The measure of responsiveness of demand to changes in income is called the income elasticity of demand. Income elasticity of demand measures the degree of responsiveness of quantity of a commodity demanded to a certain change in income of buyers and is defined as the percentage change in quantity demanded divided by the corresponding percentage change in income.

The formula of calculating income elasticity (Ey) is:

The concept of income elasticity is based on the assumption, that the prices of all goods are given and that it is only the consumers’ income which changes. From the above formula, it can be said that where the income elasticity is high, a small increase in a consumers’ income, say, by 1%, causes a proportionately much larger increase in the demand for the good, say, by 20%. Here, the income elasticity would be 20/1 = 20. Similarly, where the income elasticity is low, a small increase in consumers’ income would cause a much smaller proportionate increase in the quantity demanded of a good.

ADVERTISEMENTS:

It is to be noted that, except in the cases of inferior goods, income elasticity of goods is positive, as increase of income generally increases the demand for goods. In some cases (e.g., housing) it is equal to 1, it is greater than 1 in the case of luxury articles (viz. jewelleries, automobiles, TV sets, perfumes, fur coats, etc.) and less than 1 in the case of necessary goods (viz., rice, wheat, soap, tea, sugar, salt, etc.).

In some cases, it may be even zero; this happens when a given increase in income fails to cause any increase at all in the purchases of goods. It is to be noted that the income elasticity is a relative concept, as it varies from person to person depending on their level of income.

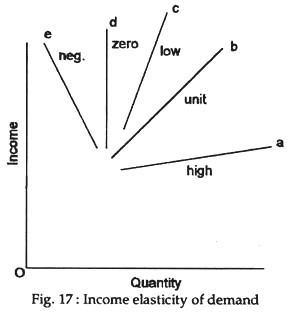

Income elasticity is shown in the five income demand curves. See Fig. 17.

ADVERTISEMENTS:

In Fig. 17, the ‘a’ curve (marked high) cuts the income axis and shows the increase in income accompanied by relatively larger increases in the quantity bought. The b curve (marked unity) is drawn at 45 angles and shows the equal increases in the quantity bought with the increases in income.

The b curve (marked low) cuts the quantity axis and shows the quantity increasing relatively less than income. The d curve (marked zero) shows that the quantity bought is constant regardless of changes in income. The e curve (marked negative) shows that less is bought at higher incomes and more is bought at lower incomes.

For most goods income elasticities of demand are positive. These are called ‘normal’ goods, while those with negative elasticities are named as ‘inferior’ goods. Of course, these terms are mostly relative. Thus, to one income level bread is an ‘inferior item’ while it is a ‘normal’ one to another income group.

ADVERTISEMENTS:

Income elasticity of normal goods may be less than unity (inelastic) or greater than unity (elastic) depending upon whether (say) a 10% increase in income leads to less than or more than a 10% increase in the quantity demanded.

So, different goods have different income elasticities. Say Lipsey and Steiner, “Goods that consumers, at a given level of income regard as necessities, tend to have lower income in-elasticities than do luxuries for the obvious reason that as incomes rise it becomes possible for households to devote a smaller proportion of their income to meeting basic needs and a larger proportion to buying things they have always wanted but could not afford”. Moreover, income elasticity of a good is expected to be different at widely different income levels.

The income elasticity measure helps to identify commodities to some extent. Some commodities have low income elasticities, e.g., potatoes, while others’ sales ‘increase or decrease rapidly with increases or decreases in income’, e.g., radios or TV sets. W.W. Haynes argues, in general, durable consumer goods have high income elasticities than non-durable goods.

Price elasticity of demand is always negative. Income elasticity, however, may be positive or negative. For most goods it will be positive, i.e., if income rises, demand for the commodity also rises, whereas, if income falls, demand for the commodity falls.

But, for inferior goods income elasticity will be negative, i.e., if incomes rises, demand for an inferior goods will fall, whereas if income falls, demand for an inferior good will rise. Thus, with a product like margarine, if income rises, people might now be able to afford butter instead and the demand for margarine will fall. The boundary between positive and negative income elasticities is zero income elasticity, corresponding to the case where a change in income leaves quantity demanded unchanged.

Importance of the Concept:

Income elasticity of demand has great significance for the different industries in the economy. In India, a major aim of government policy is to raise incomes. For industries with an income elastic demand for their products, this implies rising demand. However, it is not just incomes in India which have implications for Indian industry: rising incomes in other parts of the world will affect the demand for Indian goods which are sold abroad (exports).

Here again, if demand for Indian goods is income inelastic in other countries, then as incomes abroad rise demand for certain Indian industries’ output will fall and they may, therefore, decline. This has implications for the balance of payments, for employment and for the standard of living in India.

Economic growth increases the income of a country. This is good for a country. However, those engaged in the production of goods, with negative income elasticities, will face a declining demand for their products. Even when we consider products with positive income elasticities, we observe a great variability of response. For example, in case of commodities like food and clothing, demand may rise with income.

ADVERTISEMENTS:

But, it might not rise fast enough to offset improvements in productivity. The end result may be unemployment for some people in the industry. The booming industries tend to be those making products which have highly income-elastic demands such as televisions, refrigerators and cars. A fall in national income, however, may well mean a rapid decline in the demand for these types of goods.