaught, especially in those markets, such as grocery products, where distributors may refuse to handle more than a proportion of the competing brands. Again if it is felt that the product is one for which considerable brand loyalty may be built up, a penetration-price strategy would be suggested.”

ADVERTISEMENTS:

On the contrary, a skimming price may be more appropriate where buyers are more concerned about the characteristics of the product, including its price, than with the supplier. Manufacturers of woolen cloth often complain that they are unable to sustain for a long time the initial price of a new design of cloth because buyers quickly switch over to new, low cost source of supply.

The above analysis is based on the assumption that the producer is concerned with making choice which will yield the highest profits over the foreseeable life of the product. However, other’ objectives such as increased sales or market share will surely encourage a penetration policy.

There is also an off-setting consideration: the firm may be interested in improving its liquidity position in the short-term, and may be unwilling to wait for the longer term rewards accruing from a penetration policy.

Finally, “although a pioneer product will not normally compete very strongly with existing products, some substitution may occur, and if this substitution is likely to encompass the producer’s existing products, a penetration price will again be less appropriate.”

Problem # 4 – The Significance of Cost:

ADVERTISEMENTS:

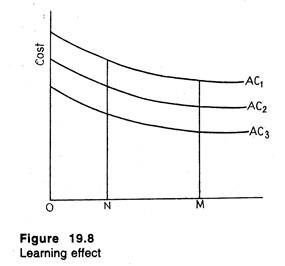

The third major factor is the cost structure of the producers. A reduction in average cost is likely if there is learning effect. In Figure 19.8, AC1 shows the unit cost of producing various quantity of a product within a period, say a day.

Average cost is lower with average output of OM than ON per day, due to scale effect. If we measure cost in a subsequent period, say, after one year, a reduction in real costs (i.e., after allowing for changes in input prices) may be expected.

The extent of this reduction would be influenced by the volume of production within the one-year period. A daily output of ON would be reflected in the cost curve AC2 and a daily output of OM would give rise to a cost curve AC3. This shows the operation of the learning effect. In general “the greater the scale factor and the learning effect, the more appropriate will a penetration policy be.”

Problem # 5 – Post-Skimming Strategies:

ADVERTISEMENTS:

Choice of a skimming price is not enough. Subsequent decisions will have to be made about the timing and size of future reductions from the initial price. In some instances, the producer’s hand may be tied by the actions of competitors. In other instances, however, producers may have more discretion.

If it is felt that the ‘top’ of the market has become saturated (i.e., the limited number of customers who are willing to pay a high price have had the opportunity to buy) it becomes appropriate to lower the price in order to attract new customers.

Another factor worth consideration is the extent to which the product has gained an image of exclusivity or prestige. A substantial price reduction may lead to loss of prestige. A series of small price reductions would be more appropriate.

Problem # 6 – Mixed Strategies:

Many firms do adopt a strategy which falls between the two extremes of the skimming and penetration prices. This policy is followed by many large companies in case of many new products. For example, Du Pont followed a mixed strategy for both nylon and cellophane.

However, cellophane was nearer the penetration end of the spectrum, apparently because the cost elasticity of volume of output and the price elasticity of growing demand were sufficiently high to permit a more rapid rate of expansion than was possible in nylon.

Again, “in the pricing of a major piece of farm machinery such as the cotton picker (manufactured by International Harvester) the decision settled on was a middle ground between the estimated maximum economic value as a replacement for hand labour, and a sufficiently low price to give assurance of widespread adoption.”

ADVERTISEMENTS:

An alternative approach is to use the customer’s estimated savings in operating costs as a guide to price. This is a special characteristic of industrial goods pricing.

Problem # 7 – Pricing in Maturity:

Maturity is generally defined in terms of the product’s rate of sales. It is the stage between the growth period, when sales increases rapidly and the period of decline, when sales falls sharply. The concept of product life cycle is useful for multi-product firms.

It prevents complacency on the part of firms who have introduced successful products, alerting them to the need to have additional products ready for launching when sales of their existing products begin to fall.

Joel Dean appears to be very unsure about the implications for pricing policy. On the one hand, he suggests that the “first step for the manufacturer whose specialty is about to slip into the commodity category is to reduce real price as soon as symptoms of deterioration appear.”

On the other hand, he declares that “this does not mean that the manufacturer should not declare open price-war in the industry. When he moves into mature competitive stages, he enters oligopoly relationships where price slashing is peculiarly dangerous and unpopular. With active competition in prices precluded, competitive efforts move in other directions, particularly toward product improvement and market segmentation.”

Another deficiency of the product-life-cycle concept is that “it implies that a decline stage will inevitably succeed maturity, whereas in some markets maturity may be prolonged for many years by a series of product innovation. In other markets, maturity may be prolonged because the product fulfils a basic need for which no close substitute exists, for example, in the case of some minerals and agricultural products”.

ADVERTISEMENTS:

Again, it is necessary to take cost conditions into account. If cost continues to fall with an expansion of output due to the learning effect there will be a pressure for price reduction, even though the market elasticity of demand may now be low.

Finally, “where there are significant cost differentials, but little scope for cost reductions, a price reduction implies increased pressure on the margins of the high-cost producers who may thereby be forced out of the market. Conversely, if the low cost firm prefers to adopt a live-and-let-live policy it will maintain its prices, perhaps utilizing the higher short-run profits thus generated for investment in product differentiation activities”.

Problem # 8 – Pricing Products in Decline:

An analysis similar to the above one can be applied to products whose sales have begun to decline.

However, three additional strategies bear relevance at the decline stage:

1. Product Reformulation Strategy:

First, there is need to reformulate the product drastically and sell at a much lower price. This is a common practice in the book business where a saturation of the market by a hard-bound edition is often the sign for the introduction of a paper-back edition.

ADVERTISEMENTS:

2. Price Reduction Strategy:

The second strategy is one of reducing price substantially to induce a temporary revival of sales. This has happened in case of Britain’s Ford Anglia, whose popularity had diminished under the impact of changes in styling and performance in competitive models.

The company had a goodwill as a reliable family car maker. And a price cut, allied to this reputation, created a good image of the company and helped in raising its sales.

3. Withdrawal of Advertisement Support Strategy:

Finally, as Livesey has pointed out, “even if a price reduction fails to make a significant impact on sales, additional profits may still be wrung out of declining products if the producer is strong- willed enough to withdraw advertising support, thus formally accepting the status of the product”.