In this article we will discuss about the extent of agricultural credit and measures to improve it.

Extent of Agricultural Credit:

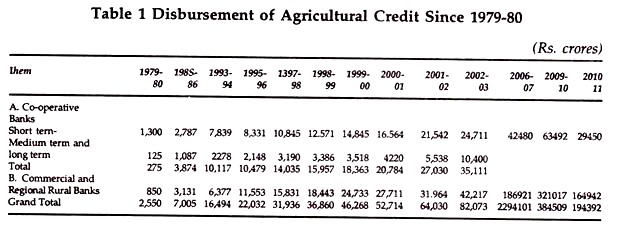

The extent of agricultural credit through different agencies for short term, medium term and long term has been given in Table 1. It reveals from the table that credit requirements of agriculture sector have increased tremendously since green revolution.

The table 1 reveals that total volume of agricultural credit has increased from Rs. 7005 crore in 1985-86 to Rs. 22,032 crore in 1995-96, Rs. 52,714 crore in 2000-01, Rs. 64,000 crore in 2001-02 and Rs. 82,073 crore in 2002-03.

ADVERTISEMENTS:

Moreover, among the various agencies disbursing agricultural credit, the amount of loan advanced by co-operatives has increased from Rs, 3874 crore in 1985-86 to Rs. 10,479 crore in 1995-96 and then to Rs. 20,784 crore in 2000- 01 and further Rs. 35,111 in 2002-03 but their share as percentage of total agricultural credit declined from 553 per cent to 47.5 percent and then to 43.1 percent respectively during the same periods.

Again the share of commercial banks and regional rural banks to the total agricultural credit has again increased from Rs.43.1 crore in 1985-86 to Rs. 11,553 crore in 1995-96 and to Rs. 27,111 crores in 2000-01 and further 42,217 crore in 2002-03.

In percentage terms their share to total agricultural credit has also increased from 44.7 per cent to 52.4 per cent and then to 56.9 per cent respectively during the same periods. The total volume of agricultural credit has increased 229,401 crores in 2006-07 6384514 crores in 2009-10 and has fallen to 194392 crores in 2010- 11. In percentage term the share of co-operative banks has come down to 15 present in 2010-11 as compared to 22% 2005-06. The share of RRBs and Commercial banks has increased from 78% is 2005-06 to 95% in 2010-11.

Again the share of commercial bank alone in total institutional credit to agricultural is almost 48 per cent followed by co-operative banks with a share of 46 per cent. Regional rural banks account for just about 6 per cent of total credit disbursement.

ADVERTISEMENTS:

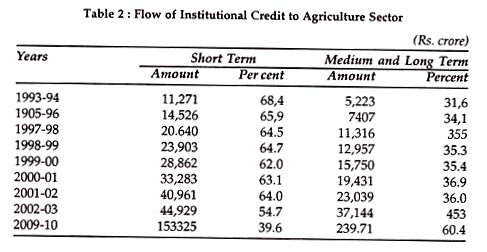

It is important to highlight the continued importance short-term credit which accounts for two-third of the total institutional lending to agriculture. The following table 2 shows the flow of institutional credit to agriculture sector.

It reveals from table 2 that below of short term institutional credit to agriculture which was Rs. 11,121 crore in 1993-94 gradually increased to Rs. 33,293 crore in 2000-01 and further to Rs. 40,961 crore in 2002-03. Long term institutional credit to agriculture has also increased from Rs. 5,223 crore in 1993-94 to Rs. 19.431 crore in 2000-01 and further 37144 crore in 2002-03. Short term agricultural credit has increased from 44929 crores in 2002-03 to 153325 crore in 2009-10.

The long term institutional credit has increased from 37144 crores in 2002-03 to 239171 crores in 2009-10. In percentage terms, the flow of short term institutional credit to agriculture which was 68.4 per cent in 1993-94 gradually declined to 63.1 per cent of the total credit in 2000-01 but again declined to 54.7 per cent in 2002-03.

ADVERTISEMENTS:

It further declined to 37.6 percent in 2009-10 and that the share of long credit has increased from 31.6 per cent in 1993-94 to 365 per cent in 2000-01 .It rose to 45.3 per cent in 2002-03. It further increased from 45.37 in 2002-03 to 60.4% in 2009-10.

Despite phenomenal increase in the volume of overall agricultural credit, there is a serious problem of over dues which has been inhibiting credit expansion and economic viability of the lending institutions especially the cooperatives and the RRBs.

The waiver of agricultural loans in 1990 has further aggravated the problem of recovery. In order to strengthen the co-operative credit structure of the country, the National Bank for Agricultural and Rural Development (NABARD) is contemplating an institutional strengthening programme.

The Government has also introduced certain measures for revitalising the co-operatives on the recommendations of the Agricultural. Credit Review Committee (1989). These measures include amendment to state co-operative laws, augmenting the reserve base of the Primary Agricultural Credit Societies (PACS), holding elections of co-operative bodies, revitalising PACS by business development planning and formulating Deposit Insurance Guarantee Scheme for PACS.

Measures Taken in 1998-99 to Improve Credit Flow to Agriculture:

In order to improve the flow of credit to agriculture, the Government has introduced the following measures in 1998-99.

(i) Procedural implication for credit deliver has been made (as per R.V. Gupta Committee Report) through rationalisation of internal returns of banks.

(ii) More powers have been delegated to branch managers to raise the credit flow to agriculture.

(iii) Introduction of composite cash credit limit to farmers, introduction of new loan products with saving components, cash disbursement of loans, dispensation of no due certificate and discretion to banks on matters relating to margin security requirements for agricultural loans above Rs. 10,000.

(iv) Introduction of at least one specialised agricultural bank in each state to cater to the need of high tech.

ADVERTISEMENTS:

(v) Introduction of cash credit facility.

(vi) Insuring Kisan Credit cards to farmers to draw cash for their production needs on the basis of the model scheme prepared by NABARD.

(vii) The Government has made arrangement for hassle free settlement of disputed cases of over dues.

(viii) To augment Rural Infrastructural Development Fund (RIDF) with a corpus of Rs. 10,000 crore with NABARD to finance rural infrastructure development projects by states.