In this article we will discuss about the formula and equation for calculating income elasticity of demand. Also learn about:- 1. Proportion of Income Spent on a Good and Income-Elasticity of Demand 2. Classification of Goods on the Basis of EI 3. Use and Application.

If the income of the buyers of a good changes, then, generally, the demand for the good would also increase or decrease. The capacity of demand to change in response to a change in income is called the income-elasticity of demand.

The measure or coefficient (EI) of income-elasticity of demand can be obtained by means of the following formula:

For example, suppose that the index of the buyers’ income for good increases from 150 to 165, and, consequently, the quantity demanded of the good (per period) increases from 300 units to 360 units. In this case, the p.c. change in income has been 10 and the p.c. change in demand has been 20.

ADVERTISEMENTS:

Therefore:

Proportion of Income Spent on a Good and Income-Elasticity of Demand:

If the (money) income of the buyers of a good changes, other determinants of demand (including the price of the good) remaining unchanged, then, generally, the demand for the good would change and, along with this, the expenditure of the buyers on the good would also change, and the ratio of the expenditure of the buyers to their income would change too.

ADVERTISEMENTS:

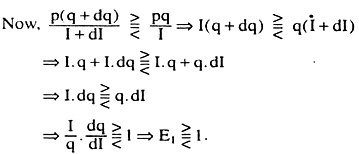

Some idea about the nature of income-elasticity of demand if the changes are observed in the expenditure-income ratio of the buyers as there are changes in their income. If, along with increases in income, this ratio also increases or decreases, then EI > 1 or EI < 1 respectively. Again, as income increases, if there is no change in this ratio, then EI = 1. These points can be proved in the following way.

Suppose, in the initial situation, the income (index) of the buyers = I, the quantity demanded of the good = q and the price of the good = p. Therefore, initially, the proportion of income that is spent on the good is p x q/I, which is the expenditure-income ratio.

Now suppose, the income of the buyers increases from I to I + dl (dl > 0) and the demand for the good increases from p to q + dq (dq > 0). Consequently, the expenditure-income ratio would change from p x q/I to p(q + dq)/ I + dI – the ratio may increase, decrease or remain the same.

Therefore, along with the increases in the money income of the buyers, if the expenditure- income ratio increases or decreases or remains the same, then EI > 1, EI < 1 and EI = 1 respectively.

ADVERTISEMENTS:

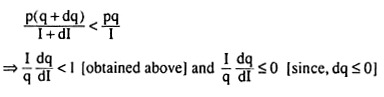

Remember here that in spite of an increase in income, if the quantity purchased of the good remains unchanged or decreases, other things remaining the same, i.e., if dq ≤ 0, then also, the expenditure-income ratio decreases, and here it is obtained

That is, along with the rise in income, if the expenditure-income ratio decreases EI < 1, but in some cases (when dq < 0), EI < 0 then the good is called an inferior good.

Classification of Goods on the Basis of EI:

If, for a particular good, EI > 0, then the good is called a normal good. Normal good, again, may be of two types. First, if for a good, 0 ≤ EI ≤ 1, then the good is called normal and necessary. Second, if for a good, EI > 1, then the good is called normal and superior (or luxury). On the other hand, if for a good EI < 0, then the good is called an inferior good.

On the basis of his statistical studies Engel came to the conclusion that in the case of a necessary good, as income rises, demand for the good rises or remains the same, and for it the expenditure-income ratio remains unchanged or diminishes, implying EI = 1 or EI < 1.

Here, as income rises, demand for the good rises, which implies EI > 0, and as income rises demand for the good remains the same, which implies EI = 0. Therefore, in this case, 0 ≤ EI ≤ 1. Or if, for a good 0 ≤ EI ≤ 1, then the good would be called a normal and necessary good.

But, in the case of a luxury good, it has been seen that, as income rises, demand also rises—so it is a normal good—and more and more proportion of income is spent on the good, giving us EI > 1. Therefore, state that if, for a good, EI > 1, then the good would be called a normal and luxury (or superior) good.

Lastly, if for a good, EI < 0, then it would be called an inferior good. In this case, as income increases, demand would decrease and the expenditure-income ratio would also decrease.

Significance of the Value of EI:

ADVERTISEMENTS:

The value of EI tells us the p.c. change in the quantity demanded of the good when the income of the buyers changes by 1 per cent. In example, EI = +2 at the point (income = 150, demand = 300) on the Engel Curve.

To understand that income increases (or decreases) by 1 per cent, demand for the good also increases (or decreases), and by 2 per cent.

Use and Application of the Concept of Income-Elasticity of Demand:

ADVERTISEMENTS:

Remember the following important points while discussing the use and application of income-elasticity of demand:

(i) If the EI for a good is negative, then, as income increases, demand for the good decreases. In this case, the good is called an inferior good, The producer of such a good knows that if income of the buyer decreases, then he would demand the good in a larger quantity. That is, he can sell his good only to the people with lower levels of income. The richer classes will not buy his good.

(ii) If, for a good 0 ≤ EI ≤ 1, then, as income increases, demand for the good and the buyers’ expenditure on it may not increase, and, if demand increases, it would increase by a smaller proportion than income, i.e., the expenditure-income proportion will fall.

The good in this case is called a normal and necessary good. The demand for a necessary good is influenced less by an increase in income. The example of a necessary good is bread. As a household gets richer, its demand for bread rises but by less than in proportion to income.

ADVERTISEMENTS:

(iii) If EI > 1, then, as income increases, demand for the good also increases, and by more than in proportion, i.e., as income rises, expenditure-income ratio also rises. The good in this case is called a normal and a luxury (or a superior) good.

In a capitalistic society, income and employment do not monotonically increase over time. Instead, there are fluctuations in income and employment in a cyclical order.

This phenomenon is known as business cycles. Income-elasticity of demand is one of the main determinants of the demand for a good in the different phases of business cycles. In the expansionary phase of the business cycle, the income of a country and that of its people increases.

During this period, when income increases, demand for the goods with EI > 1, i.e., demand for the superior or luxury goods, increases more than in proportion to the increase in income. On the other hand, demand for the inferior goods, instead of rising, actually falls, as income rises during this period. However, demand for the necessary goods increases, but, generally, less than in proportion to the rise in income.

Again, during the recessionary phase of the business cycle, demand for the luxury goods decreases more than in proportion to the fall in income, since, for these goods, EI> 1. During this period demand for the inferior goods, i.e., goods with EI < 0, increases.

Of course, the necessary goods, with 0 < EI < 1, are able to absorb the shocks of recession because their demand, generally, falls less than in proportion to the fall in income.

ADVERTISEMENTS:

It is clear that the producers and sellers of the goods have to know the nature of the income-elasticity of demand for their goods. Only then would it be possible for them to fix the sales targets for their goods during the different phases of business cycles.

For example the producers of luxury goods with EI > 1, would set high sales targets during the phase of rising income and employment and would reduce their targets during the period of recession.

Again, the producers of necessary goods with 0 ≤ EI ≤ 1 will set modest sales targets for their goods even during the period of rising income because they know that demand for their goods increases less than in proportion to the increase in income.

On the other hand, during recession, they do not reduce their targets, much for then demand falls less than in proportion to fall in income.

Lastly, the sellers of inferior goods with EI < 0 reduce their targets during the expansionary phase of the business cycle. For, during this period, along with increased income, demand for the inferior goods decreases. On the other hand, during the period of recession, they increase their target for, then, as income decreases, demand for their goods increases.